In a market where new trading platforms appear almost daily, the real challenge isn’t finding a forex broker; it’s finding one you can actually trust.

So let’s pause for a moment and ask the questions every forex trader should be asking in 2026: Is this broker safe? Is it reliable? And does it really deliver on the promises it makes?

One name that keeps showing up in these conversations is FP Markets, also known as First Prudential Markets.

Think of this guide as a conversation, not a sales pitch. If you’re an experienced forex trader, you’ll want to know whether FP Markets truly has the technology to keep up with your strategies, from scalping to high-frequency execution.

If you’re just starting, especially as an Indian trader trying to understand global platforms through a local regulatory lens, you’re probably wondering whether trading with FP Markets is legal, secure, and beginner-friendly.

That’s exactly what we’re here to explore. We’ll walk through how FP Markets operates behind the scenes, how it protects traders’ funds, and whether its global reputation is built on real substance, or just smart marketing.

By the end of this blog, you won’t just know what FP Markets claims to be; you’ll understand whether it genuinely deserves its place among the top forex brokers.

First Prudential Markets Login

What began as a local firm has, over more than two decades, evolved into a global benchmark for ECN trading, known for speed, transparency, and professional-grade infrastructure.

When it comes to financial transactions, everything begins with one crucial moment: the login. It’s natural for traders to pause and ask, “Is the FP Markets login actually safe?”

And honestly, that’s the right question to ask.

What began as a local firm has, over more than two decades, evolved into a global benchmark for ECN trading, known for speed, transparency, and professional-grade infrastructure.

FP Markets has built its platform with security at the core.

Behind that simple login screen is a multi-layered security system powered by advanced encryption protocols, designed to keep your credentials and personal data locked away from prying eyes.

Every time you sign in, those safeguards are quietly doing their job to protect you.

Then there’s the FP Markets cTrader app, which takes convenience a step further. This isn’t just a stripped-down mobile version of the website. Think of it as a full-fledged trading command center in your pocket.

From tracking over 10,000 instruments to managing funds and placing trades with a single tap, the app is built for traders who want speed without compromising control.

That said, even the strongest security systems work best when users stay alert. Before entering your login details, always double-check the app or website. Confirm you’re on the official platform, and avoid rushing through the process.

A few extra seconds of caution can make all the difference in keeping your trading account safe.

Is FP Markets Legal in India?

Forex and CFD rules in India can feel like a maze, so it’s natural to pause and ask: “Can I legally trade with FP Markets from India?” Let’s walk through it in a simple, reader-friendly way.

First, the SEBI angle. FP Markets is a global broker, not an Indian one.

That means it does not hold a licence from the Securities and Exchange Board of India (SEBI). This often raises eyebrows, but it doesn’t automatically make the broker illegal for Indian traders. It simply means FP Markets isn’t regulated locally.

Now comes the part that really matters: FEMA and RBI rules. Under India’s Foreign Exchange Management Act (FEMA), residents are allowed to send money overseas for legitimate purposes using the Liberalised Remittance Scheme (LRS).

Trading with offshore brokers falls within this framework, as long as you follow LRS limits and comply with Indian tax laws. In plain terms, Indian residents are permitted to trade with international brokers.

So what’s the final takeaway?

Yes, Indian citizens can legally open and operate an account with FP Markets.

The key thing to understand is that you’re trading under FP Markets’ international regulatory umbrella, such as ASIC (Australia) or the FSA (Seychelles), and not under SEBI’s jurisdiction.

This means Indian investor protections don’t apply, and any disputes are handled under foreign regulations.

Is FP Markets Safe?

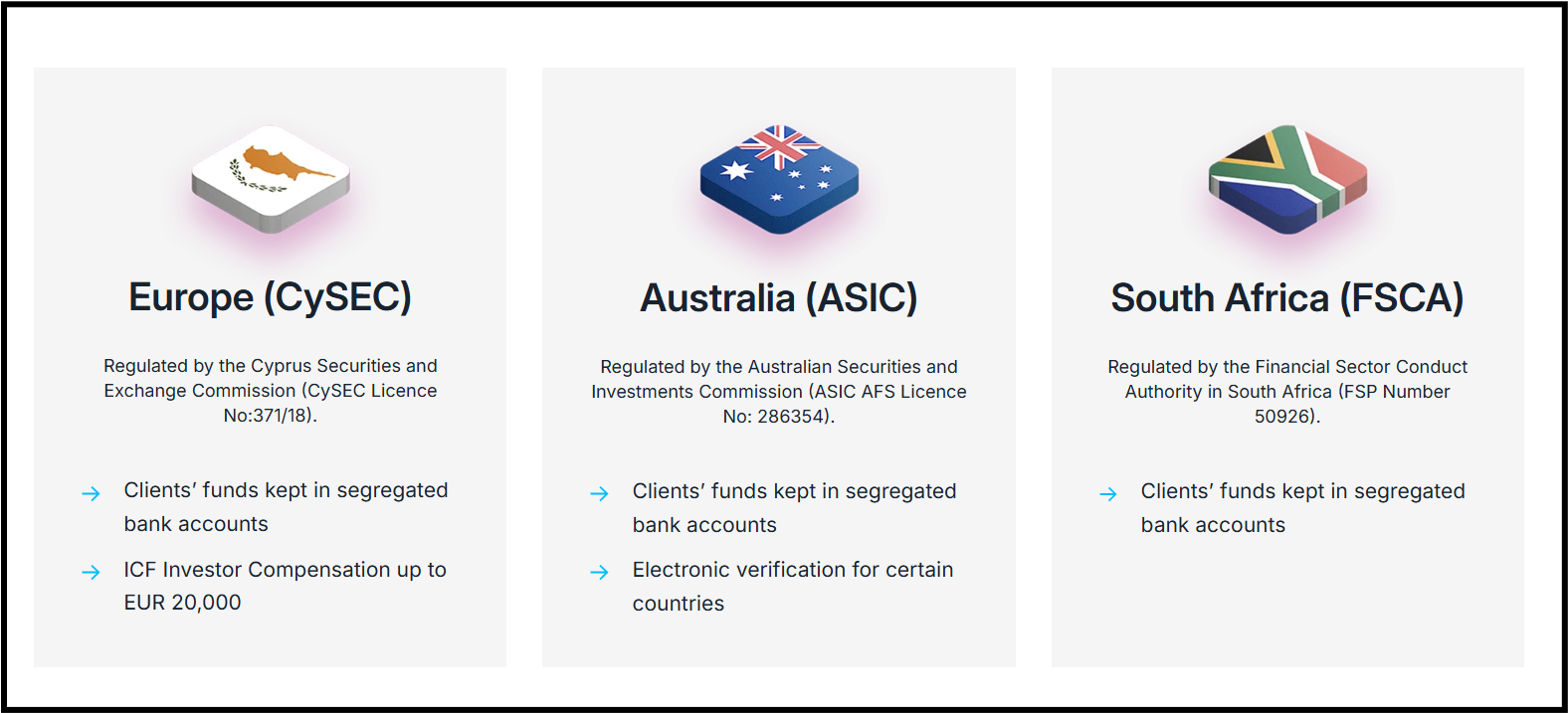

FP Markets is multi-regulated, which is a key indicator of legitimacy and oversight.

Tier-1 regulator (AFS Licence No. 286354). This is widely regarded as among the strictest global regulatory frameworks. Tier-1 (Licence No. 371/18), providing access to EU markets under MiFID rules.

Additionally, FP Markets operates under several other regional licences (e.g., Seychelles, Mauritius, St Vincent & the Grenadines), though these vary in strength and are considered less stringent than ASIC/CySEC.

Being regulated by ASIC and CySEC means FP Markets is subject to independent audits, capital adequacy requirements, and investor-protection rules, all key to safety.

FP Markets is generally regarded as a safe and legitimate broker, especially because of its regulation by ASIC and CySEC, segregation of client funds, and established 20+-year operating history.

But safety isn’t just about regulation; it also depends on your own due diligence. Checking the entity you join, understanding the protections that apply to you, and trading responsibly.

FP Markets Withdrawal Problems

Scroll through online trading forums, and you’ll almost always find someone claiming they’re “stuck” with a withdrawal. It sounds alarming until you look a little closer.

In the case of FP Markets, user experiences and official support documentation tell a far more balanced story. The broker is regulated, withdrawals are real, and payouts do happen consistently.

So why do complaints exist at all?

In most cases, it’s not because FP Markets refuses to pay. The friction usually comes from everyday, fixable issues. Incomplete KYC documents are one of the biggest culprits.

If your verification isn’t fully approved, withdrawals can’t move forward.

Another common trigger is attempting to withdraw funds while holding large open positions, which naturally restricts available balance until exposure is reduced.

In short, while “withdrawal problem” posts may dominate comment sections, they rarely point to bad faith.

With proper verification, closed or manageable positions, and a bit of patience for banking channels, FP Markets withdrawals tend to be far smoother than the internet noise suggests.

How to Report Forex Trading Scams?

If you encounter a technical glitch or a suspicious discrepancy in your account, follow these steps to report it immediately for forex trading scam recovery:

- File a complaint in Cyber Crime.

- Write the details, such as the app name, date, and any valid screenshots, in addition to providing the whole situation in a written format.

- If you made a payment through any wallet or bank, inform your bank to block suspicious transactions.

Need help?

If you have previously fallen victim to a “clone” website pretending to be FP Markets, or if you are facing unexplained issues with fund recovery from an unregulated platform, we can help.

Our team specializes in navigating the complexities of broker disputes and reporting fraudulent entities to the proper authorities. Register with us.

Conclusion

FP Markets stands out as a robust, transparent, and highly regulated broker.

While the Indian regulatory landscape requires traders to be mindful of FEMA guidelines, the platform itself offers a secure environment, professional-grade tools, and a reliable mobile app for those on the move.

Whether you are scalping the $EUR/USD$ or investing in long-term CFDs, the combination of ASIC oversight and segregated funding provides a level of peace of mind that few competitors can match.