Let’s face it, navigating the stock market is tricky, and even registered research firms you trust, like Eqwires, can sometimes let investors down.

Maybe your reports arrived late, recommendations were unclear, or subscription issues caused frustration.

Whatever the problem, knowing how to raise a complaint and get it resolved can save you a lot of time and stress.

In this guide, we’ll break down the entire process in simple steps, so you can handle Eqwires complaints confidently and effectively.

Eqwires Research Analyst

Eqwires operates as a SEBI-registered Research Analyst (Reg. No. INH000007465).

That means they are legally authorised to provide investment research and recommendations to clients.

Sounds reassuring, right?

But here’s the catch: just being registered doesn’t automatically mean all rules are being followed.

Before you rely on any research or pay hefty fees, it’s worth asking: Are they actually following SEBI guidelines?

And more importantly, do you know what those guidelines even are?

Let’s break down the major ones in a simple, easy-to-grasp way:

- Registration & Deposits

Every research analyst must maintain a deposit with a bank, which acts as a kind of financial security:

- Up to 150 clients → ₹1 lakh

- 151–300 clients → ₹2 lakhs

- 301–1,000 clients → ₹5 lakhs

- 1,001+ clients → ₹10 lakhs

This ensures analysts have some financial accountability.

Are you aware if your analyst meets this requirement?

- Fee Limits & Client Consent

You can’t just be charged whatever the analyst wants. SEBI clearly states:

- Maximum fee per year per family: ₹1,51,000 (for individual or HUF clients)

- Fees must be fair and reasonable

- No hidden or breakage fees allowed

- Your consent is mandatory before any fee is charged

If your analyst isn’t transparent about charges, that’s a red flag.

- Investment & Trading Restrictions

Here’s a critical one: your research analyst cannot trade in securities they recommend:

- Within 30 days before publishing a report

- Within 5 days after publishing a report

- They cannot take positions opposite to their recommendations

Now that you know what rules RAs must follow, let’s see where Eqwires allegedly went wrong according to SEBI findings and user complaints.

Eqwires Complaint Analysis

This is designed to prevent conflicts of interest and ensure the advice you get is unbiased.

Complaints against Eqwires Research Analyst, as reflected in SEBI’s adjudication orders and regulatory findings, fall into several clear patterns.

Understanding these categories helps investors identify red flags and evaluate whether a research analyst is functioning within SEBI’s guidelines.

Category 1: Regulatory Misinterpretation & Compliance Gaps

- Unregistered Investment Advisory Activities

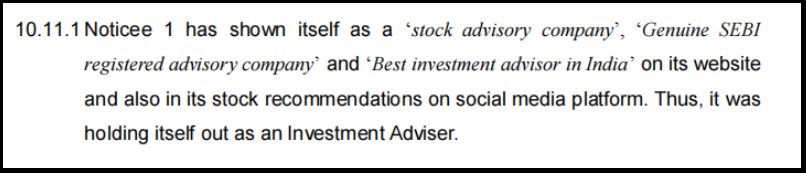

Eqwires allegedly projected itself as a “SEBI-registered advisory company” even though it only held a Research Analyst (RA) registration.

Why this matters: Research Analysts and Investment Advisors operate under very different SEBI guidelines. Misrepresenting licensing status misleads clients about the services they’re legally allowed to offer.

- Unauthorised Use of SEBI Registration Details

Regulatory findings revealed that Eqwires’ Compliance Officer misused another analyst’s SEBI registration number on fraudulent websites

Why this matters: Misusing registration credentials is a serious violation and can be used to mislead investors into trusting unauthorised platforms.

Category 2: Service Delivery Violations

- Unauthorised Access to Client Trading Accounts

Representatives of Eqwires were found to access and operate client trading accounts directly.

Impact:

- Clients lost control over their own investments

- Potential for unauthorised trades

- Risk of excessive churning to generate brokerage fees

- Failure to Provide Proper Research Reports

Instead of delivering detailed research reports, Eqwires allegedly provided only trading tips or calls, without SEBI-mandated supporting documentation.

Impact: This violates RA guidelines and leaves clients without the rationale behind recommendations.

Category 3: Marketing Misconduct & Mis-selling

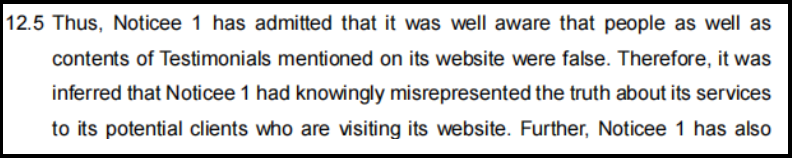

- Fabricated Testimonials and Reviews

SEBI noted that Eqwires published fake client testimonials across its website and social platforms.

Impact: Creates a false sense of credibility and misleads potential clients with fabricated success stories.

- Misleading Performance Claims

The firm made unrealistic claims—such as extremely high accuracy rates and near-guaranteed returns.

Impact:

Investors may form inflated expectations and take larger risks, often leading to losses.

Category 4: Client Treatment & Redressal Issues

- Pressure Tactics to Remove Negative Feedback

There were instances where clients were allegedly pressured to delete negative reviews, even involving family members.

Impact: This suppresses genuine criticism and prevents transparency for future clients.

- Poor Grievance Handling

Complaints and refund requests were reportedly ignored or inadequately addressed.

Impact: Clients were left without proper redressal, escalating dissatisfaction and financial stress.

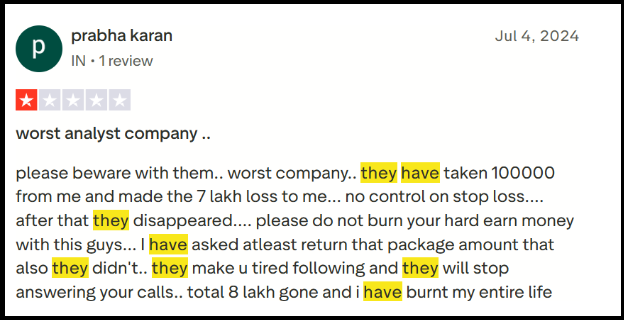

Eqwires Real User Complaints

Based on genuine customer feedback, here are the three main categories of complaints faced by users:

Category 1: Financial Losses and Stop Loss Issues

Clients report significant capital losses due to inadequate risk management and poor stop-loss implementation.

Category 2: Uncertain Relationship Manager

Frequent changes in relationship managers and a lack of professional conduct lead to communication breakdown and service inconsistency.

Category 3: Hold Strategy and Mounting Losses

Relationship managers advise holding losing positions with promises of recovery, resulting in accumulated losses without exit strategies.

User Review: “After 9 months, in JANUARY 2023, I was in a loss of 2.66 Lakh, with 0 Profit. Once the stock goes down, their Relationship Manager will assure you that it will come back, But Losses increase & they don’t work with Stop losses.”

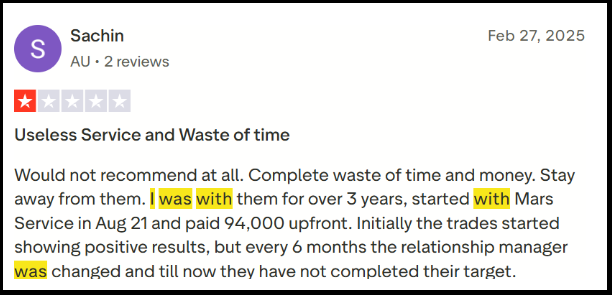

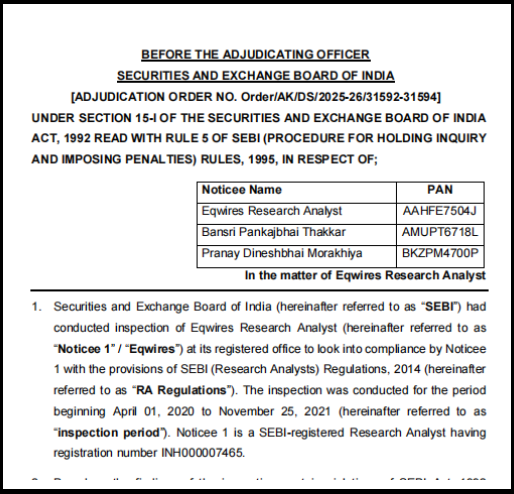

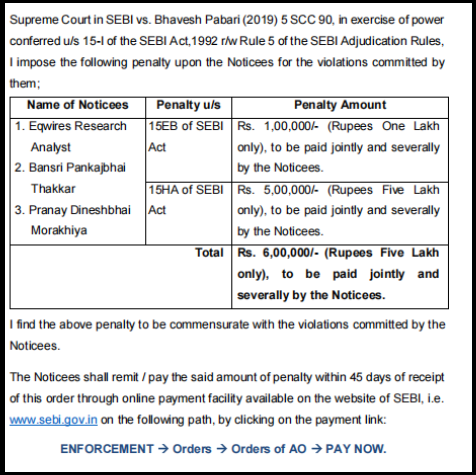

SEBI Order Against Eqwires Research Analyst

- Noticees: Eqwires Research Analyst (Firm), Bansri Pankajbhai Thakkar, Pranay Dineshbhai Morakhiya (Partners)

- Total Penalty: ₹6,00,000 (Rupees Six Lakh Only)

SEBI’s inspection and subsequent inquiry revealed a pattern of misconduct across three critical areas:

1. Illegally Posing as an Investment Adviser (IA)

Eqwires was registered as a Research Analyst (RA), but it systematically presented itself as a SEBI-registered Investment Adviser, which it was not.

- Misleading Claims: Their website and Telegram channel (with over 10,000 subscribers) used taglines like:

- “Best investment advisor in India”

- “Genuine SEBI-registered advisory company”

- “Most successful stock advisors in India”

- Client Payments: Bank statements showed clients making payments with narrations like “Advisory Service” and “Fee for Market Tips,” indicating they were sold services as an adviser.

- The Firm’s Defense (Rejected): Eqwires argued it was a “thin line” between RA and IA, and they only gave generic “buy/sell/hold” calls without personalised risk profiling.

Why This Matters: Acting as an Investment Advisor without the proper license is illegal.

IAs must follow stricter rules like checking a client’s risk level and making sure the advice is suitable.

By skipping these mandatory safeguards, EQWires put clients at risk and exposed them to advice that may not have been appropriate for them.

2. Unauthorised Handling of Client Trading Accounts

In a shocking breach of trust and rules, Eqwires directly operated a client’s trading account.

- The Scheme: A client complained that after she said she had no time to trade, Eqwires offered an “Add-on Service.”

They had her sign an authorisation letter and share her login ID and password, allowing them to execute trades in her account for nine months. - Blatant Violation: A Research Analyst’s role is strictly to provide research reports or recommendations. Handling client funds or executing trades is strictly prohibited.

- Silencing Criticism: The order also details how Eqwires pressured this client to get a negative online review (posted by her sister) removed, indirectly discouraging honest feedback.

Why This Matters: This is a severe breach of fiduciary duty. When an analyst controls your trading account, they can churn your portfolio (generate excessive transactions for commissions) or take undue risks with your capital.

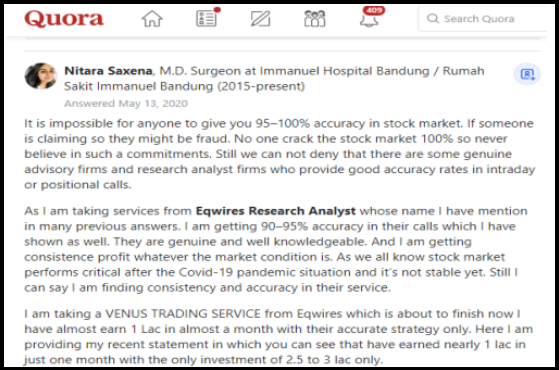

3. Fabricating Fake Testimonials & Reviews

To build a false image of success and credibility, Eqwires engaged in systematic deception.

- Fake Website Testimonials: Their website featured glowing reviews from supposedly happy clients like “Prasad Kumar.” During inspection, Eqwires admitted these were completely bogus; the people were not real clients.

Paid, Deceptive Social Media Campaigns: On platforms like Quora, fake user profiles (e.g., “Nitara Saxena, M.D. Surgeon”) claimed to earn massive profits (e.g., ₹1 lakh in a month) using Eqwires’ services. The firm confessed these were created by paid marketing agents.

- The Firm’s Defense (Rejected): They claimed a marketing agency was responsible and that SEBI’s rules against misleading testimonials came later. SEBI dismissed this, stating that honesty and good faith are fundamental obligations from day one.

Why This Matters: Fake reviews manipulate investor psychology. They create an illusion of reliability and high returns, luring inexperienced investors into paying for services.

SEBI’s Final Ruling and Imposed Penalties

The Adjudicating Officer, Mr. Amit Kapoor, found Eqwires and its partners guilty on all counts.

- Partners Held Liable: The partners, Bansri Thakkar and Mr. Pranay Morakhiya, were held equally liable under Section 27 of the SEBI Act, which makes key personnel responsible for a firm’s contraventions.

- Total Penalty: ₹6,00,000 (Rupees Six Lakh Only)

- ₹1,00,000 under Section 15EB (for RA/IA violations)

- ₹5,00,000 under Section 15HA (for fraudulent/unfair trade practices)

While the first SEBI order highlights issues within Eqwires as a firm, the second order is even more alarming because it involves misconduct by the person responsible for ensuring compliance, the Compliance Officer himself

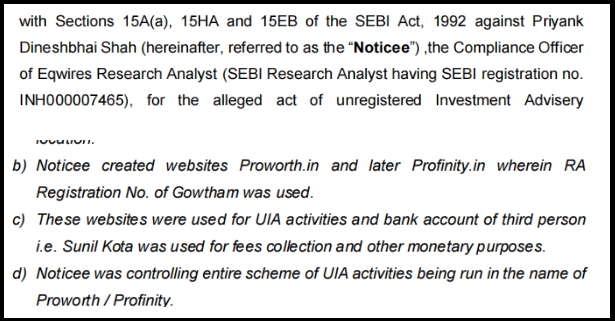

SEBI Order Against Eqwires Compliance Officer

The Securities and Exchange Board of India (SEBI) has issued a serious order. The order is against Mr. Priyank Dineshbhai Shah. He was the Compliance Officer of Eqwires Research Analyst.

This action reveals major compliance failures within the Eqwires organisation.

The Core Issue

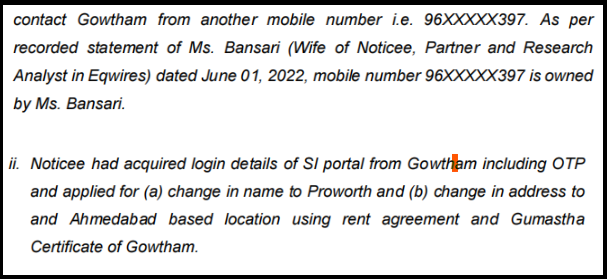

Priyank Shah, while employed as Equires’ Compliance Officer, ran a separate fraudulent scheme. He operated unregistered investment advisory websites named ‘Proworth’ and ‘Profinity’.

He misused the SEBI registration number of another individual. He collected fees from investors illegally. This was done from the same operational location as Eqwires.

Key Links to Eqwires

The connection to Eqwires Research Analyst is direct and concerning.

- Insider Position: The mastermind was Eqwires’ own Compliance Officer. His role was to ensure the firm followed SEBI’s rules. Instead, he violated them severely in a separate venture.

- Family Ties: Shah’s wife, Ms. Bansri Thakkar, was a Partner and Research Analyst at Eqwires. Her phone number was also used in the fraudulent scheme.

- Shared Address: The fraudulent operation was run from the same Ahmedabad address as Eqwires’ registered office.

- Misuse of Network: Shah used his position to recruit another SEBI-registered Research Analyst (Mr. Gowtham) into the scheme. He did this under the pretext of a job opportunity.

Impact on Eqwires Research Analyst

This order has significant implications for Eqwires itself.

- Reputational Damage: The firm’s name is now associated with a major fraud committed by its senior employee.

- Governance Failure: It exposes a severe lack of internal controls. The Compliance Officer himself was running an illegal operation.

- Regulatory Scrutiny: SEBI will likely increase its scrutiny of Eqwires’ other operations. The firm’s overall compliance culture is now in question.

- Client Trust: Investors who trusted Eqwires may now doubt the firm’s integrity. They may worry about similar misconduct within the main firm.

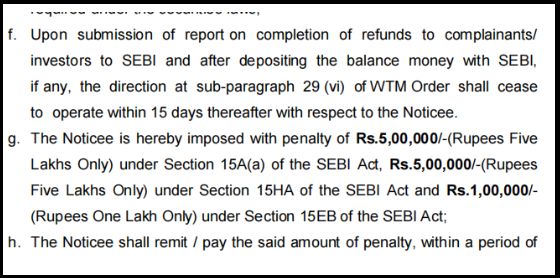

SEBI’s Actions Against Priyank Shah

SEBI has imposed strong penalties on Priyank Shah for his actions.

- Financial Penalty: He must pay a total penalty of ₹11,00,000 (Eleven Lakh Rupees).

- Market Ban: He is debarred from the securities market for 2 years.

- Refund Order: He is jointly liable to refund ₹8,47,000 collected from investors.

- Restrictions: He cannot associate with any listed company or SEBI intermediary during the ban.

This order is not just about an individual fraudster. The actions of its Compliance Officer have brought disrepute to Eqwires Research Analyst.

The case highlights that SEBI will hold individuals accountable. Eqwires must now demonstrate robust corrective actions.

How to File a Complaint Against Research Analyst?

If you face issues with Eqwires or any research analyst, here’s what you can do:

Step 1: Register With Us: Reach out to us with your complaint details. Share information about your issue with the research analyst. We will document everything properly.

Step 2: Case Manager Consultation: We arrange a call with our dedicated case manager. They understand your specific situation. They evaluate your complaint’s merits. They explain the complete resolution process to you.

Step 3: Complaint Drafting: Our team helps you draft a clear, comprehensive complaint. We include all necessary details and documentation.

Step 4: Reaching Out to the Research Analyst: We help you communicate effectively with the research analyst. We facilitate proper dialogue.

Step 5: File a SEBI SCORES Complaint: We guide you through the SCORES filing process. We ensure all information is accurate. We help with proper documentation and submission.

Step 6: SMART ODR Support: If the complaint isn’t resolved through SCORES, we assist with SMART ODR:

- Help register on the ODR platform

- Prepare all necessary documentation

- Support you during the conciliation process

- Represent your interests effectively

Step 7: Arbitration Guidance: If arbitration becomes necessary, we guide you through the entire process:

- Prepare arbitration applications properly

- Compile all evidence and documentation

We stay with you throughout the journey. From initial complaint registration to final resolution, you get expert support at every stage.

Conclusion

Dealing with research analyst complaints requires a proper understanding of procedures. SEBI provides multiple resolution avenues for investors. Start with direct communication. Move to SCORES if needed. Then SMART ODR. Finally, arbitration is a last resort.

However, navigating these procedures alone is challenging. Professional assistance ensures proper documentation and effective resolution. Whether drafting complaints, handling conciliation, or guiding through arbitration, expert support makes the difference between dismissed complaints and favourable outcomes.

Your investor rights are protected by law. SEBI’s regulatory framework ensures fair treatment. Don’t hesitate to use these mechanisms when facing genuine grievances.