If you’ve been scrolling through the Play Store or browsing social media for a quick loan solution, chances are the name “Cash Fish” has popped up more than once.

With instant approvals, easy applications, and promises of fast cash, it’s no surprise that a lot of people start searching for this app, especially when they’re in urgent need of money.

But here’s where things get interesting:

Is Cash Fish really the financial lifeline it claims to be, or is it something you should stay far away from?

Before you hit “Download,” it’s worth taking a closer look at how the app operates, why so many borrowers are curious (and sometimes worried), and whether it’s truly a safe option.

So let’s uncover what’s really going on behind the scenes—and figure out whether Cash Fish is worth your trust or just another risk you don’t need.

What is Cash Fish App?

Cash Fish (also known as CashFish) is an instant loan application that claims to offer quick cash loans ranging from ₹2,000 to ₹50,000 with a repayment period of 91 to 365 days.

The platform advertises itself as a paperless, convenient lending solution, but it is neither available on the Play Store nor the App Store.

So, what looks like an instant solution could be a predatory lending platform.

Before you click on any link to download Cash Fish, beware it could be a scam that can steal not only your money but data.

Is Cash Fish Safe?

There are no records of any registration or approval of the platform with the RBI or NBFC.

Further, the app is not safe, as there are a few red flags as below:

| Aspect | Cash Fish (Illegal) | Legal RBI-Approved Lenders |

| Registration | Not RBI-registered NBFC | Verified NBFC registration |

| Disbursement | ₹5,640 for ₹8,000 loan (30% cut) | Full approved amount |

| Interest Rate | 700-900% effective annually | 18-36% annually |

| Repayment Period | 7 days (claimed 91-365) | 91 days to 5 years |

| Documentation | Demands excessive permissions | Minimal necessary KYC only |

| Collection | Abusive, threatening calls | Professional, legal process |

| Privacy | Shares data with contacts | Protected by law |

| Recourse | No customer support | Ombudsman mechanism |

Cash Fish App Complaints

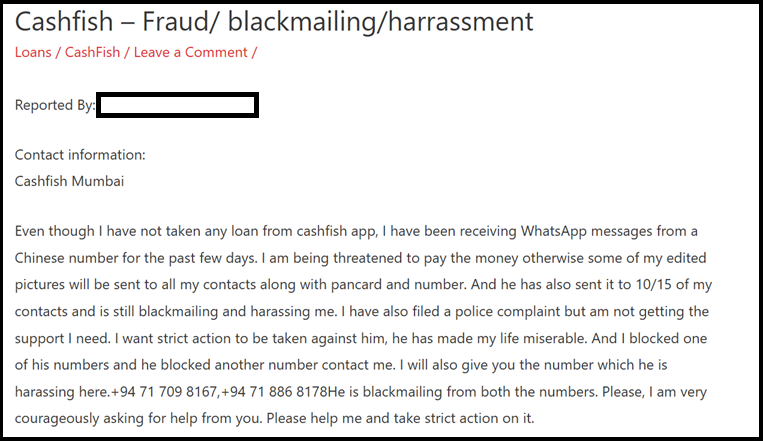

User Feedback #1: Fake Loans

One user complained about the harassment and threatened calls/messages from the loan provider, even without borrowing any money from the platform.

User Feedback #2: The ₹8,000 Loan Nightmare

“They give 8000 loan amount and disbursal amount 5634 and 2436 as charge, over due charge 168 per day. I told him my problem he agreed, but today other guy called and started abusing on phone. This harassment leads human to suicide.”

For an ₹8,000 loan, victims receive only ₹5,634 with ₹2,436 deducted as mysterious charges (30.45% deduction). The daily overdue charge of ₹168 amounts to a catastrophic 766% annual interest rate on the actual disbursed amount.

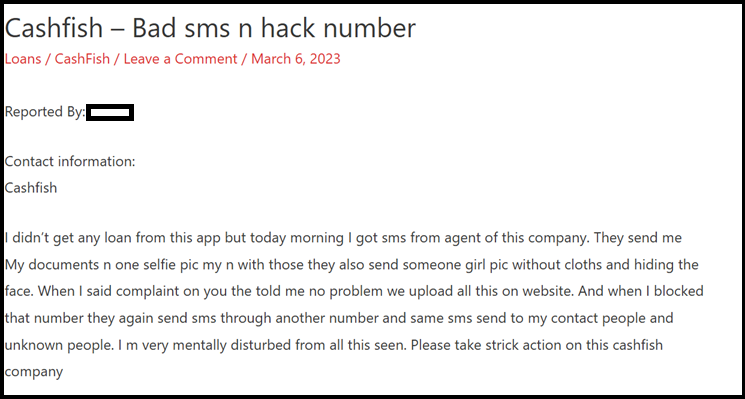

User Feedback #3: Morphed Images Without Taking Loan

“I didn’t get any loan from this app but today morning I got sms from agent of this company. They send me my documents n one selfie pic my n with those they also send someone girl pic without cloths and hiding the face.”

The most terrifying aspect: Cash Fish harasses people who never even took a loan from them, sending morphed nude images created from stolen selfies and threatening to distribute them.

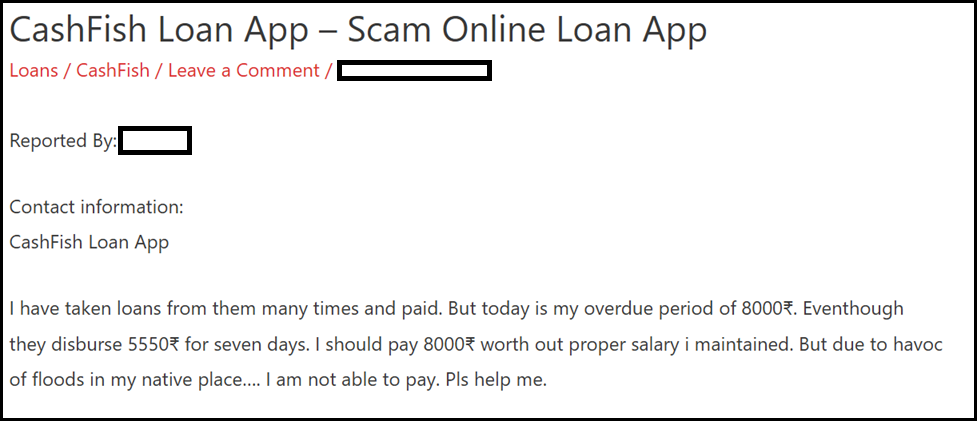

User Feedback #4: Payment Fraud After Repayment

“I have taken loans from them many times and paid. But today is my overdue period of 8000₹. Even though they disbursed 5550₹ for seven days, I should pay 8000₹.”

Even regular borrowers who previously repaid successfully get trapped when circumstances change. The app shows no flexibility and threatens contact list harassment for any delay.

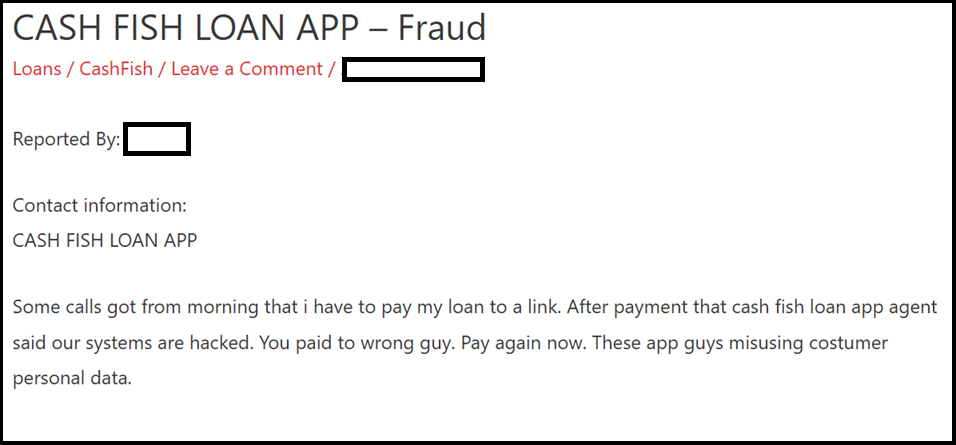

User Feedback #5: System Hacking Claims

“Some calls got from morning that I have to pay my loan to a link. After payment that cash fish loan app agent said our systems are hacked. You paid to wrong guy. Pay again now.” –

Scammers claim their “system was hacked” after victims make payments through provided links, demanding double payment while stealing the initial amount.

Risks of Cash Fish Loan App

Scammers always stay one step ahead and design their operations in such a way that it becomes almost impossible for the one to identify the fraud.

Here are some of the risks associated with using the Cash Fish app.

Step 1: Aggressive Permissions Demand

During installation, Cash Fish demands access to:

- Contact list (to identify harassment targets)

- Photo gallery (for morphing images)

- SMS and call logs (to steal OTPs and financial info)

- Camera (for video verification that’s used against you)

- Device location and storage

Step 2: Identity Document Theft

Users submit Aadhaar card, PAN card, selfies, and bank details believing they’re applying for a legitimate loan.

Step 3: Massive Upfront Deduction

For every loan, Cash Fish deducts 25-35% as:

- “Processing fees”

- “Documentation charges”

- “Platform fees”

- GST (often inflated)

Step 4: Impossible Repayment Structure

- Repayment window: Just 7 days typically (not 91-365 days as advertised)

- Interest rate: 30% monthly (360% annually) officially, but the effective rate exceeds 700%

- Daily penalty: ₹168 per day of delay

- No partial payment option

Step 5: Systematic Harassment Campaign

When victims cannot repay inflated amounts within 7 days:

- 100+ harassing calls daily to the borrower and all contacts

- Abusive, threatening language, including suicide threats

- Messages sent to family, friends, and professional contacts

- Morphed nude images created from selfies and sent to contacts

- False accusations of being “fraud,” “cheater,” “rapist”

- Threats to expose Aadhaar details publicly

Step 6: Payment Fraud

Even after payment:

- The app doesn’t reflect the payment status

- Agents claim “the system was hacked” and demand repayment

- Continuous harassment claiming non-payment

- Additional penalties keep accumulating

How to Check Fake Loans?

Here are some of the red flags that help you identify fake loan apps and avoid loan scams:

Financial Red Flags:

- Disbursed amount significantly less than the approved amount (25-35% less)

- Vague “processing fees” and “documentation charges”

- Actual repayment period much shorter than advertised (7 days vs 91-365 days claimed)

- Interest rates are not clearly disclosed upfront

- Daily penalty charges exceeding ₹100

- No clear loan agreement or terms document

Behavioral Red Flags:

- Demands a video selfie with ID cards before approval

- Requires access to contacts, gallery, and SMS before loan processing

- Customer care becomes unreachable after disbursement

- Recovery agents use personal WhatsApp numbers (not official channels)

- Threats and abusive language from day one of the delay

Technical Red Flags:

- Mixed app ratings with extreme 1-star complaints about harassment

- The company address is a residential complex, not a commercial office.

- No NBFC registration number displayed in the app.

- Privacy policy is vague or missing

- App frequently changes names or gets delisted/relisted

Document Verification Red Flags:

- Demands both Aadhaar and PAN with selfie (more than necessary)

- Asks for video verification, holding ID cards

- No physical document signing or e-signature process

- Approval within minutes without any credit check

How to Report Loan Frauds in India?

If you have downloaded Cash Fish or any similar app claiming instant loan provider, then take instant action and complaint against online loan app and report your case.

- Visit cyber crime portal.

- Click “Report Other Cyber Crime”

- Select category: “Online Financial Fraud”

- Sub-category: “Fraud Call/Vishing”

- Fill in complete details with evidence

- Upload screenshots, recordings, and bank statements

- Note down the acknowledgment number for tracking

- Report to RBI

- Register on Sachet portal

- Select “Against Other Entities”

- Complaint category: “Digital Lending Apps”

- Provide complete details of Cash Fish operations

- Upload supporting documents

- Track complaint status online

Need Help?

Have you been trapped by loan app scams promising “instant approval” but ending in harassment or fraud? You’re not alone; hundreds of victims in India have faced the same situation.

Register with us now to receive expert support and step-by-step guidance on how to recover your funds and take legal action against fraudsters.

Conclusion

The Cash Fish app stands as a clear example of a predatory lending scam that exploits financial distress and digital vulnerability among Indian borrowers.

Behind its polished marketing and false promises of “instant loans,” the app operates outside all legal and regulatory frameworks, using deception, extortion, and psychological abuse to trap victims in endless debt.

Users are strongly advised to avoid downloading or engaging with any unverified lending applications to protect yourself from cyber crime and rely only on RBI-registered NBFCs or banks for financial assistance.

Victims of such frauds should immediately report incidents to the Cyber Crime portal and the RBI Sachet platform, preserving all evidence of communication and transactions.

Ultimately, public awareness, strict law enforcement, and digital literacy are the most effective defenses against such exploitative digital loan operations.