Ever tried to withdraw from AvaTrade, and the status just… doesn’t move? Feels worrying, right?

Withdrawal issues are stressful because it’s not “just a feature.” It’s your money.

In this guide, we’ll break down the most common AvaTrade withdrawal problems, using real complaints and official policy notes.

You’ll also learn what to check first, what evidence to save, and how to report it properly.

Why Am I Not Able to Withdraw Funds from AvaTrade?

Now, first things first.

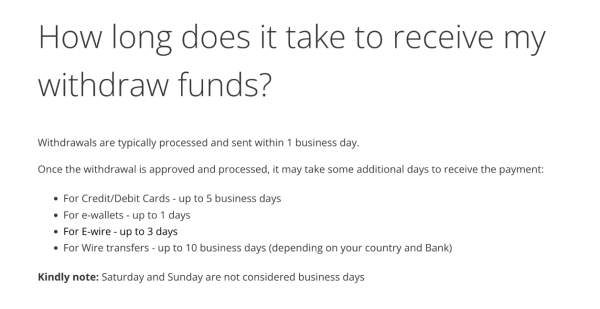

As per AvaTrade’s help centre, withdrawals are processed within about one business day after approval.

After that, the delivery time depends on the method you used. Cards can take several business days. Wire transfers can take longer.

So yes, delays can happen. But repeated cancellations or “missing funds” are a different story, and that raises the concern about its legitimacy.

AvaTrade Withdrawal Complaints

Most issues fall into a few buckets. And once you spot the bucket, your next step becomes clearer.

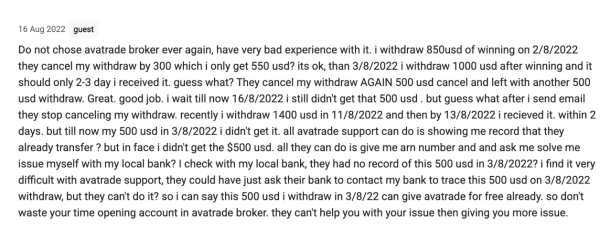

Complaint 1: Withdrawal Partially Cancelled

This is one of the most frustrating patterns. You request a withdrawal, then it “reduces.” Sounds unfair, right? A user review on Forex-Ratings describes this clearly.

They attempted to withdraw $850, but said $300 was cancelled, and only $550 arrived. Then they tried withdrawing $1,000, and again said $500 got cancelled.

Their biggest pain point was simple. They felt nobody explained the “why” properly, and support pushed them back to the bank.

What can this indicate?

Sometimes it’s a method-limit issue or a compliance/verification hold. Sometimes it’s bank-side routing or rejection.

Either way, partial cancellation needs a clear written reason from support.

Complaint 2: “Processed” On Their Side

This is the scariest one. Support says “sent,” your bank says “not received.” The same Forex-Ratings reviewer’s complaint above described this.

They claimed a $500 withdrawal never arrived, even though AvaTrade showed it as transferred. They said support gave an ARN reference and asked them to resolve it with their bank.

From a user perspective, this feels like being stuck in the middle. And honestly, it’s exhausting.

What can this indicate?

Sometimes, transfers are made in “intermediary banks.” Sometimes details mismatch. Sometimes the method is restricted by policy.

If the money is truly sent, a trace should be possible through banking rails.

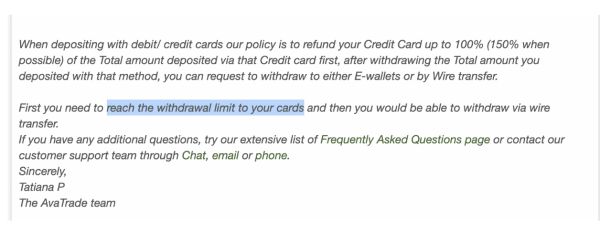

Complaint 3: Card-first Withdrawal Rule

Many traders don’t realise this early. Some brokers require you to withdraw back to your original deposit method first. A Forex Peace Army thread discusses this idea.

It mentions reaching a “withdrawal limit to cards” before using a wire transfer. If you’re expecting “wire instantly,” this can feel like an unnecessary obstacle. But method rules are common in AML compliance.

This indicates that your withdrawal route may be restricted until card refunds are exhausted.

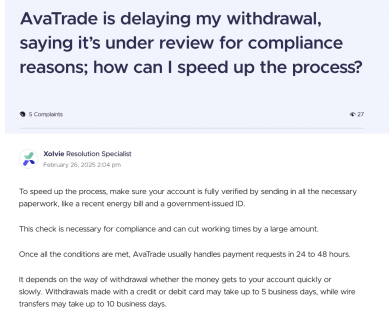

Complaint 4: Under review for Compliance

This is another frequent complaint theme. You submit the request, and then it shows “review” with no timeline. Sikayetvar includes a complaint topic about this.

It describes delays tied to compliance review, and notes timing varies by withdrawal method. Even when compliance checks are routine, the frustration lies in the silence. People want clear steps and an ETA.

This can indicate KYC is pending, that documents are outdated, or that transactions are triggering AML checks.

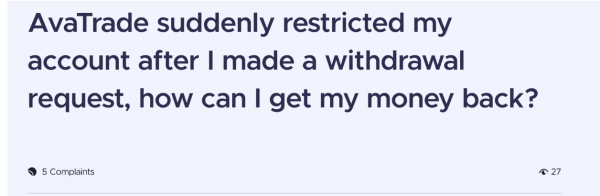

Complaint 5: Account Restricted After Withdrawal

This is where people panic. Because restriction feels like punishment. And it often arrives without clarity. Sikayetvar also discusses this scenario.

It lists possible reasons, such as verification issues, bonus conditions, or method mismatches. Whether or not those reasons apply, the user experience is the same. “Why can’t I access my funds?”

What can this indicate? Unfinished verification, bonus-related volume conditions, or mismatched withdrawal details.

What To Do If You Are Being Scammed?

Start with calm checks. Because random clicking wastes time.

- First, confirm your account is fully verified.

- Then confirm the withdrawal method rules, especially “same method” requirements.

- Next, check the timeline for your method. If it’s still within the stated window, wait one more business day.

But if you see cancellations, missing amounts, or repeated “review” status, escalate fast.

When withdrawals go wrong, details matter more than emotions.

Save screenshots of the withdrawal request. Save the status timeline. Save your bank statement window for those dates.

Also, save chat transcripts and email replies. And keep reference numbers, such as ARN or SWIFT. This is how you avoid “he said, she said.”

Keep it short and structured.

- Start with AvaTrade Support. Then escalate to the regulator for your entity.

- File a Cyber Crime Complaint.

- Lodge an FIR at the Local Police Station.

Need Help?

If your AvaTrade withdrawal is delayed, partially cancelled, or “sent but not received,” you don’t have to guess your next step.

Register with us. We’ll help you organise proof, draft a clean complaint, and escalate it the right way.

Conclusion

AvaTrade withdrawal problems usually fall into delays, compliance holds, method restrictions, or “sent but not received” disputes.

The key is not panic. The key is proof and process.

Document everything early. Push for written explanations. And escalate with evidence, not emotion. Because when it’s your money, clarity isn’t optional.