Every year, thousands of Indian investors fall victim to fraudulent brokers who promise quick returns and hassle-free trading, only to vanish with their hard-earned money.

The scary part? Many of these scammers operate elaborate websites that look exactly like legitimate brokers, making it nearly impossible for the average investor to spot the difference.

So here’s the million-rupee question that could save you from financial ruin: how to check if is SEBI registered broker is safe?

Understanding this single concept could be the difference between secure, regulated trading and losing your entire investment to a con artist operating from a dingy office or, worse, from abroad. Let’s cut through the confusion.

It’s actually very simple, takes less than two minutes, and gives you complete peace of mind. Whether you’ve already opened an account with a broker or you’re about to hand over your money to one, this blog will walk you through exactly what you need to do.

We’ll also show you the biggest red flags that should make your alarm bells ring, plus what to do if you discover your broker isn’t actually registered at all. Stick around, because this information could protect your financial future.

How to Check if a Broker is SEBI Registered Online?

Before we dive into the steps, here’s the quick version: SEBI maintains an official list of all registered brokers on its website, and you can search this list in literally 90 seconds.

The verification process is completely free, transparent, and available to everyone. Let’s break this down into simple, actionable steps.

Step 1: Visit SEBI’s Official Intermediaries Portal

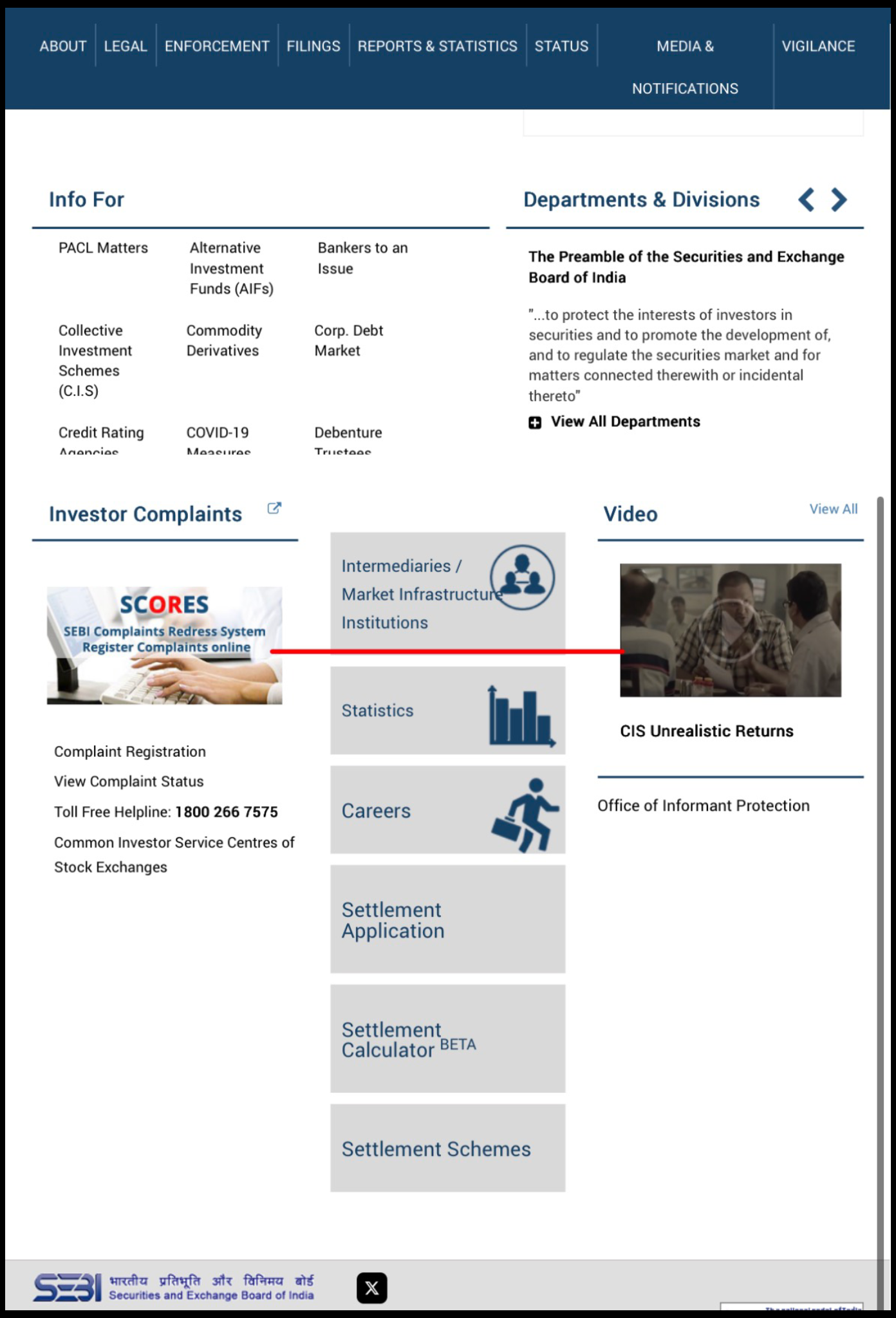

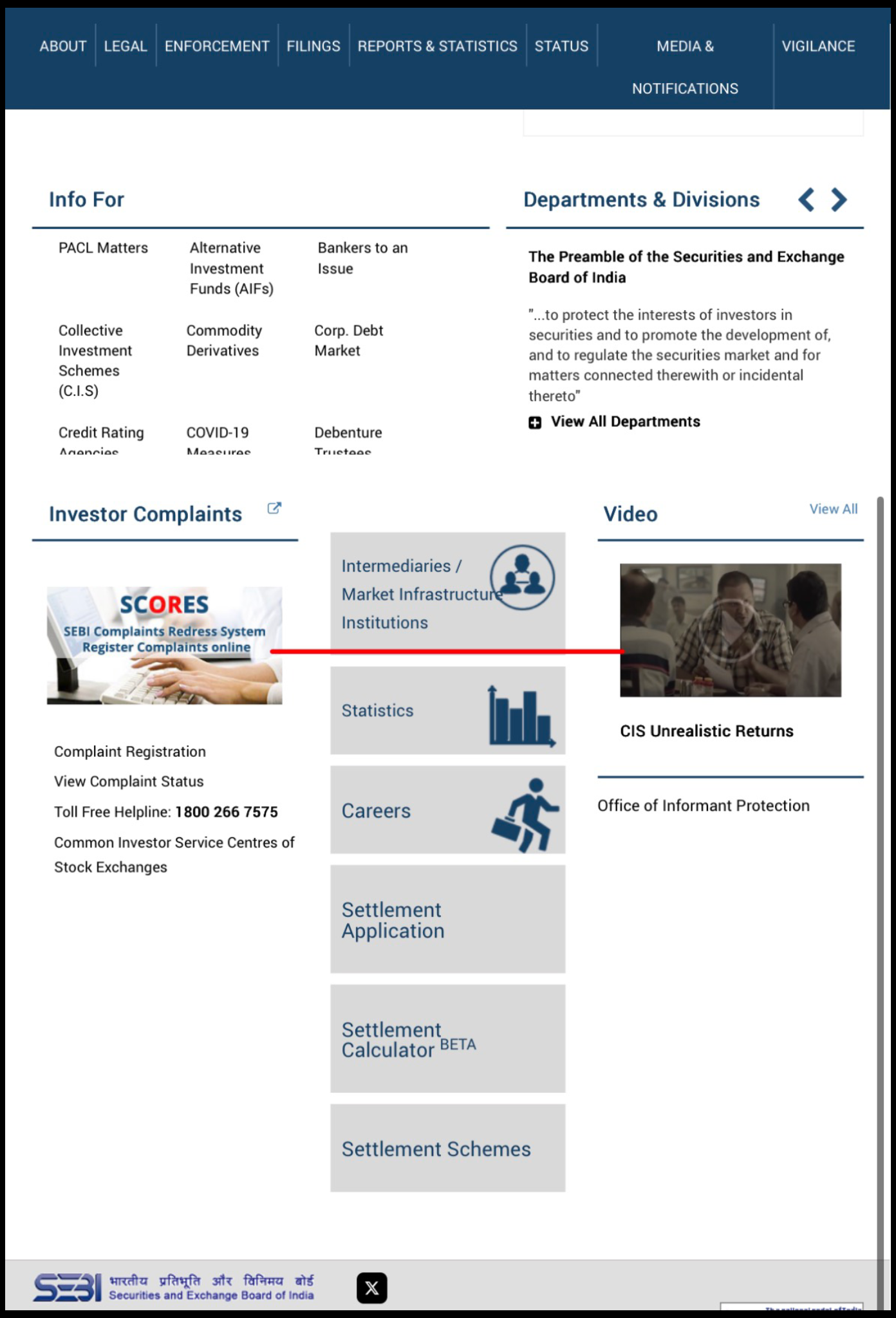

Open your browser and head to the official SEBI website. This is crucial, and always use the official SEBI domain (sebi.gov.in) and never trust third-party websites claiming to show you broker lists.

Scammers love creating fake verification websites to trick investors, so always go directly to the source.

Once you’re on the SEBI homepage, look for a section labeled “ Intermediaries” or “Market Intermediaries.”

This is your golden ticket to the complete, verified database of all legitimate brokers operating in India.

You’ll notice there are multiple categories here, like stock brokers, research analysts, portfolio managers, and more, but your area of interest is stock brokers.

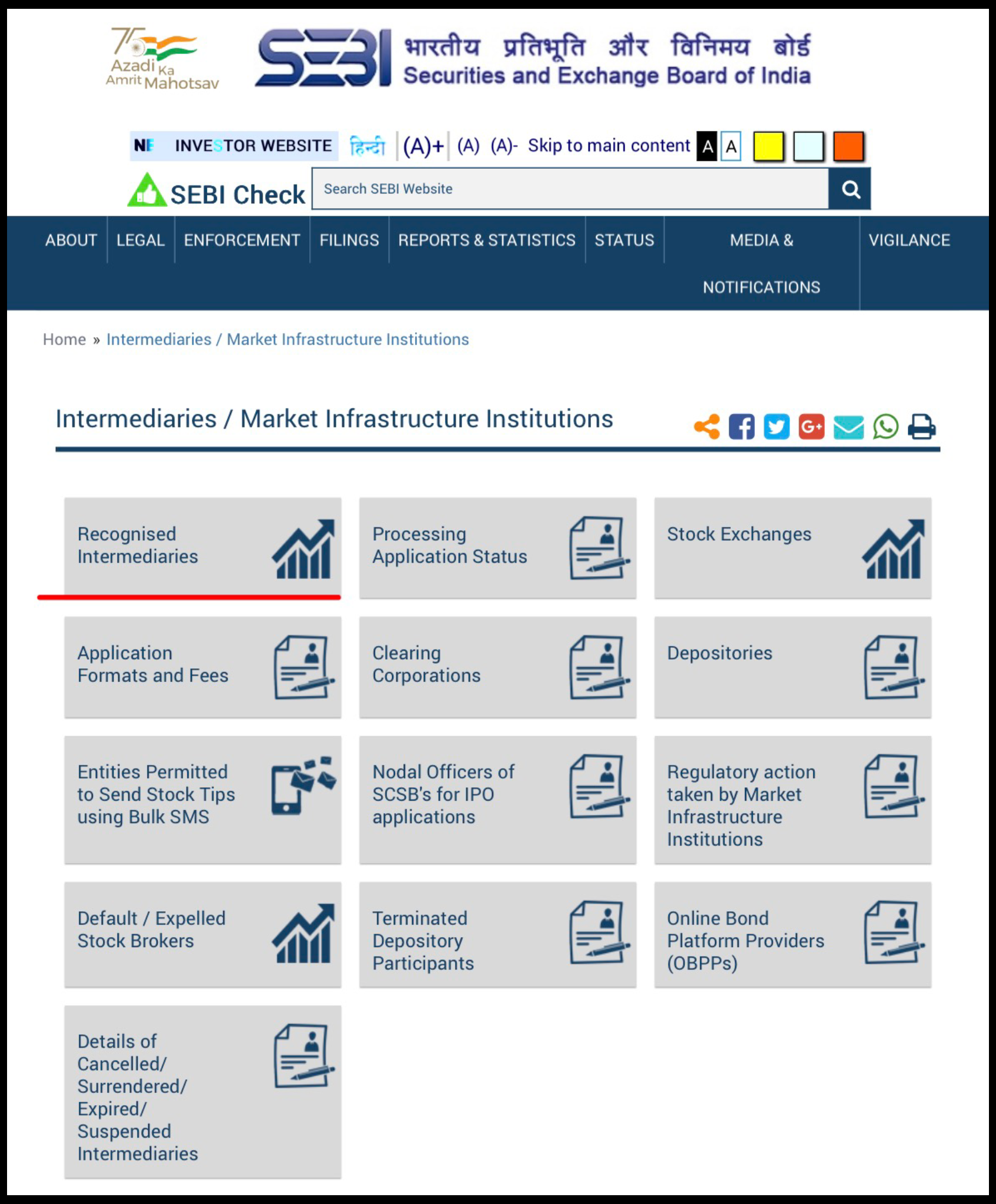

Step 2: Navigate to the Registered Stock Brokers Section

Under the Intermediaries menu, you’ll see a specific link for “Recognised Intermediaries.” Click on this.

As of January 2026, there are 4,923 registered stock brokers in the equity segment alone, so if your broker isn’t on this list, that’s a massive red flag.

Don’t get overwhelmed by the numbers. The portal is user-friendly and has a search function that makes finding your broker incredibly easy.

You can search in two ways: by the broker’s name or by their SEBI registration number.

Step 3: Search by Broker Name or Registration Number

Here’s where you do the detective work. If you know your broker’s SEBI registration number, that’s your best bet.

SEBI registration numbers for brokers always start with “INB” or “INZ” followed by nine digits. For example, a valid registration might look like “INB011326437.”

If your broker hasn’t given you a registration number or the number doesn’t follow this format, that’s a warning sign right there.

Type your broker’s name (the official legal name) into the search box. The portal will display all matching results. If nothing comes up, your broker isn’t registered with SEBI and you should immediately stop dealing with them.

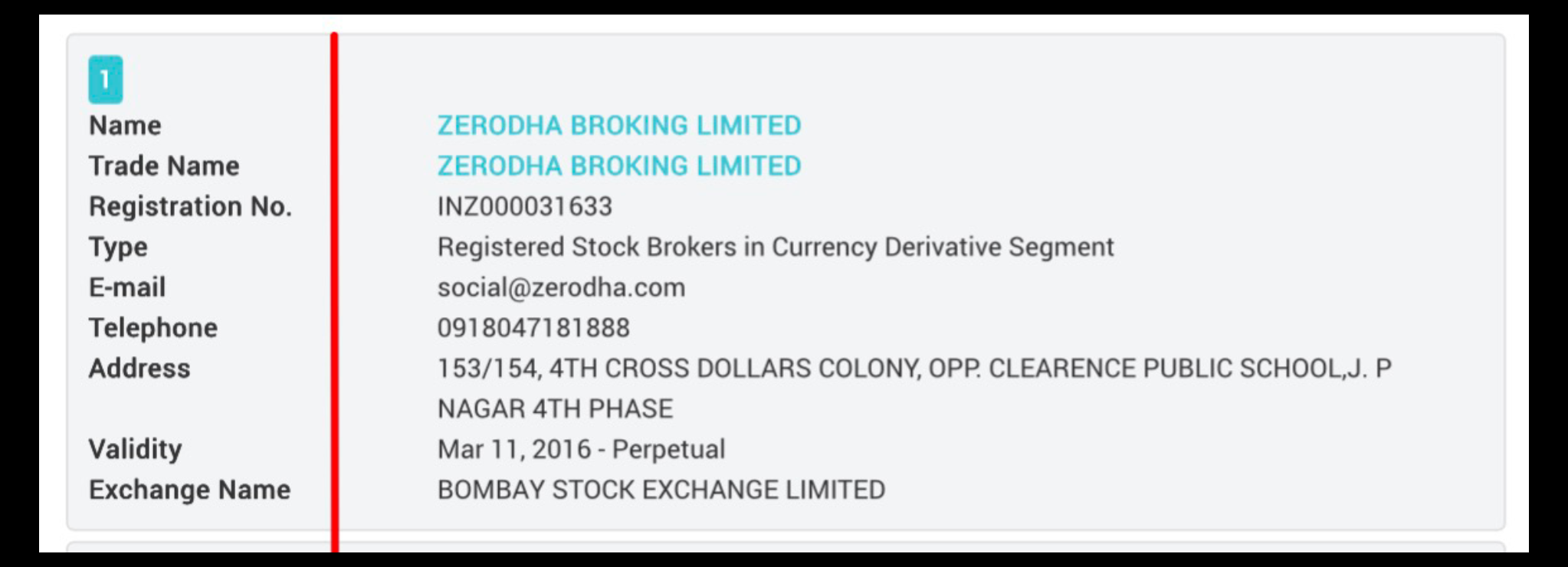

Step 4: Verify the Registration Details on the Portal

Once you find your broker on the portal, don’t just glance at the name and move on. Look at the complete details displayed:

- Validity Period: Should show something like “Perpetual” or a date far into the future. If the registration has expired, the broker has no legal right to operate.

- Exchange Memberships: Check if the broker is registered with NSE (National Stock Exchange), BSE (Bombay Stock Exchange), or both. A legitimate broker operating in the equity segment must be a member of at least one exchange.

- Registered Address: Compare this with the address shown on the broker’s website and marketing materials. If the addresses don’t match, something’s definitely off.

- Contact Information: The portal will display contact details, compliance officer names, and email addresses. A real broker will have this information readily available.

Step 5: Cross-Check with Stock Exchange Records

For extra confirmation, you can verify the same broker on the respective stock exchange’s website. NSE and BSE maintain their own member directories where you can confirm the broker’s status.

This double-check takes another minute or two but provides bulletproof verification.

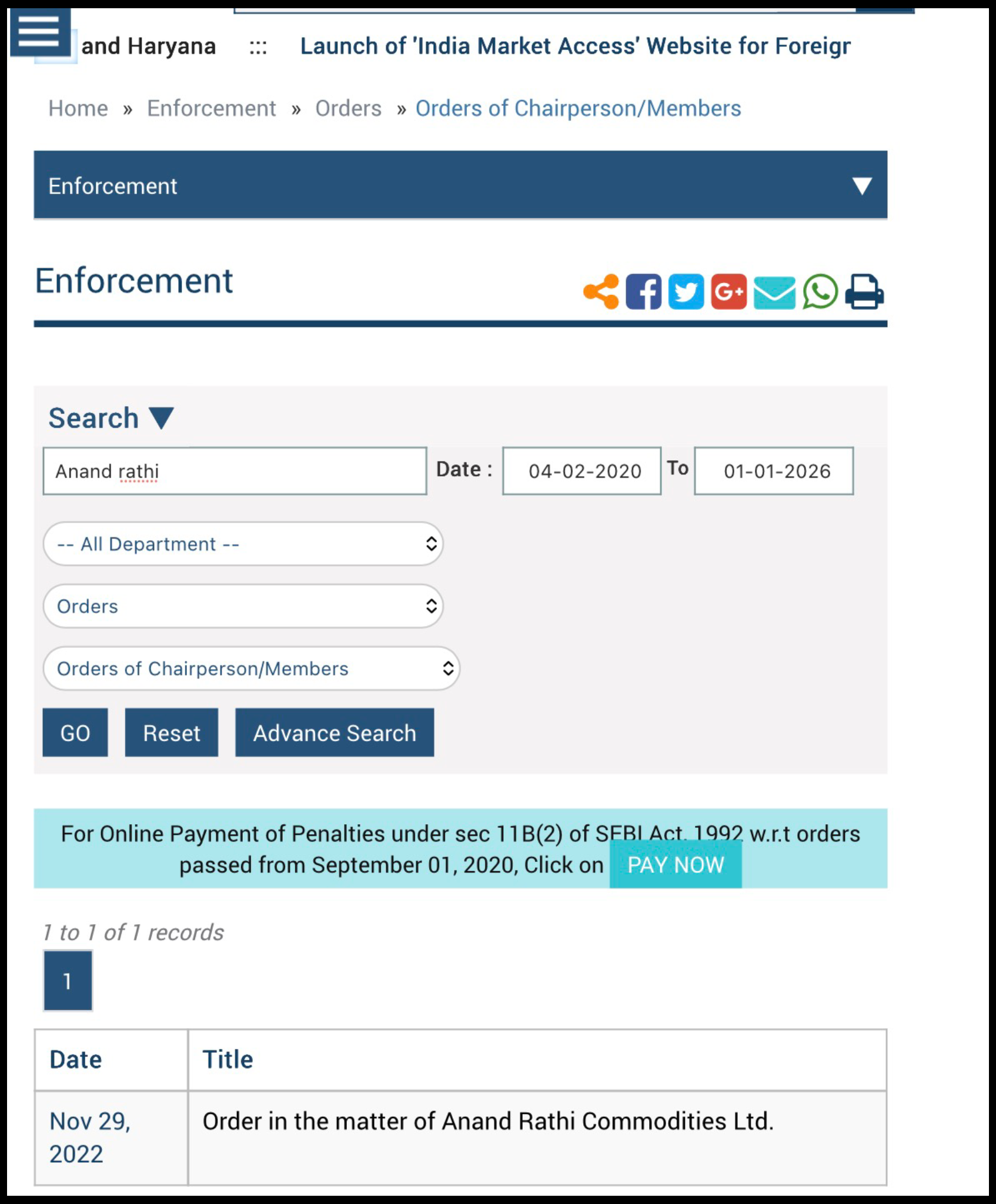

Step 6: Look for Any Penalties or Regulatory Actions

Here’s something many investors skip but absolutely shouldn’t: checking if your broker has faced any SEBI penalties, suspensions, or enforcement actions.

While a completely clean record is ideal, occasional minor penalties don’t necessarily mean a broker is fraudulent. Many legitimate brokers have faced compliance issues that were resolved. However, multiple serious penalties or repeated violations should make you reconsider.

The SEBI portal may list any regulatory actions or penalties. If the broker has been suspended or had their registration cancelled, they cannot legally operate.

Step 7: Watch Out for These Major Red Flags

Now that you know how to verify registration, let’s talk about what should immediately raise your suspicion even if the broker’s name appears on the list (because details matter):

- Guaranteed Returns: No legitimate broker or investment advisor can guarantee returns in the stock market. If they’re promising 100% returns or guaranteed profits, they’re running a scam.

- Unusual Domain Extensions: Be very wary of brokers using domain extensions like .biz, .live, .online, or .club. Real Indian brokers typically use .in domains or standard .com extensions.

- Pressure to Deposit via Unconventional Channels: Legitimate brokers operate through proper banking channels and can receive deposits into company bank accounts verified by SEBI records. If a broker is pressuring you to send money via UPI, crypto, or informal channels, run away immediately.

- No Physical Office in India: A genuine broker must have a registered office address in India. If they claim to be offshore but accept Indian investors, or have no verifiable office address, that’s a massive red flag.

- Aggressive Unsolicited Cold Calls: brokers don’t need to cold-call random people. If someone calls you out of the blue pushing you to “invest now,” hang up.

- High or Blocked Withdrawal Charges: Be suspicious of brokers that charge unusually high withdrawal fees or make it difficult to withdraw your money. This is often a sign they’re using your funds for their own purposes.

What to Do If You Have an Issue with Your Stockbroker

If you’re stuck in a dispute with your stockbroker and don’t know what to do next, you don’t have to fight it alone.

When trades go wrong, funds don’t reflect properly, or you suspect misconduct, the real challenge is not just “having a problem,” but it’s turning that problem into a strong, documented, trackable complaint.

That’s where we step in. When you register with us, we help you convert your experience into a properly structured case that can be taken to the right platforms (like exchanges, SEBI SCORES, or SMART ODR) so that it’s taken seriously and not sidelined because of missing details or unclear wording.

How We Help with Any Stockbroker Issues

- Collecting and Organising Evidence

We help you systematically gather everything needed to support your case:

- trade statements

- ledgers

- contract notes

- broker emails

- WhatsApp or chat screenshots

- call records

- platform screenshots

The goal is simple: to build a clear timeline of what actually happened so that regulators and exchanges can see the full picture at a glance.

- Drafting a Clear, Impactful Complaint

Many genuine complaints get ignored or delayed simply because they are emotional, unclear, or poorly formatted.

We rewrite your story into a precise, logically structured complaint that fits the formats expected by the exchanges, SEBI SCORES, and SMART ODR, so it is easy to understand and difficult to dismiss.

- Filing on the Correct Platforms

Different issues may need to be filed in different places with the broker, the exchange, SEBI SCORES, or via online dispute resolution.

We guide you step by step while filling online forms, uploading documents, describing the issue correctly, and making sure nothing important is missed or wrongly entered.

- Escalation and Continuous Follow-Up

If your broker does not resolve the issue or gives unsatisfactory replies, you need to know when and how to escalate.

We help you understand the escalation ladder, assist with follow-up responses, and support you in replying to queries or clarification requests from authorities.

- Support During Counselling, Mediation, or Arbitration

If your dispute moves to counselling, mediation, or arbitration, it can feel intimidating and technical.

We help you prepare your statements, arrange your documents in the right order, and clarify your key points so you feel confident and ready when presenting your side.

In short, you focus on telling your story, explaining what went wrong, and tracking your money.

We take care of the drafting, documentation, filing, escalation, and procedure against any stockbroker, so your complaint is structured, professional, and hard to ignore.

How to File a Complaint Against an Unregistered Stock Broker?

In India, stock broking and investment-related activities are strictly regulated by SEBI (Securities and Exchange Board of India).

Any individual or firm acting as a stockbroker without SEBI registration is operating illegally.

Such unregistered trading risk often lures investors through social media, Telegram/WhatsApp groups, or fake trading platforms, promising high or guaranteed returns.

If you have dealt with an unregistered stockbroker, it is important to act quickly to protect your interests and help regulators prevent further investor harm.

- Prepare all supporting documents

- Payment proofs (UPI, bank transfer, card statements)

- Screenshots of WhatsApp, Telegram, website, or app

- Promotional messages promising profits/guarantees

- Trade instructions or account access details

- Agreement or onboarding documents (if any)

- In case of an unauthorised or fake stockbroker, report to SEBI

- You can directly reach out to SEBI by sending all the proof along with a proper draft

If there is:

- Fraud

- Misappropriation of funds

- Fake trading platforms

Need Help?

In case you need help to file a complaint against a stock broker or an unauthorised body, then register with us, and we will guide you through the complaint process.

Conclusion

Checking whether your broker is SEBI registered isn’t just a formality or something only careful investors do. But it’s an absolute non-negotiable step before opening an account or transferring any money.

The stakes are simply too high. In a market where sophisticated scams become more elaborate every day, this simple two-minute verification could be the difference between growing your wealth and losing everything to a con artist.

Remember, SEBI registration is just the foundation of broker legitimacy. It’s not a guarantee that you’ve found a perfect broker.

Even after verifying registration, take time to check for regulatory penalties, read reviews, compare brokerage charges, and ensure the broker’s trading platform and customer service meet your needs.

But registration verification must always be your first step, your starting point, and your non-negotiable baseline. After all, the best investment isn’t the one with the highest returns; it’s the one you don’t lose to fraud.