India’s capital markets operate on the principles of trust, transparency, and strict regulatory oversight.

When professionals handling sensitive market information fail to follow ethical and regulatory standards, SEBI intervenes to protect investors and maintain market integrity.

One such case involved Deepak Agrawal, where SEBI took action following a detailed investigation linked to Axis Mutual Fund.

This case highlights the importance of compliance and the need for investors to remain vigilant when interacting with investment advice and market information.

Who is Deepak Agrawal?

Deepak Agrawal is a seasoned equity research professional with nearly two decades of experience in India’s financial services industry.

He has primarily specialised in banking and the BFSI sector research, working with well-known asset management and financial institutions.

Over the years, he held roles that involved access to price-sensitive and proprietary market information, which comes with high ethical responsibility under SEBI regulations.

But what went wrong when he had to pay 85 lakh rupees? Let us find out in the SEBI order.

SEBI Orders Involving Deepak Agrawal

SEBI doesn’t step in without reason. This section sets the context for regulatory orders involving Deepak Agrawal, highlighting why the regulator examined his role and what it ultimately concluded.

The orders focus on compliance, disclosures, and market conduct, assessing whether actions aligned with SEBI regulations. After reviewing facts and evidence, SEBI issued formal directions or penalties where required.

These orders reflect SEBI’s final regulatory view on the matter, signalling accountability and reinforcing investor-protection standards, even where outcomes were settled rather than contested.

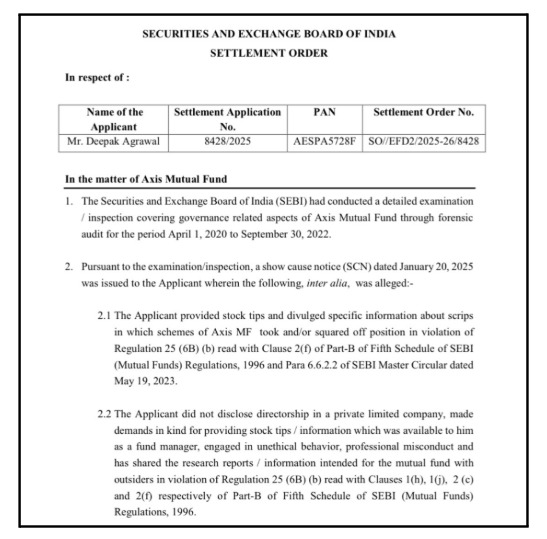

SEBI Forensic Audit & Show Cause Notice Against Deepak Agrawal

SEBI conducted a forensic audit and detailed inspection of governance-related aspects of Axis Mutual Fund for the period April 1, 2020, to September 30, 2022.

Following this investigation, SEBI issued a Show Cause Notice (SCN) dated January 20, 2025, to Deepak Agrawal, alleging multiple regulatory violations.

Key Allegations by SEBI

SEBI alleged that Deepak Agrawal:

- Shared stock tips and specific scrip-related information linked to Axis Mutual Fund schemes

- Divulged confidential research and fund-related information to outsiders

- Failed to disclose his directorship in a private limited company

- Demanded benefits in kind in exchange for providing sensitive stock information

- Induced third parties to buy or sell securities being traded by mutual fund schemes

These actions were alleged to be in violation of SEBI (Mutual Funds) Regulations, 1996, including professional conduct and ethical standards.

What Did SEBI Do?

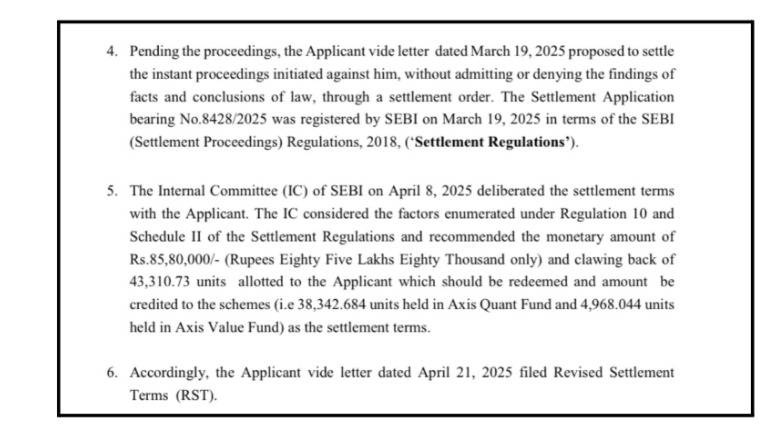

While the adjudication process was ongoing, Deepak Agrawal opted to settle the matter without admitting or denying the allegations, under SEBI’s Settlement Proceedings Regulations, 2018.

SEBI Verdict:

- Settlement Amount: ₹85,80,000 (Rupees Eighty-Five Lakh Eighty Thousand)

- Clawback of Mutual Fund Units: 38,342.684 units from Axis Quant Fund and 4,968.044 units from Axis Value Fund

- Total Units Clawed Back: 43,310.73 units

- The redeemed amount was credited back to the respective mutual fund schemes

This settlement allowed SEBI to close the proceedings while reinforcing accountability and investor protection.

How Does This Impact Investors?

Cases like this serve as an important reminder that:

- Market-sensitive information must never be misused

- Even experienced professionals are accountable under SEBI regulations

- Regulatory oversight helps protect retail investors from unfair advantages and information misuse

For investors, this reinforces the importance of relying only on registered, compliant, and transparent sources of investment advice.

Deepak Agarwal Complaints

Various users have posted about the SEBI order on community platforms, sharing screenshots, short summaries, and their own interpretations of what the regulator alleged and why a penalty was imposed.

In these discussions, people mostly focus on the key themes mentioned in the order: fee‑charging practices, whether certain social-media content counts as advertising, and what compliance expectations apply to registered advisers.

Others used the post as a broader reminder to verify SEBI registration details, read advisory agreements carefully, and not rely only on influencer-style claims when making financial decisions.

What Can You Do in Such Cases?

If you have been a victim of Deepak Agarwal, you can take the following steps to get your money back:

1. Document Everything: Keep detailed records of all tips, the dates they were published, the entry and exit prices you followed, and the eventual profit or loss. Save screenshots of app behaviour, error messages, and support requests. Record the dates you requested refunds or complained about charges.

2. Verify Independently: Never blindly follow any recommendation. Read financial statements, check SEBI disclosures, and understand why a stock is recommended before investing.

3. Report Issues Quickly: If the analyst fails to execute a trade, charges you unexpectedly, or causes financial loss, document it and contact support within 24 hours. Request a written response. Keep copies of every email exchange.

4. File Formal Complaints: If the company doesn’t resolve your issue within 30 days, file a formal complaint with the NSE or BSE (depending on where the issue occurred) through their official grievance portals. These complaints create an official record.

5. File a Complaint in SEBI: If the exchange doesn’t help, complain to SEBI’s SCORES platform. This brings in the regulator and signals the issue to the authorities monitoring the broker.

6. Seek Legal Help: For losses exceeding ₹1 lakh, consider consulting a lawyer specialising in securities law. They can guide you on arbitration, civil suits, or claims under investor protection schemes.

Need Help?

If you want step-by-step support, you can register with us.

We’ll arrange a call with a dedicated case manager who helps draft complaints, coordinate with the stockbroker, and file cases on SEBI SCORES or SMART ODR.

Based on how the matter progresses, our team also guides counselling and the arbitration process.

Conclusion

The SEBI settlement involving Deepak Agrawal highlights why ethics and compliance are non-negotiable in India’s financial markets. SEBI’s intervention ensures transparency, accountability, and investor confidence.

For investors, the lesson is clear: Always verify credentials, avoid shortcuts, and question anything that promises assured profits.

Stay informed. Stay cautious. And always check everything properly before trusting or investing your money.