XM Broker is in the limelight, not for its services or high leverage, but because of reports related to XM withdrawals.

For traders in the fast-paced world of Forex and CFDs, the ability to access your funds safely is just as important as making profits. No matter how attractive a broker’s trading conditions are, if you can’t withdraw your money, trust quickly erodes.

Recently, continuous complaints from Indian investors have raised an alarm, with many reporting difficulties when trying to access their funds.

In this blog, we take a closer look at XM Broker’s withdrawal process and uncover whether it is truly reliable or a red flag for traders.

XM Broker Withdrawal Issues

Trying to withdraw your funds from the XM platform, but instead of a withdrawal, you get messages like:

- “Update KYC” Requests

- Pending Withdrawals

- Successful but Not Received

- Account Blocks or Closures

If yes, this is a serious concern and something that should be reported immediately.

XM is undoubtedly a well-known name in the global online trading industry. It operates worldwide and is regulated by authorities in regions like Australia and Cyprus.

On paper, this makes the company appear trustworthy, which naturally leads users to believe their funds should be handled safely. So when you request a withdrawal, it’s reasonable to expect a smooth and timely process.

However, online discussions tell a more mixed story.

While many users report fast and hassle-free withdrawals, others share more concerning experiences involving delays, repeated verification demands, and unresolved complications.

This contrast is exactly why many traders start asking, is XM Broker regulated, especially from an Indian perspective.

Although XM is regulated by international bodies such as CySEC and ASIC, it is not regulated locally by SEBI or the Reserve Bank of India (RBI). This distinction is crucial.

What does this mean for you?

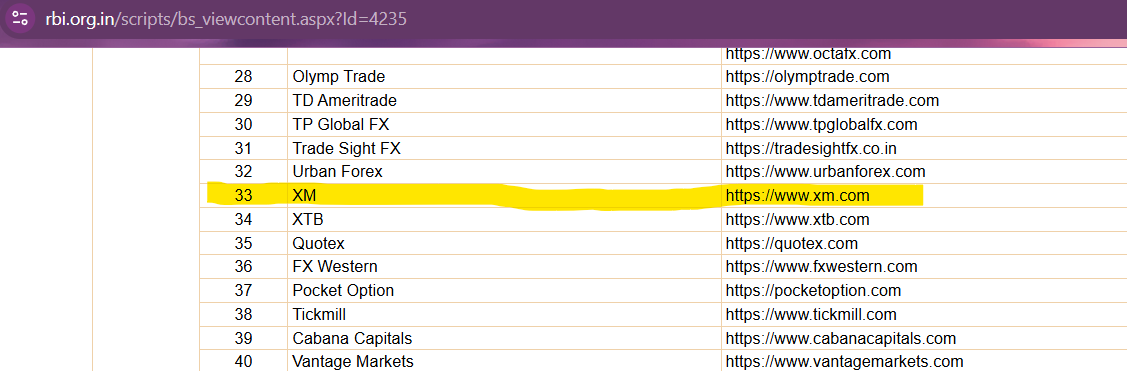

If something goes wrong—whether it’s a withdrawal dispute, account freeze, or platform issue—you don’t have legal protection under Indian law. Adding to the concern, the RBI has listed XM among forex trading platforms that are not authorised to operate in India. From a regulatory standpoint, this is a significant red flag and a clear warning that using the platform carries risk.

As an Indian trader, it is not the safest choice because you are operating in a “legal gray area” without local regulatory protection and going against the official RBI advice.

XM Broker Withdrawal Complaints

XM is the target of various accusations locally despite being a global brand. In there, withdrawal issues are the ones most heavily weighed against the company by traders.

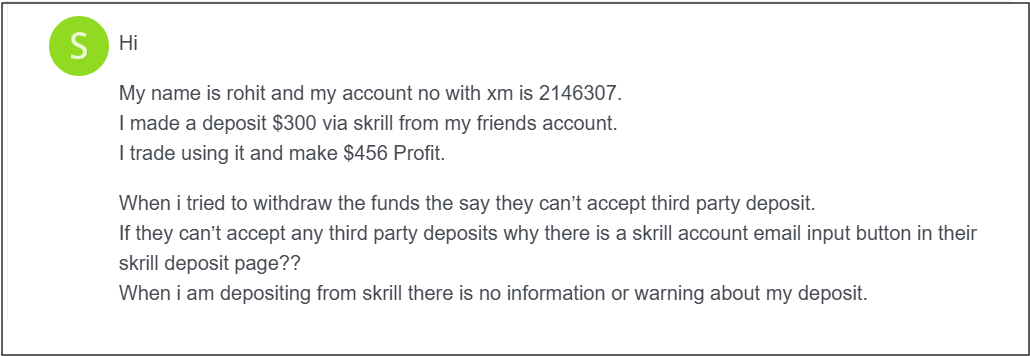

On different platforms, users’ personal experiences bring out an important aspect, which is withdrawal rejection as the main difficulty.

In most cases, these narratives refer to money that has been taken from the trading account but has not yet arrived at the bank, or the withdrawals have been hindered due to some incomprehensible reasons, such as “credit abuse” or ”arbitrage.”

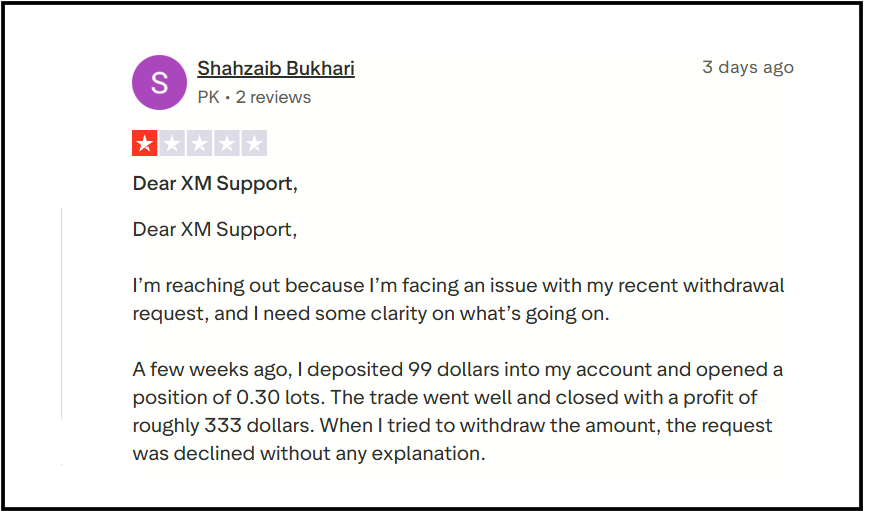

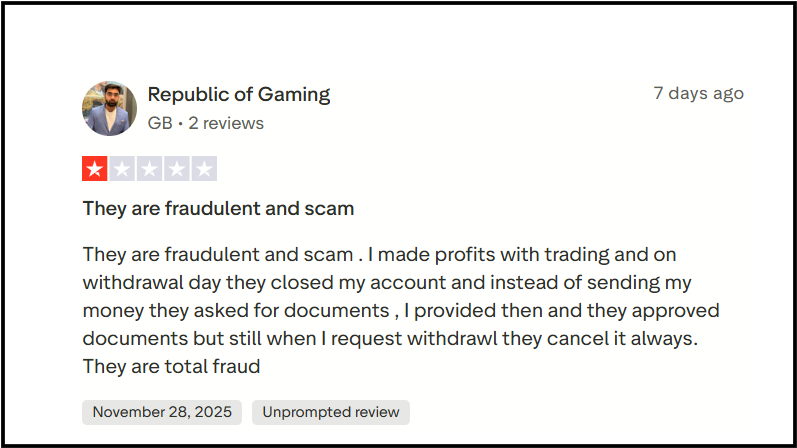

However, the Trustpilot reviews for XM paint a mixed but often alarming picture.

It can be easily depicted from the users’ complaints and reviews, most users face issues related to withdrawal. Several users claim that after making a significant profit, XM flagged their account, removed their profits, and reset their balance, citing policy violations without clear proof.

In some other cases, on the withdrawal day, XM deactivates the accounts of the users instead of crediting them with the money.

How To File Forex Trading Complaints?

If you think that you have come across some issues, take a step without delay.

Here are your steps:

1. File a Cyber Crime Complaint

- Go to the National Cybercrime Reporting Portal.

- This is very important for the purposes of freezing accounts and tracing the money trail

2. Register with Us

If you have lost funds, been misled by a broker, or had an XM broker withdrawal request unfairly rejected, fighting alone can be daunting.

Contact us now. Our team will listen to your complaint.

We will provide a dedicated case manager who will help you gather the necessary documentation and guide you through the process of filing a formal complaint with the relevant regulatory bodies.

Conclusion

When an entity is not regularised within a country, it increases the concern. The chances of withdrawal “problems” can be understood as the additional monitoring of funds that are routed through unofficial channels.

For Indian traders, XM is not considered a safe option. This is due to significant regulatory risks and the potential for severe legal and financial penalties.

The question is not about XM being a “scam”; rather, it concerns the absence of local supervision and the resulting vulnerability of you as a customer.