When a company introduces itself as a SEBI-registered research firm, most investors naturally lower their guard. The registration number sounds reassuring. The words “professional guidance” feel safe. And when markets are confusing, that confidence can be hard to ignore.

This is exactly where the story of DG Share Market Research Pvt Ltd begins.

Over the past year, investors have reported experiences that raise important questions, not just about one company, but about how financial research and advisory services communicate, sell trust, and manage accountability. What starts as a confident phone call and a demo showing small profits can slowly turn into mounting losses, repeated reassurances, and eventually, silence.

This blog looks closely at one such investor experience involving DG Share Market Research. It’s not about market ups and downs alone; it’s about expectations, communication, service promises, and what happens when an investor feels left without answers.

By breaking down how the interaction unfolded, what services were offered, and where concerns emerged, this article aims to help investors understand when to pause, when to question, and when to take action. Because in financial markets, being informed isn’t just about data, it’s about knowing your rights and recognizing red flags before they become costly.

DG Share Market Research Review

DG Share Market Research Pvt Ltd is a private Indian company that hasn’t been listed on the stock market. It was started in July 2023 and is based in Pune, Maharashtra.

The company is involved in financial activities that focus on market research and data intelligence. It works in the financial services sector and is still active according to the records available.

The company is registered with the Securities and Exchange Board of India as a Research Analyst. Its SEBI registration number is INH000015534, showing that it’s officially registered under the relevant regulations.

The company offers services related to analyzing financial markets and providing business intelligence.

It provides credit risk assessments, information about international trade, and access to financial data that helps with business decisions.

These services help organizations and investors understand their financial situations and potential risks. The company also helps with customer onboarding and due diligence processes.

Through its services, it supports businesses that need organized financial information and analysis. The company mainly provides financial data and research.

It gives access to verified registry information and historical company data. When needed, it can provide reports that include financial analysis, legal checks, trade insights, and risk assessments.

This information helps with knowing your customer (KYC) processes and evaluating risks with business partners.

The company is run by key people, including Swapnil Bajarang Patil and Karan Kundan Malani, who are listed as directors or important management figures tied to its operations.

Investors need to spend some time and look closely at the details. Each financial service has its own rules and limits and must follow certain laws.

By checking more than just the obvious parts, investors can better see if it’s right for them and how it fits their situation. Taking a thoughtful approach helps make smart choices instead of rushing to a decision.

DG Share Market Research Complaint

Complaints against SEBI-registered financial advisor and research firms often don’t begin with obvious warning signs. They usually start with reassurance—clear explanations, confident claims, and the comfort of regulatory registration. For many investors, especially those new to trading, these signals create trust and a sense of safety.

The complaint involving DG Share Market Research Pvt Ltd follows a similar pattern. What initially appeared to be professional support from a SEBI-registered research firm gradually became an experience marked by losses, repeated assurances, and unanswered questions. This section outlines the investor’s complaint and highlights where expectations and outcomes diverged.

How the Interaction Began

The investor received an unsolicited phone call from an individual who introduced himself as a representative of a SEBI-registered research firm. During the conversation, the caller shared the firm’s SEBI registration number and explained that the company offered professional trading support and research services.

The investor clearly stated that he had no prior trading experience. According to the complaint, he was reassured that this would not be an issue and that the firm would provide complete guidance at every stage of the process.

To build confidence, the firm arranged a demo trading session. The demo reflected small but positive gains, which helped establish trust and made the service appear manageable even for a beginner.

Transition to Paid Services

Encouraged by the demo results, the investor agreed to begin live trading under guidance. He also entered into a profit-sharing agreement, believing that the firm’s research and advice would help manage risk and improve outcomes.

Following this, the investor received email confirmations showing successful payment processing, invoices, and the extension of research services. These communications reinforced the impression that the arrangement was formal and professionally managed.

Trading Losses and Repeated Reassurances

Once live trading started, the investor began noticing consistent losses in his trades. When he raised concerns, the response from the firm remained reassuring.

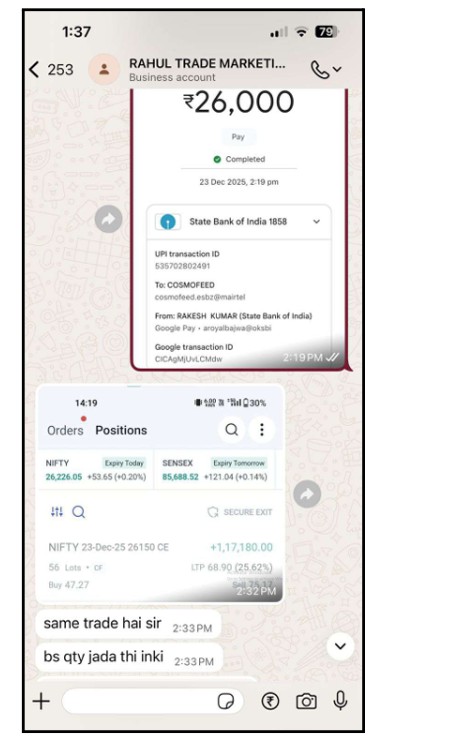

According to the complaint, communication continued through frequent WhatsApp messages and calls.

The investor was repeatedly told that:

- The losses were temporary

- Recovery would happen in future trades

- He should continue trading to balance earlier losses

Screenshots of chats reportedly show ongoing discussions around trades, follow-ups, and encouragement to stay invested.

Over time, the investor states that he paid approximately ₹3,50,000 in service fees to DG Share Market Research. In addition to these fees, he reports trading losses of around ₹2,38,000.

As losses continued, the investor claims that communication from the firm gradually reduced. Follow-ups became less frequent, and eventually, meaningful guidance and responses stopped altogether. Despite multiple attempts to seek clarification or recovery, the investor reports receiving no effective resolution.

What Investors Can Take Away

This complaint highlights the importance of understanding how financial research and trading services are explained and delivered.

Investors should:

- Carefully review service terms, fee structures, and agreements

- Understand that SEBI registration does not eliminate market risk

- Be cautious of verbal promises about recovery or assured outcomes

- Keep written records of all communications and payments

- Avoid making decisions under pressure or emotional stress

Awareness, documentation, and patience are essential protections when dealing with market-linked services.

Filing A Complaint Against Such Advisory Company

Investors often work with financial service companies hoping for clear communication and fair treatment. Even though many services follow rules set by regulators, problems can happen.

Spotting these issues early helps investors protect their money and get things fixed quickly.

Here are some reasons why you might need to file a complaint:

- Getting investment advice or trading tips from a service that isn’t registered with SEBI

- Being told you will definitely make money or get assured profits, including promises of profit sharing

- Paying high fees without getting the services you were told you would receive

- Being convinced by false or incomplete information or fake reviews

- Being encouraged to take on high-risk trades, like derivatives, without being properly warned about the risks

- Being refused a refund or having your refund request delayed, even when it’s justified

- Having unclear communication, not enough transparency, or missing details about your transactions

How To File a Complaint Against a Research Analyst?

When an investor has a problem with a financial advisory or research service that isn’t fixed, it’s best to report it through the official regulatory channel.

This makes sure the issue is handled properly. Investors can send in their complaints along with any proof they have.

Before going to the regulator, investors should first talk directly to the company to try to fix the problem. If the company doesn’t reply on time, is unclear, or doesn’t solve the issue, then it’s time to use the official complaint process.

Steps to Register and File a Complaint in SEBI:

- Go to the official grievance redressal website of SEBI.

- Create an account on the SCORES platform using your email and some basic information.

- Log in and pick the option to file a new complaint in SCORES.

- Write the name of the advisory company and choose the right category for your complaint.

- Give a clear description of the problem, including the dates, money involved, and what the issue is about.

- Attach any supporting documents like payment records, emails, agreements, and screenshots from chats.

- Send the complaint and remember the acknowledgment number for tracking.

- Check the status of your complaint on the portal and provide more information if they ask for it.

Need Help?

Losing money can be really hard, especially when you’ve trusted the person or company you invested with. A lot of people don’t speak up because they’re not sure where to start or if anyone will listen.

But it’s okay to raise your concerns; it’s not a mistake. Every investor has the right to understand what happened, be treated with respect, and get a fair chance to fix things. You don’t have to deal with this alone.

Reach out to us, and we help investors from the very beginning until the issue is fully resolved.

Our support includes looking at documents, organizing financial records, and helping you explain your concern clearly and in an organized way.

We walk you through how to file a complaint and help with any follow-up steps you might need. All the time, we focus on being clear, following the rules, and keeping you in the loop so your issue gets the proper attention.

Conclusion

DG Share Market Research Pvt Ltd is a registered financial research company that works under the rules set by India’s regulators.

Just like other services that are connected to the market, investors should carefully check what this company offers and how it communicates before deciding to use its services.

This example shows how important it is for investors to fully understand the terms of the service, how much it costs, and the risks involved.

Reading all the written agreements carefully and keeping good records helps investors make sure their expectations match what the service actually provides.

Being aware of your investments is a key way to protect yourself in the financial world. Investing in the market always involves some level of risk, and no service can take away that risk.

Investors should check if the company is properly registered, not depend on promises made verbally, and keep track of all communications.

By staying informed, being careful, and taking action, investors can make better choices and handle any problems that come up more effectively.