Anand Rathi is a well-established brokerage firm trusted by millions of investors across India. Like any large financial institution, it also provides reliable services and smooth trading experiences.

However, no broker is perfect, and sometimes issues do arise. These issues range from service delays and technical glitches to misunderstandings or isolated incidents of unauthorised trades.

These Anand Rathi complaints are not signs of a fake broker but rather signals that even reputable firms can face operational challenges.

Understanding what these complaints mean, how they are addressed and how you can protect yourself is essential for every investor.

In this blog, let’s discuss some real arbitration cases and some tips that can help keep your money safe!

Who is Anand Rathi?

Anand Rathi Shares and Stock Brokers Limited is a prominent full-service brokerage firm in India. It was founded in 1997 by Anand Rathi, a seasoned finance professional with deep roots in the sector.

It offers a wide range of services such as equity trading, commodities, derivatives (F&O), mutual funds, IPOs, portfolio management, wealth advisory, and research-driven recommendations for both retail investors and high-net-worth individuals (HNIs).

The company is registered with major exchanges like NSE, BSE, MCX, and NCDEX. Publicly available NSE data shows around 141865 active clients, with 126 complaints logged recently.

104 complaints have already been resolved. Complaint ratio of about 0.089% with a resolution rate hovering at 83%.

On paper, these figures suggest efficiency, but for the investors behind those unresolved Anand Rathi complaints, the frustration is real.

Delays in resolution or outright denials can amplify financial stress, underscoring that low ratios don’t erase individual pain.

Behind the stats lie tales of miscommunication, unmet promises, and operational hiccups that erode investor confidence, no matter the broker’s scale.

Anand Rathi Complaint Details

The complaints registered in the name of this broker fall under the following categories:

- Type I: Non-receipt / delay in payment

- Type III: Non-receipt of documents

- Type IV: Unauthorised trading/misappropriation

- Type V: Service-related

- Type VI: Closing out / squaring up

- Type VIII: IPO related

- Type IX: Others

Anand Rathi’s complaint numbers look low on paper, but every unsolved issue erodes trust.

Clients often complain that the grievance team takes forever to follow up, forcing them to escalate further. When you’re juggling millions of clients, things slip through the cracks.

Stay sharp and monitor your account closely, because the statistics don’t capture the real frustration and missed opportunities people deal with.

Anand Rathi Arbitrations

Ever wondered what actually happens when investors take a big brokerage like Anand Rathi to arbitration?

Let’s break it down with some real arbitration cases that reveal what investors went through, and what you should watch out for.

Arbitration on Unauthorised F&O Trades and Client Losses

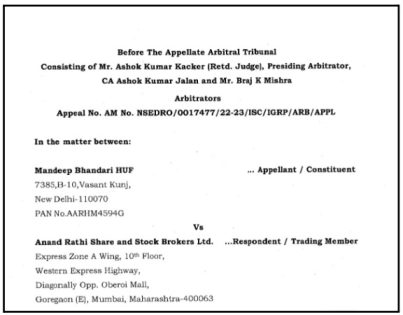

Anand Rathi faced NSE appellate arbitration from Mandeep Bhandari HUF over unauthorised F&O trades from July-November 2022.

He claimed no pre-trade consent, trades based on illegal tips via WhatsApp/Telegram, and losses after the account opened via high-return promises.

What went wrong?

Bhandari opened the account on July 4, 2022, signing KYC physically but alleging inducement. Trades executed without his pre-approval. He got post-trade SMS/emails, but claims no instructions were given.

Despite repeated emails seeking clarification, the broker delayed responding and transferred funds back to his bank account without his instruction.

Initially, IGRP noted service deficiency but rejected the notional ₹88k loss claim.

Penalty Imposed

Sole arbitrator dismissed ₹6.1 lakh claim (losses, brokerage, harassment). Appeal upheld to July 2024 and no compensation, as post-trade confirmations proved implied consent and no timely objection.

Key Takeaways

- Read KYC disclaimers like signed docs trump “promise” claims.

- Challenge trades immediately via SMS/email records.

- Pre-trade proof beats post-trade; market losses aren’t the broker’s fault.

- Document everything; delays weaken cases.

- Don’t rely solely on RMs and monitor your account actively.

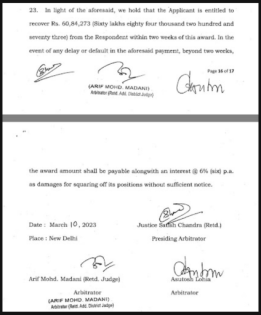

Arbitration on Premature Square-Off of Currency Positions

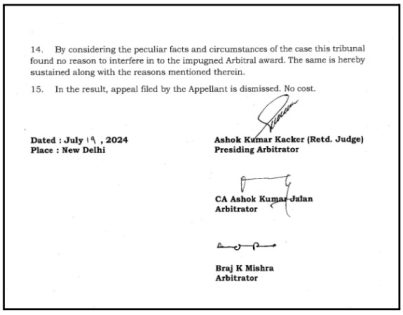

Anand Rathi Share and Stock Brokers Limited faced NSE arbitration from Unified Credit Solutions Pvt. Ltd. over premature square-off of USD currency positions in March 2020.

This caused ₹60.84 lakh loss.

What Went Wrong?

Applicant opened an account in 2018, placed USD 8 lakh contracts (maturing June-Nov 2020), and deposited ₹35 lakh margins.

On March 23, 2020, amid volatility, the broker sent MTM alerts via 2 emails (9:14-9:16 AM) and 5 SMS (9:12-9:25 AM), then squared off positions within 13 minutes, buying USD 6 lakh at 9:16 AM, USD 2 lakh at 9:25 AM.

This resulted in wiping out margins despite the applicant’s claims of timely payments. The Commercial Court ruled 13 minutes insufficient notice per NSE Reg 3.10(b).

Penalty Imposed

Tribunal awarded full ₹60,84,273 plus 6% interest if unpaid within 2 weeks (March 10, 2023), binding by the court’s prior finding of inadequate notice.

Key Takeaways

- 13 minutes isn’t enough notice for square-offs. You must demand a reasonable time per NSE rules.

- Save all MTM alerts (SMS/email timestamps critical).

- Courts bind arbitrators, and prior rulings on notice can’t be relitigated.

- Volatility doesn’t justify rushed closures without proof of client response time.

- Monitor margins in real-time as challenge square-offs immediately with records.

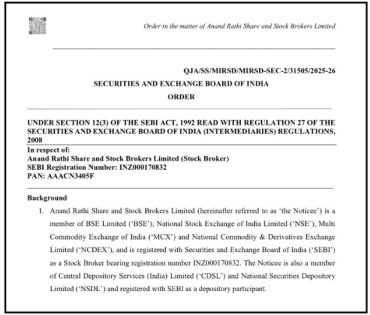

SEBI Orders Against Anand Rathi

Apart from the arbitrations that are filed by investors, SEBI itself has stepped in a few times and released official orders against Anand Rathi

And when the market regulator gets involved, it usually means the issues were serious enough to affect investor trust or market fairness.

So before we go further, let’s take a quick look at what SEBI found and why these orders matter to regular traders like us.

- Regulatory Non-Compliance by Anand Rathi

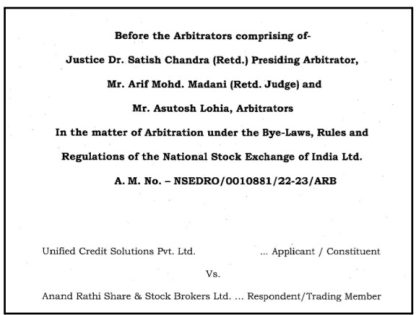

SEBI inspected Anand Rathi Share and Stock Brokers Limited’s operations as a stockbroker from April 2020 to October 2021 and identified multiple procedural lapses. These included:

- Misuse of client funds through negative G values in six instances.

- Failure to maintain daily reconciliation statements between client and proprietary accounts.

- Incorrect margin reporting and short collections.

- Ledger balance mismatches in daily margin statements.

- Unauthorised trading in three client accounts due to dealer errors.

- Improper recording of client orders without adequate evidence, like call recordings.

- Inaccurate financial data reporting under Risk-Based Supervision.

Such shortcomings violated SEBI circulars on client fund segregation, margin reporting, order execution evidence, and supervisory disclosures.

SEBI Verdict

Anand Rathi received a Show Cause Notice after adjudication proceedings imposed a Rs 5 lakh penalty on January 30, 2025. They paid this under protest while challenging it at SAT.

The broker argued the lapses were minor, technical, and Covid-related, with no investor harm or complaints, and highlighted corrective actions like system fixes and enhanced processes.

SEBI closed the case on June 30, 2025, without additional censure or directions, deeming the penalty proportionate given the procedural nature of violations and lack of market integrity impact.

- Front-Running Lapses and Settlement

SEBI examined Anand Rathi’s conduct in the front-running case involving KPIT Technologies Limited scrip and found lapses in due diligence and transparency.

The broker failed to maintain credible records of the authorised person from client Mehrangarh Financial Advisors Private Limited (MFAPL) for order placements.

It registered email IDs of its own group company employees instead of the client’s authorised email, and processed off-market transfers using instructions from an outdated authorised signatory of MFAPL rather than the valid ones as per their June 17, 2015, resolution.

These actions violated Section 12A(a), (b), (c) of the SEBI Act, Regulations 3(a), 3(b), 3(c), 3(d), and 4(1) of the PFUTP Regulations, 2003, Code of Conduct for stock brokers and depository participants.

SEBI Verdict

Anand Rathi received a Show Cause Notice on March 07, 2024, but opted for settlement without admitting or denying the findings.

They proposed revised terms after discussions, paying Rs 90.20 lakh as recommended by SEBI’s High Powered Advisory Committee and approved by the Panel of Whole Time Members.

SEBI closed the adjudication proceedings on May 13, 2025, disposing of the case while reserving rights for future enforcement if needed.

- Anand Rathi’s Client Fund Mishandling Penalty

SEBI checked Anand Rathi Share and Stock Brokers’ compliance from April 2020 to October 2021 and spotted some serious slip-ups.

They found client money got mixed up, like negative balances showing possible misuse in 6 cases (from ₹22 lakh to ₹16 crore) and one big ₹90 crore shortfall for margins.

They had no daily records of fund shifts between the client and their own accounts, wrong margin reports short by ₹20 lakh in 9 cases, and mismatches in daily margin statements.

There were a few unauthorised trades from dealer mistakes, missing proofs like call recordings for orders, and faulty reporting to SEBI’s risk system.

All this broke key rules on keeping client cash safe and reporting correctly.

SEBI Verdict

Anand Rathi got a notice in October 2023 and blamed it on COVID chaos and tech glitches. They said no one lost money, and fixed their systems.

After a hearing, SEBI agreed on the main faults but dropped some smaller ones, then slapped a ₹5 lakh fine on January 29, 2025. It took ₹1 lakh for fund issues and ₹4 lakh for other lapses, which were due in 45 days or recovery actions if unpaid.

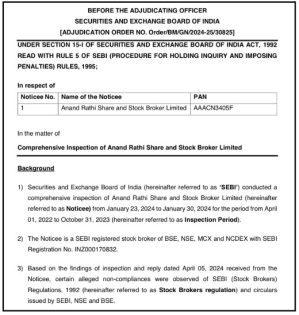

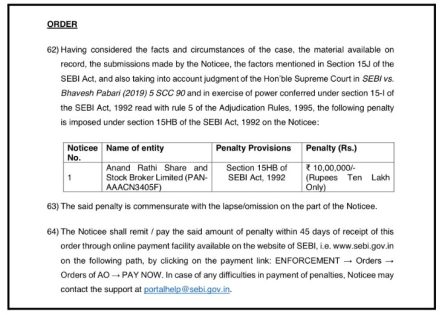

Settlement Delays and Tech Lapses Penalty

SEBI inspected Anand Rathi Share and Stock Brokers from Jan 23-30, 2024 (covering Apr 2022-Oct 2023) and found delays settling inactive clients’ funds, like:

- Rs 1.27 crore for 125 clients in Nov 2022 due to utility glitches and bad bank details

- Passing Rs 2.24 crore upfront margin penalties to clients (out of Rs 4.56 crore total, most reversed)

- Short MTF margins/MTM by Rs 33 lakh in 55 cases, no half-yearly DR live trading drills till after inspection (despite starting setup in 2022)

- Annual instead of half-yearly BCP reviews

- Missing quarterly BCP-DR policy checks

- No peak load monitoring for 3 quarters with 80% alert threshold (should be 70%)

- 7 unreported tech glitches like login fails and slow apps.

SEBI Verdict

Anand Rathi blamed bank issues, NRI tax holds, and DR setup delays, noted settling most accounts (903/1063), refunding penalties, and fixing systems post-inspection (like DR live on Jul/Aug 2024).

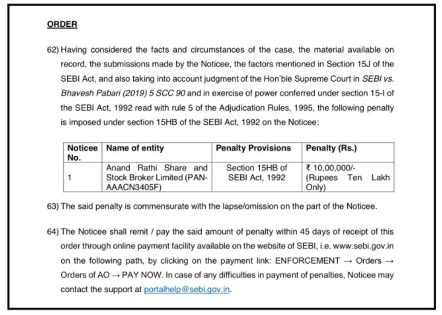

After replies and the Sep 23 hearing, SEBI upheld all violations except glitches (MCX already fined Rs 28 lakh) and slapped a Rs 10 lakh penalty under Section 15HB on Sep 30, 2024, that was due in 45 days via the SEBI site or face recovery.

- Authorised Persons Control Lapses Penalty

SEBI did a surprise check on Anand Rathi Share and Stock Brokers on Dec 27, 2023 (Apr-Dec period), focused on Authorised Persons (APs) and caught terminals in wrong spots, like:

- One AP (Rathi Sharad Shankarlal) runs trades from the UK instead of the Nashik office for family accounts.

- Another (Suyog Securities) shifted 3 terminals between Indore/Bhopal without telling NSE.

- Their own AP inspections missed these and failed to spot missing voice recordings for client orders (1 case for the first AP, 42 for the second).

This broke NSE rules on terminal locations and SEBI/NSE mandates for proper AP oversight.

SEBI Verdict

Anand Rathi said AP Sharad traded only family accounts after verbal UK travel notice, updated Suyog’s locations post-check, and argued inspections shouldn’t fixate on call logs alone. But, SEBI wasn’t convinced.

After the reply and the Aug 7 hearing, they upheld both violations as repeat issues, hitting them with Rs 7 lakh penalty under Section 15HB on Aug 23, 2024, with pay up in 45 days or face recovery.

What to Do If You Have an Issue with Anand Rathi?

If you’re facing issues with your broker and don’t know where to begin, you can register with us, and we’ll guide you through every step of the process.

Here’s what we specifically help you with:

- Documentation Assistance

We help you gather, organise, and structure all the necessary documents, trade statements, ledger reports, contract notes, call logs, screenshots, and emails, so your case is backed with solid evidence. - Drafting Your Complaint

Our team prepares clear, well-formatted complaint drafts that fit the exact requirements of NSE, BSE, SEBI SCORES, and SMART ODR.

This ensures your complaint is understood properly and not rejected due to formatting issues. - Platform Filing Support

Whether it’s SCORES or SMART ODR, we guide you through the submission process and ensure every detail is filled in correctly to avoid delays. - Escalation Guidance

If your complaint needs to be escalated beyond the broker, we show you the right path, whether it’s going to the exchange or preparing for the next stage. - Case Management from Start to Finish

Once you’re registered with us, we track your case, remind you of deadlines, and help you respond to any queries asked by regulators or exchanges. - Support During Counselling & Arbitration

If your case moves to counselling or arbitration, we assist you in preparing your statements and documents so you feel confident and ready.

By registering with us, you don’t have to struggle with complicated procedures, drafting confusion, or paperwork stress.

We make the process smoother, clearer, and faster, so you can focus on recovery while we handle the technical work.

Conclusion

Anand Rathi is a known and regulated broker. Many investors use its services without ever filing a complaint. But as the complaint data, arbitrations, and regulatory actions across the industry show, reputation does not guarantee perfection.

Even established brokers can make mistakes, face system glitches, or have staff who act beyond their authority.

The most important takeaway from any Anand Rathi complaint is not just “what went wrong” but “how fast and how well you respond when something goes wrong.”

Investors who document carefully, act within time limits, and use formal channels have a far better chance of recovering losses or at least getting a fair hearing.

If you feel something is not right in your account, even if the loss looks small today, treat it seriously.

Raise the issue, put it in writing, and push it through the proper channels. Markets will always carry risk. Your broker should not add to it.