Choosing a trading platform isn’t just another checkbox on a trader’s to-do list.

It’s a decision that can shape your entire trading journey. With dozens of brokers competing for attention in 2026, the real challenge isn’t finding options, but finding the right one. That’s where the conversation often turns to GO Markets.

But is GO Markets just another name in the crowd, or does it genuinely deliver on performance, security, and trust?

Whether you’re a seasoned scalper chasing ultra-tight spreads or a curious beginner stepping into the world of CFDs for the first time, this guide is built with you in mind.

We’ll walk through GO Markets the way a trader actually experiences it, from the first login and platform usability to safety standards, regulatory clarity in India, and what real users are saying after putting their money on the line.

No marketing fluff. No technical overload. Just a clear, engaging, and honest deep dive to help you decide whether GO Markets deserves a place in your trading arsenal.

GO Markets Login

That simple “Login” click isn’t just a gateway to a trading platform. It’s the doorway to your hard-earned capital. That’s why asking “Is the GO Markets login actually safe?” isn’t paranoia; it’s smart trading.

On the credibility front, GO Markets checks some important boxes. The broker is regulated by heavyweight authorities like the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), along with other international regulators.

Add to that institutional-grade security systems, and on paper, your data and funds are well protected.

But here’s where traders need to stay alert. Safety doesn’t end with regulation. It also depends on how and where you log in.

Scammers are getting increasingly clever, often creating look-alike websites with almost identical URLs, such as go-market-login.net, designed purely to steal your credentials.

One wrong click, and you could hand over access to your account without even realizing it.

There’s also the mobile angle to consider.

GO Markets does have an app listed on the Google Play Store, but the lack of reviews and detailed information should immediately raise your antenna.

An empty review section isn’t proof of fraud, but it is a reminder to slow down. Before downloading or logging in, take a moment to verify the app’s authenticity, developer details, and official links from the broker’s website.

In trading, profits come from strategy.

But survival comes from caution. Double-check the domain, verify the app, and never rush a login. Because in the digital trading world, one careless click can be far more expensive than a bad trade.

Is GO Markets Legal In India?

GO Markets does accept clients from India, and on paper, it’s a well-regulated international broker with a strong reputation for safety. Sounds reassuring, right? But here’s where the story takes an interesting turn.

Forex trading in India isn’t a free-for-all.

It operates under tight rules laid down by the RBI and SEBI, and those rules clearly say one thing: Indian residents can legally trade forex only on Indian exchanges like NSE and BSE, and only in currency pairs that include the Indian Rupee. Think USD/INR, EUR/INR, or GBP/INR.

So what happens if you trade with GO Markets from India?

You’re stepping outside the Indian regulatory umbrella. Your trading activity is governed by international regulations, not Indian law. That also means if something goes wrong, SEBI won’t be there to step in or protect you. You’re essentially relying on the broker’s overseas regulators and internal safeguards.

In short, GO Markets may be globally credible, but for Indian residents, trading there is more about informed risk than clear-cut legality. Knowing the rules before you place that first trade can make all the difference.

Is GO Markets Safe?

In the world of Forex and CFDs, the word “safe” doesn’t mean much unless you ask one simple question: who’s keeping an eye on the broker?

That’s where GO Markets stands apart.

This isn’t a fly-by-night operation or a name that appeared overnight. GO Markets operates under the watchful eyes of multiple global regulators, each adding a layer of credibility and protection.

At the top of the list is ASIC in Australia, widely considered one of the world’s toughest financial watchdogs. Brokers regulated by ASIC don’t get free passes.

They’re held to strict capital, compliance, and reporting standards.

If any “account manager” claiming to be from GO Markets promises you guaranteed profits, hang up. No legitimate broker guarantees returns in the volatile CFD market.

GO Markets Complaints

No broker is flawless, and that’s the truth. So instead of sugar-coating things, let’s break it down the way real traders experience it, combining user feedback with hands-on technical testing.

In some regions, especially under regulators like CySEC, traders may notice fees creeping in if an account sits inactive for too long. It’s one of those fine-print details people often discover only after the fact.

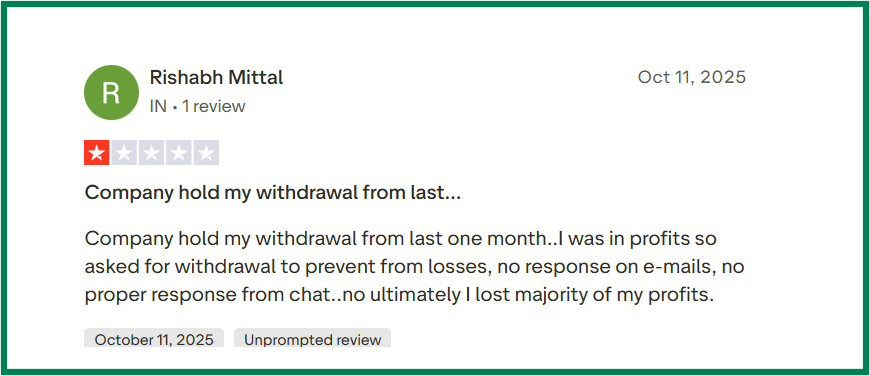

Dig a little deeper into Trustpilot reviews and trading forums, and a pattern starts to emerge.

While many users are satisfied, a handful of recurring complaints keep popping up, small friction points that, over time, shape how traders truly feel about the platform.

This doesn’t make the broker “bad,” but it does make one thing clear: knowing these realities upfront puts you in control, not the marketing promises.

A user reported that a withdrawal request for profits was held for over a month, resulting in the loss of most gains due to market changes, coupled with poor customer service.

This review is consistent with other varied customer experiences where some clients report slow withdrawals or poor chat support with GO Markets, while others have positive experiences with different aspects of the service.

The company’s withdrawal process seems to be an area that requires improvement for customer satisfaction.

How to File Forex Trading Complaints in India?

If you believe you have been contacted by a scammer pretending to represent GO Markets, or if you encounter a fraudulent website, follow these steps:

- Keep screenshots of chats, transaction IDs, and email headers.

- Use the official “Live Chat” on their website.

- Contact your bank and ask to stop any payment towards that ID

- File a complaint with SEBI

- Lodge a complaint at your local Police station.

- File a complaint in cyber crime.

Need Help?

Navigating the world of offshore brokers and regulatory compliance can be overwhelming.

Our team of experts will help you in forex trading scam recovery if any fraud happens to you.

Conclusion

GO Markets isn’t just another name in the trading world; it’s built for traders who care about what really matters.

Lightning-fast execution, razor-thin costs, and the comfort of Tier-1 regulation.

This is a broker that has been around long enough to earn trust the hard way, by consistently delivering a professional trading experience.

That said, if you’re an Indian resident, there’s an important caveat. Trading with GO Markets falls into a “proceed with caution” zone when it comes to local FEMA regulations.

The platform itself is legitimate and globally respected, but the responsibility of regulatory compliance ultimately rests with the trader.

If you’re the kind of trader who values deep liquidity, institutional-grade infrastructure, and performance over flashy deposit bonuses or marketing gimmicks, GO Markets checks all the right boxes. It’s not trying to dazzle you.

It’s trying to execute your trades efficiently. And for serious traders, that’s exactly what makes it a top-tier contender.