1. Common App Related Issues

- The app crashes frequently due to stability issues reported by multiple active users.

- Slow syncing delays order placement and makes the app feel unresponsive during volatile sessions.

- Portfolio data or SIP baskets sometimes fail to display correctly inside the app.

2. Order and Trading Issues

- The order book shows rejection reasons when insufficient cleared funds exist in your trading account.

- Segment activation remains incomplete when the income proof or required documents remain unsubmitted.

- Pending UCC, KYC, or bank mandate activation blocks trading access for several days.

3. Market and Contract Restrictions

- Exchanges restrict trading during extreme volatility to reduce sudden loss exposure.

- Illiquid option contracts fail to execute because buyers or sellers remain unavailable.

- Stock options cannot be purchased on expiry day due to physical settlement rules.

Choice Finx User Complaints

Many FinX users are raising concerns after dealing with repeated problems, unexpected fees, or unpleasant trading experiences. These worries aren’t just about the app acting up; they often relate to trust, how clear things are, and how their accounts are managed daily.

Getting a better understanding of these issues can help users stay aware and make smarter choices before things get worse.

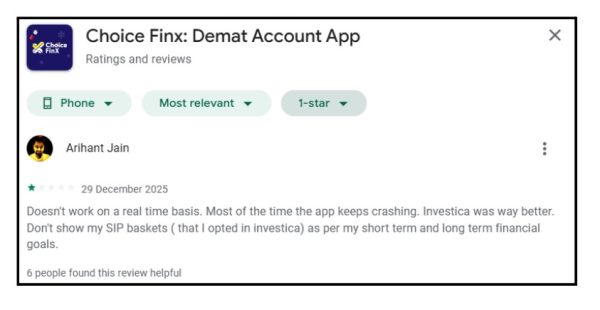

- Users report frequent app crashes and delayed real-time updates during active trading hours.

- Some investors cannot view SIP baskets migrated from the earlier Investica platform.

- Traders raise concerns about a brokerage charging per lot instead of per trade.

- Several users feel account handlers focus more on revenue generation than client profitability.

- Reviews mention missing features like 3 1 accounts and flexible brokerage plans.

User 1 – This review highlights frequent app crashes and delayed real-time performance during trading hours. The user also reports missing SIP baskets after migrating from the earlier Investica platform.

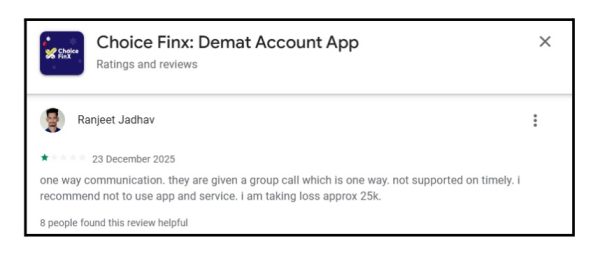

User 2 – This user raises concerns about poor communication and delayed support responses. The review mentions financial loss and dissatisfaction with the overall service experience.

User 2 – This user raises concerns about poor communication and delayed support responses. The review mentions financial loss and dissatisfaction with the overall service experience.

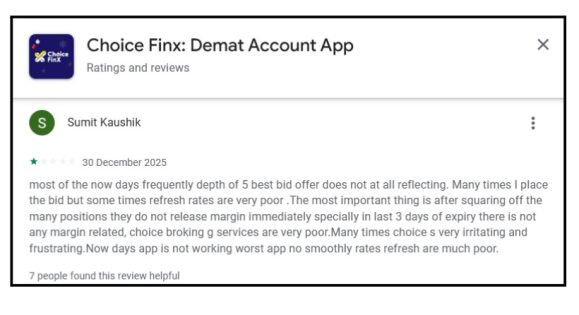

User 3 – This review points to delayed bid offer depth updates and poor price refresh accuracy. The user also highlights margin release delays after square off, especially near expiry days.

User 3 – This review points to delayed bid offer depth updates and poor price refresh accuracy. The user also highlights margin release delays after square off, especially near expiry days.

When To File A Complaint Against Choice Finx?

When To File A Complaint Against Choice Finx?

You should file a complaint if problems keep happening even after you’ve reached out to Choice FinX support and waited for a clear answer.

Delays, unexplained loss of funds, or any concerns about trust are signs that you should take the matter to official complaint channels.

If you spot any trades or fund movements that you didn’t authorize, you should report them right away.

- You should also file a complaint if your account balance or transaction history shows unexpected differences.

- Act quickly if someone asks for your password, OTP, or any other sensitive account information.

- If customer support keeps ignoring your repeated messages or doesn’t provide any written resolution, you should file a complaint.

- If there are unreasonable delays in closing your account, transferring funds, or using demat services, you should escalate the issue.

- You should proceed with a complaint if there’s no meaningful action taken within the set timeline for internal grievances.

- If agents make impossible profit promises or use pressure tactics to push sales, you should file a complaint.

- You should also raise your concerns if bad advice or unethical behavior leads to unexpected financial losses.

Reporting is needed when repeated attempts to get a response don’t work, and your problem remains unaddressed. A well-structured complaint helps protect your money, creates a formal record, and ensures the issue is resolved promptly.

Following the correct steps can help speed up the resolution process and ensure everything is properly documented.

Here are a few steps for reporting:

- Contact Choice FinX’s customer support and clearly explain the problem, including specific dates, order numbers, and transaction details.

- Write a formal complaint through their official email or official complaint channel and ask for a ticket number.

- Keep all evidence such as screenshots, contract notes, bank statements, and chat or call logs. Wait for a reasonable time for a response and keep track of all communications.

- If the issue isn’t resolved, lodge a complaint with SCORES.

- Upload all supporting documents and describe the problem in a clear, factual way without making assumptions or using emotional language.

- Check the broker’s response on SCORES and reply if you’re not satisfied with the solution.

- If the issue still isn’t resolved after the regulatory review, you can escalate it to arbitration in the stock market to recover losses.

Need Help?

If you’re feeling lost, overwhelmed, or uncertain about what to do next, you’re not alone. Many investors get to this point after dealing with losses, lack of communication, or vague answers from their brokers.

We start by listening and understanding your situation. From gathering documents to helping write your complaint, we guide you step by step without pushing you to make hasty decisions.

We’re with you from the moment you file your first complaint all the way to the end when the issue is resolved. Our team helps you gather evidence, organize your case, and take the right steps to get things moving.

You don’t have to handle this alone. Register with us, and we’ll help you navigate the entire process with clarity and confidence.

Conclusion

Choice FinX not working causes a lot of stress because trading depends on fast, accurate, and reliable systems. Constant app crashes, rejected orders, and slow updates mess up trading strategies and financial habits.

If users don’t address these issues, the risks get bigger quickly, and it becomes harder to manage losses. Taking action on time, keeping good records, and following a clear process help protect money and confidence in trading.

Telling support teams and relevant authorities about problems ensures responsibility and creates an official record of what happened. A clear and proactive approach helps traders take control again and make better decisions without worrying about unclear situations.

Ignoring repeated problems can make things worse, especially if there are losses or unwanted actions happening. Users should take action quickly, keep records of the issues, and follow the right steps to report concerns.

A clear and organized approach helps protect your money, brings things back under control, and makes sure your issues get proper attention.

User 2 – This user raises concerns about poor communication and delayed support responses. The review mentions financial loss and dissatisfaction with the overall service experience.

User 2 – This user raises concerns about poor communication and delayed support responses. The review mentions financial loss and dissatisfaction with the overall service experience. User 3 –

User 3 – When To File A Complaint Against Choice Finx?

When To File A Complaint Against Choice Finx?