Digital trading platforms such as Angel One play a critical role in enabling retail investors to participate in the securities market. Investors rely on these platforms for accurate order placement, transparent execution, proper margin management, and compliance with applicable regulatory frameworks.

Given the automated and high-volume nature of modern trading systems, even minor discrepancies can result in significant financial impact for individual investors.As trading volumes and technological complexity have increased, investors have become increasingly dependent on platform-driven systems to manage orders, leverage, and risk exposure.

This heightened reliance places a corresponding responsibility on brokerage platforms to ensure that all trades are executed strictly in accordance with client instructions, disclosed risk parameters, and regulatory norms prescribed by market authorities.

However, in recent instances, investors have raised serious concerns alleging irregular and potentially fraudulent trading activity on the Angel One platform. These concerns include trades being executed without explicit authorization, deviations from stated risk profiles, improper use of margin or credit limits, and order executions that did not align with the investor’s instructions or consent.

Such incidents have caused substantial financial loss and eroded investor confidence.

Regulatory mechanisms and arbitration frameworks exist to address these grievances by conducting a detailed examination of order placement logs, trade execution records, system controls, and compliance with exchange and SEBI regulations. The arbitration process focuses on determining whether the broker fulfilled its fiduciary and regulatory obligations, whether systemic or procedural failures occurred, and whether the investor was subjected to unfair or unauthorized trading practices.

This matter, therefore, requires scrutiny of the factual trade history, platform functionality, internal controls, and adherence to regulatory standards to assess the legitimacy of the investor’s claims and determine accountability fairly and transparently.

Fraudulent Trading by Angel One Case Study

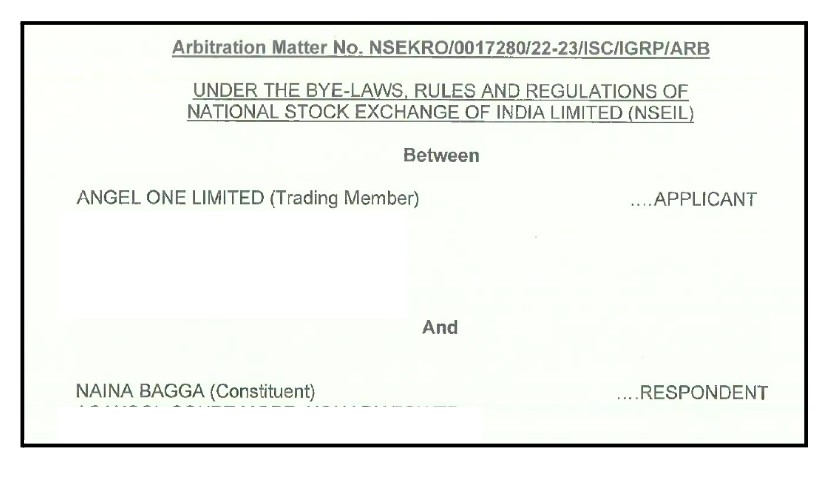

A dispute arose between a trading member and a customer concerning trades executed in the customer’s trading account. The customer had opened a trading and demat (DP) account after completing all mandatory KYC formalities. Subsequently, she enabled trading in Futures and Options by providing OTP-based confirmation. The account was duly activated for trading in the equity and derivative segments of the NSE and BSE.

Trading activity in the account commenced in July 2022 and continued uninterrupted until 3 March 2023. During this period, no complaints or objections regarding trading activity were recorded with the trading member or the exchange.

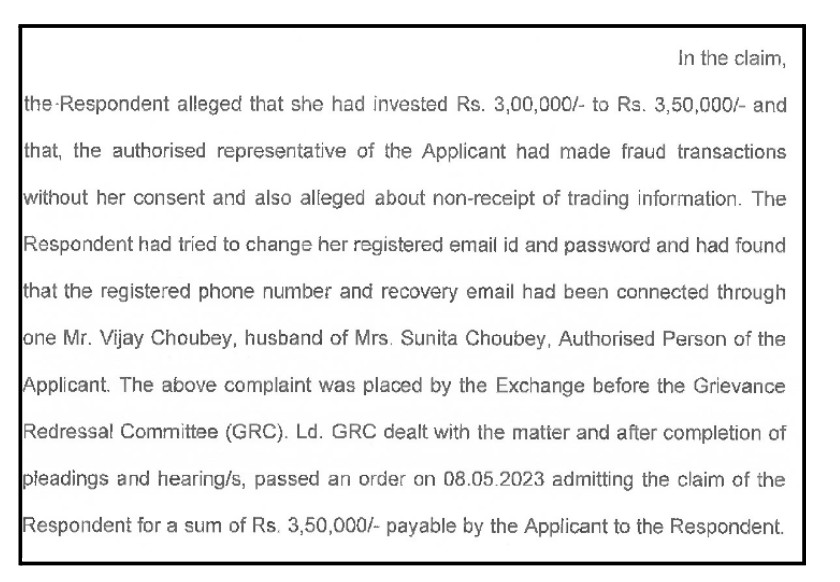

For the first time, the customer raised a complaint before the exchange alleging unauthorized trading in her account. She stated that she had invested an amount ranging between Rs. 3,00,000/- and Rs. 3,50,000/- and claimed that certain trades were executed without her consent. Based on the exchange’s investor grievance redressal mechanism, an order dated 8 May 2023 directed the trading member to pay Rs. 3,50,000/- to the customer.

The dispute primarily revolved around allegations of illegal and unauthorized trading in the customer’s account. The customer contended that trades were executed by the husband of a sub-broker and by a staff member of the trading member. She further questioned the authenticity of the call recordings submitted during the complaint proceedings and raised concerns regarding the delay in initiating arbitration.

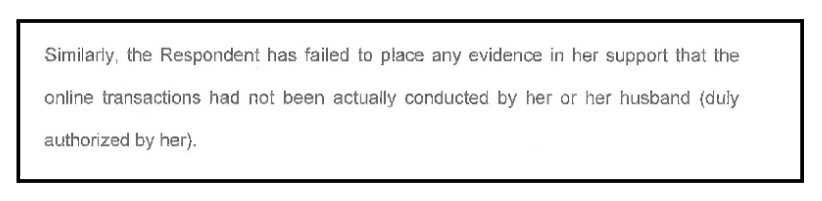

These allegations formed the core issues for determination during the arbitration proceedings. The customer claimed that approximately 75% of the trades were unauthorized, while acknowledging that about 25% of the trades were executed either by her or by her husband. However, she failed to provide transaction-wise segregation of authorized versus disputed trades and did not submit any documentary or technical evidence to substantiate her claims of unauthorized access.

On the other hand, the records produced showed that trades were executed through a combination of online access and telephonic instructions. The arbitration proceedings specifically noted the absence of any concrete proof supporting the allegation of unauthorized trading by Angel One or misuse of the account.

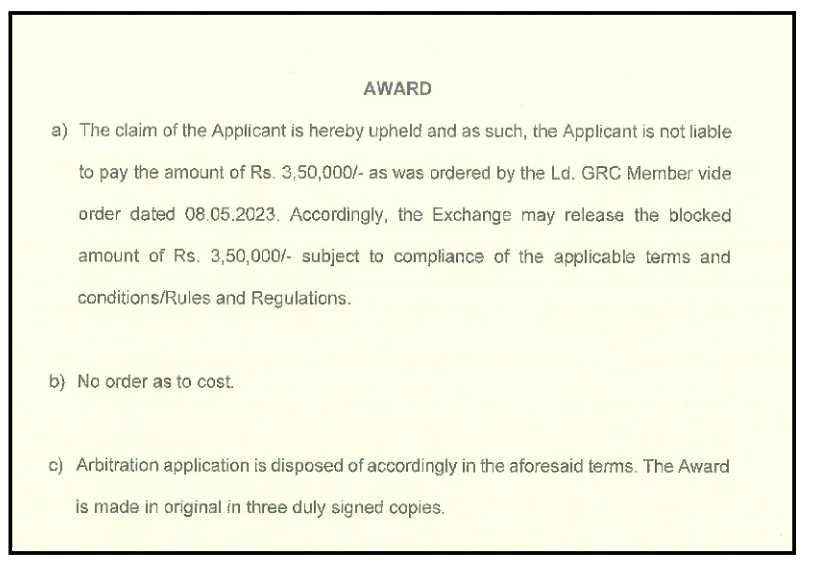

After examining all submitted documents, call recordings, and detailed trade logs, the arbitrator concluded that all trades were executed either by the customer herself or by individuals who had been authorized by her. No evidence was found to establish unauthorized trading or wrongful gain by the trading member.

Accordingly, the arbitrator held that the alleged losses could not be attributed to any misconduct on the part of the trading member. The earlier order directing payment of Rs. 3,50,000/- was set aside, and the claim was dismissed. The case was closed without any order as to costs.

The arbitration emphasized that delays in raising objections can significantly weaken claims related to trading activity. It further underscored the importance of clear, transaction-wise segregation of authorized and disputed trades, supported by evidence, for the effective assessment of such claims.

What Investors Can Do in Such Trading Disputes?

When investors see trades that don’t match their plans, it’s important to act quickly. Trading accounts work with digital permissions, system records, and saved instructions.

Regulators check disagreements using written proof and time frames. Looking at statements early and raising concerns fast helps keep things clear.

A clear response lessens confusion and ensures a fair solution.

Key Red Flags to Watch

- Unexpected trades or positions – Trades show up without prior approval or stated plan.

- Unfamiliar contact details on account – Emails, phone numbers, or recovery info change without being asked for.

- Mismatch in trade alerts – Text or email alerts don’t match the actual trades or account records.

- Delayed dispute raising – Issues are raised long after trading is done.

Safety Points for Investors

- Monitor accounts regularly – Check contract notes, account statements, and margin reports every day.

- Control authorizations strictly – Only give trading access to people you trust and have properly documented.

- Preserve communication records – Keep emails, text messages, call logs, and platform messages.

- Escalate issues without delay – Report any problems right away through your broker and exchange.

How to File a Complaint Against Angel One?

Investors should go through a proper process if they notice any unusual trading activities. There are set ways to deal with such issues.

Each part of this process depends on reporting quickly, keeping clear records, and having accurate information. Using a step-by-step method makes it easier to track things and helps in a proper review.

This process starts with the broker and moves to formal arbitration if needed.

Steps to File a Complaint:

- Write a complaint to the broker – Give all the details about the disputed trades, including dates, amounts, and any supporting documents.

- Keep all trading evidence safe – Gather contract notes, ledger statements, trade alerts, and any conversation records.

- File a complaint to the exchange’s grievance cell NSE – Use the online grievance system provided by the exchange to submit your complaint.

- Take part in grievance hearings – Clearly explain the facts, show the documents, and share the timeline of the transactions.

- Go to arbitration – Submit an arbitration in the stock market within the allowed time period, along with all necessary documents.

Need Help?

Reach out to us; we know how upsetting it can be to fall victim to fraud. It can be really tough emotionally and confusing financially, and it’s hard to know what to do next.

Investors often find it hard to handle the process when they’re also dealing with stress and worry.

Having clear direction and support can help them feel more in control during this difficult time.

A clear plan helps make everything easier to understand from the very beginning.

Here are the steps we guide you through in a clear and organized way:

- Initial case review and guidance: We look at the facts, transactions, and documents to help you understand how to report the issue.

- Complaint drafting and submission: We help you write clear and strong complaints to send to brokers and the exchange’s complaint system.

- Evidence organization and tracking: We help you gather and keep track of important documents like contract notes, ledgers, and emails.

- Grievance and hearing support: We help you understand what to do, when to act, and what rules you need to follow during the process.

- Arbitration stage assistance: We help with preparing documents, filing them, and presenting everything clearly until the matter is resolved.

Conclusion

Angle one allows access to different parts of the market through both online and offline ways. It offers services like buying and selling, research help, and talking to investors through official websites and platforms.

It is registered with the right authorities and follows clear rules, which help it play its part in the stock market. Investors use these platforms better when there is clear information, good system controls, and timely updates.

Keeping safe in the market requires being aware, checking regularly, and act quickly.

Looking at trades, getting alerts, and checking account details helps catch problems early. Having control over account access makes it harder for others to use the account without permission.

Sharing information with the right authorities on time helps resolve any issues faster. Being alert and knowing what’s happening helps build trust in investing over time.