How would you react to an ad claiming that you can buy a “₹2.5 lakh DWG algo,” sit back, and let the money flow in while you sip chai?

Sounds tempting, because who doesn’t want easy profits?

But the moment you hear something that promises returns without effort, that’s when you should pause.

And then you see the twist: this ‘₹2.5 lakh’ algorithm is suddenly being sold online for ₹3,199, cheaper than a pair of wireless earbuds.

Any ordinary buyer would naturally wonder: Why would someone reduce the price of a supposedly premium algorithm by more than 98%? What changed overnight?

Enter Delhi Wale Guruji, known for his big promises, high-energy reels, and very confident claims about trading success.

His DWG Algo is marketed as something powerful and exclusive, yet the pricing and promotions tell a very different story.

But the real concern begins when you look beyond the ads. The National Stock Exchange has already issued a caution about such offerings and activities.

When a major regulator steps in, it’s a signal for every ordinary investor, especially beginners, to slow down and understand the risks before spending money.

So before you consider paying for an algorithm that claims to make your life easier, let’s take a clear look at what’s being offered, how it’s marketed, and why so many red flags have started appearing.

Because in the world of trading, the biggest danger often isn’t the market, it’s believing something that sounds too good to be true.

What Is DWG Algo?

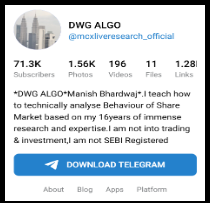

DWG Algo calls itself a trading education and “robot selling” platform, run by Manish Bhardwaj, popular online as Delhi Wale Guruji Jii.

But even before looking at the products, an ordinary person naturally ends up with several basic questions.

What exactly is being taught?

The platform claims to offer technical analysis training based on “16 years of research and expertise,” according to the Telegram bio.

But any beginner would reasonably wonder:

- What kind of technical analysis is this: stock market, currency markets, or something else?

- Is there any verified qualification or certification behind these 16 years of experience?

- Are the teachings aligned with the rules for Indian traders?

These are simple clarification points every learner deserves to know upfront.

Is there Regulatory Registration?

They openly mention: “I am not SEBI Registered.” This immediately raises another set of basic questions:

- If the algorithms, tools, or teachings influence trading decisions, should SEBI registration be relevant?

- If not SEBI, then is there any other regulatory certification—especially if the content includes forex?

- What protection does a buyer have if something goes wrong?

Again, these are standard questions any cautious consumer might ask—not conclusions.

What Market is this Algo Actually for?

This is where many new traders get confused. DWG Algo talks about trading, automation, and profit screenshots, but doesn’t clearly specify whether the strategies are intended for:

- The Indian stock market,

- Legal INR currency pairs traded on NSE/BSE, or

- Offshore forex/CFD-style trading, which Indian residents are not permitted to trade under RBI rules.

So the natural questions for any ordinary user are:

- If it’s stock-related, why is SEBI registration missing?

- If it’s forex-related, is it the legal Indian kind or the offshore kind?

- If offshore forex is involved, why is it being promoted to Indian audiences at all?

These are valid regulatory concerns, not accusations.

And last but not least, why Dubai for offline classes?

Several third-party websites mention that Manish Bhardwaj conducts offline classes in Dubai.

Nothing wrong with international workshops, but it still makes people wonder:

- Why are the classes hosted outside India instead of openly in India?

- Are the topics taught more aligned with international forex rather than Indian markets?

- Does the Dubai location make it easier to discuss strategies not permitted for Indian residents?

These are simply questions any beginner might naturally have when they see the location choice.

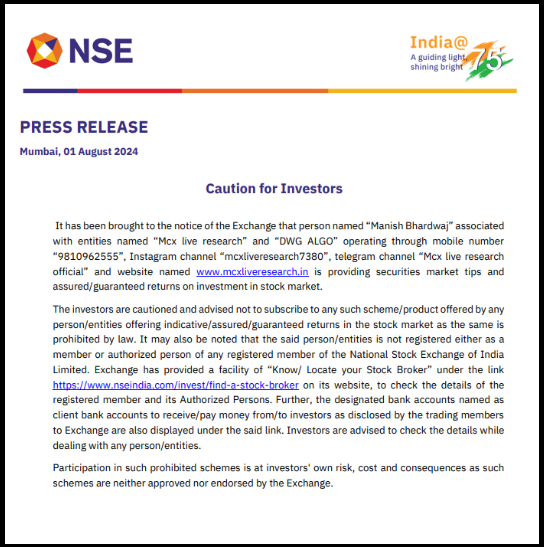

NSE Official Warning On DWG

The National Stock Exchange actually released a full public press note about this.

Yes—an official document.

Dated August 1, 2024.

And what they mention is important for anyone even thinking about paying for algorithms, “premium groups,” or guaranteed-return services.

What did NSE Say?

According to NSE’s notice, Manish Bhardwaj, linked to names such as “MCX Live Research” and “DWG ALGO”, was found to be offering stock-market tips and even promising assured returns.

This is where things start to sound serious: the moment someone makes “guaranteed return” claims in financial markets, regulators step in.

Here are some of the major concerns raised by SEBI:

1. Not SEBI Registered

NSE clearly states that the mentioned person/entities are not registered as a member or authorised person with the exchange.

For a normal reader, this basically means: they are not licensed to offer stock-market services or advice.

2. Guaranteed returns were being advertised

This is a direct violation. In India, no one is allowed to promise fixed profits in the stock market, not even SEBI-registered advisors.

3. Unauthorised stock market tips

NSE notes that tips, recommendations, or trade signals were being provided without proper registration. This is again something SEBI strongly prohibits.

4. Operating without required licenses

Meaning: offering services that usually require regulatory approval, but without having that approval.

What does this mean for regular people?

It’s simple: when a top regulator issues a notice about someone or their associated entities, it’s a sign to slow down, double-check everything, and think carefully before investing money.

No drama. No exaggeration. Just reality.

NSE’s message isn’t hidden between the lines; it basically says: If you choose to deal with such platforms, you’re doing it entirely at your own risk.

Why Manish Bhardwaj Allegedly Fled to Dubai?

This is where things get concerning. Multiple sources indicate Manish Bhardwaj now operates from Dubai.

He reportedly left India. According to course reseller websites, he takes offline classes in Dubai.

Why would a legitimate trading educator flee? Legal experts call this a classic “flight risk” pattern.

Is DWG Algo Safe?

Let’s examine concrete evidence from their own channels. These aren’t assumptions; these are facts.

1. No SEBI Registration

Evidence: Their own Telegram bio states: “I am not SEBI Registered.” In India, providing investment advice without SEBI registration violates securities law. Period.

2. Illegal Forex Trading Promotion

Evidence: Telegram post claims “दावे के साथ 2 lakh 1 दिन में #forex #trading” (₹2 lakh profit in 1 day from forex).

Forex trading in India is restricted. Only INR-based pairs through SEBI-registered brokers are legal. Promoting offshore forex is illegal.

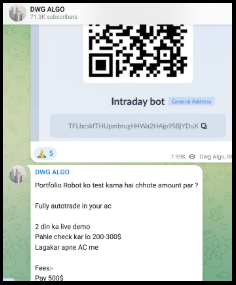

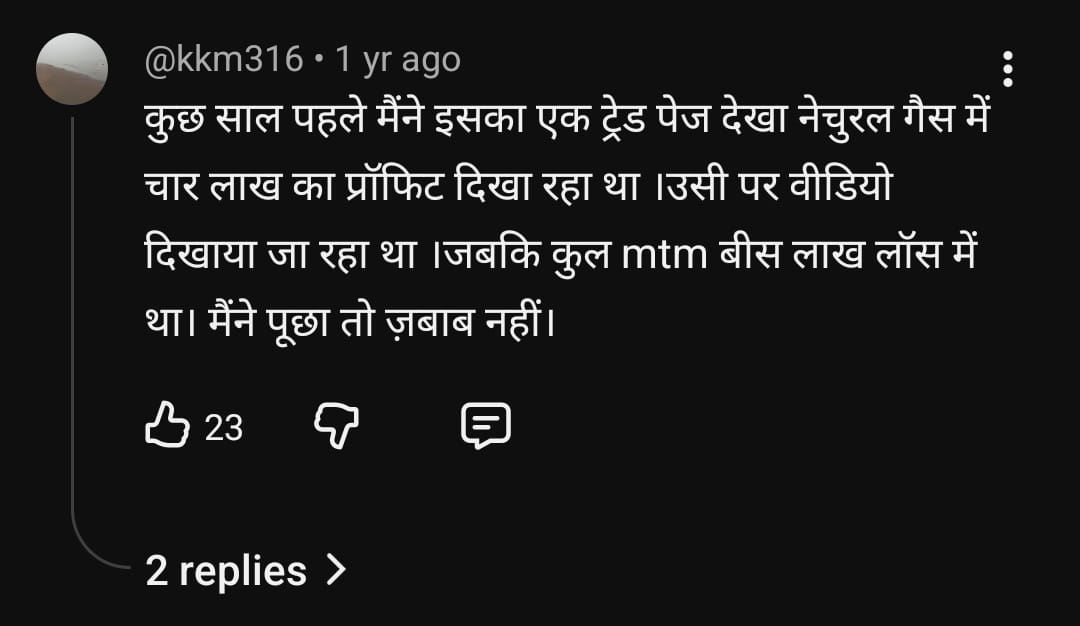

3. Expensive Robot With No Transparency

Evidence: Telegram message shows Intraday bot pricing at 45k. Instructions state: “Portfolio Robot ko test karna hai chhote amount par? Fully autotrade in your ac. 2 din ka live demo. Pahle check kar lo 200-300$”

Notice the pattern? Test with small amounts first. No verified results. No independent audits.

4. Pool Trading Collapse

Evidence: Telegram message reveals: “Pool trading sab khatam hai. Jiska fund ud gaya apna khud se karo. Kuch nahi hai AC zero hai.”

Translation: Pool trading finished. Those whose funds are gone should manage themselves. Account is zero.

This indicates that previous schemes failed. Where did the money go?

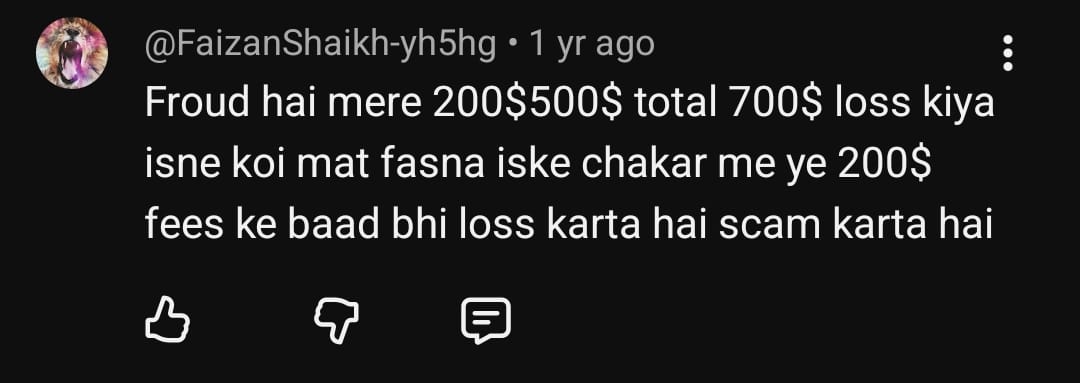

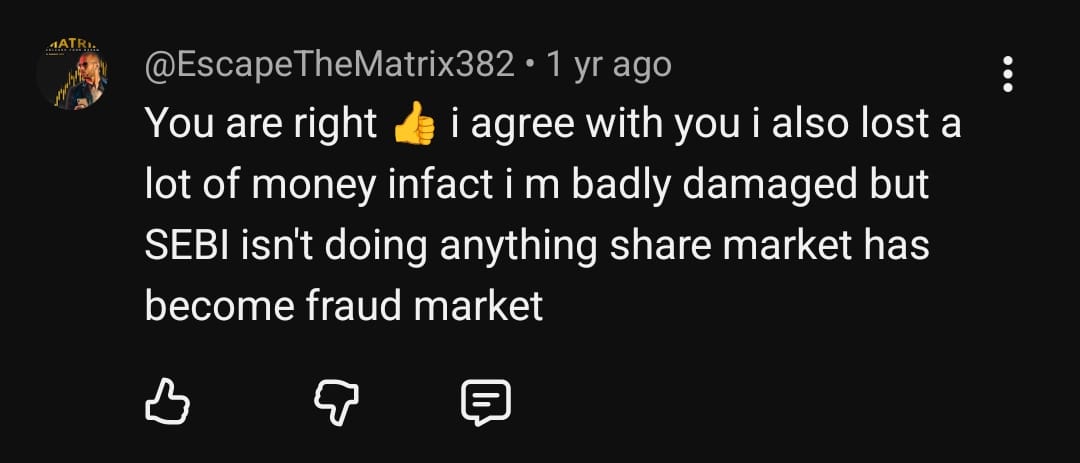

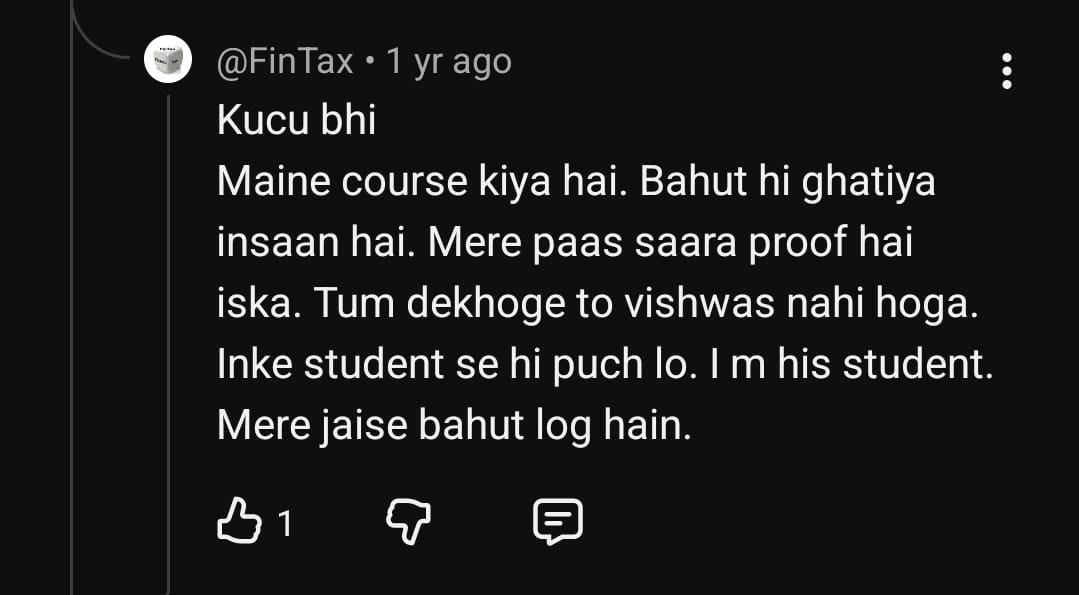

DWG Complaints

Let’s categorize real complaints from verified users. These reviews expose critical problems.

1. High Fees, Higher Losses

The users faced undoubtedly huge losses and even his own students have negative reviews towards him.

2. No Profits, Copied Losing Trades

Problem: System generates identical losing trades across multiple accounts.

User Review: “Hundreds of the same losing trades were copied from his system. It’s a typical scam. WARNING: Do not believe this man. He is NOT a successful trader.”

What This Reveals: The “advanced algorithm” is generating losses, not profits. Also, that he is himself not a successful trader.

3. Automated Scam Messages

Problem: Copy-paste responses with unrealistic profit promises.

User Review: Trustpilot review about “Manish Bhardwaj”: “They kept sending scripted, copy-paste messages promising ‘100% profit’, ‘$100,000 monthly’, and ‘$5,000 in your first month.’

These are unrealistic claims that no legitimate trader would make. They also said I’d have to pay them 10% of my earnings every month.”

What This Reveals: Classic affiliate commission scam. Not genuine trading education.

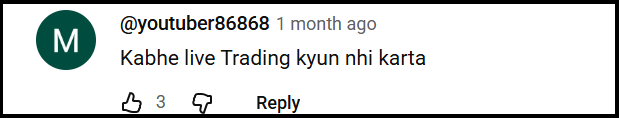

4. No Live Trading Proof

Problem: Never demonstrates live trading despite bold claims.

What This Reveals: If the robot works so perfectly, why avoid live demonstrations? Legitimate traders regularly show live trades.

How to Report DWG Algo?

Already invested? Facing issues? Here’s how to file complaints.

- Register with details of transactions

- Upload evidence (screenshots, payment proof)

Report in NSE Investor Grievance

- Mention the NSE warning document

- Provide complete transaction history

- File FIR for online fraud

- Attach all communication records

Need Help?

Have you already paid for DWG Algo courses? Bought their robot? Facing withdrawal issues or losses?

Don’t suffer in silence.

Register with us your complaints. We assist victims of trading scams through the legal complaint process. Our network connects you with:

- SEBI complaint specialists

- Cybercrime investigation support

- Recovery procedure guidance

Take action today. The longer you wait, the harder recovery becomes.

Conclusion

DWG Algo presents itself as a revolutionary trading system. The reality is starkly different.

According to NSE’s official warning, they operate illegally. They lack SEBI registration. They promote prohibited activities.

Their operator allegedly fled to Dubai after regulatory scrutiny. They attack critics but avoid transparency. They never demonstrate live trading despite bold profit claims.

The evidence overwhelmingly suggests this is an unregulated operation. One that poses a significant financial risk to Indian investors.

Bottom Line: Protect your hard-earned money. Stay away from unregistered entities. Only deal with SEBI-approved financial advisors.

If something promises guaranteed returns, it’s not an opportunity, it’s a trap.