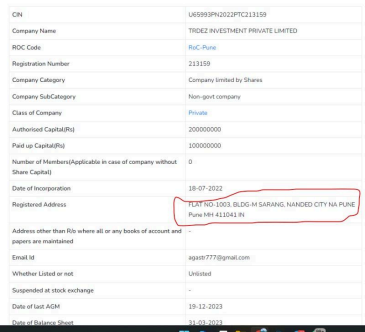

In the rural pockets around Pune, a promise of easy wealth spread quickly: earn 8–10% monthly returns, withdraw anytime, no risk. The platform, Infinite Beacon, was pitched as a smart investment backed by SEBI-registered broker TRDEZ Investment India Pvt. Ltd.. But behind it all was Agast Mishra, a name unknown to most investors, yet central to the operation.

While rarely seen, his name sits on paper as a director of TRDEZ Investment Pvt. Ltd., the very firm used to give Infinite Beacon a legal face.

What most didn’t know was that this entire setup was allegedly built on deception.

Behind the scenes, Agast Mishra is believed to be the mastermind of a multi-crore Ponzi scheme, cleverly run through a web of front companies and faces, including Navnath Jagannath Awatade, the man currently acting as the public face of Infinite Beacon.

The Hidden Hand: Agast Mishra

So, who is Agast Mishra?

He isn’t someone you’ll find hosting investor meets or sending WhatsApp promotions.

In fact, most investors have never heard of him. But his name appears consistently in company filings, and he is listed as a director in TRDEZ Investment Pvt. Ltd., TRDEZ Ventures, and other related entities.

Corporate data platforms confirm that Agast Mishra is closely connected to the firms running Infinite Beacon.

Wondering how?

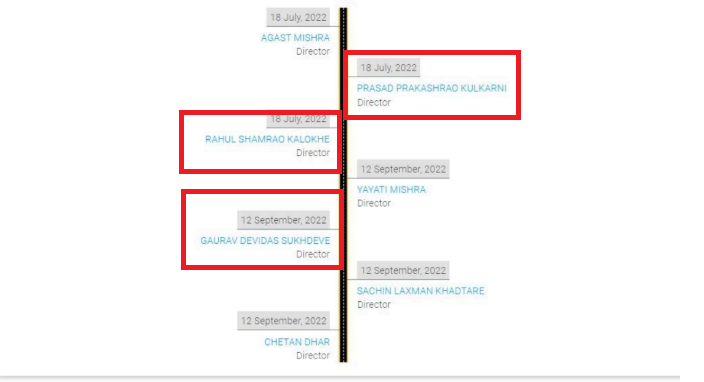

Public corporate records reveal that three directors are common between TRDEZ Investment India Pvt. Ltd. and Infinite Beacon India Pvt. Ltd.. This detail raises serious questions about their operational link.

Trdez Investment Private Limited- Directors

Infinite Beacon India Private Limited – Directors

The setup was strategic: keep the core control in his hands while using others as the visible front.

And according to the latest Infinite Beacon news and complaints filed with SEBI and BSE, Agast fled to Dubai in early 2024, once complaints began surfacing.

The Public Face: Navnath Awatade

With Agast out of sight, Navnath Jagannath Awatade was positioned as the official spokesperson, director, and operator of Infinite Beacon. He:

- Led investor meetings.

- Handled agent commissions.

- Sent legal threats to journalists and whistleblowers exposing the scam.

In one notable case, Navnath issued a ₹25,00,000 legal notice to us for publishing an exposé that detailed the working of Infinite Beacon.

As covered in the blog “We Received ₹25,00,000 Legal Notice from Infinite Beacon – But Why?”, this move was widely seen as an attempt to silence criticism.

But instead of shutting down the investigation, it added more fuel. The blog exposed how:

- Infinite Beacon was using bank accounts without any SEBI license.

- TRDEZ and Infinite Beacon had three directors in common.

- No evidence of real trading activity existed.

Infinite Beacon Financial Services is Real or Fake in India

The pitch was simple, yet powerful:

- Invest your savings through Infinite Beacon.

- Earn 8–10% fixed monthly returns.

- Refer others and get a 2.5% commission.

- Get holiday rewards and cash bonuses if you bring more people.

To the average investor, it sounded like a dream backed by stock market trading. After all, Infinite Beacon claimed ties to TRDEZ, a SEBI-registered broker, giving it a layer of credibility that most wouldn’t question.

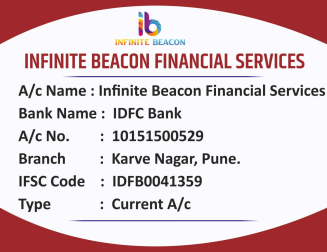

Once someone agreed to invest, they were asked to transfer funds to bank accounts under names like:

- IB Prop Desk

- Sispay TFS

- Infinite Beacon

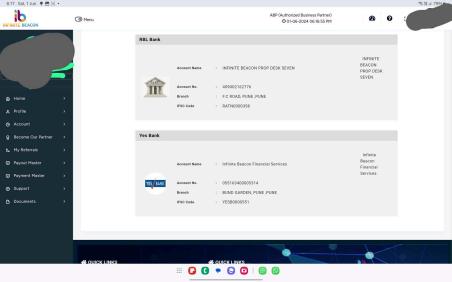

After payment, they were given access to a login dashboard showing investment amount, growth, trade orders, and withdrawal options.

But it was all an illusion.

The Proof

Our research helped us gather some proofs that reveals how the fraud was conducted.

Here’s a breakdown of what’s inside and what it exposes:

1. Fake Corporate Identity

- Company names like “Infinite Beacon” and “IB Prop Desk” were used to project a professional image.

- Investors believed they were dealing with a licensed entity, especially when told it was “backed” by TRDEZ, a SEBI-registered broker.

- However, Infinite Beacon itself is not registered with SEBI or any exchange, making its collection of funds completely illegal.

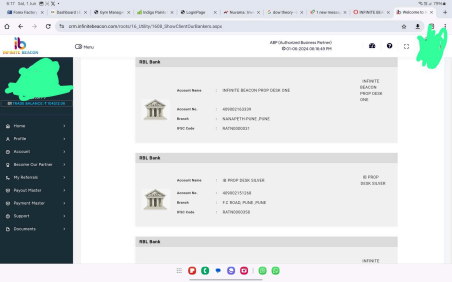

2. Multiple Bank Accounts Used for Collection

Proof documents include screenshots of bank account details where investors were told to transfer funds. These included:

- Account names like Infinite Beacon, IB Prop Desk, Sispay TFS, and others.

- No link to exchange-approved clearing or custodial services.

- Several receipts showing investor deposits into current accounts, not client-trading accounts.

What this proves: These were not compliant accounts as per SEBI broker regulations, they were private accounts collecting funds illegally, away from the audit trail.

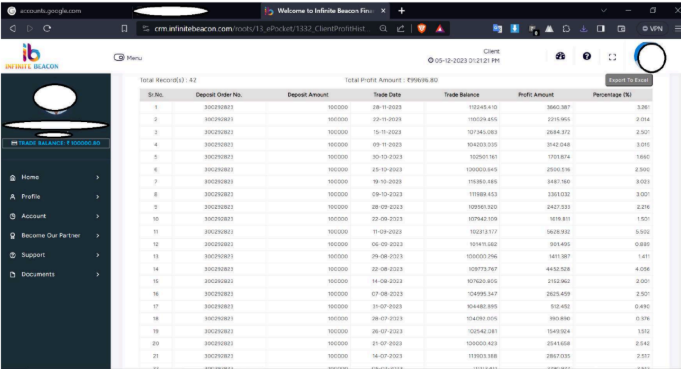

3. Fake Dashboards, Real Deposits

The investor dashboard screenshots in the PDF are particularly shocking:

- They show falsified order books, where supposed buy/sell transactions are listed.

- A “ledger” of profits, supposedly earned daily or monthly.

- A clean “withdrawal” interface with history of past requests and amounts.

But this entire system was built as a visual trap.

What this proves: There is no backend link to stock exchanges or real-time trading platforms. It’s a custom-built fake frontend made to mimic legitimate brokers.

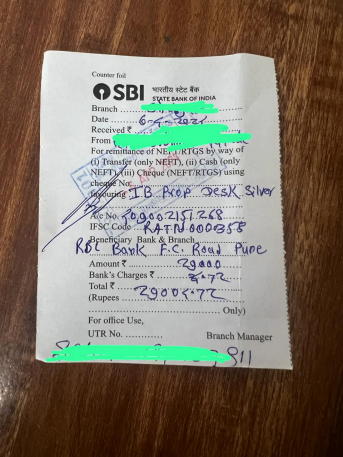

4. Receipts & Payment Confirmations

Screenshots show investors receiving receipts and confirmations, like:

- Manual receipts iare ssued on company letterhead after funds are transferred.

- Follow-up payment confirmations showing date and amount received.

- No contract notes, no DP slips, no trade confirmations — just informal receipts.

What this proves: These are non-compliant and illegal documents used to build false confidence among investors.

5. Fake Returns Displayed on Ledger

To make people invest in the scheme, they display the fake returns on their ledger.

Investors believe that their money is growing:

- Looks at the values, believing it to be real money

- Keep adding more funds

Unaware of the deception, investors often assume these ledger figures represent actual returns when, in reality, they are nothing more than fabricated numbers designed to mislead.

6. Role of Agents and Commissions

Through this structure, over 300 agents were deployed across villages:

- These agents were offered 2.5% commissions on every deposit they brought in.

- Some were promised international holidays, others were given bonuses for monthly targets.

- Agents often belonged to the same area as the investors, helping build trust.

What this proves: This is a multi-level referral-based structure — classic signs of a pyramid or Ponzi scheme.

Why This Is a Ponzi Scheme?

By every regulatory standard and financial logic, this is a textbook Ponzi scheme:

- Fixed returns are not allowed under Indian securities law.

- Referral bonuses and cash incentives are typical of pyramid-style fraud.

- Fake dashboards are a strong sign of misrepresentation.

- SEBI has not approved Infinite Beacon or its investment products.

- The key person, Agast Mishra, has absconded.

Complaints & Regulatory Loopholes

Multiple complaints have already been filed:

- SEBI SCORES

- SmartODR – BSE

Both were closed prematurely, based on responses from the company. However, our investigation further revealed that the companies involved share directors and office addresses, a detail that regulators failed to act upon.

What’s at Stake?

Over ₹4500 crore is believed to have been collected so far, with over 300 agents actively collecting money across Maharashtra, Goa, Karnataka, and Gujarat. Many investors have taken loans or sold assets, based on trust in the company and the early payouts.

If not stopped soon, this could lead to another Sahara-like collapse, affecting thousands of low- and middle-income households.

What Should You Do?

If you have invested in Infinite Beacon, or know someone who has:

- Preserve all records—receipts, dashboards, communication.

- Immediately stop any further investment.

- File a complaint with SEBI.

- Report the matter to the ED and file a complaint in Cyber Crime.

- Warn others. Many are still being targeted.

Conclusion

Infinite Beacon is not just another scam; it is a well-planned corporate fraud disguised under a SEBI license.

While Agast Mishra hides behind paperwork and a Dubai address, and Navnath Awatade continues operations in India, the investors are left holding empty promises.

This case is not only a test of our regulatory system—it’s a reminder that scams today don’t come in shady envelopes. They come with websites, dashboards, and registered companies.