Looking for high returns on alternative investments?

24% returns sound great until you realize there’s no SEBI license and the owners are doing business with themselves.

WO Trades promises those annual returns. They offer invoice discounting and angel investments.

But is it safe? Let’s find out.

WO Trades Review

WO Trades operates as an alternative investment platform. They target retail investors in India. The company focuses on people with limited capital.

It offers four main investment products. Each promises attractive returns.

Company Details:

- Legal Entity: WO Trade Ventures Private Limited

- CIN: U72900TG2023PTC170067

- Location: Hyderabad, Telangana

- Authorized Capital: ₹4.50 Lakh

- Paid-up Capital: ₹1.00 Lakh

The platform promises 18% to 24% annually.

These numbers beat traditional fixed deposits significantly by providing investment opportunities in:

- Invoice Discounting: Short-term business invoice financing

- Fractional Real Estate: Partial property ownership

- Angel Investments: Startup funding opportunities

- Asset Leasing: Equipment financing deals

Sounds attractive, right?

But is it safe

Is WO Trades Legal?

Here’s where things get concerning.

WO Trades lacks proper regulatory oversight. This is a major red flag.

SEBI Registration: Not registered with SEBI.

This is critical for investment platforms. SEBI registration ensures investor protection. It guarantees compliance with securities laws.

RBI Authorization: No authorization from RBI.

Invoice discounting platforms need proper banking credentials. WO Trades doesn’t have them.

Can they legally collect investor money?

The company’s MCA classification says “other computer-related activities.” But they operate as a financial services platform.

This mismatch indicates regulatory gaps.

How to Identify Investment Scams?

Multiple warning signs emerged during research. Each factor plays an important role in helping investors detect scams early and avoid costly mistakes.

Let’s examine them closely:

- No Escrow Account Protection

According to reports, investor money goes directly to their account.

No separate escrow arrangement exists. Your funds mix with the company’s operational money.

What does this mean?

If WO Trades faces bankruptcy, your money disappears. No legal claim possible. Zero investor protection available.

This is extremely risky.

- Related Party Transactions

The reports highlighted suspicious deal patterns.

Platform owners doing business with their own companies?

Companies listed on WO Trades share ownership with directors. The Adhidhala family name appears repeatedly across deals.

Here’s the shocking part:

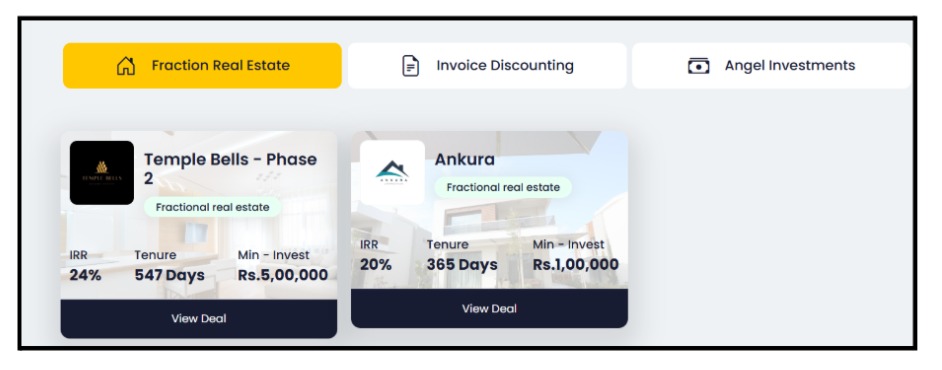

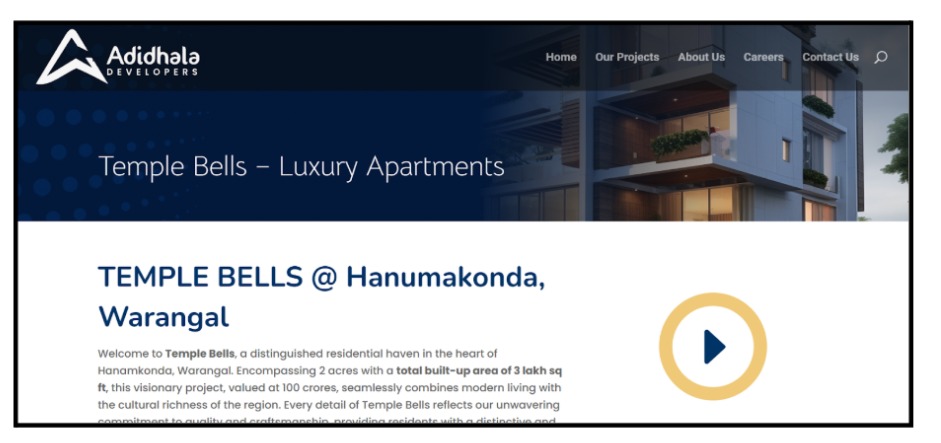

Temple Bells – Phase 2 and Ankura are both fractional real estate deals on WO Trades. Both projects list Adidhala Developers as the company.

The Adhidhala family owns these companies. They also own the WO Trades platform.

Temple Bells – Phase 2 Deal:

- IRR: 24%

- Tenure: 547 Days

- Minimum Investment: Rs. 5,00,000

- Developer: Adidhala Developers

Ankura Deal:

- IRR: 20%

- Tenure: 365 Days

- Minimum Investment: Rs. 1,00,000

- Developer: Adidhala Developers

Platform owners doing business with their own companies?

Both deals have the same developer contact. Both are by the Adhidhala family.

Nowhere do they mention these as related party transactions.

Do you expect them to do due diligence on their own companies? Can they provide unbiased investment advice?

- Unusually High Returns

WO Trades promises 18-24% annual returns.

Industry standards for invoice discounting? Typically 12-16%.

What explains this premium?

Some deals showed inflated IRRs.

What is IRR?

IRR measures investment profitability over time. It calculates the actual return you earn annually. A higher IRR means better returns.

IRR manipulation can hide risks. It can make bad deals look attractive.

These rates exceeded industry benchmarks significantly.

- Poor KYC Verification

According to ALT Investor, Independent researchers tested their system.

Incorrect documents were accepted. Proper verification didn’t happen. Basic security checks failed repeatedly.

Weak KYC opens doors for money laundering. It indicates poor operational standards.

Professional platforms never compromise on verification.

- No Clear Information About the Director

Limited public information exists about directors.

Previous directors included Pavani Adhidhala and Aleti Hanisha. They stepped down within seven months.

Then the new directors came.

Then again, some new ones.

Why the frequent leadership changes?

What’s the real ownership structure? These details remain unclear.

WO Trades User Reviews and Complaints

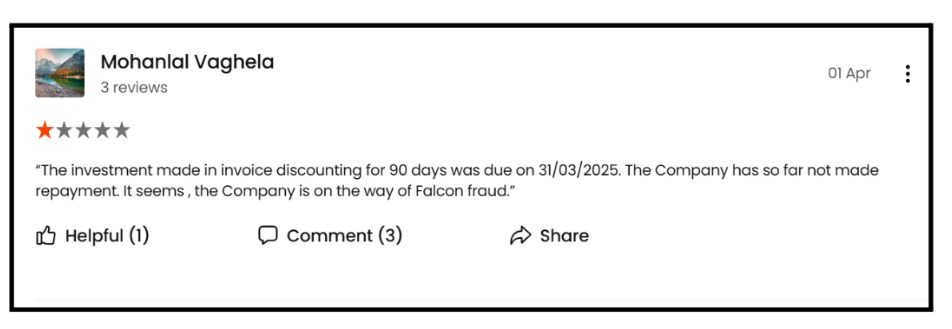

We found limited but concerning user reviews and reports with serious payment issues.

Let’s examine real complaints from investors.

1. WO Trades Withdrawal Issue

Investors report companies failing to repay on maturity dates. Invoice discounting investments show payment defaults.

This indicates systematic repayment failures. Investors cannot access their matured investments.

2. Complete Payment Blockage

Multiple users report total inability to receive payouts. No communication from the platform. No resolution provided.

This shows the problem affects multiple investors. Payment issues remain unresolved for months.

How to Report Investment Scams?

Invested in WO Trades and facing issues?

Take immediate action. Don’t delay.

Here is how to report such scams:

- File a cyber crime complaint: Visit the National Cyber Crime Portal to register a complaint.

- File a Complaint in SEBI: Send an email with all the proof and evidence.

- RBI Sachet Portal: Report financial fraud.

- Local Police: File FIR at the nearest cyber crime police station

- Consumer Forum: Approach district consumer forum for grievance redressal

Gather all documentation before reporting.

Save transaction receipts and agreements. Keep communication records safe. Screenshots prove valuable during investigations.

Time matters critically in fraud cases.

Report within 24 hours of discovering irregularities. Quick action improves recovery chances.

Need Help?

Facing difficulties with WO Trades?

Unable to withdraw funds? Concerned about investment safety?

Register with us for expert guidance.

Our team specializes in alternative investment platform analysis. We help investors understand risks. We navigate complaint procedures effectively.

Get personalized assistance for your situation.

Don’t wait until problems escalate. Early action protects your interests better.

Conclusion

WO Trades operates in India’s unregulated investment space.

The platform lacks essential regulatory approvals.

No SEBI registration exists. No RBI authorization either.

Multiple red flags emerged during research.