Choosing a forex broker isn’t like picking an app; it’s more like choosing a business partner. When markets turn wild, and emotions run high, you need to know one thing: will your broker stand with you, or vanish when your money is on the line?

If you’ve landed here, chances are you’re already uneasy and searching for GO Markets Review Complaints. Maybe you’re wondering whether your hard-earned money is actually safe. Maybe you’ve seen unsettling posts about delayed or blocked withdrawals.

GO Markets, a well-known name that’s been around since 2006, often gets the “veteran broker” tag. But as experienced traders know, survival alone doesn’t guarantee trustworthiness today.

This is where we slow things down and look beyond the marketing. In this in-depth GO Markets review, we lift the veil and examine what really matters.

We’ll dive into the concerns raised by real users, unpack the regulatory and legal angle, especially from an Indian perspective.

GO Market User Complaints

Let’s Talk About the Grey Zone. Is Go Market Legal in India?

Here’s the reality. The Reserve Bank of India (RBI) takes forex regulations very seriously. Under the Foreign Exchange Management Act (FEMA), Indian residents are allowed to trade only those currency pairs that involve the Indian Rupee and are offered on SEBI-authorised exchanges.

The moment you trade non-INR forex pairs through an offshore broker, you’re technically crossing a legal line.

Now, where does GO Markets fit into this picture? While GO Markets is a well-known global broker, it is not regulated by SEBI.

While many traders are drawn to the platform for its competitive spreads and familiar MT4/MT5 integration, a more troubling narrative is beginning to surface. A growing surge of “GO Markets review complaints” suggests that the user experience isn’t always as seamless as advertised.

Beyond the initial GO Markets login, some users report finding themselves trapped in a maze of unresolved grievances and silent support channels. So, what is actually happening behind the scenes?

Let’s zoom in on one of the most frequently cited issues.

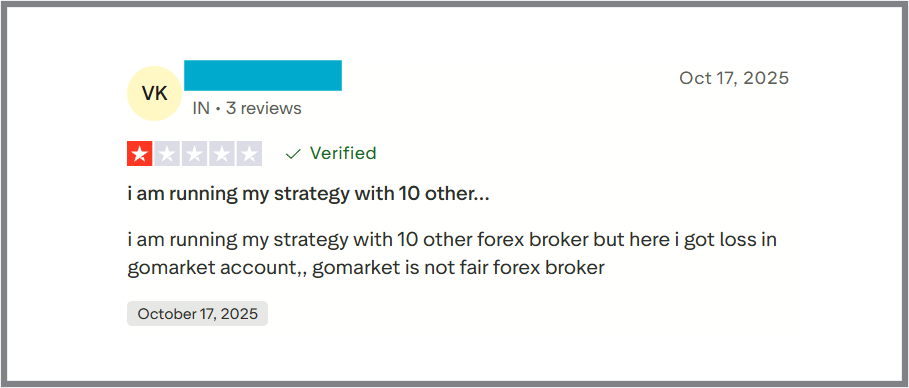

One trader mentioned that GO Markets is not a fair forex broker. That’s a strong accusation, and it naturally raises eyebrows.

When a trading strategy performs consistently across multiple brokers but breaks down with just one, it’s rarely a coincidence. Traders immediately start asking uncomfortable questions. Are the prices the same as the broader market?

Are stop-loss levels being hit too easily? Is slippage quietly eroding profits trade by trade?

If GO Markets consistently executes trades at worse prices compared to other brokers, the damage compounds over time, leaving traders wondering where their edge disappeared.

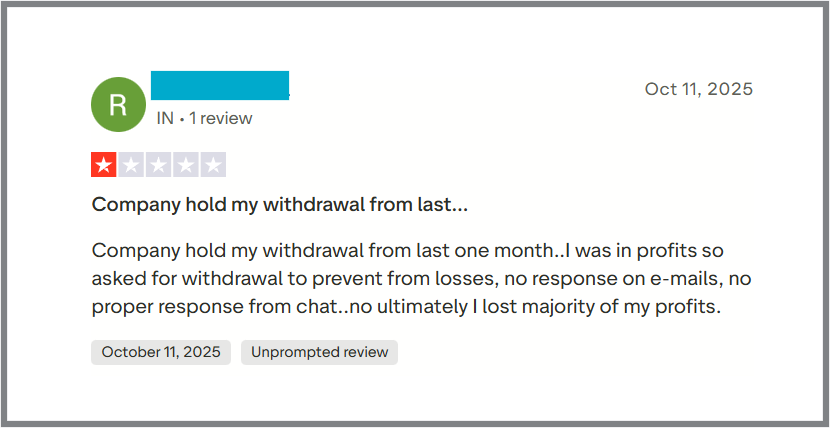

Then comes the complaint that no trader ever wants to deal with: withdrawals. One user alleged that their withdrawal request was held up for an entire month, with emails and chat messages going unanswered.

During that waiting period, they claim most of their profits disappeared.

This is where concerns turn serious. A broker’s willingness to process withdrawals promptly is a basic trust test. When withdrawals are delayed without explanation, traders fear the worst, especially the possibility that the broker is stalling, hoping frustration will push the trader back into the market until the balance is gone.

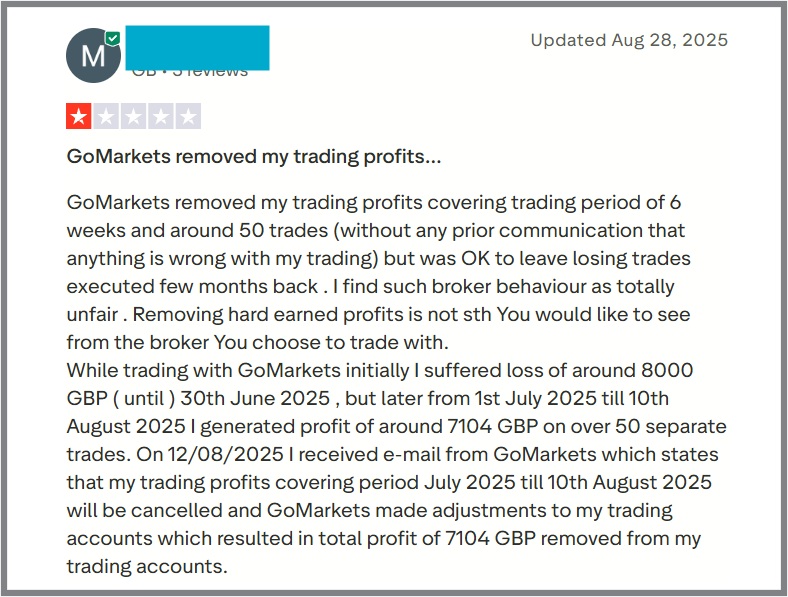

Another review is an even more alarming complaint: profit cancellation. One trader shared a shocking experience.

For many traders, this is where the foundation of trust completely collapses. Some brokers hide behind vague clauses regarding “arbitrage” or “scalping”—often buried deep within the legalese of their terms and conditions—to justify wiping out profits they’ve retroactively labelled as “invalid.”

When a firm selectively deletes winning trades while conveniently leaving the losses untouched, it sets off loud alarm bells and forces a critical question: Is GO Markets safe? While a broker’s regulatory standing provides a baseline of security, these discretionary “profit adjustments” are exactly what separate a transparent partner from a predatory one.

How to Report if you have been scammed?

If you are already facing issues with GO Markets, do not wait.

- Register with us for expert consultation, detailed recovery procedures, and legal resources to fight back against fraudulent earning apps.

- Lodge a Complaint in SEBI SCORES

While using the SEBI portal for the very first time, you may feel that it is somewhat complicated.

We can do:

- Assist you in registering on SEBI SCORES.

- Lead you through the complaint filing process, step by step.

- Make sure all the documents have been uploaded correctly. Check that the categorisation of the complaint is right.

- Keep track of your SEBI complaint status.

- We can also help you to file a complaint in Cyber Crime.

- Lodge an FIR at your nearest cyber police station

Conclusion

GO Markets isn’t a shady fly-by-night operation; it’s a real, multi-regulated brokerage with a large global client base and plenty of satisfied traders. On the surface, everything looks solid. But here’s where the story gets interesting.

Think of GO Markets as a broker that plays well with casual, small-scale traders, but gets a little uncomfortable when the stakes go up.

Reports of withdrawal delays and profit adjustments raise eyebrows, not because they happen to everyone, but because they tend to surface when traders start doing too well.

If your strategy is highly profitable, high-volume, or driven by algorithms, you may suddenly find the rules becoming flexible.

So while GO Markets can work fine for everyday retail trading, it’s not exactly a stress-free partner for consistently profitable traders. The real risk isn’t losing trades, that’s part of the game.

The bigger concern is watching your hard-earned profits get questioned, delayed, or quietly “adjusted” when success knocks too loudly.