Looking for a reliable investment platform? Recently, the Future Life app has been popping up everywhere, promising high returns, easy earnings, and quick withdrawals.

But behind the glossy ads and tempting offers, a serious question emerges: Is this app genuinely profitable, or is it another trap waiting to swallow your money?

Let’s uncover the truth.

Future Life App Review

With a name like Future Life, the app seems to promise a pathway toward stability, growth, and a brighter financial future.

But is that so?

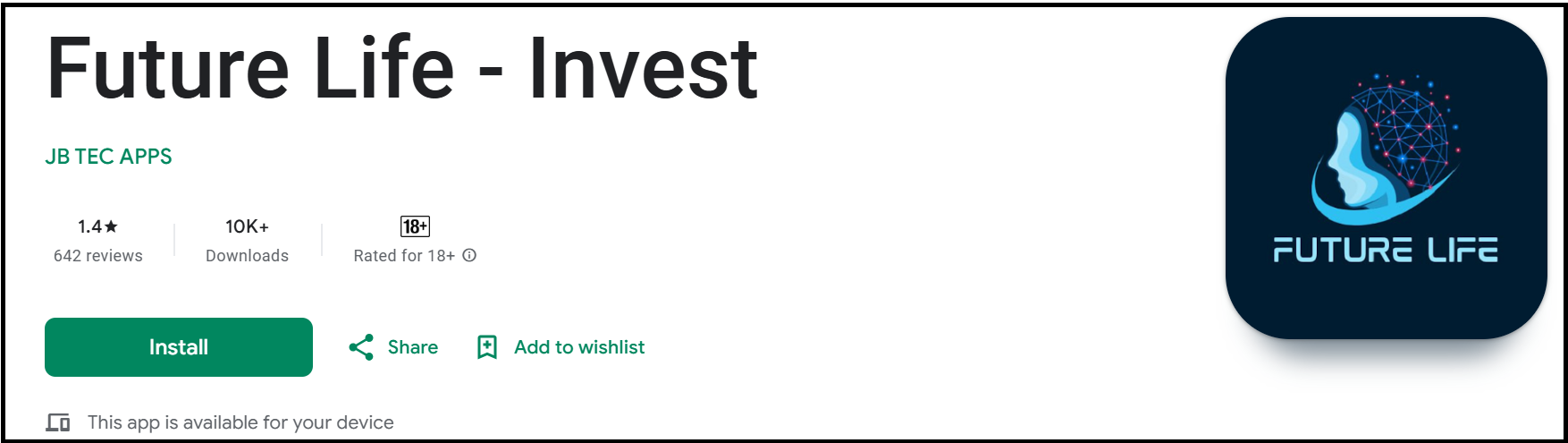

Looking at the data of the Google Play Store, the app has crossed 10,000+ downloads on Google Play.

But the rating it is something that one can’t ignore.

There are around 640 user reviews that gave a rating of 1.4 stars

That’s alarmingly low, right?

Apart from this, the app claims to be part of a company called Future Life Better Technology Ltd., which it says was established in 2019 and is supposedly based in the United States.

According to the app’s own description, the company positions itself as an innovator in AI, cloud computing, big data, and computing-power technology.

In simple terms, the app portrays itself as a platform where users can “participate” in this technology ecosystem, mainly through investment-style plans that promise benefits tied to computing power or tech growth.

In short, the app description and user reports, here’s how it works:

- Investment Plans – Users deposit money for promised high returns

- Referral System – Earnings through inviting new users

- Daily Tasks – Complete activities to unlock withdrawal eligibility

- Minimum Investment – Starts from ₹500 to ₹1,000

Sounds simple?

That’s exactly how traps work.

Is Future Life App Safe?

The 1.4-star rating tells a brutal story.

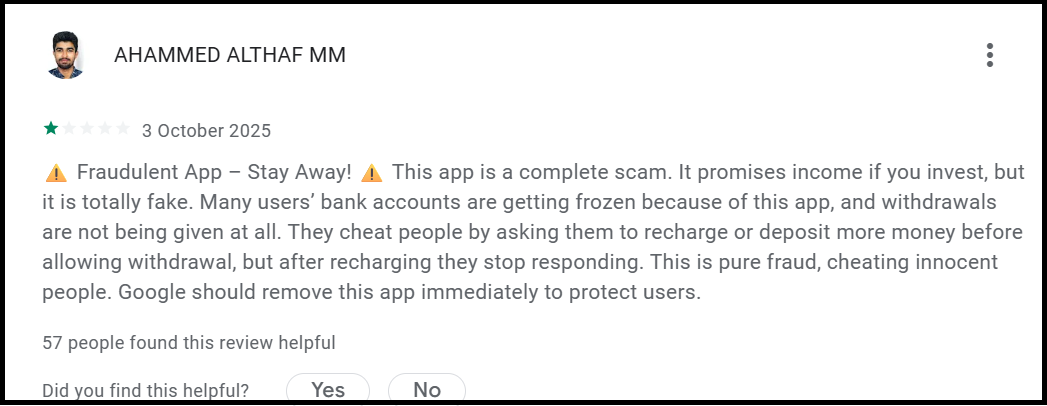

Google Play reviews appear to follow several recurring patterns reported by users (e.g., withdrawal issues, account freezing, referral complaints).

Easy money? In this economy? If Future Life’s ads have you curious, hold on.

Let’s first see whether this app is a smart opportunity or just another flashy promise with some user reviews.

1. Withdrawal Issues (Most Common)

“Cannot withdraw money. Customer support doesn’t respond.” – Arjun M.

This indicates a recurring withdrawal problem. Many investment scams follow this pattern. They allow deposits but block withdrawals systematically.

2. Money Loss Reports

“Lost ₹15,000. App stopped working suddenly.” – Priya S.

“Invested ₹8,000. Account suspended without reason.” – Vikram D.

Some user reviews report app crashes and difficulty accessing funds.

These issues raise concerns but do not independently confirm fraudulent activity.

3. Fake Promises

“Fake promises of high returns. Don’t install.” – Rohit K.

“Showed 40% monthly returns. All lies.” – Meera T.

Another user, Ahammed, claimed that the app is completely fraudulent.

4. Referral Scam Complaints

“Forced to add 10 people. Still no withdrawal.” – Amit P.

“Pyramid scheme in disguise.” – Kavita J.

Referral-based incentives are commonly seen in many high-risk or MLM-style schemes, but their presence alone does not confirm an MLM or scam structure.

In short, the app gives several warning signs:

- No License – Not registered with SEBI or RBI

- Poor Rating – 1.4 stars from 642 reviews

- Withdrawal Issues – Multiple users report blocked funds

- No Company Details – Zero credible information about JB TEC APPS

- Unrealistic Returns – Promises that seem too good to be true

- Forced Referrals – Withdrawal depends on adding new users

Is Future Life a Ponzi Scheme?

Based on user complaints, the app displays some warning signs often associated with high-risk or fraudulent schemes, but there is no official confirmation that it is a Ponzi scheme.

The app lacks:

- Company incorporation details

- Transparent business model

Moreover, according to cybercrime reports, similar apps have vanished overnight. Users lose everything without trace.

How to Report Investment Scams?

Facing issues with the Future Life app or any similar scam platform? Don’t wait—take action immediately. Here’s what you should do:

1. Document Everything

Keep all evidence safe:

- Screenshots of the app

- Transaction history

- Chat messages

- Notifications

- Payment IDs

These will be crucial for cybercrime investigation.

2. File a Cyber Crime Complaint

Go to the National Cybercrime Portal (cybercrime.gov.in) and submit a complaint under “Financial Fraud.”

Upload screenshots, payment proofs, chats, and app details.

3. Report to the Consumer Forum

If you lost money or were misled, you can file a complaint with your District Consumer Disputes Redressal Commission.

4. RBI Ombudsman (Only for Regulated Entities)

If the fraud involves a bank transaction, digital wallet, or payment gateway, file a complaint through the RBI Ombudsman Scheme.

5. Report the App on the Google Play Store

Open the app page and scroll to “Flag as inappropriate”. Now choose Fraud or Scam.

This helps get the app reviewed, restricted, or removed.

Need Help?

Lost money to the Future Life app?

You’re not alone. Register with us for guidance on recovery options. We connect victims with proper legal channels and consumer protection resources.

Don’t suffer in silence.

Conclusion

The Future Life app shows multiple red flags, such as poor reviews, withdrawal complaints, unclear company details, and a lack of regulatory licensing.

There is no publicly available evidence showing that JB TEC APPS holds any investment-related authorisation in India.

The app’s features resemble patterns seen in high-risk investment apps, but no official authority has confirmed that it uses Ponzi mechanisms.

User testimonials consistently report financial losses.

Your hard-earned money deserves better protection. Always verify regulatory licenses before investing. If something promises unrealistic returns, it’s probably a trap.

Stay safe, stay informed.