The biggest scam in cybersecurity? Thinking that your fancy degree or corner office makes you bulletproof against hackers.

Educated professionals often believe their degrees and smarts shield them from cyber fraud. But this dangerous misconception is exactly what scammers exploit to strike.

Now, let’s dive deeper into a key question you might have: how exactly are these scams pulled off, step by step?

Understanding the mechanics reveals why even sharp minds get caught.

How Cyber Frauds Target Educated Professionals?

Cyber frauds targeting educated professionals often masquerade as golden opportunities tailored to their ambitions and lifestyles.

Scammers craft these frauds with precision, mimicking trusted processes to build quick trust and urgency.

They start by harvesting your details from public profiles or data leaks, then personalize attacks via WhatsApp, email, or job sites.

Imagine this: your phone buzzes with an “urgent” alert. A doctor gets hit with a fake medical council probe, a corporate hotshot faces a scary tax crackdown notice, and a tech whiz is dangled a “can’t-miss” high-return gig tailored just for their skills.

Coincidence? Not a chance. These are slick, custom-built traps designed to reel you in fast. Next comes credibility building, where they wow you with insider lingo.

Picture a scammer posing as a SEBI officer, tossing around terms like “NSE compliance audit” or naming your boss to sound real. They might even reference a real bank branch near your office, making you nod along.

They twist the knife with professional identity exploitation, tailoring the con to your world.

If you’re a lawyer, it’s an “urgent court filing fee.” Engineers get fake project bids that scream expertise. You think, “I get this, no need to ask anyone,” and dive right in.

Urgency and authority crank up the heat. They hit you with threats like “Your trading account freezes in 24 hours unless you pay now” or “SEBI deadline or face penalties.”

Fake cop badges or executive emails pile on the panic, pushing you to act fast.

Isolation seals the deal. “Don’t tell your family or colleagues,” they warn, “it’ll look bad on your record.” Alone and stressed, you skip the second opinion that could save you.

Extraction is the cash grab. They often send UPI links for “verification,” crypto wallets for “secure transfers,” or screen-sharing to “fix your account” while they snag your passwords.

Even after repeated exploitation keeps the nightmare keeps going. Your details get sold, sparking recovery scams where “helpers” charge to get your money back, or worse, identity theft that haunts you for years.

Real Cases of Cyber Scams

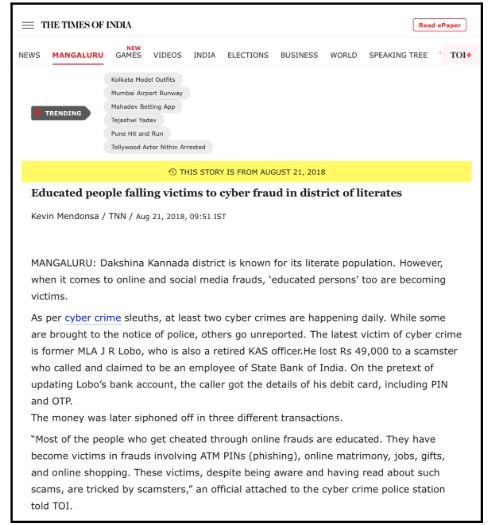

Ever wonder why even the brainiest folks in a city like Mangaluru, packed with degrees and smarts, keep losing lakhs to these online crooks? It’s a wake-up call that education alone doesn’t block scammers who prey on trust and haste.

1. J R Lobo’s Bank Account Heist

Picture this: J R Lobo, a retired KAS officer and former MLA who was super educated, super connected, picks up a call from someone claiming to be from the State Bank of India.

The guy sounds official, chats about updating his account details, and sweet-talks Lobo into sharing his debit card info, PIN, and even OTP.

Boom, Rs 49,000 vanishes in three quick transactions.

Lobo thought he knew better, but these fraudsters from places like Bihar did their homework and struck fast.

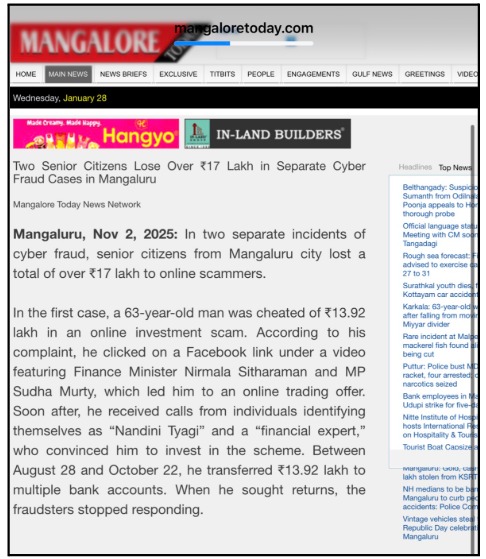

2. Mangaluru Man’s Rs 13.92 Lakh Investment Trap

Then there’s this local guy, well-read and savvy enough to spot most tricks, who gets lured by fake experts posing as “Nandini Tyagi” and a so-called financial whiz.

They hook him with big-return promises on investments, and between late August and October 2025, he wires Rs 13.92 lakh across multiple accounts.

When he asks for his money back, they reply with silence and total ghosting.

Cyber cops in Mangaluru flagged it as part of daily educated-victim cases losing lakhs despite awareness drives.

Why Are These Frauds Exploding Now?

Educated professionals are prime targets because scammers know their mindset: ambition, busyness, and a belief in invincibility.

But deeper factors fuel this rise, turning everyday digital habits into traps.

- Overconfidence from education makes them skip double-checking “official-looking” offers.

- High smartphone penetration lets scammers send personalized phishing via WhatsApp or email at scale.

- Economic pressures post-pandemic push desperate job hunts, ignoring shady portals.

- Weak verification on job sites allows foreign entities easy access to sensitive Indian data.

- International syndicates use VPNs and fake IDs, staying steps ahead of local cops.

These points reveal a perfect storm: tech-savvy victims meet borderless crooks. The question is, will ignoring this cost you next?

How to Spot These Scams?

Spotting scams early saves your wallet. Always look for pressure tactics and verify before clicking. Educated pros often miss these because they seem “professional.”

- Demand for OTPs or instant payments screams fraud; real entities never ask.

- Unknown job portals or calls from foreign numbers promising defence roles are traps.

- Fake dashboards or small payouts in investment apps hide Ponzi schemes.

- “Digital arrest” threats without an official ID or local police visit are bogus.

- Unsolicited links or pop-ups claiming Microsoft errors lead to remote access theft.

Train your gut: pause, verify via official sites, and question urgency.

What To Do If You Are A Victim of Cybercrime?

Reporting swiftly boosts recovery chances. All you need to do is act within golden hours via national helplines.

Here’s your step-by-step guide on where to report Cyber Crime:

- Collect all the evidence of fraud. This will help you in building a strong case.

- Call the national cyber crime helpline immediately for cyber fraud; it alerts banks to freeze transactions via CFCFRMS.

- File an online complaint in cyber crime with screenshots, transaction IDs, and details. You can also check your cyber crime complaint status online.

- Lodge FIR at your local police cyber cell or NCRP portal for tracking.

- For bank freezes under MHA SOP, request review within 90 days if innocent.

- Contact RBI Ombudsman if banks delay refunds post-SOP guidelines.

Timely action under new rules means faster money back.

Need Help?

If you have lost your money to such scams, don’t worry and register your complaint with us.

We are a team of dedicated professionals who will help you in your recovery process.

Conclusion

Cyber crimes in India don’t discriminate by education.

They prey on haste and hubris, but awareness arms you best.

From job portal spies to digital arrests, India’s pros lost billions, yet government SOPs and alerts offer real shields.

So, always stay vigilant and don’t be overconfident. Your money is your responsibility; choose wisely.