In the digital lending landscape, numerous apps promise quick cash and instant loans. Bright Cash App has emerged as one of the most controversial names in India’s loan app ecosystem.

When an app promises instant loans with zero hassle, it’s tempting to believe help is just a tap away, but Bright Cash may not be the lifeline it claims to be.

Bright Cash Loan App Review

Bright Cash App is an instant loan application that claims to offer quick personal loans with minimal documentation.

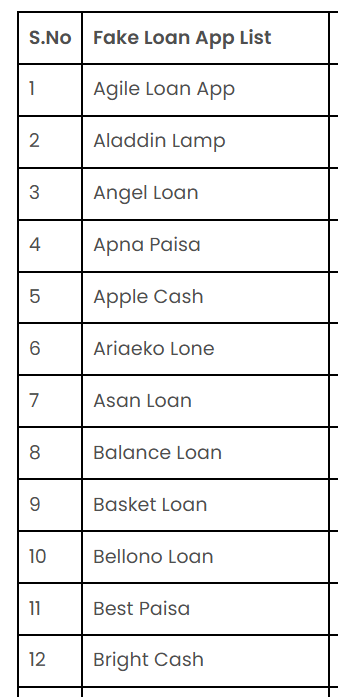

However, Bright Cash appears on multiple verified fake loan app lists in India, listed alongside other fraudulent lending apps.

This raises immediate concerns about its legitimacy and safety for potential borrowers.

How Does Bright Cash App Claim to Work?

Like most predatory loan apps, Bright Cash typically:

- Promises instant loan approvals within minutes

- Claims to offer loans from ₹5,000 to ₹50,000

- Requires minimal documentation (Aadhaar, PAN, bank details)

- Advertises “no credit check” or “bad credit accepted”

- Requests access to phone contacts, gallery, and SMS

WARNING: These are classic hallmarks of fake loan apps designed to steal your personal data and harass you for money.

Is Bright Cash Safe?

Any loan app is considered safe if it is authorized by the RBI in India.

But unfortunately, the Bright Cash Loan app doesn’t show any such registration details.

Apart from this, there are a few signs that make the app unsafe for Indian users:

1. Listed on Official Fake Loan App Lists

Bright Cash has been identified on comprehensive fake loan app lists compiled by cybersecurity experts and financial authorities.

Being featured on these blacklists is one of the strongest indicators that an app engages in fraudulent activities.

2. Not RBI Registered

2. Not RBI Registered

All legitimate loan apps must be registered with the Reserve Bank of India (RBI) or affiliated with RBI-registered Non-Banking Financial Companies (NBFCs).

Bright Cash App does not appear on the RBI’s list of registered lending entities, making it an illegal operation.

3. Excessive Permission Requests

Fake loan apps often request access to sensitive personal data, including phone contacts, photo galleries, messages, and device information.

This is risky as the platform can be misused for harassment and blackmail. Bright Cash typically asks for these intrusive permissions during installation.

4. Aggressive Advertising on Social Media

Fraudulent apps often aggressively advertise on platforms like Facebook, Instagram, and Google Ads, tempting unsuspecting users to click and apply for loans.

If you’ve seen Bright Cash ads with “too good to be true” offers, that’s a major red flag.

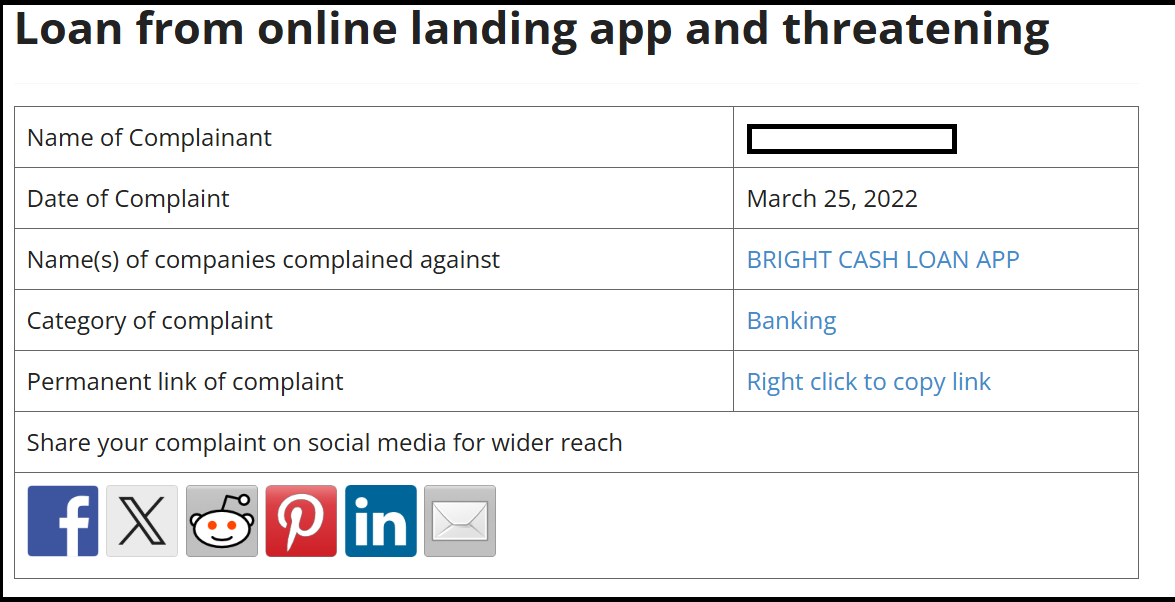

Bright Cash Loan App Complaints

Bright Cash is one of the many instant-loan apps that has repeatedly appeared in consumer complaint forums for aggressive recovery tactics and misuse of personal data.

One complaint clearly highlights the pattern many borrowers report.

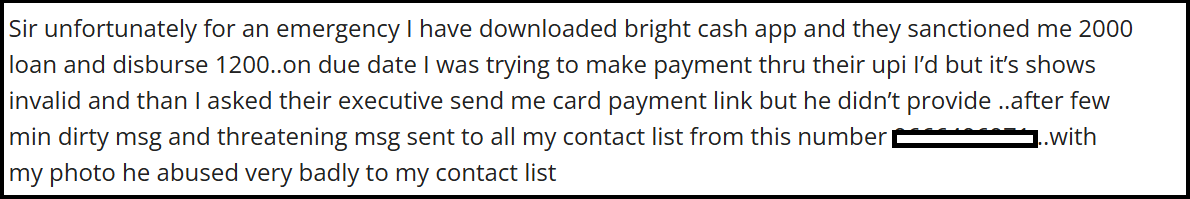

According to the complainant, they downloaded the Bright Cash app during an emergency and were approved for a ₹2,000 loan, but received only ₹1,200 after deductions.

When the repayment date arrived, the borrower attempted to pay through the UPI ID provided inside the app,only to find that the payment address was invalid.

After contacting the app’s support team for an alternate link, no proper repayment method was provided.

Within minutes, the situation escalated dramatically. The borrower began receiving abusive and threatening messages.

Even worse, the recovery agent allegedly sent vulgar texts and the borrower’s photo to people in their contact list, causing humiliation and distress.

This matches a common pattern seen with unregulated or illegal loan apps:

- Disbursing less money than sanctioned

- Providing invalid or non-functional repayment options

- Using borrowers’ contact lists to intimidate them

- Sending abusive or defamatory messages to friends and family

Complaints like these make it clear that Bright Cash operates with predatory practices, violating borrower privacy and causing emotional harm.

Anyone considering such apps should be extremely cautious and verify whether the lender is RBI-registered before sharing personal data or granting contact permissions.

Modus Operandi of Bright Cash App Loan Scam

Fake loan apps attract users with promises of easy and instant loan approvals, but beneath the surface, they’re traps set by cybercriminals designed to steal personal and financial information.

Here’s their typical playbook:

- The fraud begins with Flashy ads promise instant loans, “no paperwork,” and fake success stories.

- The app demands excessive permissions, scooping contacts, photos, SMS, and bank details.

- Users are pushed to share sensitive info, leading to hidden fees, blocked access, or forced deposits.

- Within days, illegal agents launch abusive calls, threats, and blackmail using stolen data.

The app vanishes, reappears under new names, and becomes nearly impossible to track.

How to Check Fake Loans?

Watch for these warning signs: no registration with RBI, unusually low or no documentation requirements, absence of physical office or proper contact details, and no clarity on interest rates and terms

Red Flags Checklist:

- Promises that sound too good to be true (instant approval, no credit check, 100% guaranteed)

- Not listed on RBI’s registered NBFC list

- Requests advance fees before loan disbursement

- Uses aggressive social media advertising

- Company details are vague or missing

How to Report Loan Frauds in India?

If you spot any of these red flags or have already been targeted, report the app immediately to protect yourself and help authorities take action.

- File a Cyber Crime Complaint

Visit the cyber crime portal, select Report Other Cybercrimes, and submit all evidence (screenshots, messages, transactions). - Report to Your Local Police Station

File an FIR under cyber fraud sections of the IT Act. Carry proof such as app screenshots, call recordings, and payment receipts. - Report the App to Google Play Store

Open the app page, scroll to Flag as Inappropriate and choose Fraud or Scam to help get it removed.

Need Help?

Have you been trapped by loan app scams promising “instant approval” but ending in harassment or fraud? You’re not alone; hundreds of victims in India have faced the same situation.

Register with us now to receive expert support and step-by-step guidance on how to recover your funds and take legal action against fraudsters.

Conclusion

Bright Cash App is definitely a SCAM. It appears on multiple official fake loan app lists, is not RBI-registered, and operates using the same predatory tactics as other fraudulent lending platforms that have harmed thousands of Indians.

If an offer seems too good to be true – instant approval, no documentation, guaranteed loans – it almost certainly is a scam designed to steal your information and money

To protect yourself from cyber crime, verify everything, and spread awareness to help others.