Gold has always held a special place in India, not just as a precious metal, but as an emotion, a tradition, and a trusted form of wealth. With gold prices soaring year after year and demand touching new highs, more Indians have been searching for smart ways to invest in the metal.

From digital gold to gold bonds to private gold schemes, the promise is simple: invest today and your money shines tomorrow. And when the market is booming, people tend to trust any opportunity that claims to multiply their wealth quickly.

But what happens when someone offers even more than the market could ever deliver?

What if a company promises 10% to 30% monthly returns, free gold coins, and guaranteed payouts?

That’s exactly how thousands of people walked into one of the biggest investment traps in recent years – the Aarudhra Gold Investment Scam.

What seemed like a golden opportunity turned into a financial nightmare for over one lakh investors, exposing how easily greed and trust can be exploited in the name of gold trading.

What is Aarudhra Gold Investment Scam?

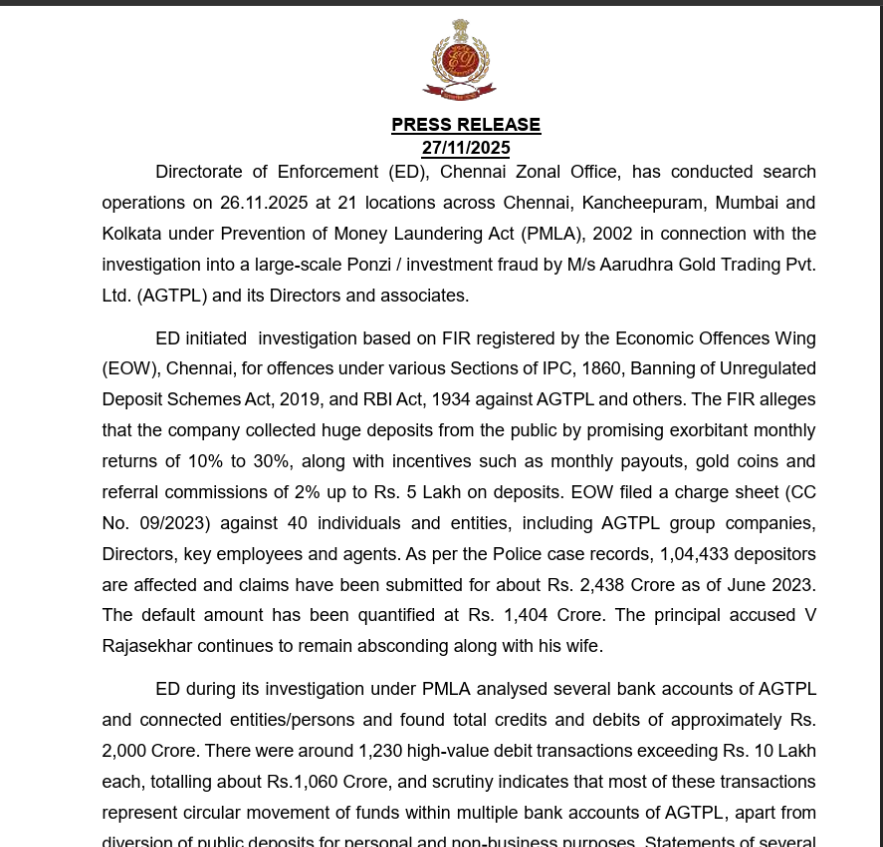

Aarudhra Gold Trading Pvt. Ltd. (AGTPL), operating from Aminjikarai, Chennai, posed as a gold trading and investment company. Between September 2020 and May 2022, it aggressively mobilised deposits from the public by offering unrealistically high monthly returns-10% to 30%.

The Aarudhra Gold Trading scam has shaken thousands of families across Tamil Nadu and beyond. What seemed like a high-return gold investment opportunity has now been exposed as one of the biggest Ponzi-style frauds in recent years.

With over ₹2,400 crore collected from more than one lakh unsuspecting investors, the case has triggered investigations by the Economic Offences Wing (EOW) and the Enforcement Directorate (ED).

How They Lured Investors?

The company and its agents manipulated vulnerable depositors through:

- 25%–30% monthly returns claims

- Monthly payouts

- Gold coins as incentives

- 2% referral commissions (up to ₹5 lakh)

- Meetings hosted at luxury hotels

- Promises backed by “directors” who were later found to be dummy employees

Scale of the Fraud

According to EOW’s chargesheet (CC No. 09/2023):

- 1,04,433 investors were affected

- ₹2,438+ crore worth of claims filed

- ₹1,404 crore officially defaulted

- Many so-called “directors” were menial workers used as name-lenders

- The main accused, V. Rajasekhar, and his wife remain absconding

The company failed to pay both promised interest and the principal amount, leaving lakhs of families financially paralysed.

Aarudhra Gold Investment Scam: Role of ED and Its Findings

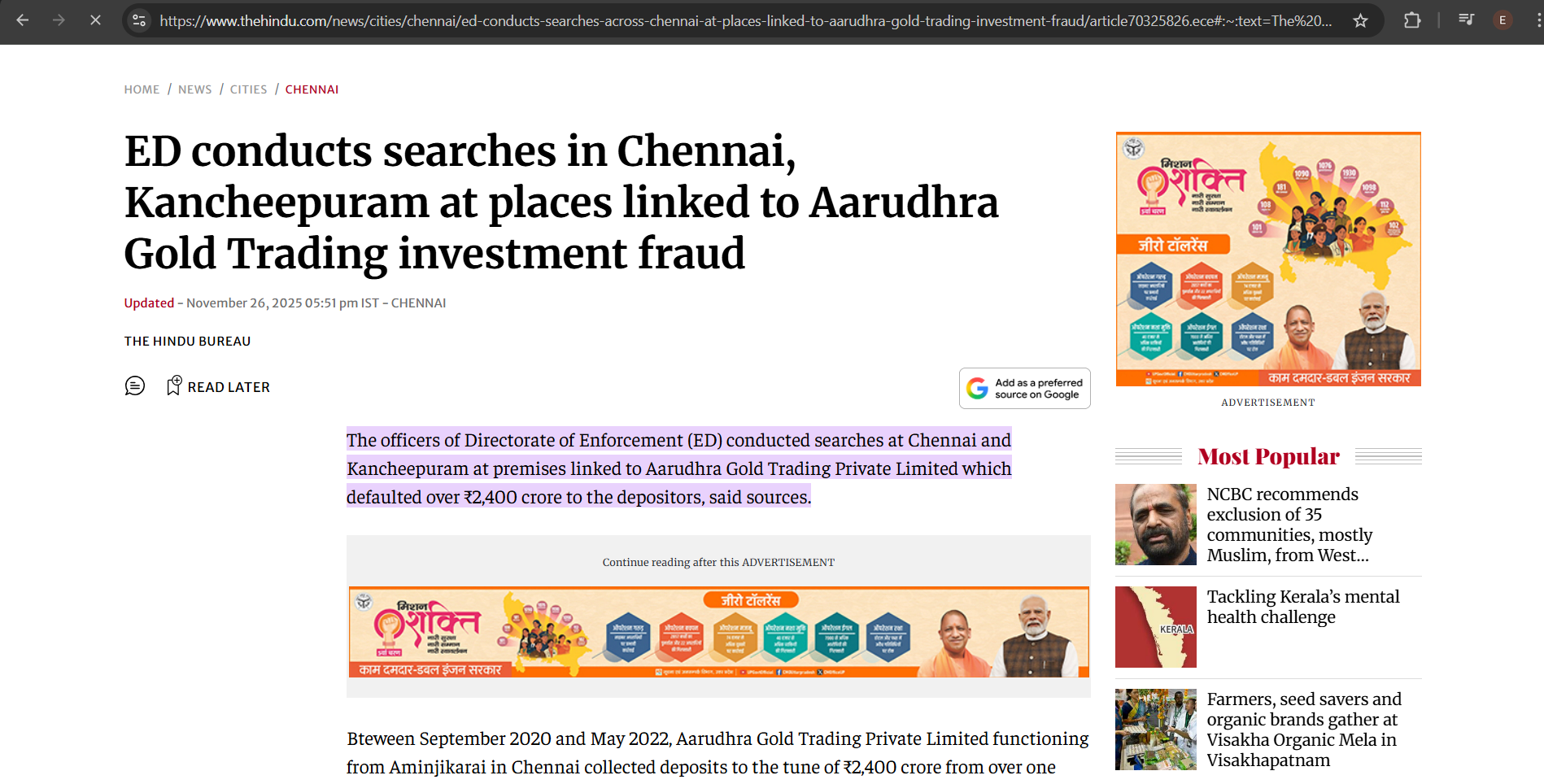

The Enforcement Directorate (ED) launched an investigation under the Prevention of Money Laundering Act (PMLA), 2002, following the EOW FIR.

Major ED Actions & Findings

1. Multi-City Search Operations

On 26 November 2025, ED conducted searches at 21 locations across:

- Chennai

- Kancheepuram

- Mumbai

- Kolkata

These included private apartments and business premises linked to the scam.

2. Detection of ₹2,000 Crore Suspicious Transactions

ED’s financial scrutiny revealed:

- ₹2,000 crore+ movement through multiple accounts

- 1,230 high-value debit transactions (>₹10 lakh each)

- ₹1,060 crore worth of suspicious debits

- Circular fund movement within AGTPL accounts

- Depositors’ money diverted for personal use, luxury purchases, and layering via shell firms

3. Discovery of Dummy Directors

Many “directors” were:

- Daily-wage workers

- Not aware of transactions

- Used only to mask real ownership

This indicates deliberate planning by the key conspirators to hide the fraud.

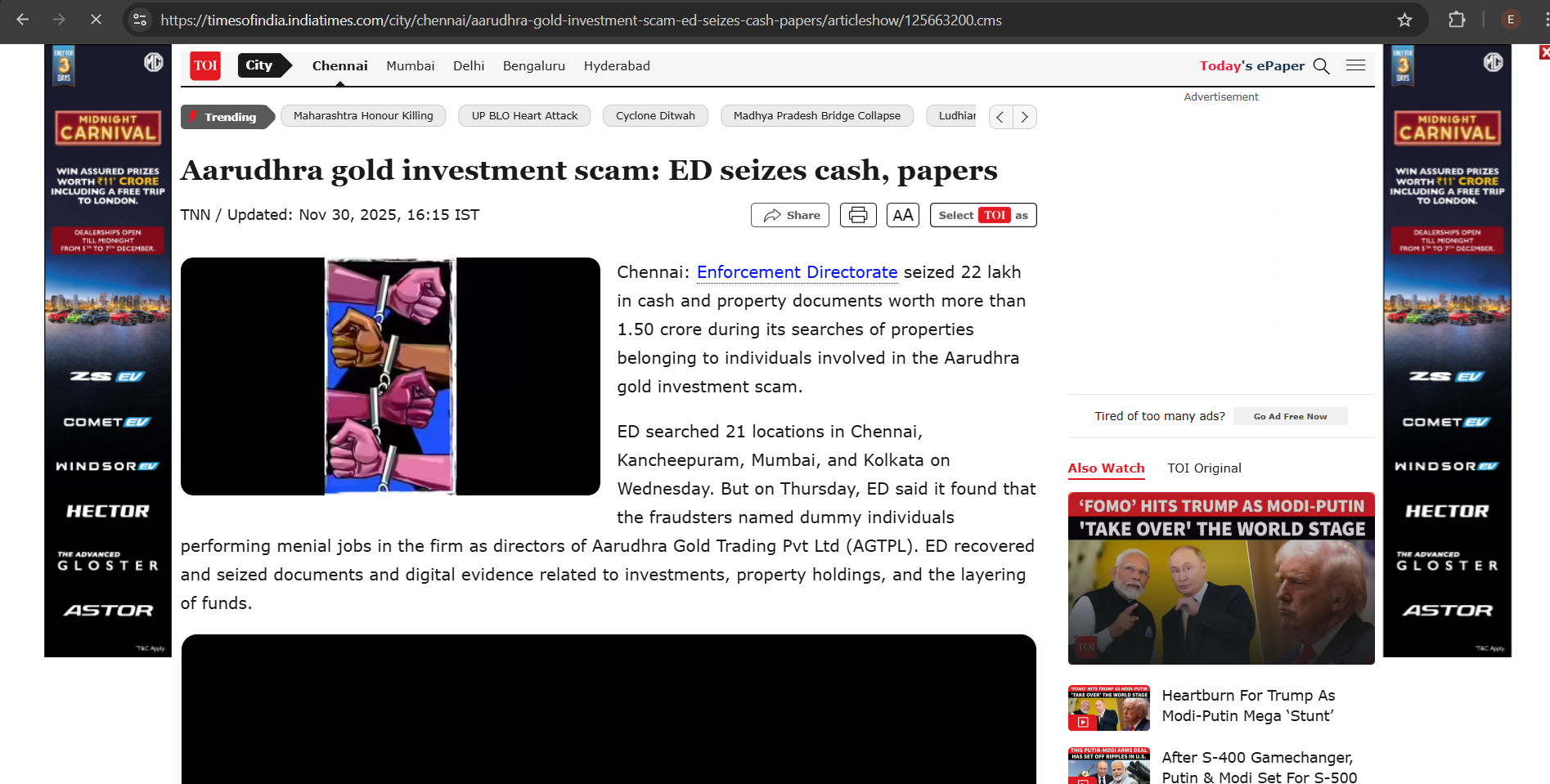

4. Recovery During Searches

ED seized:

- ₹22 lakh in cash

- Property documents worth ₹1.50 crore+

- Digital devices, shell-company documents

- Records proving fund diversion and money laundering

The agency also confirmed that attachment of properties will soon follow and that the investigation will continue further. The case underscores how unregulated deposit schemes continue to thrive, especially during periods of economic instability.

How to Report Investment Scams?

If you or someone you know has fallen victim to similar schemes, act immediately.

1. File a Cyber Crime Complaint with Police

- Visit your nearest Economic Offences Wing (EOW) office

- Or complain about state police portals

Include: receipts, agreements, bank statements, WhatsApp chats, and IDs.

2. Complaint in SEBI / RBI

If a company claims to be registered but behaves suspiciously, verify and report:

- File a SEBI SCORES Complaint

- RBI Sachet Portal

3. National Cyber Crime Reporting Portal

Useful if payments were digital or online.

4. Email ED or Government Helplines

Provide transaction details, IDs, and contact information.

Need Help?

If you want step-by-step support in filing your complaint, you can register with us.

We guide victims through documenting evidence and submitting official reports through proper legal channels.

Conclusion

The Aarudhra Gold Trading scam is a sobering reminder that financial frauds are evolving faster than ever. Despite regulatory warnings, thousands still fall prey to Ponzi-style promises of quick, unrealistic gains.

While ED’s crackdown is a positive step, long-term safety depends on:

- Public awareness

- Regulatory vigilance

- Early reporting by victims

- Stricter control of unregulated deposit schemes

Always remember:

Any investment offering 10%–30% monthly returns is not an opportunity; it’s a red flag.

Stay alert. Stay informed. Stay protected.