If you trade Forex or CFDs, you’ve probably come across the term XM Broker. To get started, an XM Broker login is essential to access global financial markets.

But before entering your credentials, it’s crucial to ensure you’re dealing with a trustworthy broker.

So, what’s the first thing you look for in a broker? Is it low fees, a wide range of trading options, or something else entirely? Have you ever wondered whether the flashy XM Broker ads popping up on your screen are genuinely helpful, or just a clever marketing trick?

Maybe you’ve heard some buzz about XM and want to separate fact from fiction. Either way, you’re in the right place.

In this article, we’ll take a deep dive into XM, examining any suspicious issues and uncovering the truth behind the broker’s reputation.

Is XM Broker Safe?

For more than ten years, XM has been instrumental in the online forex trading community. Globally, XM is a well-known online brokerage that provides trading services in forex, CFDs, and other financial instruments.

The firm has been around since 2009 and is regulated by several international financial authorities.

However, in a market full of fraudulent schemes, how do you ascertain that your money and information are really secure, especially when many traders are influenced by unofficial sources like XM Broker telegram channels, circulating tips and offers?

The choice to log in to an XM trading account depends on whether the platform is your top three security, platform reliability, and regulatory oversight.

So, if you check the website, you will find that XM allows you to access through the standard industry MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as its own proprietary XM App and Members Area.

Pretty good, right?

But, does regulation at the international level automatically make a broker safe for India?

This is the point where the Indian traders wonder: is XM Broker regulated in India? While XM is a globally legitimate, the location of you makes the difference.

For clients in India, XM is providing services through its entity in Belize, which gives less regulatory protection than a couple of its licenses in Australia and Cyprus.

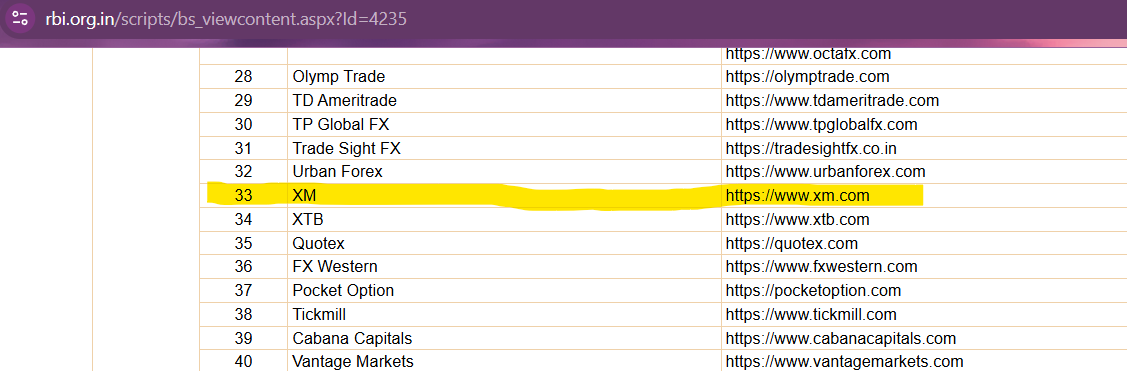

In simple terms, XM is not regulated by SEBI or the RBI. This means that if you have a dispute, the Indian legal system cannot protect you.

Moreover, this platform is listed on the RBI’s alert list as well.

Apart from this, trading specific forex pairs via offshore brokers such as XM is not allowed by Indian foreign exchange regulations (FEMA Guidelines). Thus, traders are in a legal grey area, which is a considerable risk.

To be clear, XM offers extremely high leverage, which can be a double-edged sword. While it has the potential to boost your profits significantly, it can also wipe out your account very quickly, especially if you’re a novice, sometimes before you even realise it.

So, under such risky conditions, what would be your priority?

High profits that are only potential or the safety of your finances?

Think about it.

How To File Forex Trading Complaints?

If you have complaints about any of the trading platforms, you can follow the official process to contact the relevant authorities.

- File a cyber crime complaint.

- File a report with the local police.

- Inform your bank immediately.

- File a complaint with SEBI, including screenshots and transaction details.

Need Help?

If you are a new trader, you may feel overwhelmed by the technical details of regulation, account types, and platform navigation.

Perhaps you require help in putting a complaint against a forex trading broker, then this is the right place for you.

Register with us, and we will be there for you to figure out the first stages of checking whether a broker is genuine and getting to know the documents required for your account opening and verification.

Conclusion

The login process alone serves as a reminder of how different the regulations are. Since you are sending your KYC documents to an offshore entity, it means that your personal data is not covered by Indian data protection laws.

In case your login is blocked or you have some issues, you cannot turn to any local authority for help, and if an XM Broker withdrawal problem arises, you would still have no Indian system to turn to for protection or resolution.

How would you describe your emotions knowing that, in a worst-case scenario, you do not have any local legal protection?

The combination of XM being in the “grey area” regarding its legality, the absence of local protection, and the aggressive use of high leverage are all aspects that should make you hesitate and reconsider logging in and depositing your money.