Instant loan apps promise relief when money is tight. A few taps, quick approval, and cash in your bank account, that’s the pitch.

Cash King presents itself in exactly this way, claiming to offer fast personal loans with minimal paperwork and instant disbursal.

But behind the promises, several users have raised serious concerns.

Complaints available online, including reports of harassment, altered images, and misleading loan terms, suggest that Cash King may not be as safe or legitimate as it appears.

This article looks at what Cash King claims, what users report, and what’s missing where it matters most: regulation and accountability.

What is Cash King?

Cash King markets itself as a personal loan app designed to provide emergency funds quickly.

The app advertises instant approval, direct bank transfers, and a paperless process. For someone facing urgent expenses, this kind of convenience can be tempting.

Like many similar apps, Cash King positions itself as a modern digital lender, avoiding traditional bank delays.

However, convenience alone does not determine whether a loan app is genuine or safe.

Is Cash King RBI Approved?

This is the most important question, and also where concerns begin.

There is no clear public evidence that Cash King is operated by an RBI-registered Non-Banking Financial Company (NBFC).

Some online mentions loosely connect the app to a company named Samvan Financial Services Private Limited, but this entity does not appear in the official RBI NBFC registration list.

A legitimate loan app in India must either:

- Be run directly by an RBI-registered NBFC, or

- Clearly disclose its partnership with one, including registration details

Cash King does not transparently display such information.

The absence of RBI or NBFC registration means the app operates outside the formal regulatory framework, leaving users without institutional protection.

Is Cash King Safe?

Cash King exists as an app, but legitimacy is not about existence alone.

Based on available information:

- The app does not clearly disclose RBI or NBFC registration

- Users report misleading interest rates and hidden charges

- There are allegations of harassment, threats, and misuse of personal data

- Complaint records show behaviour inconsistent with regulated lenders

Taken together, it is clear that safety concerns around Cash King go beyond financial loss.

Cash King App Complaints

Multiple users online report that the app demands access to contacts, photos, and messages.

Once access is granted, users allege harassment calls, threatening messages, and pressure tactics. sometimes even after loan cancellation or partial repayment.

Such behaviour indicates that personal data may be used as leverage rather than for legitimate credit assessment. This is a known tactic among unregulated loan apps, where fear and embarrassment are used to force payments.

In one complaint, a user reported that Cash King allegedly shared morphed and vulgar images and sent threatening messages.

The complainant stated that he was being harassed over a loan taken by someone else and was threatened with further image circulation if payment was not made.

Such allegations point to extreme collection practices that violate basic legal and ethical standards.

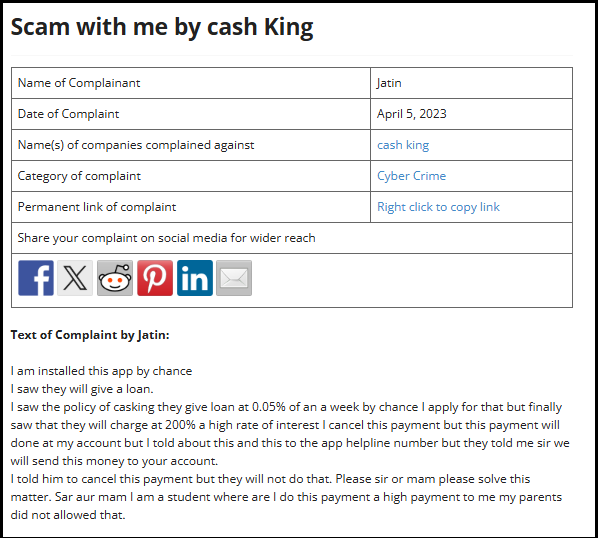

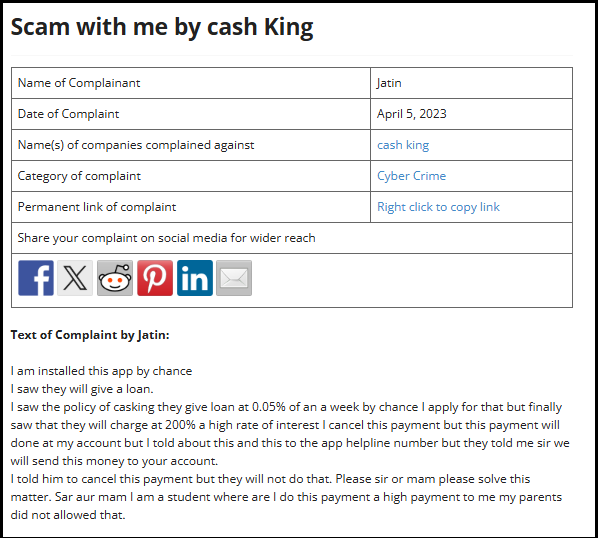

Another complaint from April 5, 2023, describes a different issue.

The user claimed that while the app advertised extremely low interest, the actual charges escalated dramatically, reportedly reaching an annualised rate close to 200%.

Even after attempting to cancel the loan, the user alleged that money was debited without consent. The complainant, a student, described intense pressure and confusion over repayment demands.

These complaints align with patterns commonly seen in illegal digital lending apps, where misleading terms, harassment, and coercive recovery methods are frequently reported.

How to Report Loan Frauds in India?

If you’ve been a victim of such loan app scams, it’s important to act quickly and calmly.

Here are the steps to file complaint against online loan app:

- Start by preserving evidence, screenshots, transaction records, messages, and call logs.

- Inform your bank immediately if there are unauthorised debits or suspicious transactions.

- You can also file a complaint on platforms where the app is listed and approach your local cyber cell or police station if threats or image misuse are involved.

These actions help create a formal record and prevent further harm.

Need Help?

Cases involving illegal loan apps can be overwhelming, especially when harassment or data misuse is involved.

We assist individuals with drafting complaints, organising documentation, reporting to cybercrime authorities, escalating matters to regulators, and preparing representations where further legal or regulatory action is required.

The focus is on clarity, proper procedure, and ensuring your complaint is taken seriously.

You don’t have to handle this alone; just register with us now.

Conclusion

Cash King promises quick loans and easy money, but user complaints and the absence of regulatory clarity paint a different picture.

Apps that operate without RBI oversight often expose users to financial loss, privacy violations, and emotional stress.

When it comes to borrowing, urgency should never override safety.

Always verify RBI or NBFC registration, read terms carefully, and be cautious of apps that ask for excessive permissions or promise unrealistic ease.

A fast loan should not come at the cost of your dignity, privacy, or peace of mind.