Imagine waking up to find that your GTT orders get triggered at a much lower price. resulting in huge losses. Unfortunately, for many Groww users on May 12, 2025, this was a horrifying truth caused by a significant Groww technical glitch.

Let’s get into the details of what exactly happened and how Groww responded to this.

Groww App Issues

On May 12, 2025, a Monday morning after a long weekend, traders open the Groww app to make another successful day in their trading journey.

But Groww didn’t let it happen as the app faced a glitch.

Now it was not like earlier glitches, where traders were facing issues in taking or exiting positions.

It was more horrifying, as the app displayed incorrect investment values.

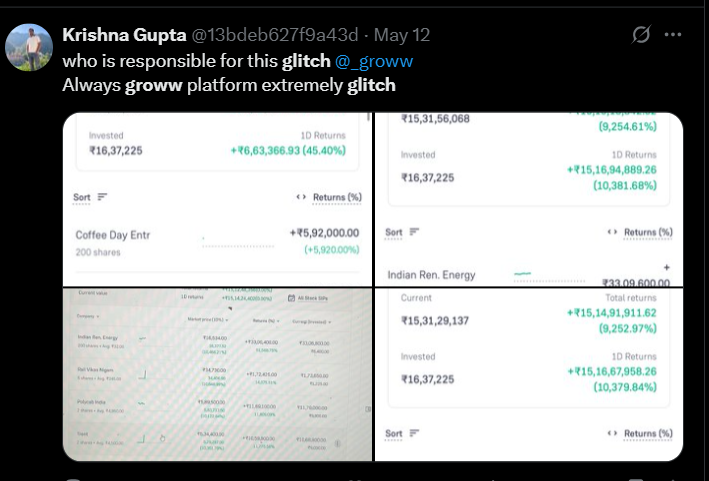

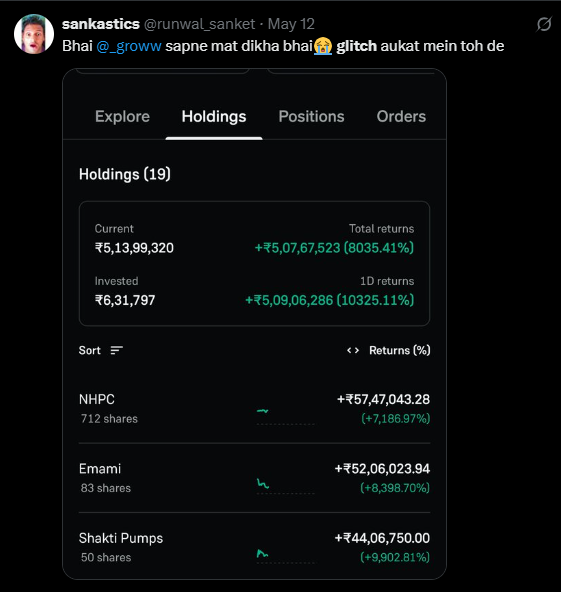

Many traders witnessed a 10,000% jump in the invested value. Felt like a dream of becoming a millionaire came true, right?

But it was just an illusion created due to a technical glitch in the app.

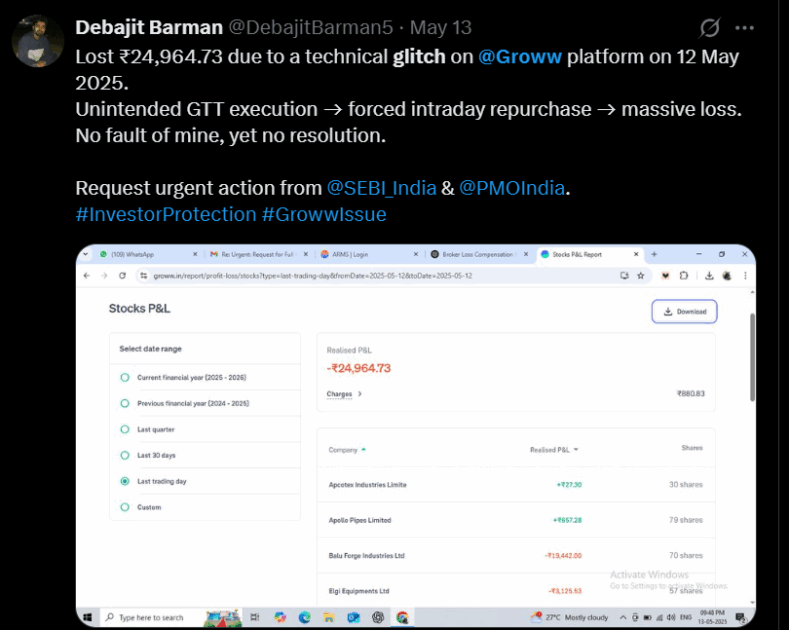

Conversely, others faced unexpected losses as their Good Till Triggered (GTT) orders were executed based on these incorrect stock prices, leading to real financial setbacks.

Social Media Uproar

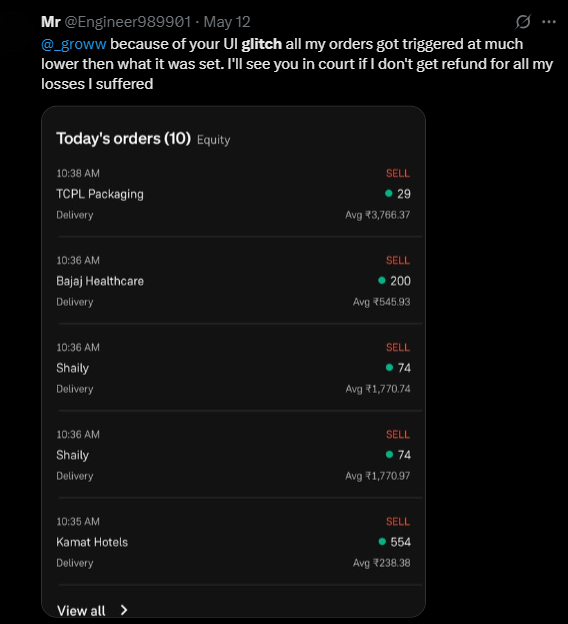

The incident quickly gained traction on X (Twitter) & other social media platforms.

Users shared screenshots of inflated portfolio values and expressed frustration over unexpected losses.

One user tweeted, Lost ₹24,964.73 due to a technical glitch. Unintended GTT execution → forced intraday repurchase → massive loss. No fault of mine, yet no resolution.

Another user showed his frustration by posting a tweet: because of your UI glitch all my orders got triggered at much lower then what it was set. I’ll see you in court if I don’t get refund for all my losses I suffered

And then there was another user, raising a genuine question for his and other traders who lost their money.

who is responsible for this glitch. Always groww platform extremely glitch

One of the traders, who saw a skyrocket in his returns of around 8000%, tweeted: Bhai sapne mat dikha bhai 😭 glitch aukat mein toh de.

Groww’s Response

Acknowledging the problem, Groww stated on X (formerly Twitter), “Some of our users observed discrepancy in stock prices. This was a temporary issue and is now resolved.”

They further mentioned that their support team was reaching out to affected customers whose GTT orders were triggered due to the glitch.

A Pattern of Technical Issues?

One tweet. That’s it.

Every time a glitch occurs, stockbrokers do a formality with a single apology tweet, no transparency, no accountability, no explanation of what really went wrong.

This isn’t the first time Groww has faced serious technical challenges.

Back in January 2024, the platform suffered a glitch that prevented users from placing trades. And to settle a related case with SEBI, Groww paid ₹34.12 lakh—without admitting or denying any fault.

But what about the traders and investors who trusted the platform? Who lost money?

Once again, there’s a long silence. No replies. No resolution.

And the truth is — yes, it will happen again. Maybe not in the same way, but it will. New glitch. New losses.

So what can traders and investors do?

Stay aware. Ask questions. Don’t mistake brand popularity for reliability. And most importantly, always have a backup plan when your money is at stake.

Lessons for Investors

For current and prospective Groww users, this incident serves as a reminder of the importance of platform reliability in online trading.

While technical glitches can occur, the frequency and handling of such issues are crucial factors to consider.

If you were affected by the May 12 glitch, it’s advisable to register with us and document any discrepancies in your account. Our team will guide you with the process for escalating a complaint against Groww App.

Staying informed and vigilant can help mitigate potential risks in the fast-paced world of online trading.