Choosing a financial advisory service requires careful evaluation of its regulatory status, service structure, and transparency. Investors today look for clarity in how recommendations are provided and how risks are communicated before making any commitment.

Alderleaf Stockmantra operates within India’s regulated research framework and presents itself as a provider of market-based insights and trading support.

In this blog, we take a closer look at the firm’s background, stated services, and overall positioning within the financial advisory ecosystem to help readers understand its operations in a structured way.

Alderleaf Stockmantra Review

In July 2024, right in the heart of Pune’s fast-growing tech ecosystem, a new name entered India’s financial services space: Alderleaf Stockmantra Private Limited. But here’s what makes them stand out in a sea of market noise.

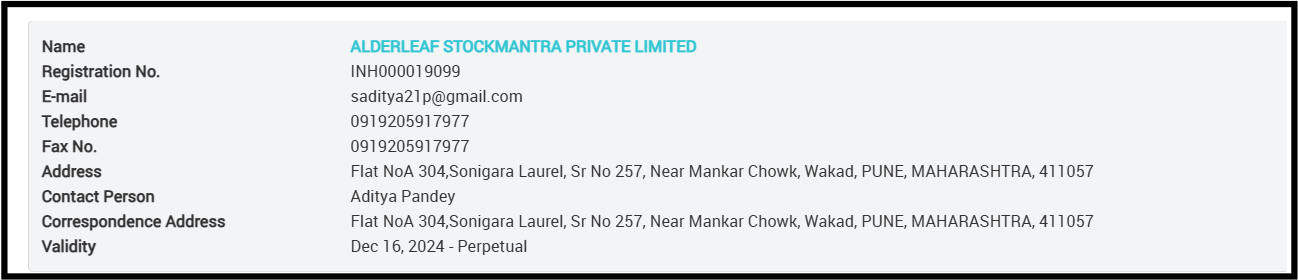

They’re not just another social-media “fin-fluencer.” Alderleaf Stockmantra carries a badge that actually matters: SEBI Registered Research Analyst (Reg. No. INH000019099).

In an era where “get-rich-quick” schemes are rampant, SEBI registration is the gold standard of credibility.

It means the firm operates under strict regulatory guidelines designed to protect you, the investor. Trading isn’t about luck. It’s about probability.

With 200,000+ members on their Telegram channel, they’ve built more than just a following; they’ve created a learning-driven trading community that values clarity over hype.

In short, if you’re tired of market noise and looking for regulated, research-backed insights, Alderleaf Stockmantra is a name worth knowing.

Moreover, it provides market analysis and real-time alerts through an online platform, including a large community on Telegram for active traders.

It may appear reassuring at first, but SEBI registration defines what the firm is permitted to do and what it is not allowed to do.

What SEBI Allows a Registered Research Analyst to Do?

Under SEBI (Research Analysts) Regulations, 2014, registered research analysts (RAs) can legally provide research and advisory services if they follow regulatory rules.

They are allowed to:

1. Publish Research Reports: RAs can release structured reports on listed stocks, sectors, or market trends. These reports may include analysis, financial data review, valuation insights, risks, and assumptions. They must be unbiased, fact-based, and disclose any conflicts of interest.

2. Share Research-Based Recommendations: They can suggest investment actions based on proper research. Such recommendations must be supported by documented analysis, include risk warnings, and avoid guaranteed return claims.

3. Share Analytical Opinions: RAs can provide insights on stocks, sectors, macro trends, and derivatives — but only as analysis, not as trading execution or fund management.

4. Charge Transparent Fees: They are allowed to charge fees, provided the structure is clear and compliant. Fees cannot depend on trading profits or involve profit-sharing arrangements. Transparency and independence are mandatory.

What SEBI-Registered Research Analysts Cannot Do?

1. No Guaranteed Profit Claims: They cannot promise fixed income, assured returns, or daily profit claims. Market outcomes are uncertain, and such promises are considered misleading.

2. No Loss Recovery Guarantees: They cannot claim to recover past losses or offer “sure-shot” strategies that eliminate risk.

3. No Profit-Linked Fees: Fees cannot be tied to client profits, capital size in a performance-based way, or deducted from trading gains, as this creates conflicts of interest.

4. No Pressure Selling: Aggressive marketing, repeated unsolicited calls, or creating urgency to force payments is against fair practice principles.

5. Proper Documentation & Disclosures Required: Clients must receive clear service details, risk disclosures, and written agreements. Lack of transparency may lead to regulatory action.

What Should You Do If Problems Arise With Your RA?

If you feel that a Research Analyst has acted in a misleading, non-compliant, or unethical way, stay calm and handle the situation carefully.

There are investor protection systems in place, and following the right process can help you protect your interests and resolve your concerns properly.

Here are the steps you should follow:

- Collect and organize all proof – Gather all relevant documents such as payment receipts, bank statements, chat logs, emails, call records, and screenshots. Arrange them in the order of dates to show a clear timeline of events.

- Write a factual summary of the problem – Create a short description that includes the time period of the service, the fees paid, any losses suffered, and the gaps in the process. Stick to the facts, dates, and amounts—avoid assumptions or emotional language.

- Lodge a complaint in SCORES – Sign up for an account on the SEBI SCORES portal. Make sure the personal details you provide match your KYC records exactly.

- Submit the complaint online – Choose the correct intermediary type, enter the advisor’s details, and upload the supporting documents. Explain each issue clearly in separate points to make things easier to understand.

- Keep checking SEBI complaint status – Log into SCORES regularly to follow the progress and see the advisor’s response. If SEBI asks for more information or clarification, respond quickly.

- Take the next step if the issue isn’t resolved – If the response doesn’t properly address your concern, use the escalation feature on the platform. Be clear about the reasons and attach any previous communications.

- Keep your own records throughout – Save copies of every submission, acknowledgment, and response. These records are important if the matter moves to another level of regulatory or legal review.

Need Help?

Many people get confused in cases involving SEBI-registered firms because registration often creates a false sense of trust.

When you register with us, we guide you step-by-step on:

- How to properly verify SEBI registrations

- How to identify rule violations and misconduct

- How to draft strong complaints to SEBI and cybercrime authorities

- How to recognize when mis-selling turns into fraud

Our approach focuses on evidence, proper procedure, and holding the right parties accountable.

Conclusion

Alderleaf Stockmantra provides market research, trading alerts, and educational insights for investors and traders in the Indian stock market.

If you are considering taking their services, it is important to understand both what they are allowed to do under SEBI regulations and what they are not permitted to do.

Before subscribing, check their registration details, fee structure, service terms, and risk disclosures carefully. Make sure their recommendations are research-backed and not presented as guaranteed outcomes.

Also, ensure there is proper documentation and clear communication regarding responsibilities.

Taking informed decisions after reviewing these factors helps you align expectations and reduce potential misunderstandings.