Investing and trading are no more a hassle. With smartphones and easy internet access, people can trade from anywhere, anytime. However, with this easiness comes the danger of unauthorised & banned forex trading apps in India.

Now, scammers generally promote these apps through flashy ads displaying high returns or guaranteed profits.

But in reality, such apps are not regulated by any of the regulatory bodies; SEBI or RBI in India.

Among multiple unauthorized trading apps, the major ones are those that allow trading in forex. Let’s get into the details to understand the difference between legal & illegal forex trading apps in India.

Is Forex Trading Legal in India?

In India, SEBI and stock exchanges allow trading in some of the currency pairs, which include USD, EUR, GBP, & JPY. These currency pairs are also traded under strict guidelines and rules.

However, illegal forex trading apps bypass these regulations, allowing traders to trade in international forex pairs, which are prohibited in India.

RBI Banned Forex Trading Apps

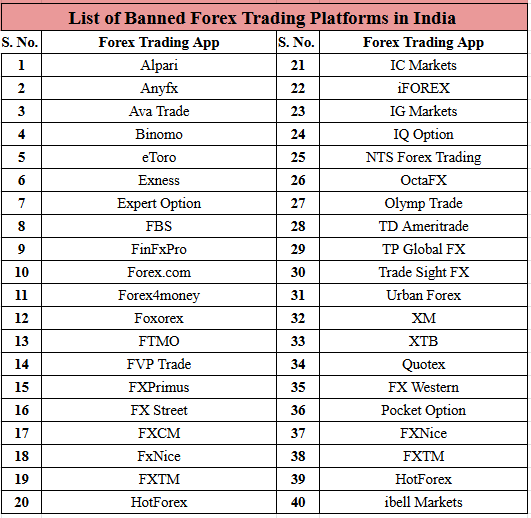

With the rise in unauthorised forex trading fraud cases, the RBI released a list of 40+ forex trading apps that are banned in India.

Traders must understand that forex trading involving currency pairs outside those approved by RBI is not legal in India.

RBI has consistently warned people of the risk involved in trading such apps:

- Illegal Operations: The first and foremost reason is quite straightforward; none of the unauthorised apps are regulated in India.

- Investors’ Protection: Now, the app provider generally lures people by showing high returns and low risks. Investors in the greed of making huge returns generally neglect to see the major risks of getting scammed behind these ads & promotions.

- To Prevent Identity Theft: Most of the time, scammers generally steal away the details and IDs investors upload at the time of registration and misuse them to do financial scams or use them to execute other big crimes and fraud, leaving a long-lasting impact on the victim.

Recently, major actions have been taken against such platforms involved in forex trading or another form of unauthorized trading in India. SEBI has also actively participated in this where it has blacklisted most of the cryptocurrency apps.

RBI Banned Forex Trading Apps List

Here is the list of all forex trading apps that have been identified as illegal and banned by SEBI.

How to Identify Illegal & Banned Trading Apps in India?

Telegram and social media are the major platforms to promote such apps in India. Fake finfluencers use authority bias to manipulate their followers by showing fake P&L screenshots.

They make videos to promote such apps and make groups in Telegram where they lure their audience by displaying fake PnL screenshots.

Not able to catch the scam, most people fall victim to the scam, eventually losing hard-earned money. Now getting scammed using such trading apps leads to financial distress and also makes victims vulnerable to RBI penalties.

According to the Foreign Exchange Management Act (FEMA), 1999, forex trading is legal only through authorized dealers and recognized exchanges.

Any trading conducted outside these channels is considered illegal and may result in penalties in different forms.

- Monetary Fines – Under FEMA, individuals found trading on illegal forex platforms can face penalties of up to ₹10,000 per day for continuing violations.

- Frozen Bank Accounts – Banks have the authority to freeze the accounts of individuals engaged in unauthorized forex trading.

- Legal Action – In severe cases, violators may face legal proceedings, including the loss of profits made through illegal forex trading.

- Restricted Foreign Transactions – Traders caught using unauthorized forex apps may be restricted from making further foreign transactions.

Now, to avoid such penalties & consequences, it is important to be more alert and look for ways to identify such apps.

1. Check for RBI & SEBI registration

- RBI regulates forex trading in India, and trading in those forex pairs is allowed only on the authorized brokers’ platform.

- SEBI does not allow trading in currency pairs beyond INR-based pairs.

- If an app offers international forex pairs like EUR/USD, GBP/USD, or XAU/USD, avoid doing any trade and delete the app.

2. Unrealistic Profit Claims

- Apps promising guaranteed returns or high profits with no risk are likely scams.

- Legitimate forex trading involves risks, and no one can guarantee profits.

3. Pressure to Refer Others

- Illegal forex trading apps often run MLM (Multi-Level Marketing) schemes.

- They offer bonuses for referring friends, but don’t focus on actual forex trading.

6. Use of Unregulated Payment Methods

- If an app only allows crypto payments, UPI to personal accounts, or e-wallet transfers, it’s likely illegal.

- Regulated brokers use bank transfers or recognized payment gateways.

7. Lack of Transparency in Operations

- No clear contact details or fake office addresses.

- No legal terms and conditions or risk disclosure.

- No customer support or only available through social media.

Forex Trading Complaints

In case you have fallen into the trap of a scammer and lost your money in forex trading scams, then do not panic.

There are ways to report to get forex scam recovery.

The only thing that is required is to act quickly. Register with us now and know the right process and platforms to file your complaints following the right protocol.

Conclusion

Illegal forex trading apps in India operate without RBI or SEBI approval, exposing traders to fraud, financial losses, and legal risks. Many of these platforms promise high returns, easy withdrawals, and “zero risk” trading, but they often engage in scams, fund misappropriation, and Ponzi-like schemes.

Indian regulations only allow forex trading in INR-based currency pairs (USD/INR, EUR/INR, GBP/INR, JPY/INR) on NSE, BSE, and MCX. Trading international forex pairs like EUR/USD or GBP/USD via unauthorized apps is illegal.

Be aware and be alert while downloading any trading apps. Check for authentication & certification to prevent yourself from getting scammed.

In case you have been a victim of a forex trading scam in India then fill in the form below. Our team will call you and assist you in reporting the complaint on the respective platform.