You might have come here after facing trouble with 5paisa. Maybe your trade didn’t go through, support ignored your calls, or surprise charges hit your account.

5 paisa complaints have become an important search term for many traders who started with high expectations but later ran into issues.

We all dream of growing savings easily, but when the app freezes or money gets stuck, it feels like a betrayal.

This blog talks straight about it all. From what 5paisa offers, to real complaints from users, SEBI fines, arbitration facts, news, and how to fix your issues fast.

Read on to get clear steps to protect your money and know if 5paisa is right for you or time to move on.

5 Paisa Review

5 Paisa Capital Limited is a discount stockbroker. It offers trading in equity, derivatives, currency, mutual funds, and other products through its mobile app and web platforms.

It positions itself as a low‑cost, technology‑driven broker with simplified interfaces and an all‑in‑one app aimed mainly at retail investors and beginners.

The broker is registered with SEBI (Regn No. INZ000010231) and the exchanges. It publicly highlights its grievance redressal framework, escalation matrix, and the option to move unresolved issues to SEBI SCORES.

On paper, this mix of regulatory registration, digital platforms, and formal complaint channels makes 5paisa look like a fairly structured and regulated choice in India’s crowded broking market.

But have you checked the complaints and reviews of real users who trusted the platform in search of a better future and landed in court hearings?

5 Paisa User Complaints

5paisa has an active client base of 366347 users. According to the available data, it received 91 complaints from its users.

Most of the complaints have been resolved, and the company’s resolution rate is 84.62%.

Types of 5 Paisa Complaints

Seeing the NSE data, it is clear that most of the SBICAP complaints are grouped under:

Type I: Non-receipt / Delay in Payment

The traders didn’t get their payout on time. They reported that funds took longer to reflect, or the withdrawal request got stuck.

This is frustrating for clients as their trading money stays blocked.

Type II: Non-receipt / Delay in Securities

Clients reported that purchased shares didn’t reach their demat account on time.

The delay creates confusion, especially when users want to sell or track their holdings.

Type III: Non-receipt of Documents

According to the victims, they didn’t receive contract notes, statements, or account documents.

Missing records create doubts and make it hard for traders to verify transactions.

Type IV: Unauthorized Trades / Misappropriation

Users report trades they never placed. These issues raise serious concerns about account safety and are prohibited.

Any unauthorized activity leads to stress because clients’ money is at risk.

Type V: Service Related

Users report complaints related to app glitches, platform downtime, slow customer support, login issues, and delayed responses.

Traders expect quick help, so service flaws cause frustration.

Type VIII: IPO Related

This includes allotment confusion, failed applications, or missing refunds during an IPO. Users feel concerned when their application status doesn’t match their bank or broker updates.

Type IX: Others

This is a mixed category for issues that don’t fit the main types.

It includes technical bugs, account update delays, wrong charges, or any unclear problems that traders experience.

Even a small set of 5 Paisa complaints in these buckets can hit investors in real ways.

5 Paisa User Reviews

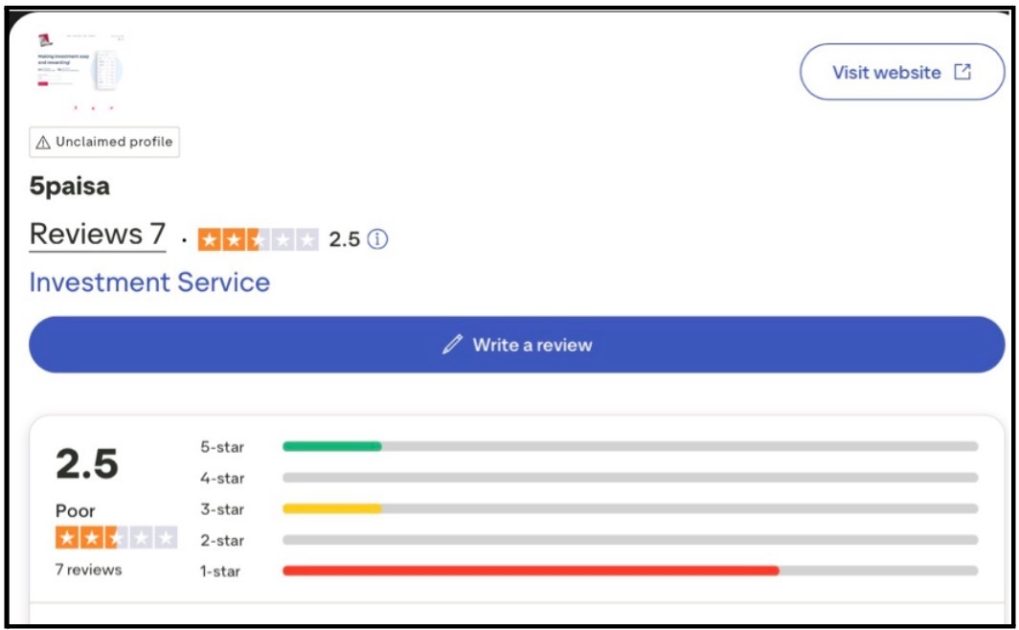

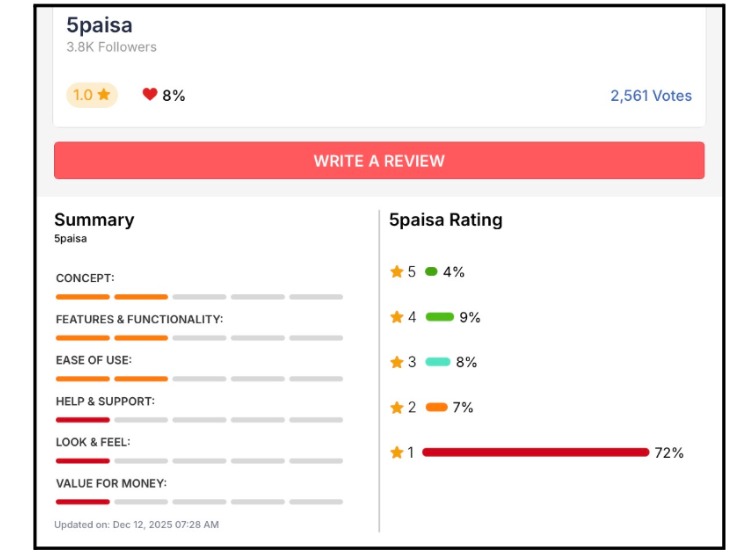

Reviews about 5 paisa issues are not as expected. Users are unhappy with their experience on Trustpilot; most of the reviews are negative, with 2.5/5.

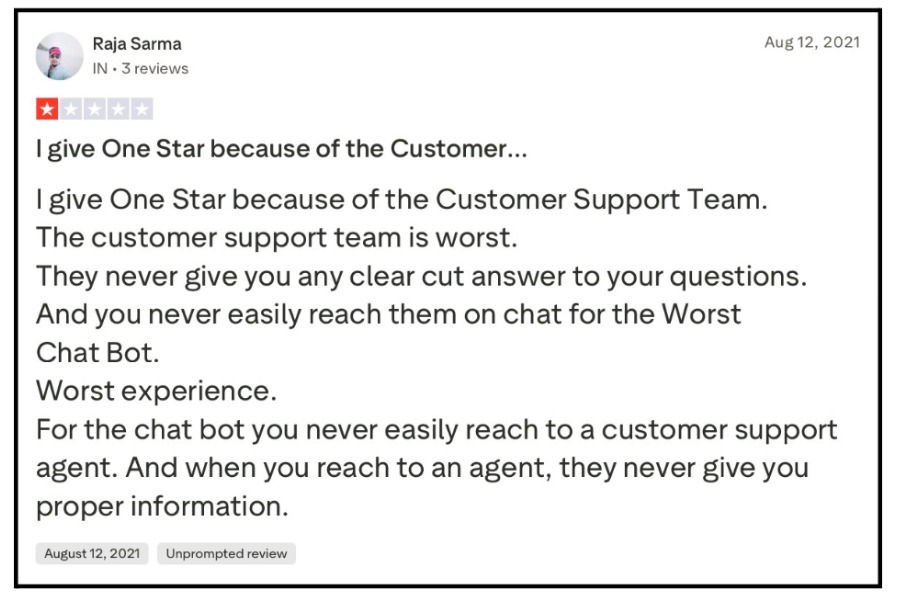

Some users have complained about poor customer support. The user said that they do not give any clear answers to your questions.

Reaching the chat box feels like a task in itself.

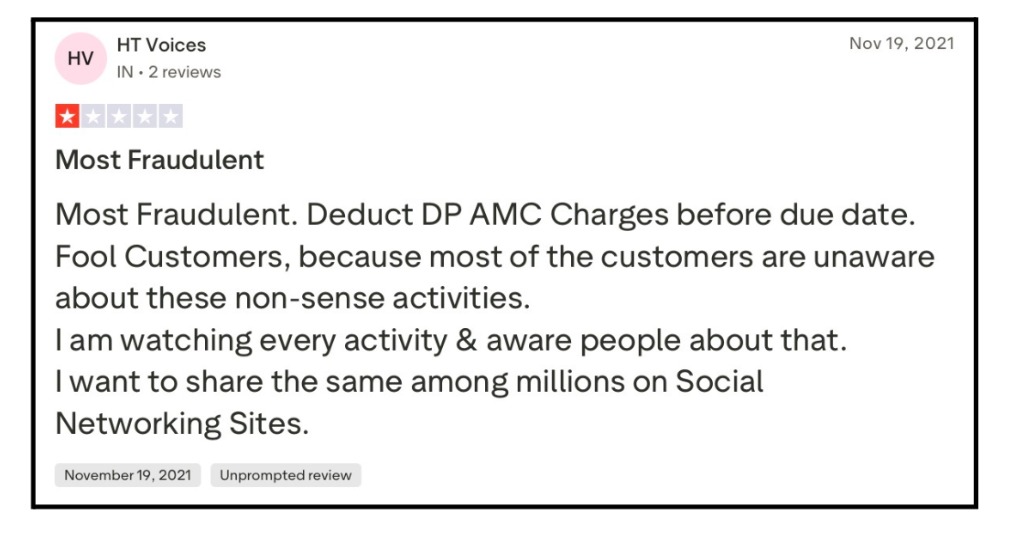

Another user said that this is fraud. They deduct charges before the due date and fool the customers.

This is something that people should really be aware of.

Similar patterns of reviews can be seen on MouthShut as well. Customers are unhappy with the service and have negatively reviewed the platform. The ratings here are mostly 1 star.

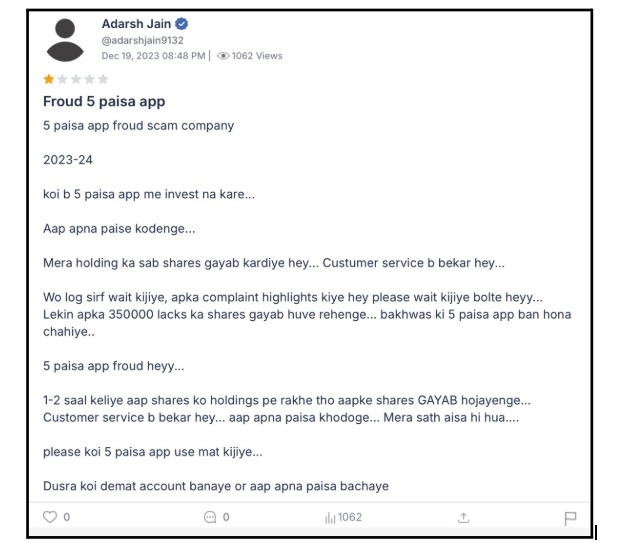

The users call 5paisa a “fraud scam company,” saying their holdings or shares went missing and that customer service kept asking them to “wait” without any proper resolution.

They warn others not to invest or use the app at all and say people should open a demat account somewhere else to save their money.

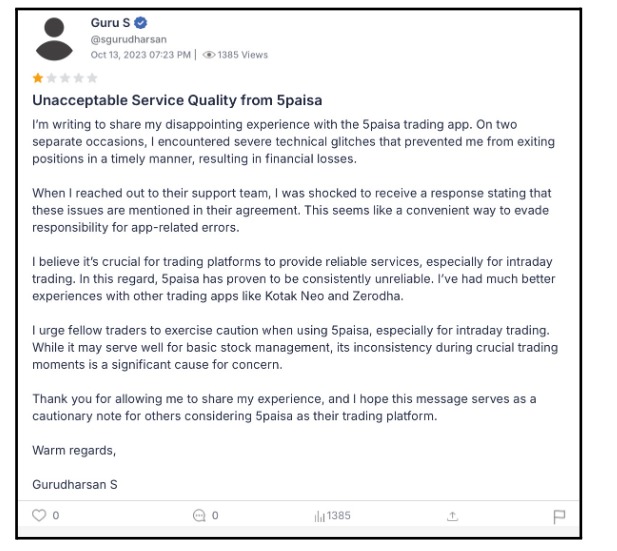

The user complains about repeated technical glitches during trading that stopped them from exiting positions on time, which led to real money losses.

The support team told them such issues are “already mentioned in the agreement,” which the user feels is just a way to avoid responsibility.

They call 5paisa “consistently unreliable,” especially for intraday trading, and say they have had better experiences with other apps.

These reviews create fear and doubt in the minds of new or small investors, especially those who are already nervous about online trading.

When someone reads about “missing shares” or losses due to glitches, they may either avoid opening an account or use the app very cautiously with tiny amounts.

Even if 5paisa is regulated and not an outright scam, repeated public complaints like this on open forums damage its image.

And when such complaints increase, so do the escalations, which finally lead to Arbitrations in the stock market.

5 Paisa Arbitration Cases

There have also been a few arbitration cases filed against 5 Paisa, a reminder that even regulated brokers can face disputes when things don’t go as expected.

Let’s take a closer look at the issues raised by clients and what led them to seek arbitration in the first place.

Case 1: MTM Shortfall Square-Off Dispute

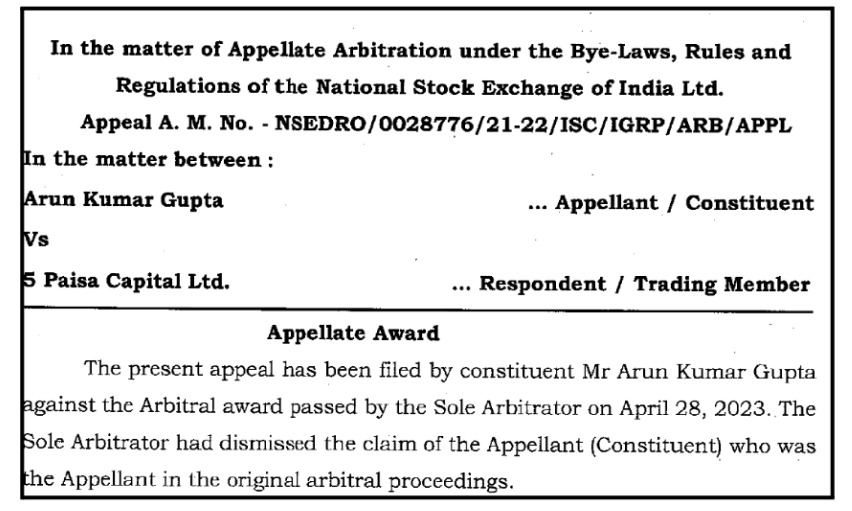

Arun Kumar Gupta appealed against 5 Paisa after the broker automatically closed his short positions during market hours, causing him heavy losses.

He argued that 5 Paisa miscalculated his real-time Mark-to-Market (MTM) losses by ignoring profits from his long positions, creating a fake margin shortfall.

He also complained about no proper alerts before the square-off and issues with the NSE portal errors when filing his late appeal.

5 Paisa defended by saying the appeal was filed late, and their Risk Management System (RMS) correctly triggered under NSE rules when his net worth dropped 50%.

Penalty Imposed

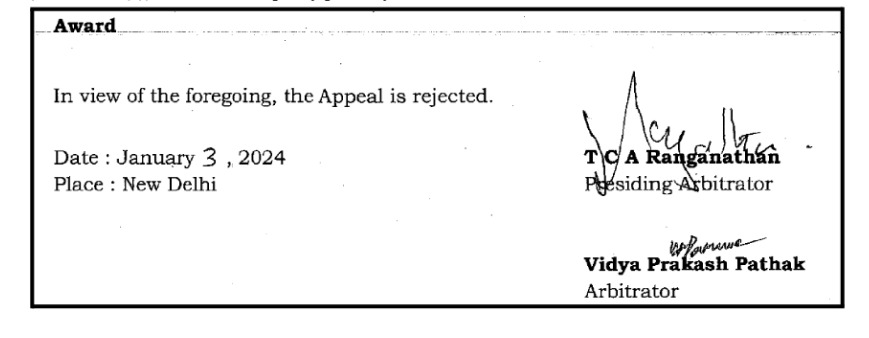

The panel rejected Arun’s appeal on January 3, 2024. They found 5 Paisa followed NSE F&O regulations (Clause 3.10(b)) and their RMS policy perfectly.

No compensation awarded to the client.

Key Takeaways

- Always track your MTM losses in real-time and don’t trust just the app display.

- Learn your broker’s exact RMS triggers, like 50% net worth drops, to avoid surprise square-offs.

- Add funds quickly during volatile hours as automated systems won’t wait for you.

- File appeals on time via reliable portals, and keep screenshots as proof.

Case 2: Wrong Margin Display & Square-Off Alerts

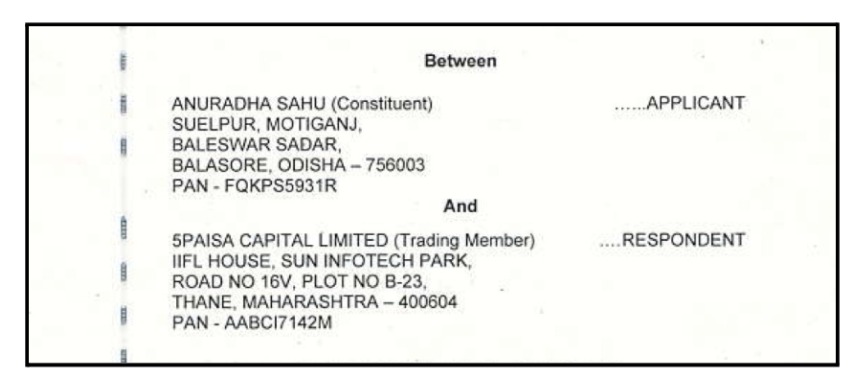

Mrs. Anuradha Sahu opened her trading account with 5Paisa in June 2018 and was a regular user of their app.

On June 16, 2022, she pledged 4,892 Nippon India ETF shares, but a technical glitch made the app show a huge ₹91 lakh margin (when she was eligible for only ₹8.37 lakh).

Relying on this false margin display, she bought 3,31,699 NALCO shares worth ₹2.71 crore at ₹81.60, thinking it was safe for MTF holding.

After market close, 5Paisa reversed the excess margin, her GHV dropped below 20%, and they squared off her positions on June 17-20, causing a ₹30.48 lakh loss.

She also claimed extra interest charges.

Penalty Imposed

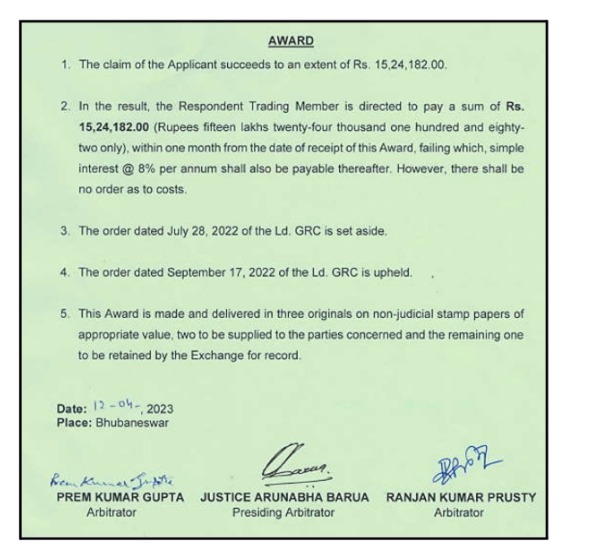

NSE Arbitration Tribunal (March 2023) ruled both sides at fault. The glitch was 5 Paisa’s responsibility, but Anuradha exploited it.

Set aside, GRC’s partial award ordered 5Paisa to pay ₹15,24,182 (50% of loss) within 1 month, or 8% interest after. Upheld rejection of ₹3.01 lakh interest claim.

Key Takeaways

- App glitches can show fake margins, so always verify your real eligibility before big trades, don’t chase high exposure.

- If you spot wrong numbers, call support immediately instead of trading; brokers must fix errors, but they won’t always save your losses.

- Track GHV and margin alerts closely; square-offs happen fast when limits drop below 20%.

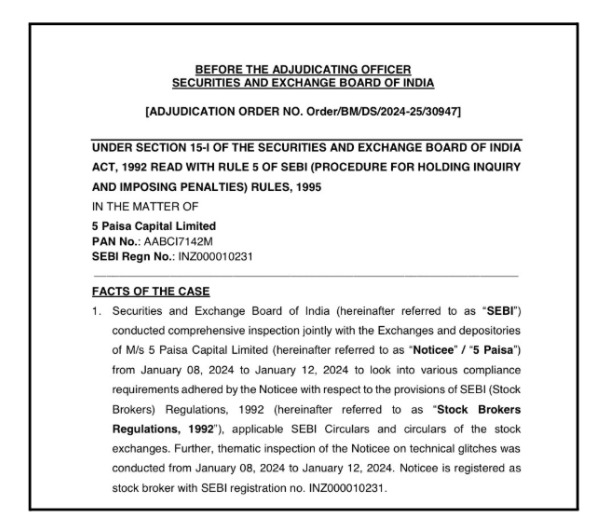

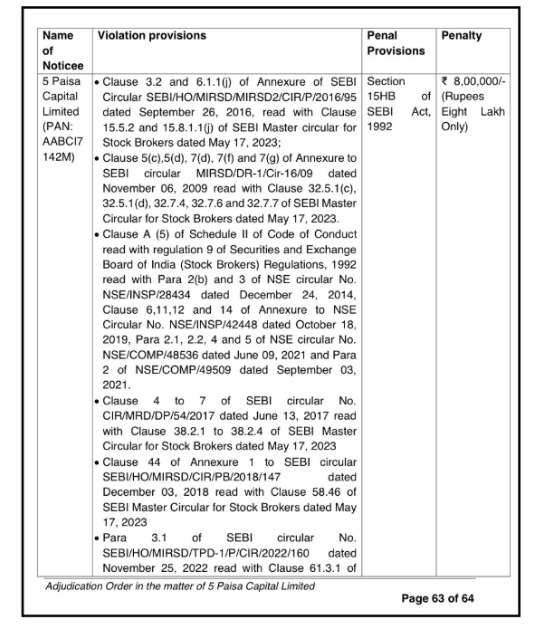

5 Paisa SEBI Orders

SEBI regularly keeps a check on its registered brokers to ensure that they are following the guidelines. If they find something unusual, they monitor it.

SEBI has passed the following orders on 5 Paisa for violation of rules and regulations:

- ₹8 Lakh Penalty Exposes Hidden Risks for Traders

SEBI’s joint inspection with exchanges/depositories flagged violations like:

- Incorrect enhanced supervision reporting (e.g., overstated client bank balances by ₹46.91 lakh on May 19, 2023)

- Discrepancies in cash equivalents vs. segregation reports (up to ₹81 crore gap on June 30, 2023)

- Poor supervision of Authorized Persons (APs handled ₹2.45 crore client funds improperly from unapproved locations)

- MTF margin shortfalls (₹2.99 crore from 16 clients)

- Delayed cyber-security fixes (80+ VAPT vulnerabilities open beyond 3 months)

- Unreported technical glitches (e.g., fund transfer delays of 1-2.5 hours).

These breached SEBI Stock Brokers Regulations, enhanced supervision circulars, AP guidelines, MTF rules, cyber resilience norms, and glitch reporting mandates.

What SEBI Did?

Under Section 15HB of the SEBI Act, 1992, a total ₹8,00,000 penalty was levied, factoring in no direct investor loss but repetitive lapses and prior NSE fines (₹1 lakh for MTF shortages).

They were asked to pay this amount within 45 days, or they would face consequences from SEBI.

Learnings for Investors

Always check SEBI’s public orders for your broker’s compliance record before onboarding to avoid hidden risks like fund mismanagement.

Insist on direct broker settlements, bypassing APs, and report irregularities promptly to protect your funds. Prioritize brokers with timely glitch reporting and cyber fixes, especially for MTF trading, to minimize operational disruptions.

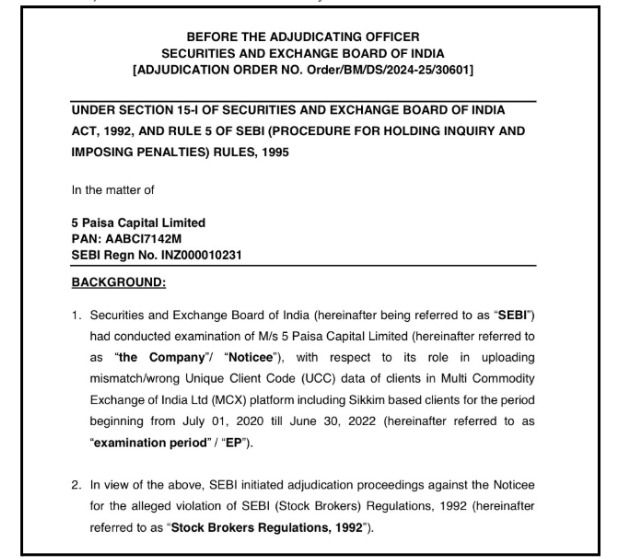

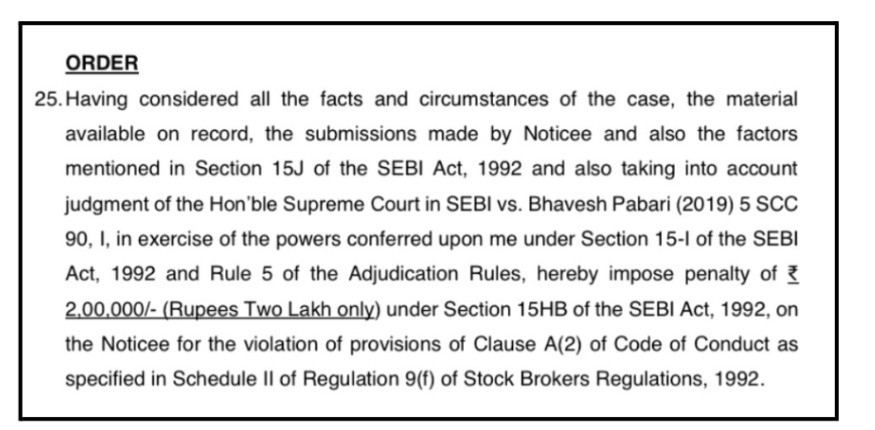

₹2 Lakh Fine for Massive UCC Data Blunders

SEBI’s examination revealed 5 Paisa uploaded mismatched/wrong UCC details for 14,494 clients (4.81% of total UCCs). It included 22 non-Sikkim clients falsely marked as Sikkim-domiciled.

Thus, potentially evading stamp duty exemptions meant only for Sikkim residents per the MCX circulars and the Stamp Duty Act.

This stemmed from faulty pincode-state mapping using incomplete MCX master files (April/Nov 2019), lacking proper internal checks. It violated Clause A2 (due skill, care, diligence) of Schedule II, Regulation 9(f) of SEBI Stock Brokers Regulations, 1992.

What SEBI Did?

Under Section 15HB of the SEBI Act, 1992, a ₹2,00,000 penalty was imposed on July 30, 2024, considering no quantified gain/loss to investors or repetition under the Stock Brokers Regulations (though MCX fined ₹1 lakh for 14,494 clients + ₹2.2 lakh for 22 Sikkim mismatches).

It was to be paid within 45 days via the SEBI portal, or they would face recovery, including property attachment.

Learnings for Investors

Always check if your broker enters your details correctly on exchanges like MCX or NSE.

Wrong info can cause tax problems for you. Ask your broker to double-check the pincode and state details before trading.

Small errors can lead to big fines. Pick brokers with no SEBI or exchange penalties. This keeps your money safe from hidden issues.

How To File a Complaint Against Stock Broker?

If you’re facing issues with 5 paisa and feel stuck, you don’t have to handle it alone.

Register with us, and we’ll help you turn your problem into a proper, trackable complaint.

How we help with 5 paisa issues:

- Collecting proofs: We help you gather trade statements, ledgers, contract notes, emails, chats, and screenshots, so your case has strong evidence.

- Writing your complaint: We draft clear complaints in the correct format for NSE, BSE, SEBI SCORES, and SMART ODR, so they are not ignored or rejected over wording or formatting.

- Filing on the right platform: We guide you step by step while submitting on SCORES or SMART ODR and ensure all details and documents are filled in properly.

- Escalation and follow‑up: If 5paisa doesn’t solve the issue, we show you how to escalate to the exchange or next level and help you reply to any queries.

- Support in counseling/arbitration: If your case goes to counseling or arbitration, we help you prepare your statements and documents so you feel ready and confident.

In short, you focus on telling your story and tracking your money, and we handle the drafting, filing, and procedure against 5 paisa.

Conclusion

5 Paisa sits in a grey zone for many investors. On one side, it is a SEBI‑registered discount broker with low brokerage, a full grievance redressal structure, and approval to run newer offerings like an online bond platform.

On the other hand, there are serious concerns for which SEBI has already penalised it.

Several users have publicly complained about glitches, difficulty exiting trades, missing holdings, poor customer support, and recurring 5Paisa not working issues during critical trading hours.

For a common investor, this simply means 5 paisa cannot be treated as a “blind trust” platform.

It may work for basic, low‑frequency investing if you are careful, but it looks risky for heavy intraday trading or for parking large, long‑term holdings when so many issues are tied to execution and service.

The safest approach is to start small, monitor how the app behaves in real market conditions, and see how quickly your issues are resolved in writing.

If you notice repeated problems, slow replies, or any confusion around your holdings, it is wiser to shift to a more stable broker rather than fight constant battles.