In today’s investment landscape, new platforms appear every day, some promising convenience, others showcasing the dream of passive income.

So when people land on the Conifer Investments or Conifer Investment app, curiosity is natural.

But so are the questions.

Can you really invest through this platform? Are the returns legitimate? What are the risks? And most importantly, is the Conifer Investment app a smart financial move, or a cleverly packaged scam?

This blog will walk you through the full picture, cutting through the hype and confusion to give you a clear, honest breakdown.

Conifer Investment App

Conifer Investments presents itself as a slick, polished investment app. The platform is built to make you believe you’re entering a serious, well-structured financial platform.

The interface looks modern, the messaging feels confident, and the overall branding suggests legitimacy.

On the surface, it appears to offer a convenient way for everyday users to participate in opportunities like block trading, IPO allocations, and high-return investment plans.

But beneath this appealing front, the way Conifer Trading operates begins to tell a different story.

Here’s how it typically positions itself and interacts with potential users:

- It markets itself as a gateway to premium investment opportunities, especially those that ordinary retail investors usually can’t access easily.

- The first point of contact often comes through WhatsApp or Telegram groups, where self-proclaimed advisors introduce the platform and pitch it as a “regulated” service.

- Conifer account for trading is framed as a simplified route to guaranteed share allotments or unusually high returns, which naturally draws in people looking for quick, low-effort gains.

- The platform encourages users to trust its process, offering explanations, screenshots, and “proof” that past participants made significant profits.

- It leans heavily on the impression of being SEBI-aligned or professionally managed, even though publicly available information rarely supports these claims.

This section sets the stage for the deeper layers that follow, how the app approaches users, how the investment process is presented, and where discrepancies begin to appear.

Is Conifer Investments Safe?

Now, if such questions arise in your head, then the first thing that must grab your attention is whether this platform is SEBI-registered or not.

Well, unfortunately, no such information is available.

Another concern is Block Trading.

Block trading is done by large institutions and companies.

But you are not an institution, but a retail trader.

So, think for a while, is Block Trading safe or not?

Well, clearly not!

So, how is Conifer account for trading, claiming it?

Isn’t it doubtful?

But even after that, most people end up investing in such platforms.

Why?

Because of the way they convince people on Telegram & WhatsApp.

Members in the groups often share screenshots of profits, supposedly successful IPO allocations, and testimonials that appear real.

The advisors respond quickly, use technical market terms, and maintain a friendly tone.

For someone new to investing, or even someone experienced but tempted by faster returns, this environment feels reassuring.

It’s designed to lower skepticism long before any actual transaction takes place.

Conifer Investments Complaints

To understand how platforms like Conifer Trading approach users and gradually trap them, it helps to look at a real case involving a 78-year-old senior citizen, Mr. Amal Singh, who suffered a significant financial loss after being targeted through online trading groups.

According to his written complaint to the National Cyber Crime Reporting Portal, Mr. Singh was added to a WhatsApp/Telegram group where members introduced themselves as SEBI-registered advisors offering stock market and IPO guidance.

Within these groups, he was encouraged to use a mobile application called Conifer, which they claimed was their official trading platform.

At first, everything appeared legitimate. Mr. Singh invested ₹50,000, and the group members continued to reassure him with confident advice, fabricated screenshots, and promises of high returns.

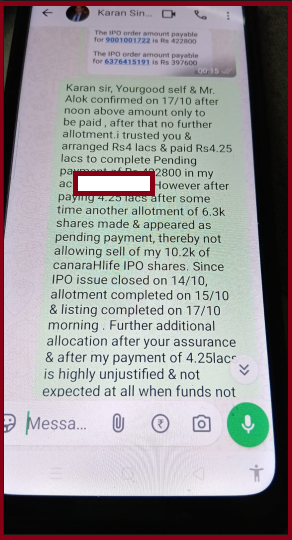

Over time, their tone became more persuasive and urgent, convincing him to invest larger amounts to “secure” IPO allocations.

The situation escalated when they told him he had been allotted CANHLIFE IPO shares worth ₹3.2 lakh and that he needed to deposit an additional ₹4,00,000 to confirm the allotment.

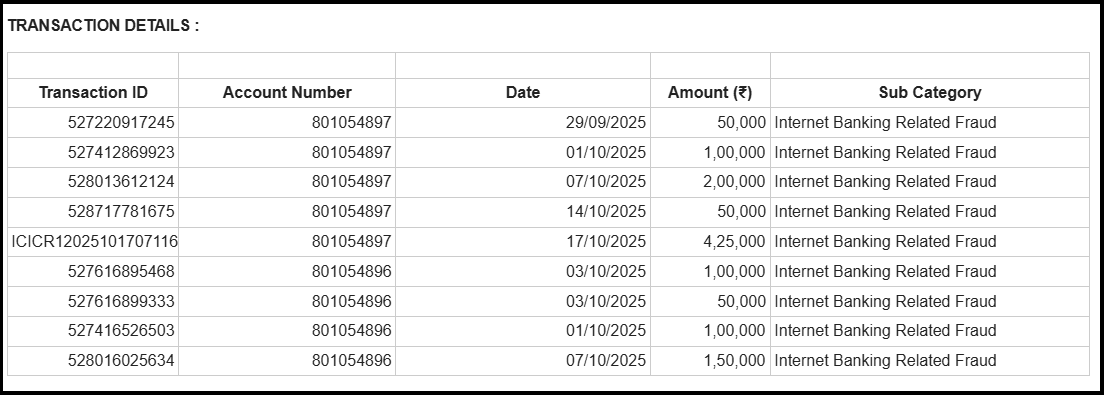

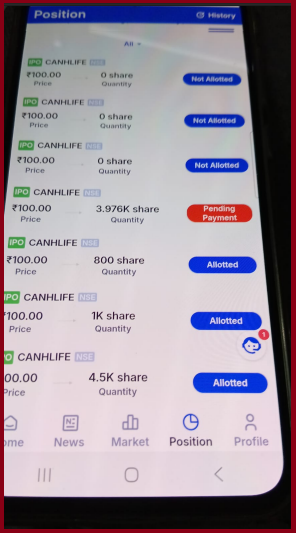

Trusting their repeated assurances, he transferred ₹4,25,000 as instructed. The platform then displayed what appeared to be 10,200 shares in his trading account, along with another 6,300 shares shown under the name of a family member, totaling 16,500 fully paid shares.

However, a closer look revealed a troubling detail: these allotments were shown after the official IPO timelines had already closed.

The IPO closed on 14/10/2025, the allotment ended on 15/10/2025, and the listing was completed on 17/10/2025.

The supposed “allotted shares” were reflected after these dates, making it evident that the transactions were not real but were created only to block his money and demand more.

In reality, none of the funds he invested could be withdrawn.

Every time he attempted to retrieve his money or liquidate the shares, the platform displayed errors or delays, classic signs of a blocked account used to trap victims.

The emotional toll on Mr. Singh has been significant. As a senior citizen with a heart condition, the financial loss of ₹12,25,000 has caused severe stress, anxiety, and hardship.

Despite filing an official cybercrime report, he has not yet received an update, which prompted him to escalate the matter further.

His experience illustrates how convincingly these schemes operate, using professional language, fake regulatory claims, and sophisticated manipulation to gain trust before blocking funds and disappearing.

How to Identify Block Trading Scams?

Block Trading Scams typically involve large-volume transactions carried out through authorized brokers under strict regulatory oversight. When scammers misuse this concept, they mimic the structure but skip the rules.

Here are the major warning signs that help you identify a block-trading scam before it’s too late:

1. Outreach Through WhatsApp or Telegram Groups: Legitimate brokers do not add random users to private groups. If your “advisor” finds you through unsolicited messages or unknown groups, it’s a major red flag.

2. Claims of Guaranteed Allotments or Guaranteed Profits: No real financial professional, especially one operating under SEBI’s framework, can guarantee IPO allotments or fixed profits. Scammers use absolute promises to lure victims quickly.

3. Requests to Transfer Money to Personal Bank Accounts: Authentic block trades always go through regulated broker accounts or official payment gateways. If someone asks you to transfer money to:

- Individual accounts

- Random UPI IDs

- Newly opened bank account.

It is almost always part of a fraudulent setup.

4. Allotments Appearing After IPO Deadlines: One of the common scam techniques is showing fake allotments after the IPO timelines have passed. Any platform displaying allotments after closure or listing dates is manipulating data.

5. Pressure to “Top Up” for Taxes, Confirmation, or Unlocking Funds

Scammers often claim you need to deposit extra for:

- TDS

- “transaction unlocking”

- “last step confirmation”

- “margin” or “processing fees”

Legitimate brokers deduct charges automatically; they don’t ask for extra deposits to “unlock” your own money.

6. No SEBI Registration Number or Unverifiable Credentials: Scam groups tend to throw around the word “SEBI-registered” without providing an actual registration number. If the number cannot be verified on SEBI’s official site, treat it as suspicious.

7. Sudden Restrictions on Withdrawals: When your funds appear blocked, withdrawals show errors, or the support team vanishes, the scam is already in motion. Withdrawal restrictions are the biggest indicator of a bogus platform.

- Telegram channels/WhatsApp messages promising exclusive block-deal allocations or guaranteed returns. Guaranteed returns, huh? Yes, the sirens in your brain should be going off right then and there!

- Asking to move money outside your broker (UPI/Bank transfer to random persons).

- Promises of hidden buyers or guaranteed quick profits.

- Apps or broker names you can’t verify on SEBI/BSE/NSE registries.

How to File a Complaint Against Investment Scams?

If you or someone you know has encountered such a scam, reporting it quickly increases the chances of tracing funds and taking legal action. Here is a step-by-step process:

1. File a Cyber Crime Complaint

File a complaint under Financial Fraud and upload:

- Screenshots

- Chat logs

- Bank statements

- UPI/transaction IDs

- App links

- Phone numbers involved

This creates an official crime reference number for follow-up.

2. Lodge an FIR at the Local Police Station

Provide a written, signed complaint with all supporting evidence. Even if a cybercrime complaint is already filed, a local FIR/CSR helps strengthen your case.

3. Notify Your Bank Immediately

Ask your bank’s fraud department to:

- Flag the transaction

- Alert the receiving bank

- Place a hold or freeze when possible

- Issue an official dispute request

Banks sometimes can reverse or freeze funds if notified early.

4. File a Complaint in SEBI

- Visit the SEBI portal

- Report the individuals or groups falsely claiming regulatory registration.

- SEBI cannot recover funds, but it can initiate investigations and issue warnings.

5. Preserve All Evidence

Keep everything, including:

- Screenshots of the app

- Chat history

- Email conversations

- Payment slips

- KYC steps you completed

- Digital evidence strengthens the case.

Need Help?

If you have lost your funds in any such fake investment schemes, then register with us now.

We will guide you with the process to report the complaint on the respective portal on time to get your loss recovered.

Conclusion

The Conifer Investment app is not safe to use if you’re looking into investing via Block Trading.

It’s a definite fraud that people must be made aware of.

Always remember that Block Trading is not for retail traders, and when it comes to IPO investment, always apply using registered stock broking platforms to not become a victim of IPO Scams.

The more risk you take, the more ready you have to be to face the consequences!