Have you ever downloaded an app promising easy money through simple typing tasks, only to wonder if the Golden Duck app withdrawal process lives up to the hype?

Many users jump in via the Golden Duck app login to start completing tasks, watching ads, and earning coins, but questions linger about whether you can actually cash out without endless hurdles.

This blog delves into the reality of Golden Duck app withdrawals, uncovering what real users face and helping you decide if it’s a smart move or a risky gamble.

Golden Duck App Withdrawal Problem

Curious about how the Golden Duck app works and what it offers?

This mobile app markets itself as a straightforward earning platform where anyone can make money through basic typing jobs and tasks. Users primarily earn coins by:

- Watching video ads

- Solving captchas

- Finishing in-app offers

- Referral Schemes

This app then allows users to convert those coins into real cash via UPI, PayPal vouchers, or Amazon Cash.

However, the real test comes when you try to withdraw, as the system pushes for more engagement before paying out. Many start with high hopes, but the relentless barrage of ads raises doubts about sustainability.

Wondering how the Golden Duck app withdrawal system actually operates step by step?

The platform provides options for all users without forcing a paid premium upgrade for initial cash-outs, though it uses a structured approach to ensure ongoing activity and curb misuse.

This setup aims to balance user access with app stability, but it introduces specific thresholds you need to hit.

For your first cash-out, things look promising since you only need a minimum coin balance, often around 1,100 coins (₹9-₹11), with no extra tasks required once you reach it.

Moving to the second withdrawal bumps the requirement significantly, typically to about 68,500 coins (₹15k-16k), and here you must finish designated in-app tasks like specific offers before approval happens.

From the third payout and beyond, the pattern continues with a similar offer completion step displayed right in the app, but completing it once covers all future requests without needing premium status.

This tiered method encourages steady use while keeping basic access open, yet it sparks questions about fairness when coin values fluctuate or deductions apply for low engagement.

Is Withdrawal as Simple as They Promise?

Promotional materials paint a picture of smooth payouts, but user experiences and app policies reveal layers of conditions that make it far from instant.

Reports highlight opaque conversion rates where 100 coins might equal one rupee for premium users but vary for others, potentially slashing your expected payout without notice.

Plus, platform fees between 5% and 25% can be deducted from your total based on activity quality, leaving many feeling the process favors the app over genuine earners.

All of this naturally leads users to wonder whether the Golden Duck App is real or fake, especially when the time invested often outweighs the actual money earned.

Based on user experiences and payout conditions, the Golden Duck app appears unreliable and misleading, offering very low returns after excessive effort, making it closer to fake than a genuine earning app.

Golden Duck App Withdrawal Complaints

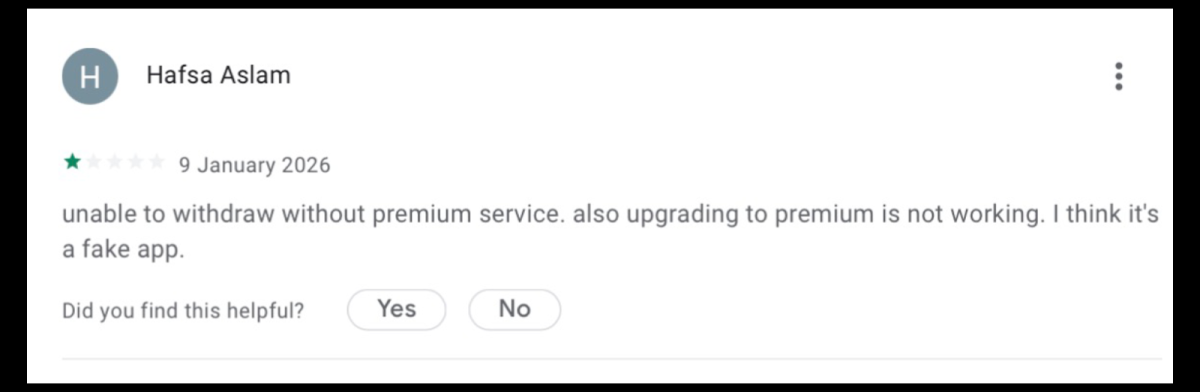

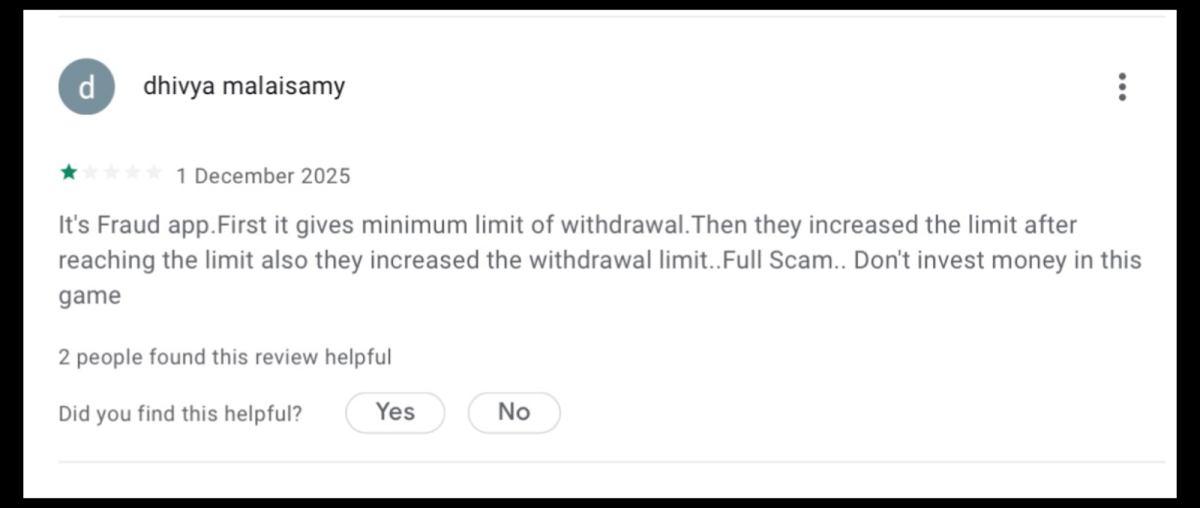

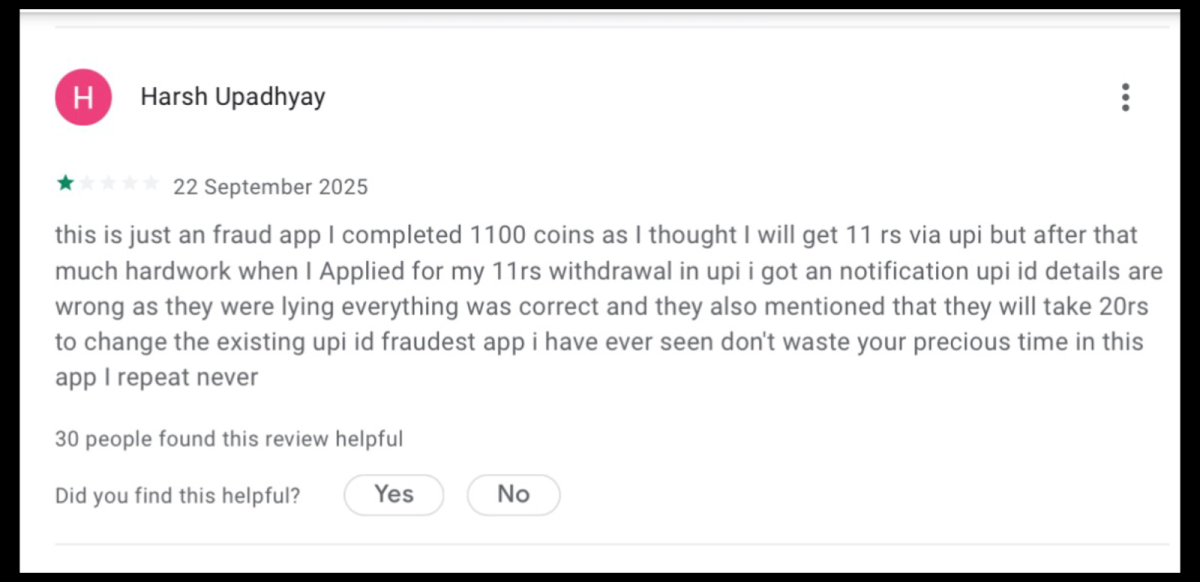

Ever heard fellow users venting about Golden Duck app withdrawal complaints, and wondered if they hold truth?

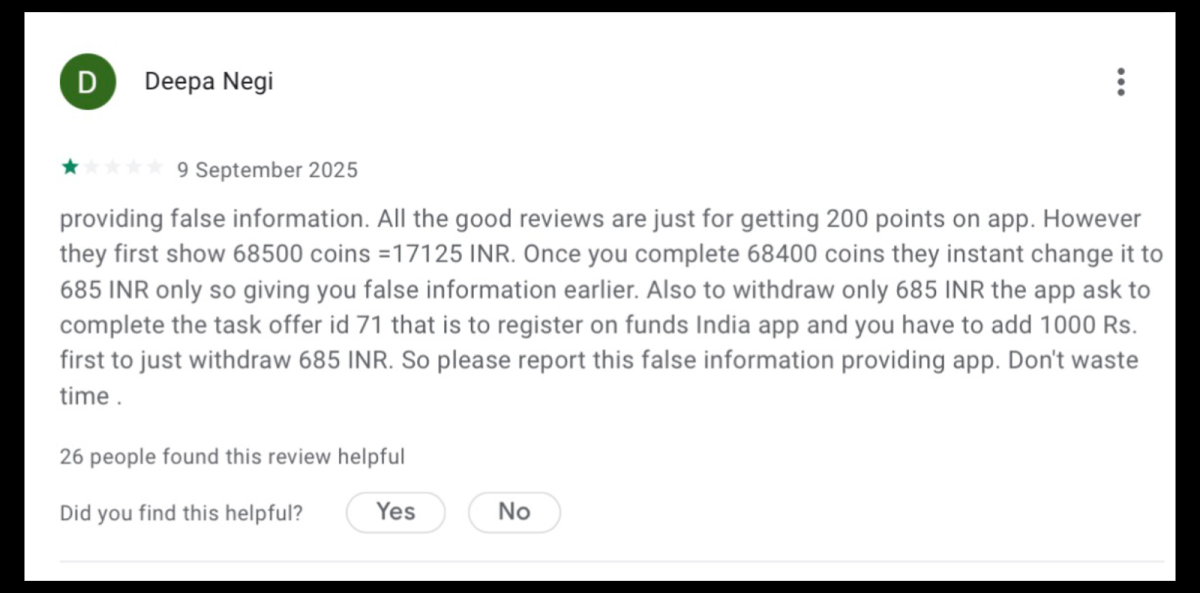

A big frustration revolves around payouts stalling after offers, with some claiming requests get rejected despite meeting thresholds, citing vague reasons like invalid ad views.

Please be careful! Many users are reporting serious problems with this app.

Here is why you should avoid it:

- Payment Traps: The app asks you to pay for “premium” services or “fees” just to get your own earnings out.

- Changing Rules: As soon as you get close to the withdrawal limit, the app raises the goal or lowers the value of your points.

- Fake Errors: It may claim your payment details are wrong and then try to charge you a fee to “fix” them.

- Invest to withdraw: users have also reported that whenever they reach their withdrawal limits, the app asks them to do a certain task. This task involves investing in some other app where you need to 1st pay ₹1000 to withdraw your ₹600 money.

Through these reviews, the message is loud and clear: do not spend your time or money here. If you have already downloaded it, do not pay them any fees!

What To Do If You Are Being Scammed?

Facing troubles with the Golden Duck app withdrawal and thinking about how to report this effectively to get help or justice?

Here are some simple steps:

- Start by documenting everything, including screenshots of your wallet, completed offers, and rejection messages.

- Next, contact the app’s in-app support first, though responses prove slow for many.

- If no resolution comes, escalate to the Google Play Store by flagging the app for misleading practices or payment failures right from your download page.

- You must also file a complaint in Cyber Crime detailing the app’s name, your transaction proofs, and how it misled you on earnings or withdrawals.

- For financial angles, approach your bank or UPI provider to dispute charges if you bought premium features.

- Share your story on consumer forums to warn others.

Need Help?

Losing your hard-earned money can be tough. But there’s always a possibility waiting for you.

If you register with us, you can make your money recovery process easy and smooth. Our team specialises in recovering money lost to scams or fraud.

Conclusion

Pondering if Golden Duck app withdrawal makes it a go-to for extra income?

While the first payout might work for some, mounting barriers, complaints, and scam red flags point to bigger risks than rewards.

Protect yourself by researching deeply, avoiding premium buys, and treating such apps as time-wasters rather than income sources.

Stick to verified platforms, prioritize your data privacy, and remember real earnings demand skill, not endless ads.

Stay aware, question promises, and choose wisely to avoid common traps in the earning app world.