Imagine this: You’re scrolling through your phone, and a neighbor shares a “sure-shot” investment tip promising 20% returns every month.

Sounds like a dream, right?

But what if we told you this chit funds scam has already ruined millions in India, turning trusted community savings into a nightmare?

A chit funds scam preys on our love for quick money, disguised as a harmless group savings plan.

In 2023 alone, over ₹5,000 crore vanished in such frauds, leaving families bankrupt.

Have you ever wondered if that local chit fund your uncle joined is legit? Stick around as we break it all down so you can spot the trap before it snaps shut.

What is a Chit Fund Scheme?

A chit fund scheme is a traditional savings and credit scheme popular in India. A group of people comes together to pool a fixed amount of money at regular intervals, like monthly installments.

Think of it as a rotating jackpot among friends, family, or neighbors where everyone contributes equally to a common pot, and one member gets the full amount each cycle through a bidding or lottery process.

But here’s the question buzzing in your mind: Is it like a bank fixed deposit?

To be clear, chit funds are informal, community-driven, and riskier because there’s no government insurance.

Regulated ones offer steady returns of around 12-15% annually, beating many savings accounts.

Still, the chit funds scam often hides behind this innocent setup, luring you with promises too good to be true.

Is Chit Fund Legal in India?

Short answer: Yes, but only if registered.

Wondering how to tell?

Legitimate chit funds fall under the Chit Funds Act, 1982, overseen by state governments. They must register with registrars, display licenses, and cap returns realistically.

Illegal ones?

Fly-by-night operations without registration, often multi-level marketing disguised as chits. SEBI warns against unregistered schemes promising fixed high returns as they’re outright Ponzi traps.

Ask yourself: Does your chit have a government ID number?

If not, run!

In 2024, states like Tamil Nadu busted 200+ illegal chits, recovering ₹300 crore. Legality protects you, but vigilance saves you.

How the Chit Fund Scam Unfolds?

The real danger of chit fund scams lies in how legitimate they appear at the start.

Fraudsters first present themselves as trustworthy “foremen” or organizers, often claiming years of experience and showcasing fake registrations or forged licenses.

They lure people by promising high, consistent returns with little or no risk, something that should immediately raise a red flag.

They collect monthly installments from members, usually through mobile apps, UPI transfers, or cash, avoiding proper documentation.

To build credibility, they pay out a few early members on time, creating an illusion that the scheme is genuine. These early payouts are not profits; they are funded using money collected from new participants.

As more people join, the fraudsters amplify the hype:

- Fake member lists and fabricated success stories are circulated

- Unrealistic returns are highlighted

- Pressure tactics like “limited seats” or “last chance to join” are used to rush decisions

In a genuine chit fund, auctions are conducted transparently, and rules are clearly defined. In scams, there are no real auctions, only smoke and mirrors.

Once new inflows slow down or scrutiny increases, the operators suddenly disappear, shutting down apps, changing phone numbers, and vanishing with the entire pooled amount.

Red Flags of Chit Fund Scams

If returns look too good to be true, they probably are. Always verify registrations and never invest money based on trust alone.

Here are a few warning signs that help in identifying such scams in the first place:

- Guaranteed or unusually high returns

- No written agreement or verifiable registration

- Payments are demanded in cash or personal accounts

- Lack of transparency in auctions and member records

Real Cases Of Chit Fund Scam

Many victims have been exposed to this chit fund scam. The numbers feel heavy as they are people who have lost their hard-earned money to this scam.

Here are some real victim stories of chit fund scam:

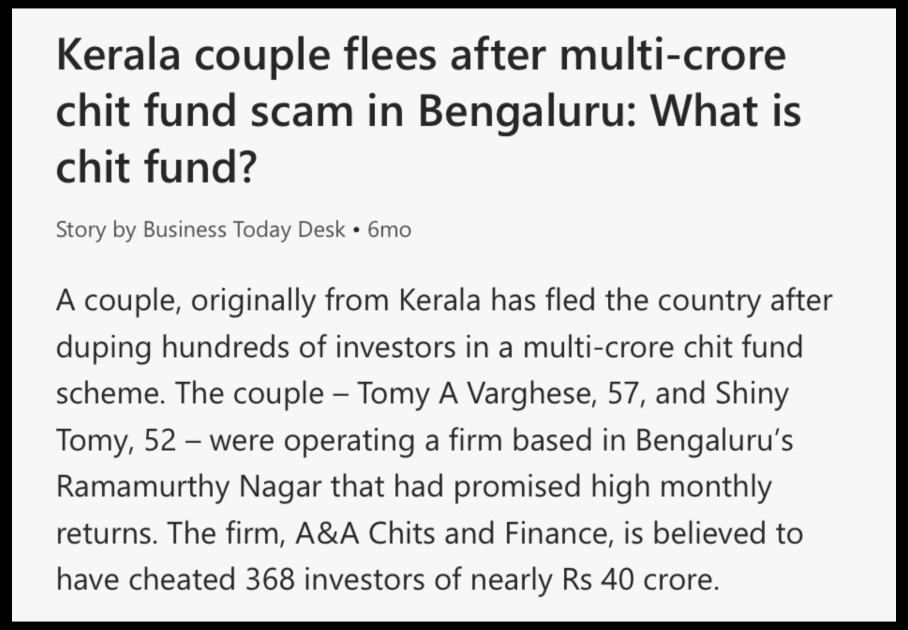

- The Bengaluru “A&A Chits” Scam

A Kerala couple, Tomy A. Varghese and Shiny Tomy, ran “A&A Chits and Finance” for 25 years. They built immense trust before suddenly stopping payments and fleeing to Kerala in July 2025.

- Money Stolen: Approximately ₹40 crore.

- People Affected: Over 400 to 750 investors, including many pensioners who lost their entire life savings.

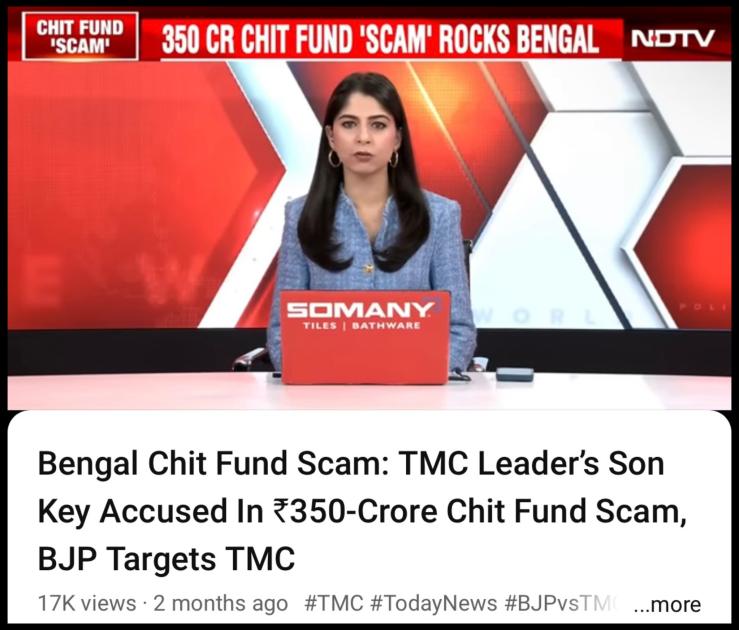

- The Asansol Ponzi Scheme

Tahsin Ahmed, son of a TMC leader, allegedly ran a fake, unlicensed company promising 14% monthly returns.

He vanished in October 2025, leading to massive local protests.

- Money Stolen: Estimated at ₹350 crore.

- People Affected: Around 3,000 families were reportedly looted.

- The Rightmax Technotrade Scam (Karur/Odisha)

A firm called Rightmax Technotrade International promised to double money by offering ₹1,000 monthly for 33 months on a ₹10,000 deposit. Director G. Sivakumar was recently arrested by the CBI after being on the run since 2018.

- Money Stolen: Roughly ₹18.25 crore.

- People Affected: Hundreds of small investors across Odisha and Tamil Nadu.

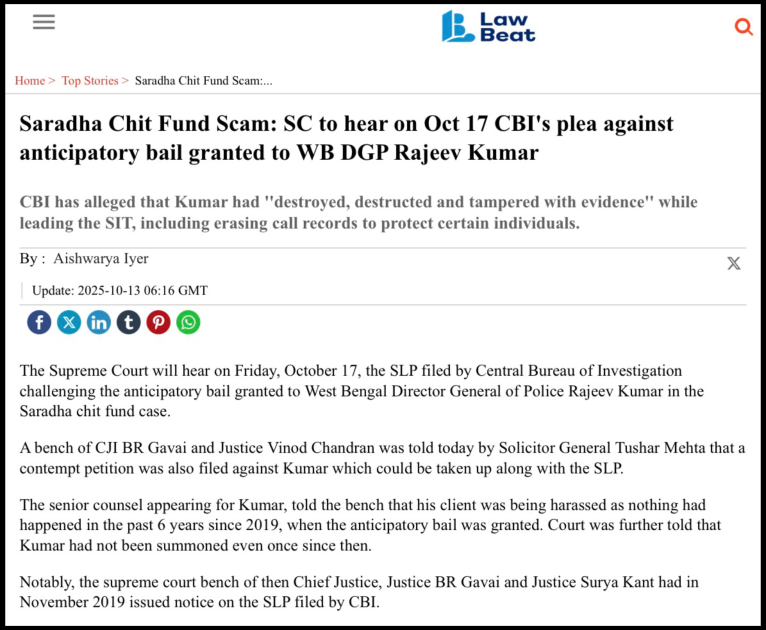

- The Massive Saradha Legacy

A decade-old wound that still haunts the Supreme Court. The Saradha Group used celebrity endorsements to lure people into a classic Ponzi scheme.

- Money Stolen: Over ₹2,500 crore.

- People Affected: A staggering 1.8 million (18 lakh) depositors across multiple states.

These stories serve as a grim reminder to always verify if a chit fund is registered under the Chit Funds Act, 1982, before investing.

Question for you: Joined a chit lately? If payments are delayed or excuses pile up, it’s scam red flags waving.

What to do if Online Fraud Happens?

Caught in the web?

Don’t panic, as reporting can recover funds and nail the crooks.

Here’s your step-by-step guide:

- Gather Evidence Immediately: Collect the following data:

- receipts

- bank statements

- WhatsApp chats

- chit agreements

Screenshot everything and save dates, amounts, and promises.

- File FIR at Local Police: Visit your nearest station or cyber cell. Mention it’s a chit funds scam under IPC Sections 420 (cheating) and 120B (conspiracy).

- Lodge Complaint with Chit Fund Registrar: Contact your state’s Registrar of Chits (e.g., Tamil Nadu: 044-2859 3201). Submit docs online or in-person. It is important to address unregistered Chit Fund complaints.

- Alert RBI/SEBI Helplines: File a complaint with SEBI or RBI. They blacklist fraudulent entities.

- Follow Up and Join Victim Groups: Track via police portals; connect on social media for collective action. Courts often order attachments, as in recent Hyderabad cases.

Act fast, as statutes limit claims to three years. Thousands recover via these steps yearly.

Need Help?

If you have lost your money in a chit fund scam or any other scam, you can contact us and register with us.

Our team of experienced professionals will help you every step. We will make sure that the result is satisfactory for you.

Conclusion

Chit funds can be a smart savings hack, but the chit funds scam lurks like a wolf in sheep’s clothing, preying on trust and dreams of quick wealth.

From Saradha’s empire of lies to Kerala’s gold mirage, these stories scream one truth: If it sounds too sweet, it’s probably poison.

Ask yourself today: Are you verifying before investing?

Stay vigilant, report ruthlessly, and let’s build a scam-free India together.