If an online platform promises you quick riches with little to no effort, that’s your first red flag. Yet thousands of unsuspecting investors in India are being lured into the platform like XPO

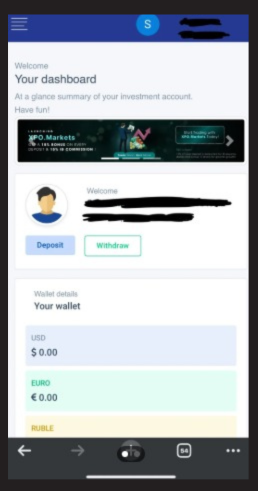

They attract users with shiny dashboards, bold profit claims, and promises of easy income.

But behind that glossy façade lies a troubling reality: blocked withdrawals, fake returns, vanishing balances, and Ponzi-style tactics that leave investors helpless.

That’s why it’s important to understand that,

XPO.ru was a SCAMMER!

How to Get Money Back?

As it reflects the real struggle people face once their money gets trapped.

In this blog, we’ll dig deep into the growing XPO complaints and reveal why this platform poses serious risks for Indian investors.

XPO Fraud

Many investors who tried XPO quickly realised that things weren’t as smooth as promised. Complaints keep popping up online, showing a consistent pattern of issues that make this platform extremely risky.

Before putting your money into XPO, it’s important to understand the reality behind huge profits.

XPO, which seems to be a regular income source to many, is actually operating a Ponzi scheme.

Many investors who had put their capital complained about withdrawal blocks.

Investors who have tried XPO report some alarming patterns:

- Blocked or Delayed Withdrawals

Small withdrawals may succeed initially, but larger requests are often delayed or denied. Users report sudden “processing fees” or other excuses that prevent them from accessing their money. - Referral Pressure

XPO encourages investors to recruit friends and family to earn referral bonuses. This push to bring in more participants is a classic Ponzi scheme tactic. - Fake or Exaggerated Profits

Many dashboards show consistent returns regardless of market conditions, creating a false sense of security. These profits are often exaggerated or entirely fake. - Unresponsive Customer Support

Investors frequently complain about poor or no support when facing issues, leaving them frustrated and helpless.

A Reddit user recently shared a troubling experience with XPO after a friend introduced him to the platform, showcasing flashy certificates, awards, and even a promoter named Rajat Sharma from Jaipur to make it look credible.

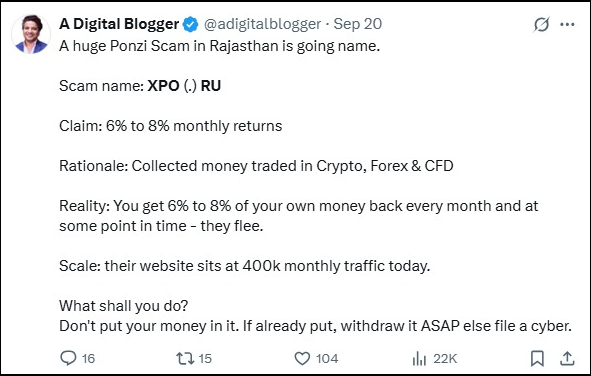

But the promised 6–8% monthly returns felt too perfect, and the overall structure seemed heavily reliant on recruiting new members, classic signs of a pyramid or Ponzi-style setup.

These XPO complaints paint a clear picture: XPO is operating more like a Ponzi scheme than a legitimate trading platform.

We also keep updating people through our social media handle “X”, and we shared a post informing that this is a kind of huge Ponzi scam running in Rajasthan and other nearby states.

Why Not to Invest in XPO?

Many more user experiences give reasons why not to invest in XPO.

Some of the XPO complaints from users show exactly this pattern, like:

- Payouts are small.

- Recruitment is pushed aggressively.

- Large withdrawals are blocked.

Above all, at its core, XPO operates like a Ponzi scheme. Here’s how it works:

- New investor money is used to pay older investors.

- Small withdrawals succeed initially, creating a false sense of security.

- Promises of guaranteed profits keep investors engaged and encourage recruitment.

- Eventually, the system collapses when new deposits slow down, leaving most investors with heavy losses.

And you can see the live video session of these scammers, how they work and trap people through online sessions. We caught a live session where around 230 people were attending this meeting.

XPO also promotes Forex trading for Indian residents, which is illegal unless the platform is registered with SEBI or RBI. Investors face multiple risks here:

- There’s no legal protection if the platform defaults or disappears.

- Profits shown on dashboards are often fake, adding to the deception.

- Participation in unregistered Forex trading can lead to legal complications.

The combination of a Ponzi scheme structure and illegal Forex operations makes XPO extremely dangerous.

Complaints online clearly reflect both these risks, making it a platform that should be avoided at all costs.

XPO Fraud Recovery

If you suspect you’ve been targeted by a Ponzi scheme like XPO, acting quickly can protect your money.

Here’s what to do:

- File a cyber crime complaint online: Use the National Cyber Crime Reporting Portal to report online investment fraud.

- File a complaint in SEBI: If it’s an unregistered investment platform, file a complaint in SEBI by sending an email.

- Contact local authorities: Share all transaction records, screenshots, and communications when filing a police report.

- Notify your bank or payment provider: Inform them immediately if you transferred funds via UPI, bank transfer, or crypto.

Need Help?

Victim of XPO or worried about your investment? Register with us now and we will guide you with the process to report the scam and take steps to recover your funds.

Conclusion

XPO is extremely risky for investors. Its Ponzi scheme structure means early payouts are funded by new deposits, not real profits, leaving most participants with losses.

On top of that, promoting illegal Forex trading in India exposes investors to serious legal and financial trouble.

If you’re considering online investments, stay alert. Avoid unregistered platforms, ignore promises of guaranteed returns, and if you’ve already invested, report the platform immediately to safeguard your money and prevent others from falling victim to XPO fraud.