In today’s fast-moving world, financial emergencies can appear without warning. When that happens, people naturally look for apps that offer quick, secure, and reliable loan options.

This is where Aadhaar-based lending seems like a lifesaver, promising instant approvals, simple documentation, and assurance of regulatory compliance.

But this convenience has also opened the door for fraudsters. Many scammers now misuse the Aadhaar Credit Loan name to trick users into believing they are dealing with a legitimate, government-backed service.

That’s why it’s important to pause and verify: Is the Aadhaar Credit Loan app real or fake?

While countless apps claim to provide fast, hassle-free loans, not all of them can be trusted.

Cybercriminals know that people trust anything linked with Aadhaar, so they hide behind fake authorisations and pretend to offer instant personal loans that never actually reach your account.

Before you take any step, let’s take a closer look at how the Aadhaar Credit Loan app claims to work, and whether it truly stands up to scrutiny.

What is the Aadhar Credit Loan App?

The Aadhaar Credit Loan app claims to offer instant personal loans using nothing more than your Aadhaar and PAN details.

On the surface, it appears to function like a standard NBFC-style platform, with quick processing, minimal paperwork, and easy approvals.

Sounds convenient, right?

But here’s where things get suspicious.

There’s another platform called Aadhar Financial Services Limited, and both apps look almost identical.

The websites follow the same loan process, use similar layouts, and even present themselves as RBI-authorised lenders.

But take a closer look at the details that actually matter:

- Are their RBI registration numbers the same?

- Do their CIN numbers match?

- Can two separate companies legally operate under the same NBFC license?

Absolutely not.

If those core identifiers overlap or look copied, there’s only one logical explanation: one of them is impersonating the other.

Is the Aadhar Credit Loan App Legit?

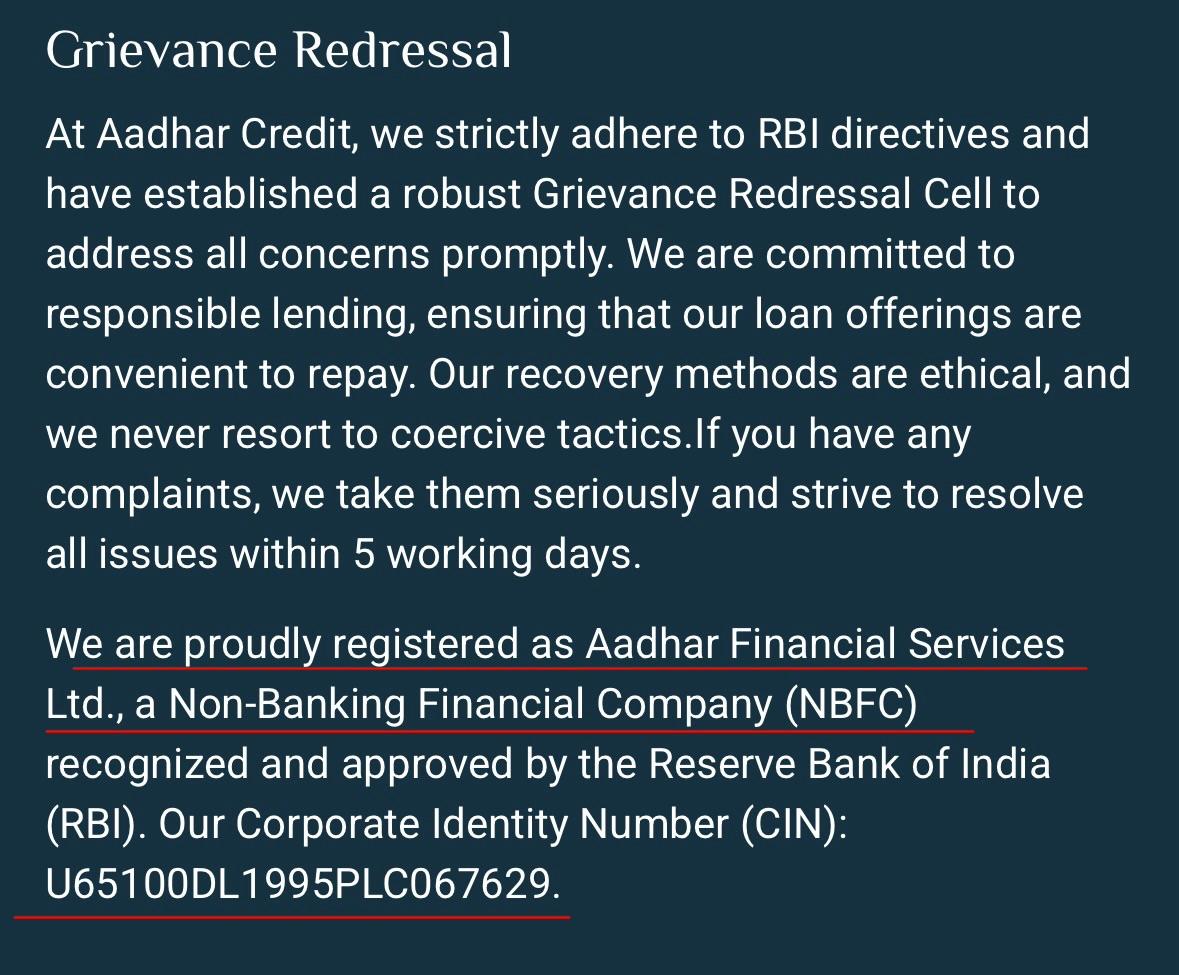

The Aadhaar credit loan app appears to be a genuine website when we read the information.

Especially when you check the grievance redressal section, you see that the company calls itself as NBFC and proudly flaunts that CIN number.

A user would generally look at the RBI name and CIN number to trust a website.

But what if RBI tells you that the information provided by them doesn’t belong to them?

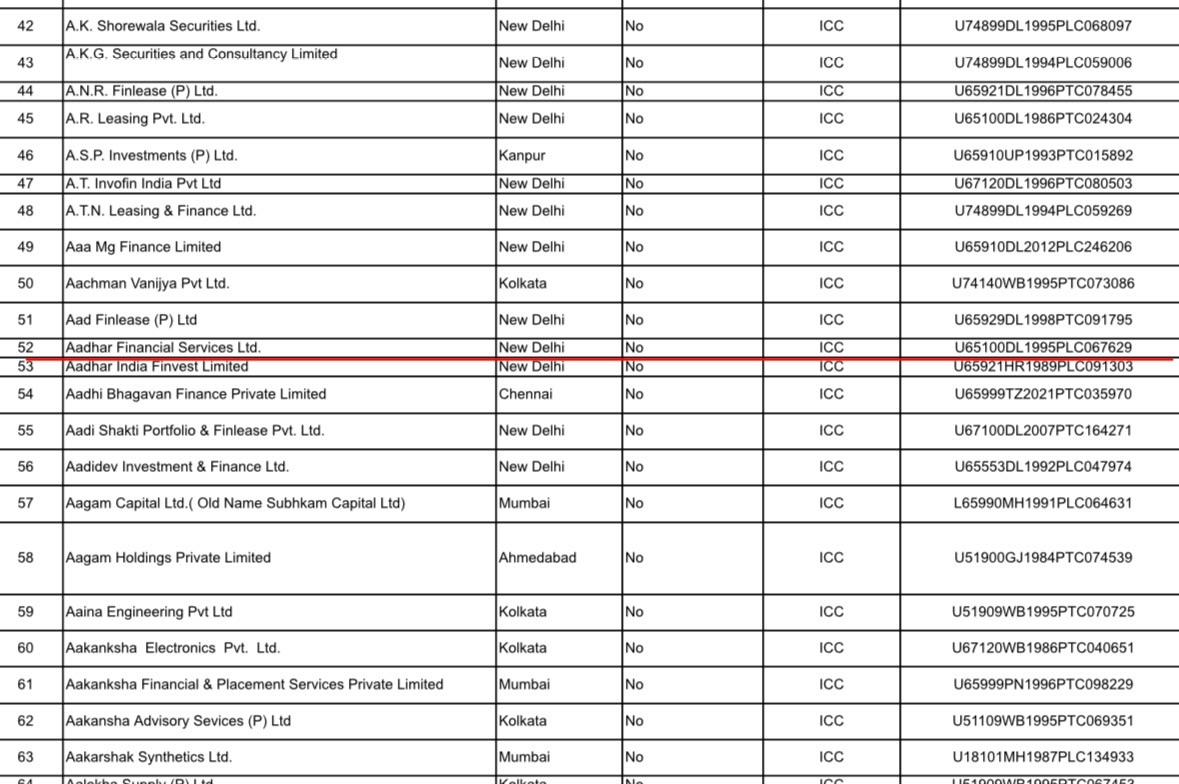

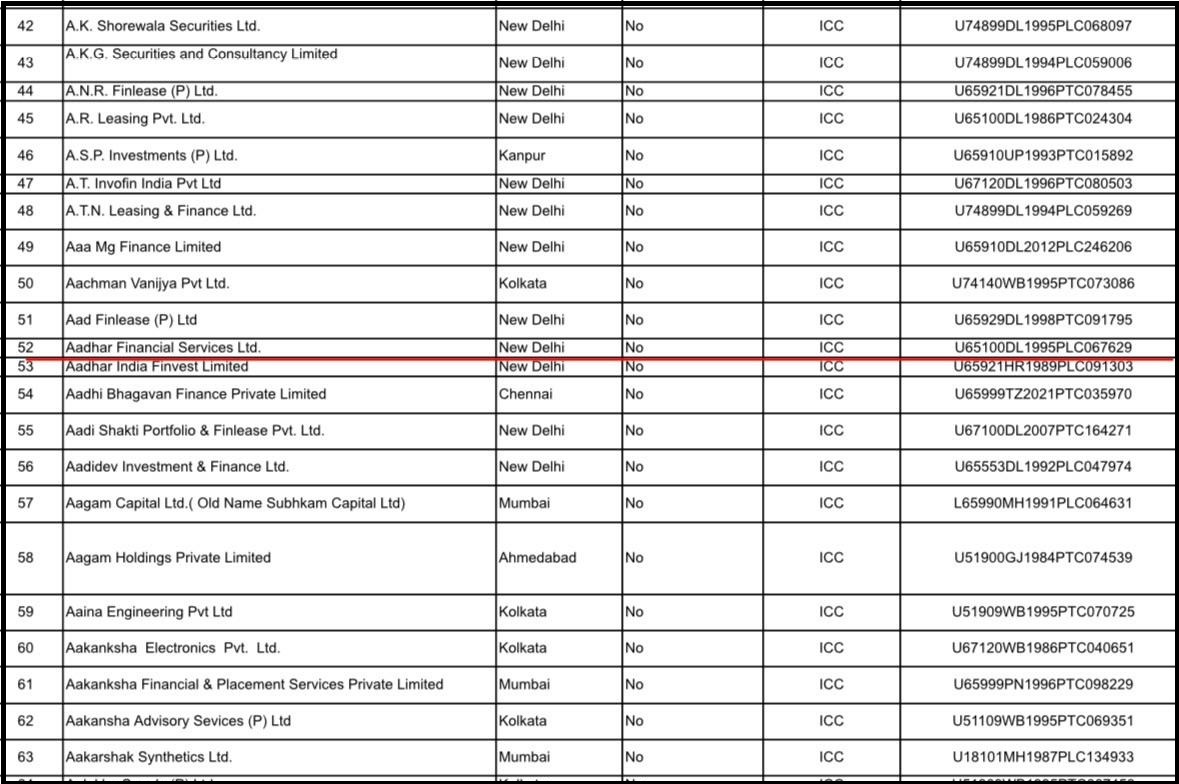

Upon investigation, we found out that the Aadhar credit-named company is not available on the RBI’s NBFC list.

Upon investigation, we found out that the Aadhar credit-named company is not available on the RBI’s NBFC list.

Well, that’s strange and shocking because the website clearly mentions their identity number.

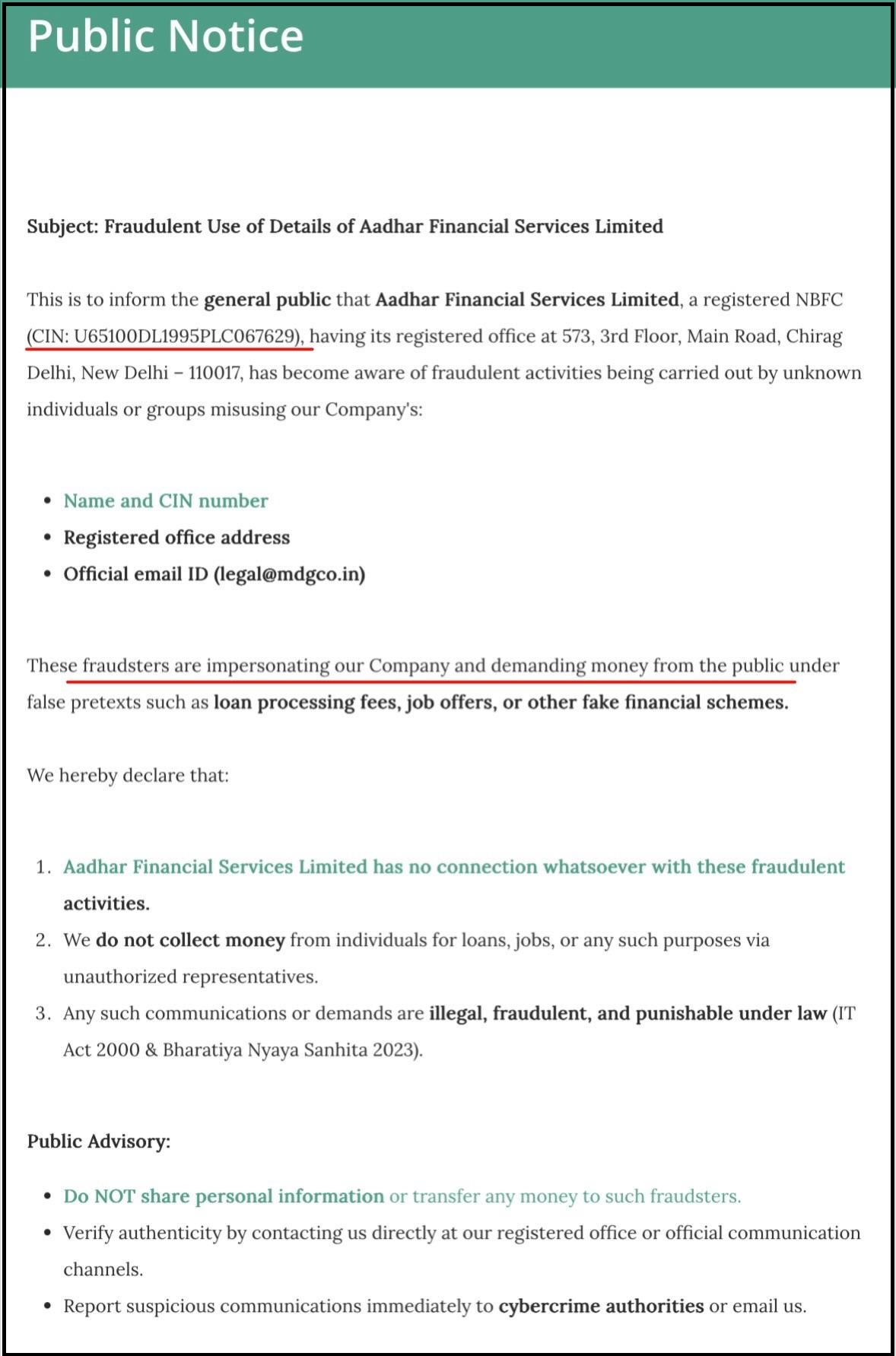

This is a common technique used by scammers to deceive people. While checking the CIN number, we found out that the CIN number belongs to the real Aadhaar Financial Service Limited.

So, all of this was just a bait to deceive people so that their money could be looted.

If you check the website of Aadhar Financial Service Limited, you will see a notice in which it is clearly mentioned that some fake websites are using their data to scam people.

Thus, we come to the conclusion that the Aadhar Credit Loan app is totally fake!

Aadhar Credit Loan App Scam

Imagine trusting a website, and then it turns out to be a fraud. Hundreds of users have fallen for this scam. Trusting their license, many have lost thousands of rupees.

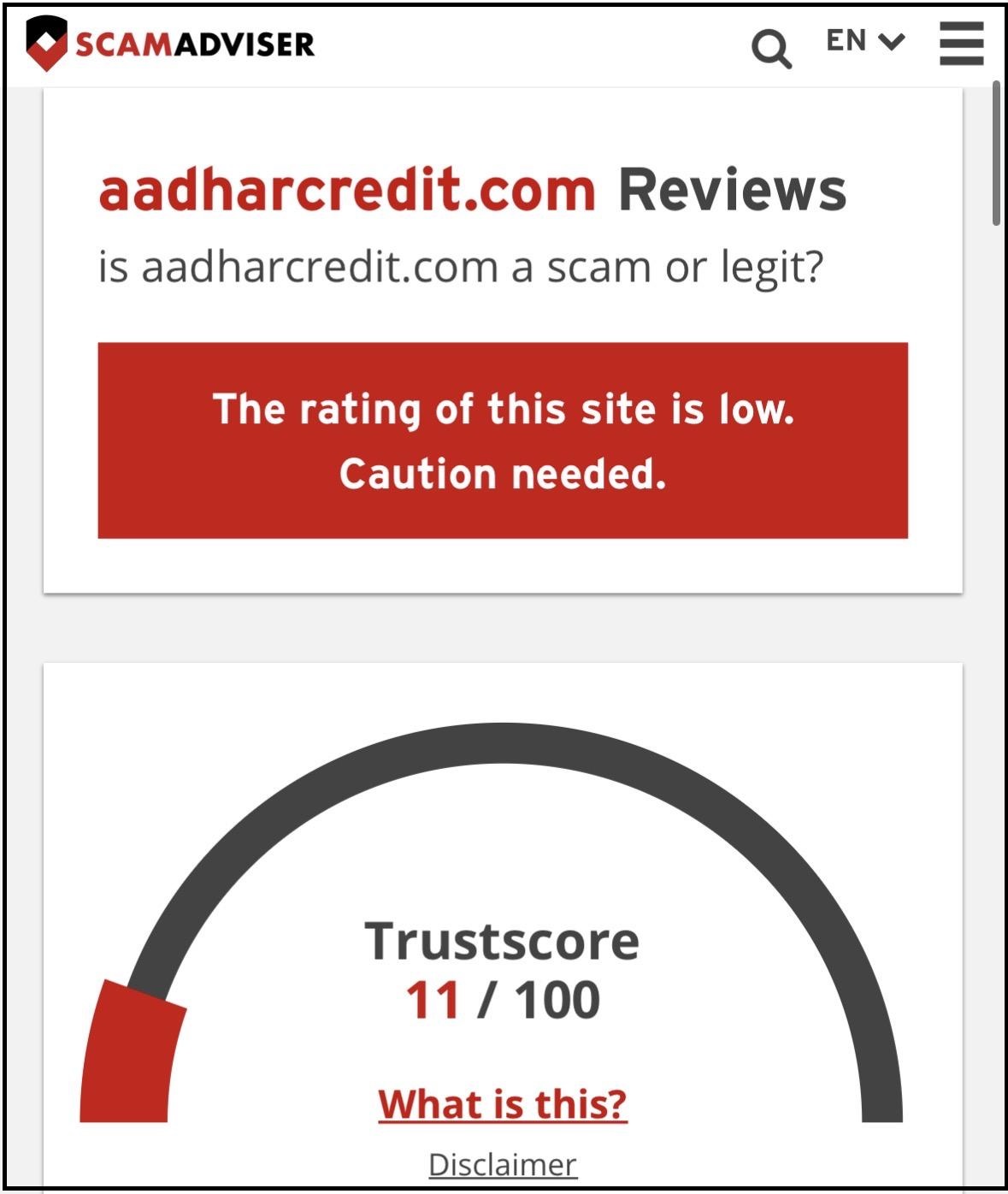

The Aadhaar credit loan app was also checked through Scam Advisor, and the results were not shocking this time.

The trust score was 11/100, which is generally there if the website is a scam.

Not only this, but there is a warning given to users to stay away from this website.

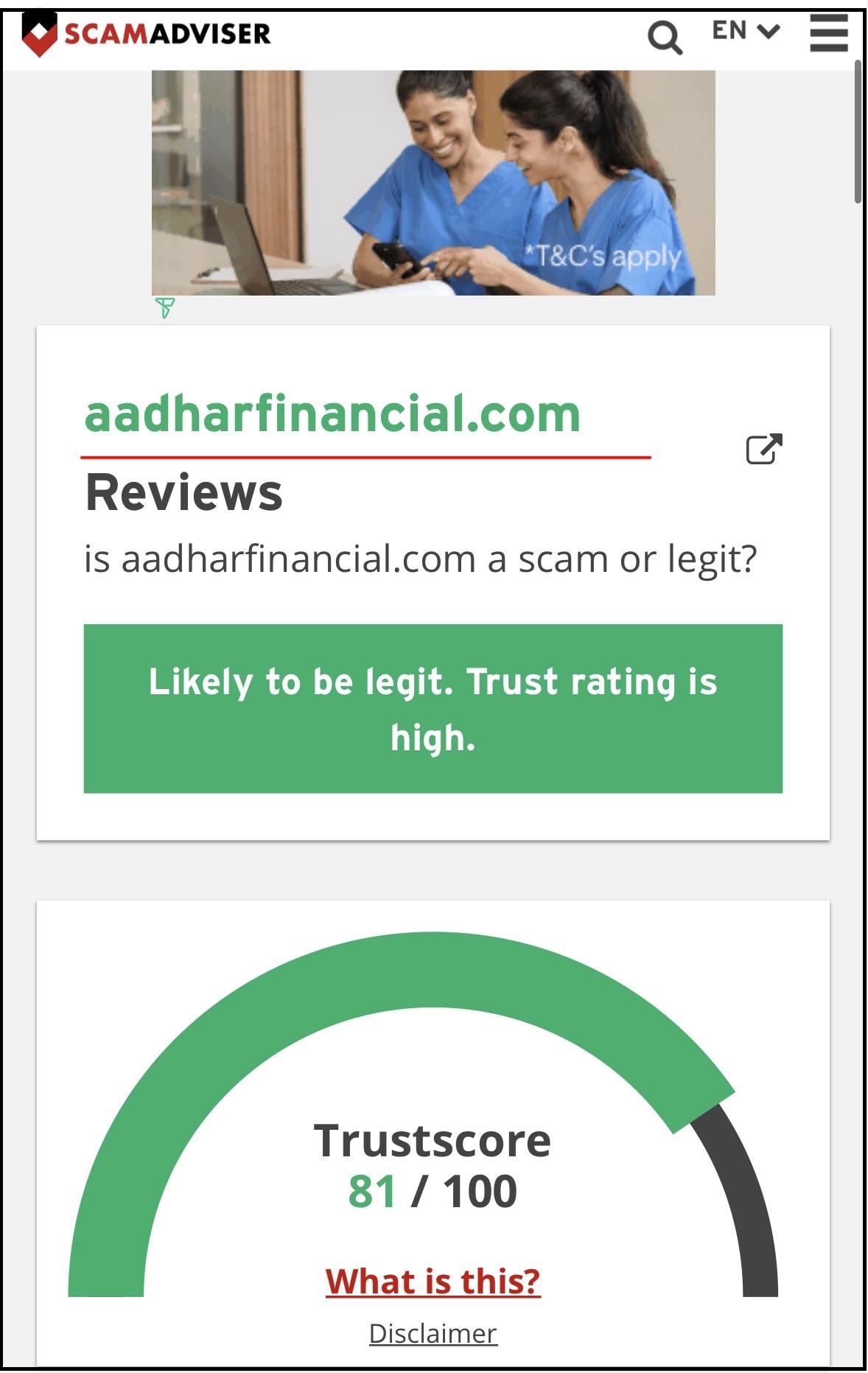

Then we checked Aadhar Financial Service Limited to see if that is real or not. It was also checked through Scam Advisor.

Well, the result and investigation show that the real application is Aadhar Financial Services, whereas the other one is just another scam, waiting for its prey.

To verify our claim, we also checked the process of getting a loan through this application. We found out that this exactly works like an impersonated scam loan app:

- They advertise on social media or WhatsApp using fake RBI approval certificates.

- They ask users to pay small “refundable” fees for processing or verification.

- Once a person pays, they demand additional charges under the name of GST, TDS, or insurance.

- Eventually, they disappear and block communication or shut down the website.

In most cases, victims lose their money and never receive any loan.

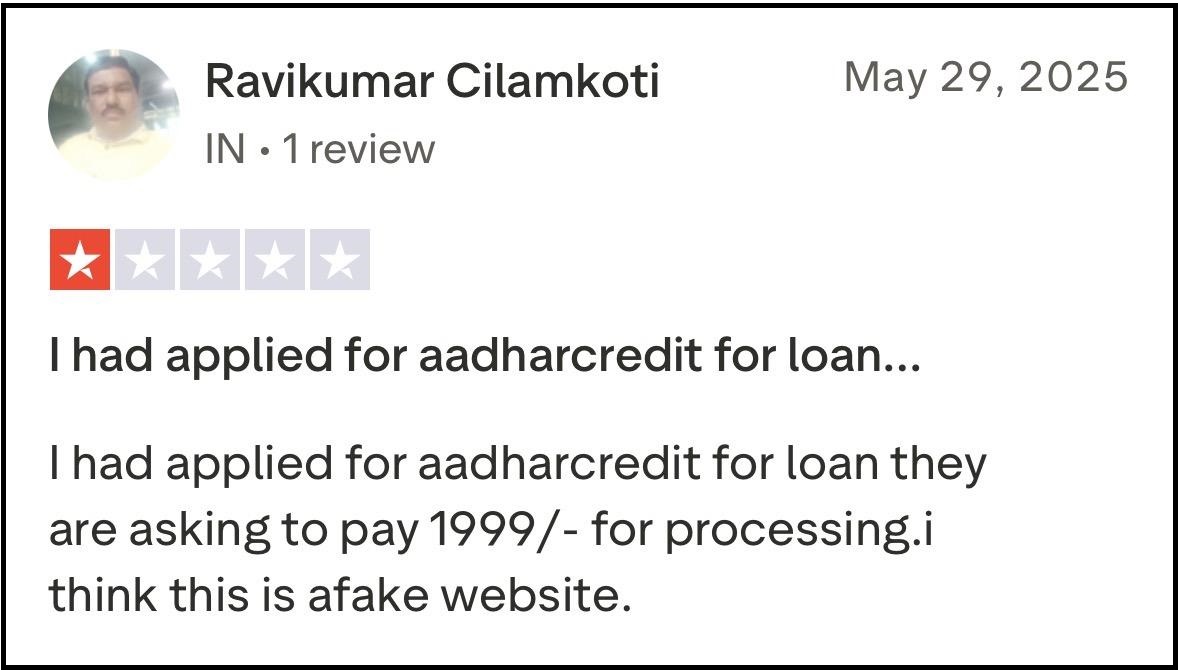

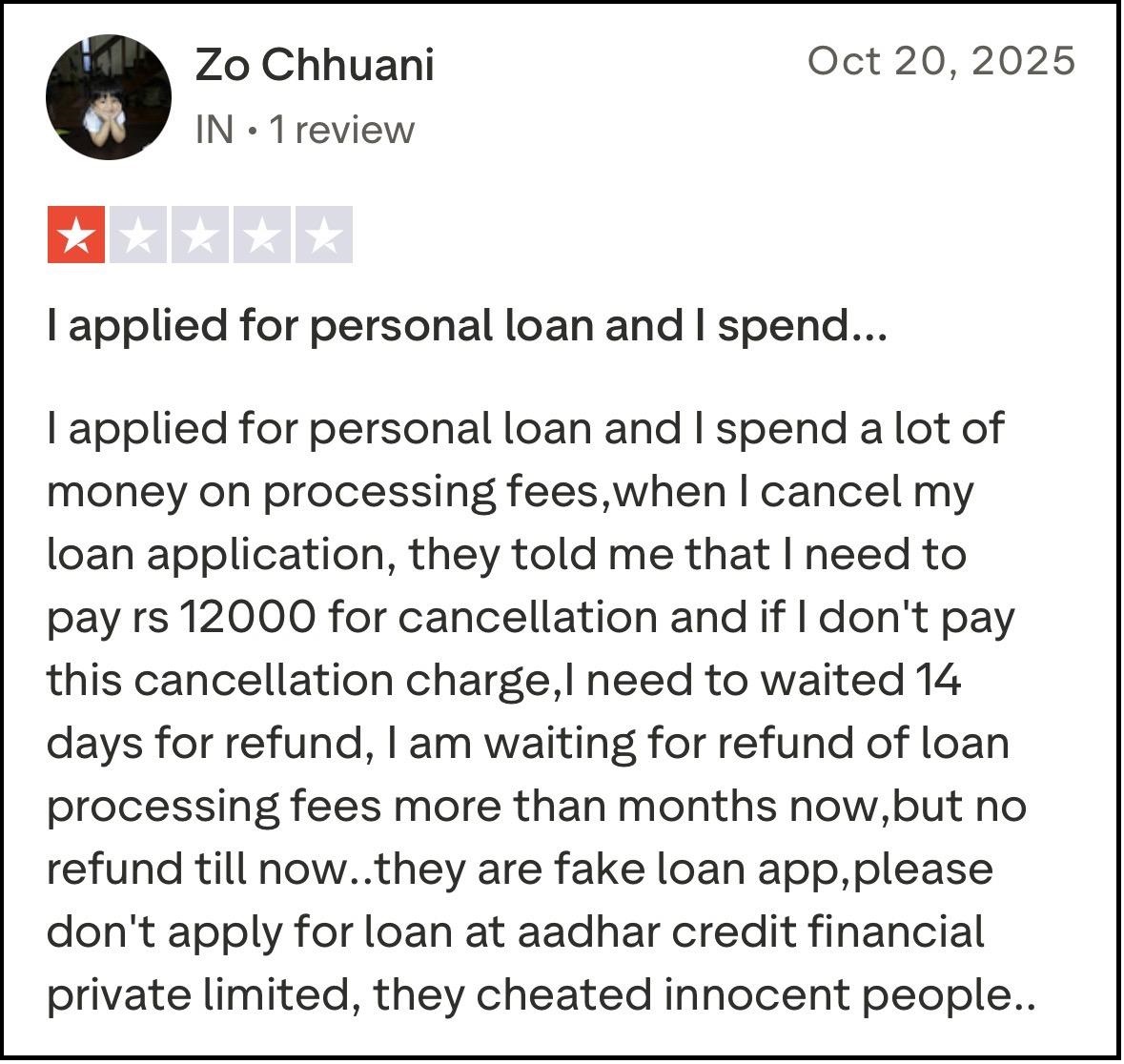

Aadhar Credit Loan App Complaints

Here is a real story of how these impersonated Aadhar credit platforms take advantage of your trust.

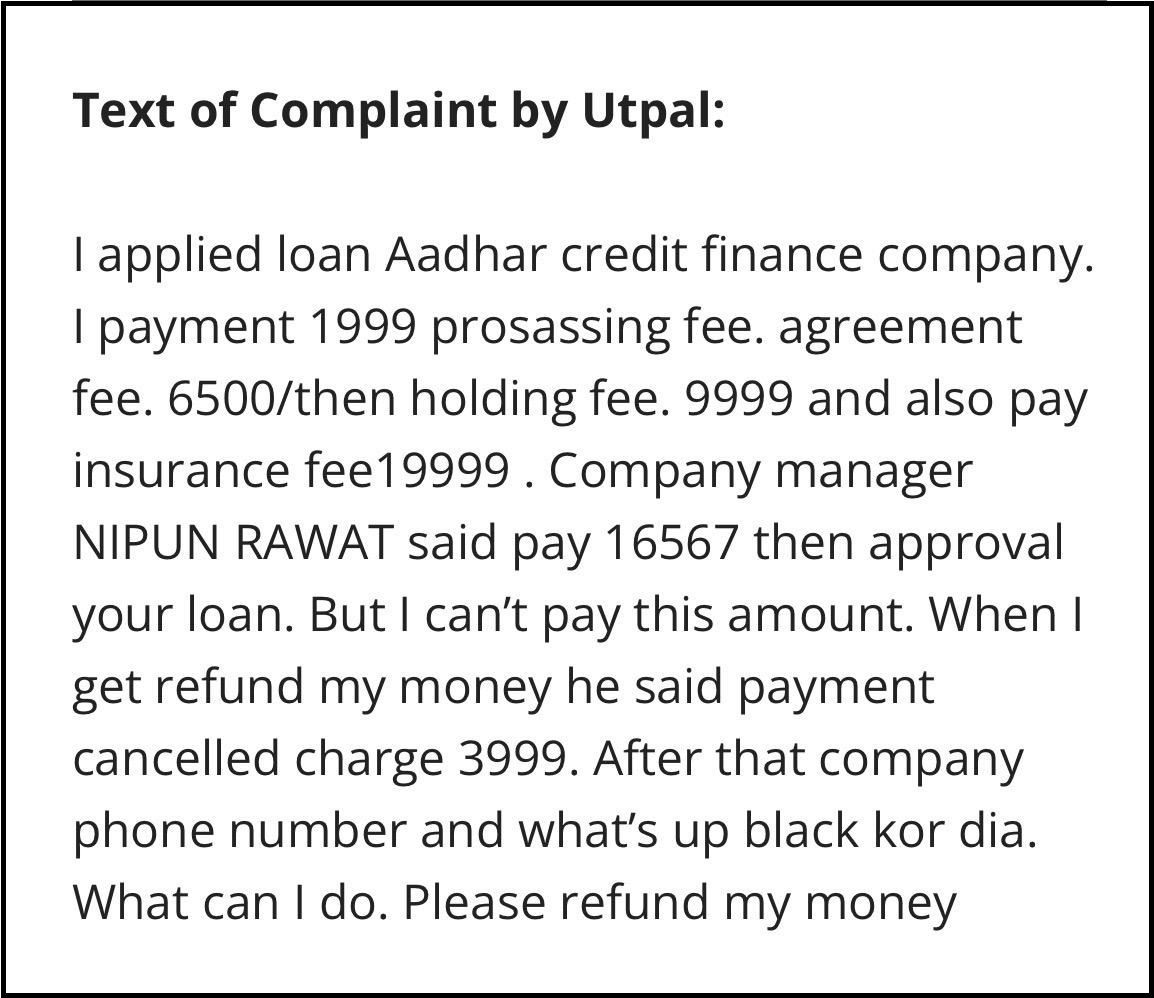

On May 21, 2025, one of the victims of the Aadhar Credit loan app came forward with a troubling experience, one that began like a routine loan inquiry but quickly turned into a series of red flags.

They had applied for a personal loan through a company called Aadhaar Credit / Aadhaar Financial Services Limited.

The platform claimed to be RBI-approved and assured the borrower that the loan would be credited soon after clearing just a “few small fees.”

At first, it all seemed normal.

The company asked for refundable processing and verification charges, something many legitimate lenders also request.

Trusting the RBI name and the professional tone, the borrower went ahead and paid. Honestly, anyone would have.

Up to this point, it felt like a typical, though slightly fee-heavy, loan process.

And then came the real twist.

What seemed like a simple personal loan suddenly began to look like a subscription to endless charges. New requirements kept popping up:

- Extra GST fees

- Additional TDS deductions

- More “mandatory” payments before the loan could be released

Each time the borrower cleared one payment, another excuse followed. It was no longer a loan application; it was a money-draining loop.

When the borrower finally refused to pay another rupee, the façade crumbled. The company went silent. Calls stopped. Messages disappeared. Support vanished.

No loan. No refund. Just a trail of payments, and a painful reminder of how scammers misuse trusted names like Aadhaar Financial Services to trap innocent people.

Sadly, this is not an isolated case. Multiple victims have reported similar frauds on various consumer complaint platforms, all involving look-alike loan apps exploiting the “Aadhaar” name.

Users often describe their experience as a cycle of “never-ending charges.” Fraudsters take advantage of people’s urgent need for money, especially when someone is simply trying to secure a small loan to take care of their family.

Instead of providing real help, these scammers keep inventing new fees and end up enriching themselves at the cost of ordinary borrowers.

How to Report Aadhar Credit Loan App?

If you have been a victim of an impersonated Aadhar credit loan app, you should immediately follow the steps given below:

- Visit the national cybercrime portal and file a cyber crime complaint under the financial fraud section.

- Report fake RBI ties to shut down unauthorised apps pretending to be legit lenders.

- You should “Report” on Google Play or Apple App Store to help get the scam app removed before it tricks more people.

- File a complaint at your nearest police station.

- Collect all the evidence like screenshots, messages, calls, amount transferred, etc.

Need Help?

We understand that it becomes very frustrating when all our hard-earned money just vanishes in seconds. In case you don’t know how to complaint against online loan app or are confused about how to report such loan app scams online, register with us now.

We will guide you with the process and help you in filing your complaint online.

Conclusion

The Aadhar credit loan app is an impersonated app, which is just a scam.

Before you apply for any online loan, always cross-check the app credentials. Holding fake RBI licenses doesn’t make any loan app credible.

If it pressures you to make unnecessary payments, one after another, there is definitely something wrong.

If you ever come across suspicious companies demanding deposits or fees, report them immediately.

Awareness is the strongest weapon against online fraud.