Groww, a platform operated by Nextbillion Technologies Pvt. Ltd., is a leading Indian fintech platform that has revolutionised how millions invest.

Groww has made investing in mutual funds, stocks, and digital gold incredibly easy and accessible. They operate on a zero-commission model, which means more of your money goes into your actual investments, not fees.

This simple approach is empowering countless Indians to take control of their finances and build wealth. However, one needs to focus on all the factors, both positive and negative, before driving into investing.

This article examines the complaint landscape surrounding Groww, analysing data from regulatory sources to provide a transparent view of customer grievances.

Groww Review

Groww operates as a digital-first investment platform that democratises investing for Indian retail investors.

The platform functions as a registered stockbroker with both NSE (National Stock Exchange) and BSE (Bombay Stock Exchange), and is also registered as a depository participant with CDSL (Central Depository Services Limited).

Key Features of Groww’s Operations:

- Zero-Commission Trading: Groww offers commission-free investing in mutual funds and charges competitive brokerage for equity trading

- Digital Onboarding: Complete account opening and KYC verification can be done digitally through the app

- Multiple Investment Options: Users can invest in stocks, mutual funds, ETFs, IPOs, and digital gold through a single platform

- Educational Content: The platform provides extensive educational resources to help new investors learn about financial markets

Groww Complaint Statistics And Analysis

Based on the most recent data available, here’s a detailed breakdown of Groww’s complaint statistics:

Overall Complaint Metrics

- Number of Active Clients: 1,20,45,507 (Over 1.2 crore active clients)

- Number of Complaints Received: 1,073 complaints

- Complaints Resolved Through Exchange/IGRC: 971 complaints

- Percentage of Complaints Against Active Clients: 0.09%

- Resolution Percentage: 90.49%

Types of Complaints Against Groww

Here’s a detailed breakdown of the types of complaints received against the broker:

Type I – Non-receipt/delay in payment: 19 complaints

This category includes issues where clients face delays in receiving funds from sales, withdrawals, or dividend payments.

Type IV – Unauthorised trades/misappropriation: 326 complaints

This is the largest category, encompassing complaints about trades executed without client authorization or allegations of fund misappropriation. This represents approximately 19.7% of all complaints.

Type V – Service related: 862 complaints

The single largest category at approximately 51.5% of all complaints, covering general service issues such as platform glitches, customer support delays, account access problems, and operational inefficiencies.

Type VI – Closing out/squaring up: 20 complaints

Issues related to the forced closure of positions or squaring off of trades.

Type VII – IPO related: 32 complaints

Complaints specific to Initial Public Offering applications, including application failures, refund delays, or allotment issues.

Type VIII – Others: 185 complaints

Miscellaneous complaints that don’t fit into the standard categories, representing approximately 11.1% of all complaints.

The above data reveals some interesting patterns. Service-related issues (862 complaints) dominate the complaint landscape, accounting for more than half of all grievances, where scaling customer support and platform infrastructure can sometimes lag behind user acquisition.

The second-largest category, unauthorised trades/misappropriation (329 complaints), warrants attention.They often arise from misunderstandings about order types, market orders executed at unexpected prices, or genuine security breaches of user accounts.

Major Regulatory Actions on Groww

Despite Groww’s reputation as a well-known and trusted broker, there are indeed a number of dispute cases pending.

Here are some of them, let’s take a look:

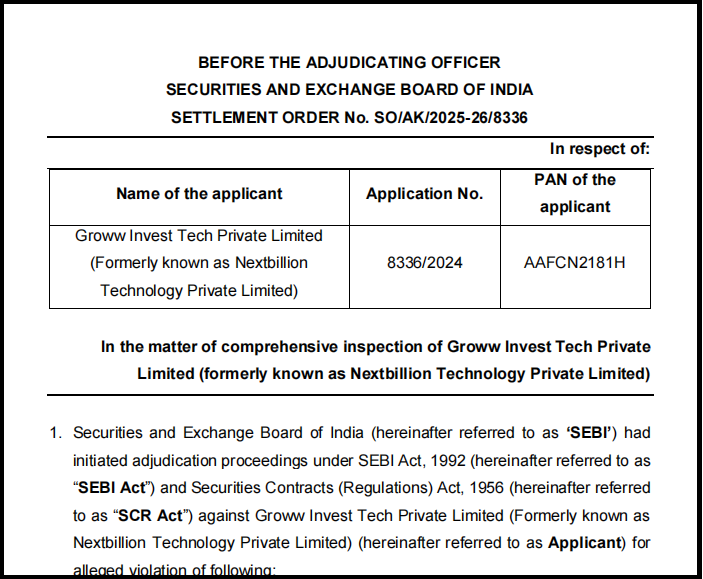

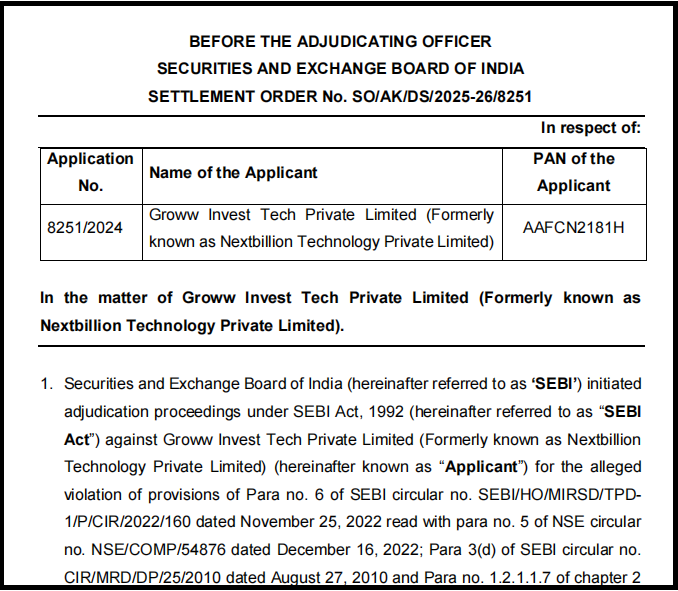

SEBI ORDERS

Groww has recently settled two major legal cases with SEBI. They paid a total of ₹82,97,500 (around ₹82.98 lakhs) to settle these cases.

This shows that SEBI found serious problems in how Groww was operating and protecting its investors. The company settled without admitting it was guilty, which is a common legal step.

A. SEBI ₹83 Lakh Settlement for Investor Safety Lapses

This case came from a detailed SEBI inspection. It found many big failures:

1. Giving Wrong Account Information to Clients

The Problem:

Groww sent monthly account statements to clients that had mistakes. The balance shown and the margin money required did not match in 38 cases.

Investors Impact:

People make trading decisions based on their account statements.

If the information is wrong, they might trade more than they can afford, get penalized for margin shortage, or have their positions forcibly closed by the broker.

They are basically trading blind.

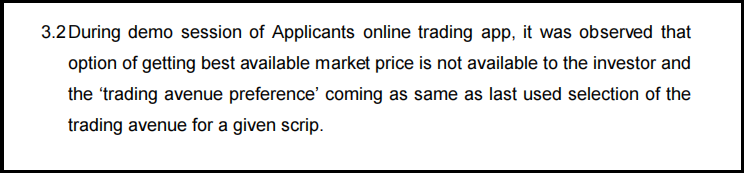

2. Faulty App Design & No Choice in Trading

- The demo version of the trading app did not show the “best available market price” option clearly.

- The app automatically selected the same stock exchange (NSE/BSE) the client used last time, instead of asking each time.

- Did not allow “interoperability”, meaning clients couldn’t easily move their stocks or money between different clearing houses.

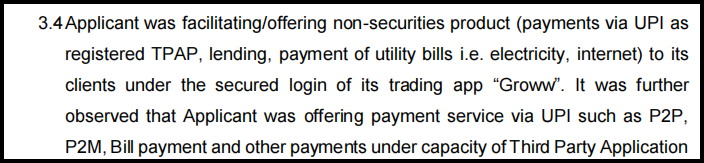

3. Mixing Stock Trading with Banking & Payments

The Problem:

Groww offered non-stock market services like UPI payments, loans, and bill payments inside the same logged-in section of its main trading app “Groww”.

Investors Impact:

This is very risky and confusing. If there is a problem with a UPI payment done through Groww’s app, it could create a legal mess.

This dispute might even affect the safety of the investor’s main trading account and money. Stock trading and payments should be kept separate for safety.

4. Poor Backup Systems & Tech Failure Plans

The Problem:

- Groww had no backup method (like a desktop website or phone line) for clients to trade if the mobile app or website crashed.

- Their “Disaster Recovery Plan” (called BCP) was checked only once a year, not twice as required.

Investors Impact:

If the app stops working, investors are completely stuck. They cannot buy, sell, or exit their existing trades.

If the market moves fast during this time, they can suffer huge, unavoidable losses. A weak disaster plan means these outages can last longer.

5. Weak Checks for Illegal Activity & Client Risk

The Problem:

- No automatic alert system to flag when a client’s trading size or margin requirement was too big compared to their known income.

- Failed to update income and financial details for 83 cases involving 41 clients.

Investors Impact:

This makes the platform weak against money laundering or fake trading.

For honest investors, it means Groww is not stopping them from taking dangerous, excessive risks that could wipe out their savings.

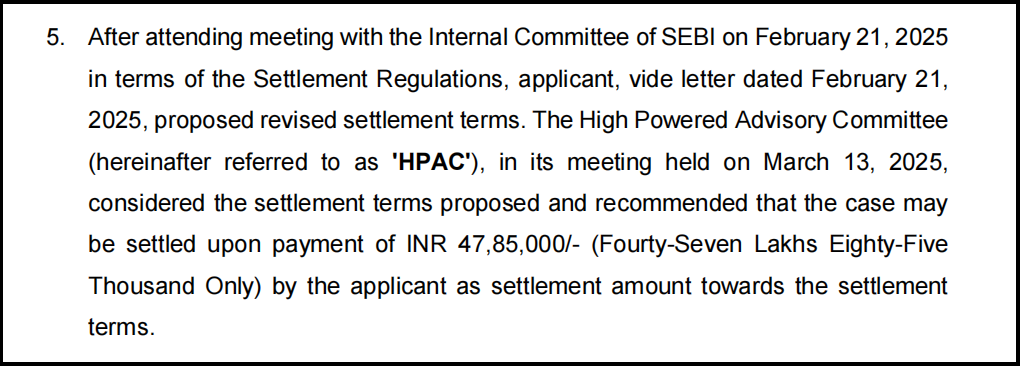

The Final Settlement

The company submitted revised settlement terms on February 21, 2025.

These terms were then reviewed and accepted by SEBI’s High Powered Advisory Committee, which recommended a final settlement payment of ₹47,85,000.

B. SEBI Settlement For Tech Failure & Lapse

This case was specifically about a major technical failure and how poorly Groww handled it.

1. Not Sharing Important Data with the Exchange

The Problem:

Did not send the required trading data to the stock exchange’s monitoring system on a particular day.

Market Impact:

This makes it harder for SEBI and the exchange to watch the market and catch illegal activities in real time.

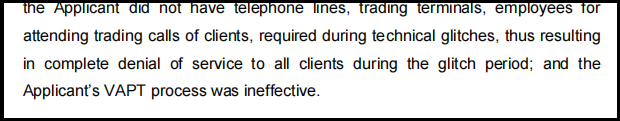

2. Total Shutdown During a Tech Glitch

The Problem:

During a platform failure, Groww had absolutely no backup. No phone support, no alternative terminal, no staff to take orders over the phone call.

Investors Impact:

This proves the biggest fear from Order 1 was true. Clients had no way to reach the market. They missed profit chances or, worse, couldn’t sell to stop their losses. This is a basic failure of a broker’s job.

3. Weak Cyber Security Checks

3. Weak Cyber Security Checks

The Problem:

Their process for finding security holes in their app and website (called VAPT) was not effective.

Investors Impact:

This puts every user’s personal data, password, and money at high risk of hacking. A breach could lead to unauthorized trading or theft.

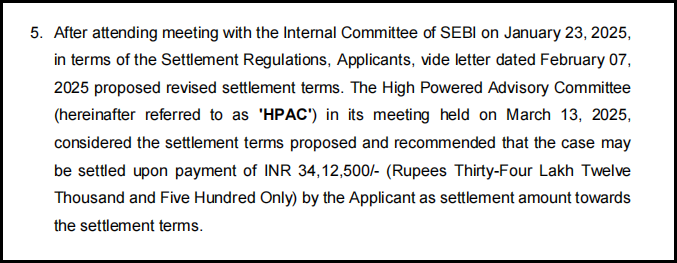

The Final Settlement

The applicant proposed revised settlement terms to SEBI on February 7, 2025.

The advisory committee reviewed them and recommended a final settlement of ₹34,12,500, which was accepted on March 13, 2025.

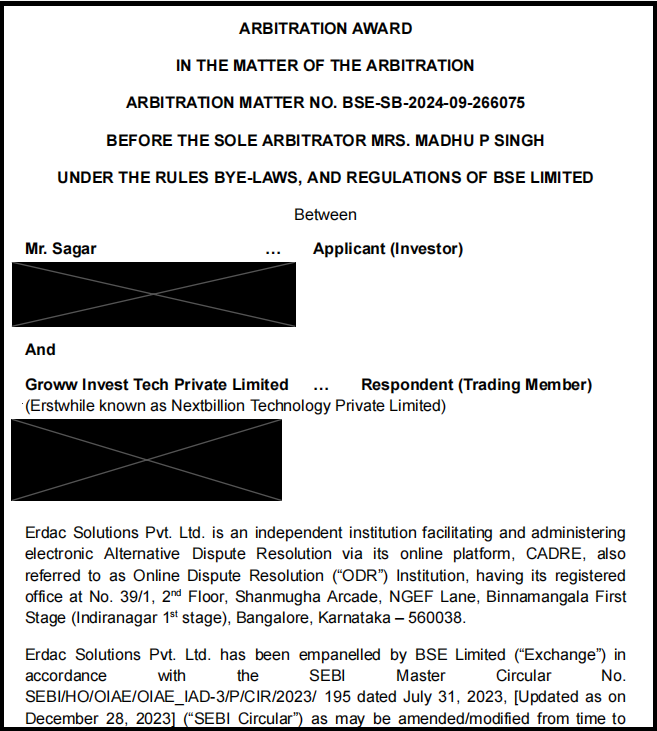

BSE Arbitration Case Against Groww

Case Reference: Arbitration Matter No. BSE-SB-2024-09-266075

Parties: Mr Sagar (Investor) vs. Groww Invest Tech Private Limited (Broker)

Outcome: Claim dismissed. The investor’s request for ₹12.45 lakhs in compensation was denied.

What Happened: A Timeline of the Dispute

- At 12:32 PM, Mr. Sagar placed a limit sell order for 20,000 quantities at ₹50 to square off his position.

- The order was immediately rejected due to an intermittent system glitch in Groww’s order-splitting feature.

- Within 11 seconds (by 12:32:20 PM), he placed another order at a higher price, which went through.

- However, due to rapid market movements (typical on expiry days), he eventually squared off his total position of 30,000 quantities at a much lower price (₹6.45 average) via a market order at 3:03 PM, resulting in a significant loss.

The Arbitrator’s Key Findings & Reasons for Dismissal

1. Technical Glitch Was Real but Very Brief

- The arbitrator confirmed that a glitch did occur on September 13, 2024, at 12:32:09 PM.

- However, it lasted only about 11 seconds, as the investor was able to place another order successfully immediately after.

- Since the outage was less than 5 minutes, Groww was not required to report it to the exchange per NSE guidelines.

2. Investor Bound by Agreement Waiving Tech Glitch Claims

- The arbitrator heavily relied on the Rights & Obligations document that Mr. Sagar signed when opening his account.

- This document, based on SEBI’s 2011 circular, explicitly states:“The Client shall not have any claim against the Exchange or the Stock broker on account of any suspension, interruption, non-availability or malfunctioning of the Stock broker’s system… due to any link/system failure… for any reason beyond the control of the stock broker/Exchanges.”

- The arbitrator ruled this clause legally binding, barring the investor’s claim for opportunity loss.

3. “Stability Guaranteed” Was Not an Absolute Promise

- Groww clarified that this phrase referred to order slicing and execution processes, not 100% uptime.

- The arbitrator accepted this interpretation, stating that technical glitches are inherent risks in online trading, not covered by this promise.

4. Claims for Margin Restoration & Brokerage Refund Were Unfounded

- Margin was charged as per regulations and was not a penalty but a requirement.

- Brokerage fees were legitimately earned on executed trades and are not refundable.

5. Precedents Cited by Investor Were Deemed Not Applicable

- Sagar cited a Delhi High Court order where brokers were held liable.

- The arbitrator distinguished those cases, noting they involved longer, systemic failures (hours, not seconds), and the investors in those cases had not signed away their rights through the same 2011 SEBI terms.

What Can You Learn From These Cases?

1. A Harsh Reminder of “Fine Print” Risks for Retail Investors

- This case highlights how standard brokerage agreements heavily favour the broker.

- By signing these terms, investors may unknowingly waive their right to claim compensation for most technical failures, even if they result in losses.

2. The “Seconds vs. Hours” Loophole in Tech Glitch Accountability

- The ruling creates a dangerous precedent: if a glitch lasts less than 5 minutes, the broker may bear no liability, regardless of the financial impact.

3. “Stability Guaranteed” – Marketing Hype vs. Legal Reality

- Fintech brokers often use confident, reassuring language in marketing.

- This case shows that such slogans have little legal weight when challenged. They are treated as aspirational messaging, not contractual guarantees.

How to Complaint Against Groww App?

Navigating the complaint process can be overwhelming, especially if you’re dealing with financial disputes for the first time.

That’s where professional assistance can make a significant difference.

Our Comprehensive Support Services:

- Initial Consultation & Registration: Register with us to file your complaint, and we’ll immediately assign a dedicated case manager to your case.

- Complaint Drafting Assistance: Our team will help you draft a clear, comprehensive, and legally sound complaint that includes:

- Proper documentation and evidence compilation

- Clear articulation of your grievance

- Relevant regulatory citations

- Timeline of events

- Quantification of losses or damages

- Broker Engagement We’ll assist you in reaching out to the stockbroker through proper channels, ensuring your complaint receives the attention it deserves and is documented appropriately.

- Support to File a SEBI SCORES Complaint

- Smart ODR Navigation

- Post-ODR Complaint Counselling

- Arbitration Guidance

Ready to File Your Complaint?

Contact us now to schedule your best path forward for resolving your dispute with Groww or any other stockbroker.

Conclusion

Groww, operated by Nextbillion Technologies, is a major digital investment platform in India with over 1.2 crore active clients. It maintains high customer satisfaction with a 90.49% resolution rate for complaints.

So, How Reliable is Groww’s Customer Support?

Think about this: only 0.09% of their active clients have ever filed a complaint.

Even with this impressive record, no platform is perfect. Some complaints and arbitration cases still occur. This highlights the crucial point for every investor: you must remain vigilant, prioritise account security, and be fully aware of the support systems available to you.

Understanding both the benefits and the grievance mechanisms is key to investing wisely and protecting your interests.