Considering enrolling in Delhi Wale Guruji’s trading program? Does the ₹2.5 lakh “automated robot” promise effortless profits?

Before you invest your hard-earned money, it’s important to step back. Let’s break down the claims, the costs, and the reality behind it all.

DWG Trading

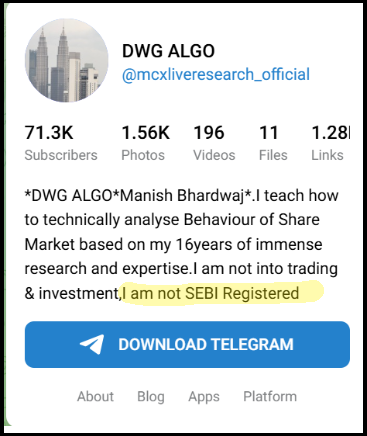

Delhi Wale Guruji is the online persona of Manish Bhardwaj. He runs DWG Algo, a trading education platform.

According to DWG Algo Telegram Channel bio (@mcxliveresearch_official with 71.3K+ subscribers), he claims “16 years of immense research and expertise.”

But here’s the critical part. He openly admits: “I am not SEBI registered.”

Sounds concerning, right?

In India, providing investment advice without SEBI registration is illegal. Yet he continues operating with thousands of followers.

Delhi Wale Guruji Course

According to course reseller websites, DWG offers trading courses originally priced at ₹2,50,000.

Even after saying in his bio that he isn’t into trading.

However, the same course sells for just ₹3,199 through resellers.

That’s a 98% price drop. Why would genuine education collapse like this?

His offerings include:

- Forex and Indian market strategies

- Trading robots (₹45,000 – ₹2,50,000)

- Telegram signal services

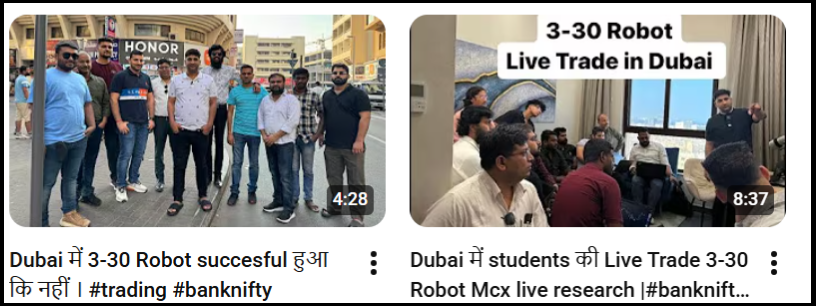

- Offline classes in Dubai

Yes, Dubai. Not India.

According to multiple sources, Manish Bhardwaj conducts his main classes in Dubai. This raises questions about regulatory oversight.

Delhi Wale Guruji Trading Formulas

Course descriptions claim that DWG offers multiple “proven” trading formulas.

But how reliable are they, really?

The 3:30 Formula

Marketed as his flagship strategy and reportedly bundled into the ₹2.5 lakh course package.

Yet, there’s a glaring gap: no publicly verified success rate, no third-party audit, and no independently published performance data.

If a strategy truly works consistently, why isn’t there transparent proof?

TTT Formula Training

Another heavily promoted concept.

The catch? According to the course details, it requires physical attendance in Dubai.

This raises an obvious question: why must traders travel internationally to learn something that could be taught online?

In modern financial education, effectiveness isn’t tied to geography.

Trap Formula Techniques

Promotional content claims this formula helps identify market traps.

Ironically, user grievances suggest the opposite; many traders claim they were trapped by the strategy itself, facing losses instead of clarity.

The Bigger Question

If these formulas are genuinely reliable, where are the independently verified data, the audited results, and the long-term performance records?

In trading, credibility isn’t built on promises; it’s built on proof.

All of this leads to an even bigger question: if the formulas already lack verifiable performance, how transparent is the DWG Algo an automated trading robot itself?

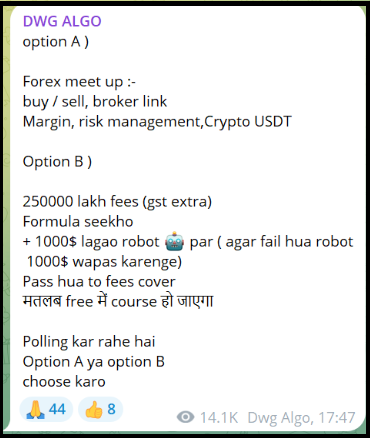

Delhi Wale Guruji Robot

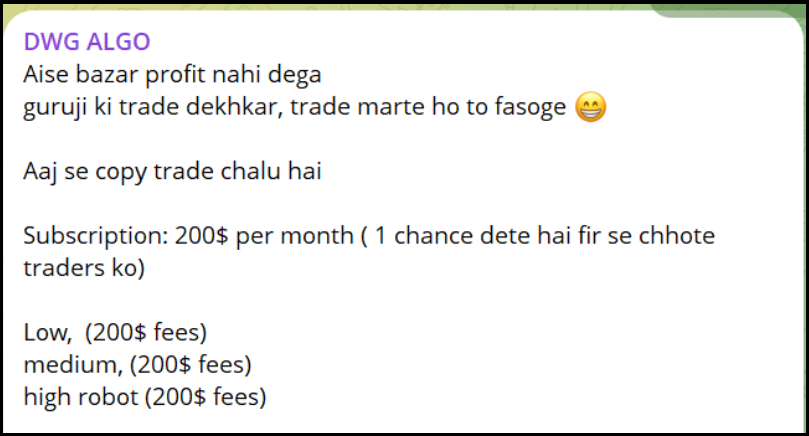

Information shared on Telegram shows a pricing structure that raises serious concerns.

Monthly Subscription Plans

- Low Risk Robot: $200/month (₹16,600)

- Medium Risk Robot: $200/month (₹16,600)

- High Risk Robot: $200/month (₹16,600)

Scalping Robot: $300/month (₹24,900)

Different risk categories, different trading styles, yet nearly identical pricing. That alone prompts an obvious question:

If the risk and strategy truly differ, what exactly is being “customised” here?

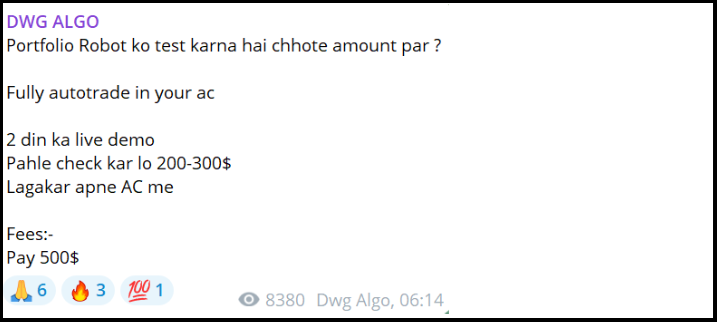

Advance Payments That Shift Risk to the User

- Auto-trade subscription requires an upfront payment of $2,500 (₹2,08,000)

- Traders must also deposit a minimum balance of $500 (₹41,500)

This setup places the financial risk almost entirely on the trader, with no clear disclosure of drawdowns, historical losses, or failure rates.

Where’s the Accountability?

There is no publicly shared audit, no verified long-term track record, and no regulated performance reporting.

Once the advance is paid, accountability becomes unclear, especially if results don’t match the promises.

Okay… but is this just bad marketing, or is this a full-fledged scheme?

How the DWG Trading Scheme Actually Works?

Let’s examine how the scheme actually works.

Stage 1: The Bait: Unrealistic Profit Claims

Telegram messages promise “दावे के साथ 2 lakh 1 दिन में” (₹2 lakh in 1 day with guarantee).

These messages are designed to trigger urgency and desire, especially among retail traders looking for quick recovery or fast growth. The language used suggests certainty rather than probability, which is a common FOMO-driven tactic.

Key red flags at this stage:

- Use of the word “guarantee.”

- Daily profit projections without risk disclosure

- No verified trading logs or audited proof attached

The goal here is not education, but attention.

Stage 2: The Hook: Controlled Demo & False Confidence

Once interest is shown, messages shift tone:

“Portfolio Robot ko test karna hai chhote amount par? 2 din ka live demo.”

This stage creates psychological safety. A short demo period is presented as “proof,” but:

- The demo duration is too brief to reflect real market conditions

- Drawdowns and losing market phases are not shown

- Users are guided on what to observe, limiting independent judgment

The intention is to build trust without revealing long-term risk.

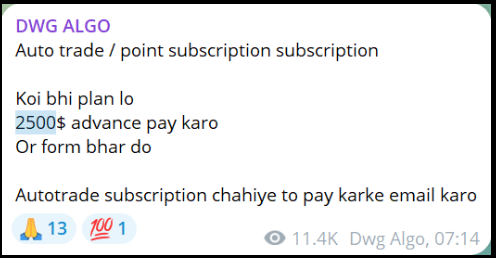

Stage 3: The Pressure: Advance Payment Demand

After the demo and repeated success messaging, pressure escalates:

“Koi bhi plan lo. 2500$ advance pay karo.”

That translates to ₹2,08,000 paid in advance, before:

- Strategy documentation is shared

- verified performance records are provided

- Any formal agreement or refund clause is discussed

At this stage:

- Language becomes urgent (“limited slots”, “last chance”)

- Questions about risk are deflected or delayed

- Responsibility subtly shifts from the promoter to the trader

This is the commitment point designed to lock users in financially.

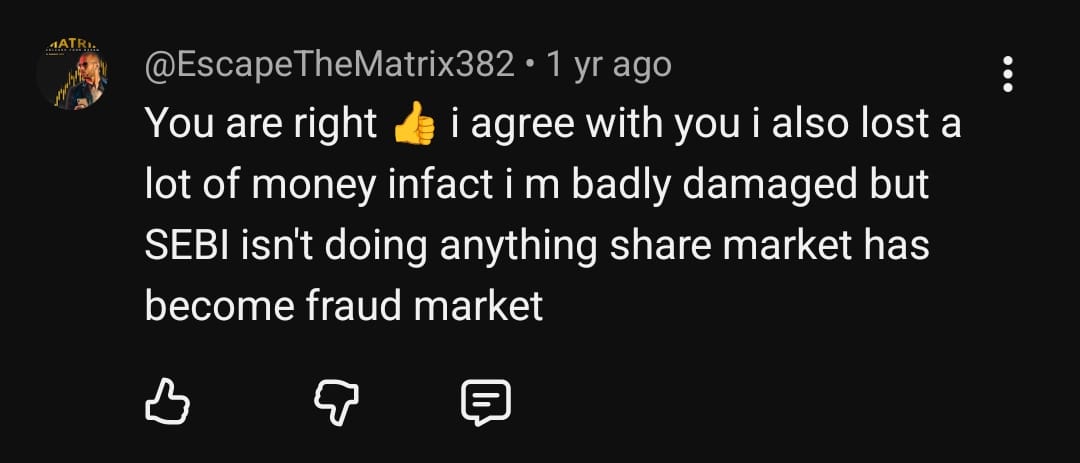

Stage 4: The Trap Signals: Accountability Disappears

Telegram messages later introduce distancing language, such as:

“Pool trading sab khatam hai. Jiska fund ud gaya apna khud se karo.”

While the channel continues promoting robots or new plans, responsibility for losses is clearly redirected to users.

Common warning signs here:

- Losses are framed as “market risk”

- Support responses slow down or stop

- Users questioning the results report being muted or removed

- No acknowledgement of prior profit guarantees

At this point, communication protects the system, not the trader.

Individually, each step may appear harmless.

For traders, recognising these stages early is critical.

In financial markets, transparency, verifiable data, and accountability are non-negotiable. When communication avoids these elements, caution is not fear; it’s common sense.

NSE Official Warning for DWG

Now, why you must be alert while enrolling in DWG trading is the NSE warning itself.

The National Stock Exchange issued a public warning dated August 1, 2024 against Manish Bhardwaj and DWG Algo.

Key violations identified:

- Not SEBI Registered – Operating without proper authorisation

- Guaranteed Returns Advertised – Promising assured profits (illegal under Indian law)

- Unauthorised Stock Tips – Providing trading signals without licensing

According to NSE’s notice, investors dealing with such entities do so entirely at their own risk.

Delhi Wale Guru Ji Trading Complaints

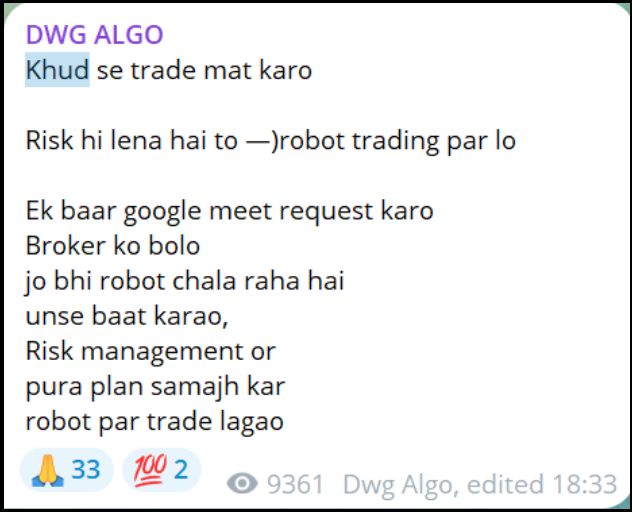

According to documented user experiences and social media reviews, multiple Indian traders report serious issues.

Problem 1: Complete Account Losses

What users experienced: Accounts hitting zero despite following signals

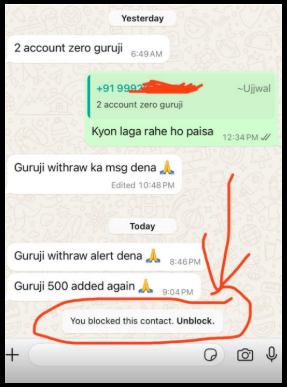

According to WhatsApp conversations shared in the source material, users report devastating losses. When questioned, they get blocked.

Real User Review:

One Indian trader shared: “Paid ₹2.4 lakh for the course. My account went to zero. When I asked for help, Guruji blocked me.”

Another user stated: “The 16 years of research claim is fake. I lost everything following his signals.”

Problem 2: No Profits Despite High Fees

What this reveals: The promised expertise doesn’t translate into profitable trades

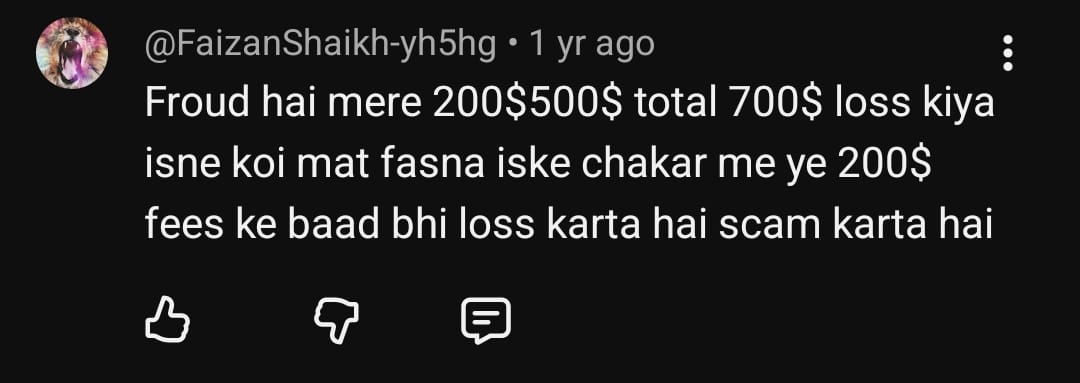

According to documented student reviews, multiple learners report negative results despite paying ₹2,40,000.

Real User Reviews:

“Maine full course liya tha. Kuch nahi mila. Sab loss hi loss.” (Translation: I took the full course. Got nothing. Only losses.)

According to another review: “His formulas don’t work. My trading account is empty. This is a scam.”

Problem 3: Dependency Trap

What users experienced: Discouraged from independent trading

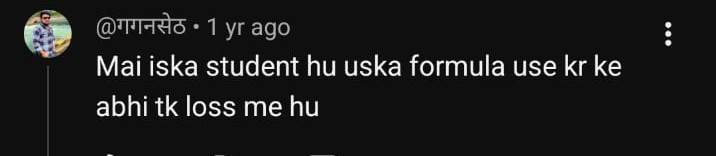

According to Telegram messages: “Khud se trade mat karo. Risk hi lena hai to robot trading par lo.”

Real User Review:

“He doesn’t teach actual trading. He just wants us to buy his expensive robot. When the robot failed, he said, ‘manage yourself.'”

Problem 4: Hidden Additional Costs

What this reveals: Total investment far exceeds initial promises

According to user complaints, the ₹2.4 lakh fee is just the beginning.

Additional costs include:

- Robot subscription fees

- Testing fees (₹41,500)

- Broker commissions

- Dubai travel expenses

Real User Review:

One trader shared: “First, they said ₹2.4 lakh. Then robot fees. Then, there are testing fees. Then, Dubai travel. Total crossed ₹5 lakh easily.”

Problem 5: Scripted Scam Messages

What this reveals: Automated promises designed to trap victims

According to user complaints outside Telegram, traders receive copy-paste messages.

Real User Review:

According to a Trustpilot-style review: “They kept sending scripted messages promising ‘100% profit’, ‘$100,000 monthly’, and ‘$5,000 in first month.’ These are unrealistic claims no legitimate trader would make.”

How to Report Delhi Wale Guruji?

Have you lost money to Delhi Wale Guruji’s schemes?

Paid for courses? Bought robots?

Watching your account hit zero?

Register with us to report your. We assist victims through proper case documentation, SEBI complaint filing, consumer forum representation, and legal consultation connections.

Don’t let embarrassment stop justice. The longer you wait, the harder recovery becomes.

Conclusion

According to the NSE warning dated August 1, 2024, Delhi Wale Guruji (Manish Bhardwaj) operates illegally without SEBI registration.

He conducts classes in Dubai, avoiding Indian regulations. He accepts payments for robots that reportedly don’t deliver results.

According to documented complaints, his pool trading scheme collapsed, with investors losing everything. Students report losses, not profits.

Quality trading education doesn’t cost ₹2.4 lakh. Legitimate educators operate transparently within India. They don’t flee to Dubai. They don’t demand cryptocurrency. They don’t promise guaranteed returns.

Your hard-earned money deserves legal protection. Stay away from unregistered entities.