Thinking about making quick money online? Platforms like XPO.ru promise easy profits and instant payouts, especially to Indian users. But the harsh reality is:

XPO.ru was a SCAMMER!

How to Get Money Back?

Many users have lost money, and it’s crucial to understand the risks before you even think about trading on this platform.

This XPO.ru review will help you spot the tricks, protect your hard-earned cash, and know exactly what steps to take if you or someone you care about gets caught up in the scam.

XPO Trading Review

Scammers are becoming increasingly sophisticated, luring thousands of people across India with flashy apps, false promises, and aggressive referral schemes.

If you’ve come across xpo.ru, which is registered with the name Xeno Portfolio OOO, stop before you click!

XPO fraud has made deep inroads among Indian investors through a well-organized network of local agents, especially in Jaipur.

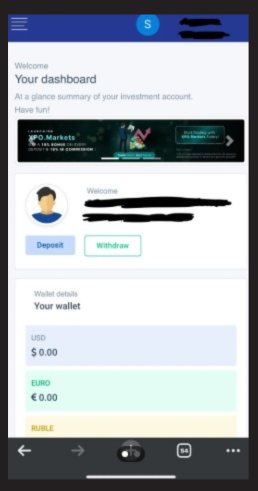

The platform presents itself as a trendy, trustworthy investment app, making sign-up seamless for Indians by accepting Aadhaar, PAN, and UPI bank payments.

What truly sets this scam apart is its strong connection to Jaipur: freelancers and crypto consultants based in the city actively promote xpo.ru and its Xeno Portfolio forex trading app via WhatsApp and Telegram groups, personal consultations, and informal community events.

These agents focus on aggressive recruiting, often convincing people to invite friends and family with tempting referral bonuses and promises of “guaranteed returns.”

Victim reports frequently mention being approached by Jaipur-based advisors, highlighting how local support adds a deceptive sense of trust.

However, xpo.ru’s legal headquarters are in Moscow, Russia; there’s no official Indian or Jaipur branch, and all city-based activities are run by independent recruiters, which proves that XPO is illegal in India.

Once people attempt to withdraw their money, accounts get blocked and support vanishes, with agents demanding extra “release fees” or disappearing altogether.

Scam exposés, user-registered XPO.ru complaints, and YouTube reviews consistently flag these Jaipur activities as the engine of xpo.ru’s Ponzi scheme in India, demonstrating classic red flags like blocked withdrawals and fake profits.

The Reserve Bank of India has officially warned against xpo.ru, and consumer watchdogs urge everyone to avoid both the app and its network of local agents—especially those operating from Jaipur.

If you encounter xpo.ru through any channel, stay away, protect your details, and report suspicious activity immediately.

Is XPO Safe?

Here is one of the major reasons why not to invest in XPO.

XPO is not only a forex trading scam, but also this platform is spreading a Ponzi scheme, which is visible through the following red flags:

- Guaranteed High Returns: XPO.ru promises “daily profits,” “instant payouts,” or “AI-powered high yield investments.” Legitimate platforms never guarantee fixed daily earnings.

- Blocked Withdrawals & Extra Fees: Many users discover their money is stuck when trying to withdraw. Instead of help, they’re asked for additional “taxes,” “release fees,” or verification charges, classic Ponzi scam tactics.

- Aggressive Referral and Recruitment: The app and local agents, especially in cities like Jaipur, encourage users to invite friends, family, and social contacts with promises of bonuses and rising earnings. But the catch is clear:

- No Regulatory License: Is XPO registered in India? Do SEBI or RBI, or any recognized authority allow trading in the platform? The answer is NO. It hides behind fake offshore registration claims (Belize, Russia), which are meaningless for Indian investors.

- No Real Trading or Transparency: There’s no verifiable company info, no public financial reports, and no proof of actual trading activity. Most returns aren’t coming from actual trading, but from the deposits of newly recruited investors—a textbook pyramid structure. Ponzi platforms rely on new deposits to pay out supposed profits—not real market success.

- Disappearing Support & Opaque Ownership: Customer service vanishes if you complain. No real office, no way to hold anyone accountable—another Ponzi hallmark.

- KYC Abuse: It asks for sensitive Indian documents—Aadhaar, PAN, passport—putting your identity at risk.

- Victim Stories: Across India, users report losing money, never getting their withdrawals, and being blocked or ignored once they stop recruiting. Negative reviews flood consumer and scam alert forums.

One user on Reddit shared that someone he knows introduced him to an “XPO platform” promising fixed monthly ROI and showcasing certificates, awards, and a promoter named Rajat Sharma from Jaipur.

Although it looked polished, he suspected it was nothing more than a pyramid-style scheme, despite the person claiming returns of 6–8% in a month. He posted the review seeking clarity from others, worried that the setup might be misleading or potentially fraudulent.

XPO.ru exhibits every major sign of a Ponzi scheme: fake profits, blocked withdrawals, referral dependency, lack of regulation, and denial of basic investor rights.

How to Protect Yourself?

Worried you, or someone you know, might get tangled with xpo.ru or a similar scam? Here’s how to stay safe:

- Don’t Share or Invest: If an app or website isn’t regulated by SEBI or another major authority, don’t enter your bank details, Aadhaar, passport, or send a single rupee.

- Ignore “Urgent” Offers: High-pressure messages about “limited time bonuses” or “guaranteed returns” are designed to rush your decision. Take a breath—a real investment never acts desperately.

- Check Their License: Search the company name in official databases (SEBI, RBI). If you can’t find proof, it’s not legit.

- Stop Referrals: Never recruit friends or family unless you’re 100% sure the platform is genuine—and with xpo.ru, that’s never the case.

How to Report XPO Fraud for Recovery?

If you’ve lost money in the platform, here’s exactly where you can file XPO complaints in India:

- Collect payment proof/screenshots, and share all chat or email records.

- You can contact the bank if the scam involves UPI, bank transfer, or cards.

- File a cyber crime complaint online.

- Register with us directly, and we will help you report such scams and recover your funds.

Conclusion

XPO.ru looks flashy, promises easy money, and targets Indian investors with tempting offers and referral bonuses.

But behind the scenes, it’s riddled with classic Ponzi scheme signs—fake profits, blocked withdrawals, aggressive recruitment, and zero regulation.

The safest thing you can do?

Walk away. Don’t share your details, don’t invest, and don’t let friends or family get lured in.

If you’ve already been affected, report it right away using the official channels—your action could help stop the scam and protect others.

When it comes to your money, always pick genuine, regulated platforms and never trust “guaranteed returns.” Staying smart today can save you (and many others) from tomorrow’s losses.