How do you deal with the regular calls of the advisory services luring you with high profits?

Well, some try to ignore it but the continuous calls create an urge to try it for once.

This is something that happened with Mr. Tarun (name changed). Tarun a new trader in the market received multiple calls from an Indore-based advisory firm. Initially, Tarun showed no interest, but after continuous follow-ups by them, Tarun tried their services.

Finally the day before the budget July 22, 2024, Tarun agreed to use their services. It was just after 2 days of their services he lost more than ₹1,00,000.

Wanted to know how all this happened.

Well, here is the complete detail. Although Tarun made a mistake by believing their promises later he took our help and finally, his determination helped him recover 90% of his capital.

How Tarun Came Under Debt After Taking Fake Advisory Services?

So, it all started around 1 month before the budget day when Tarun received a call from an advisory firm based in Indore. The executive on the call started pitching their advisory services and it can help Tarun in increasing his trading profits.

Tarun had recently opened a demat account and was not interested in their services.

The advisory service continued calling him for follow-ups. Later they added him to a WhatsApp group where they used to share daily profits screenshots of other clients.

Finally, on July 22, 2024, when they called Tarun for the same, Tarun asked for the fees for their services. They proposed a profit-sharing model which further convinced Tarun and he finally agreed to avail their services.

The only condition was that all the trades would be taken by them on behalf of Tarun. Hence Tarun shared his demat account details with them and added funds of ₹1,00,000 to get started.

That day, everything went well and the company also took trades cautiously. By the end of the day, the profit displayed in Tarun’s account was ₹1,80,000.

Tarun was glad to see this but his happiness was ephemeral as the advisory company asked him to share ₹1,00,000 profit with them.

Now as per the settlement rule, trading profit is credited after one day. However, the advisory company pressured Tarun to transfer the profit share on the trading day only.

Tarun borrowed ₹1,00,000 from his friend and transferred the funds to the company’s bank account.

The following day, on the budget the market was highly volatile. The company took aggressive trades using the funds and the profit amount in Tarun’s account in that volatile market.

They blew off almost the whole capital in a few hours. By the end of that trading day, the funds in Tarun’s account decreased to ₹23,000.

He called the advisory company and asked for a refund. They took his calls for the first few days but stopped replying to his calls and messages.

Tarun, who had borrowed money from his friend to transfer the profit share, mortgaged his wife’s jewelry to repay it.

The situation devastated him. He couldn’t understand what happened to him.

After a few days, he decided to take action but had no idea of how to report online frauds in India.

Fortunately, he found our website, and the rest is history.

How Our Team Helped Tarun in Recovering ₹90,000?

Our team listened to Tarun’s case and, after in-depth research on the company, discovered that they were running fake advisory services.

Further, the account handling in stock market is completely illegal if the account is less than ₹50,00,000.

Tarun, unaware of this regulation, fell into the trap of an illegal & fake advisory.

Our team collected all the proofs from Tarun and helped him in drafting a complaint against stock advisory.

Luckily, Tarun received a call from the advisory company, which agreed to pay ₹30,000. But Tarun wanted the whole capital of ₹1,00,000, which he initially deposited in the account.

We continued with the process and filed a complaint with the respective authorities.

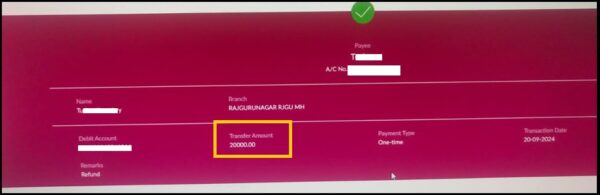

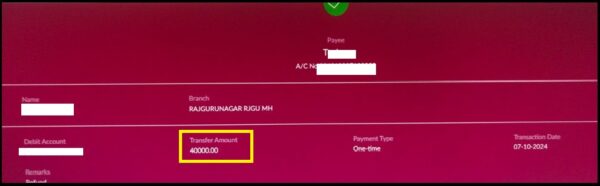

Within a week, the company officials reached out to Tarun again, and after negotiation, they finally repaid the amount of ₹90,000 in 3 installments.

Conclusion

The market regulator SEBI completely prohibits account handling by both registered and unregistered advisory firms. Only Portfolio Managers can handle their clients’ accounts if the minimum amount is ₹50,00,000.

Unluckily, because of the lack of information available to new traders, scammers easily trap them in their high-profit model and somehow convince them to use their illegal services.

New traders having big dreams of earning profit do not consider doing complete research or validating details of the company, and end up losing their hard-earned money.

Tarun’s incident is a lesson for many who usually get convinced by regular service calls of fake advisory services and without proper analysis agree with their terms and conditions.

It is important to remember that when it comes to financial services like trading, one must not only be cautious while availing services but also be responsible towards their money.

Trusting anyone who makes big promises and sells dreams is one of the most unwise decisions one can ever make.