When you see someone flaunting ₹36 lakh profits on Instagram and claiming to turn ₹10,000 into ₹1 lakh in just 8 days, what’s your first reaction?

Excitement or suspicion? If you’ve come across the Intraday Hunter YouTube channel, you’re probably asking the same question thousands of Indian traders are asking right now.

Let’s dive deep into what’s really happening behind those flashy profit screenshots.

Intraday Hunter YouTube Channel Review

Intraday Hunter operates as a YouTube channel focused on intraday trading, particularly in Bank Nifty and Nifty options.

The channel has approximately 249,000 subscribers and has generated over 33.85 million views.

Key Details:

- SEBI Registration Status: Not SEBI Registered

- Primary Content: Live trading sessions, market analysis, profit showcases

- Target Audience: Retail traders, especially from Tier 2 and Tier 3 cities

- Revenue Sources: YouTube ad revenue, potential referral commissions, Telegram premium memberships

According to the channel’s own disclaimer on Instagram, they clearly state: “We Are Not Sebi Registered Advisor”, which immediately raises questions about the legitimacy of providing trading advice.

How Intraday Hunter Operates?

Before we dive into the controversies, let’s understand how this channel actually functions on a day-to-day basis.

The channel’s typical content includes:

1. Live Trading Videos: The channel regularly uploads videos showing real-time trading in Bank Nifty and Nifty options.

2. Short-Form Content: On platforms like Instagram and YouTube Shorts, Intraday Hunter posts quick 15-60 second clips highlighting:

- Daily profit screenshots

- Trading position updates

- Market movement predictions

3. Market Analysis: Regular videos breaking down technical charts, support-resistance levels, and intraday trading opportunities for the upcoming session.

Is Intraday Hunter Legit?

Recent investigations by followers have uncovered some deeply troubling patterns.

Let’s examine the evidence that’s making experienced traders question everything.

1. Manipulated Trade Data

One of the most damning pieces of evidence comes from a Reddit user who noticed something suspicious. Sounds concerning, right?

The Allegation: In a live trading video, Intraday Hunter allegedly showed a BankNifty trade at the 50,000 strike price, which was then changed to a 51,000 strike price within seconds in the same video.

This part was deleted from the video after this post went viral and was replaced with a caution screen, saying this is just for informational purposes.

This type of manipulation suggests post-production editing of trading data to make it appear that trades were placed at different, more profitable strike prices than they actually were.

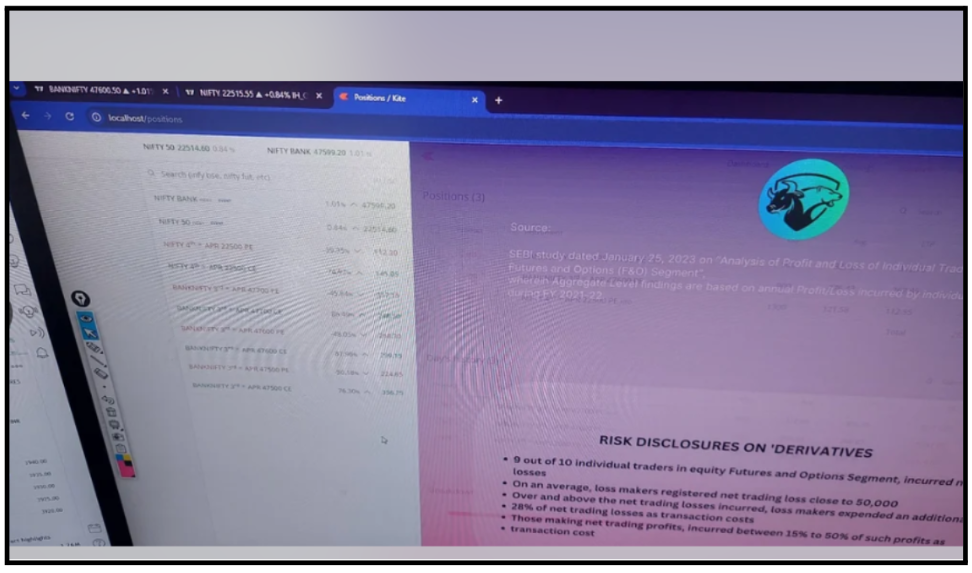

2. The Localhost Website Allegation

Perhaps the most shocking discovery was when a follower spotted Intraday Hunter using what appeared to be a fake trading platform.

What happened? Screenshots reveal a “localhost” link visible on the screen during a live trading session.

For those unfamiliar, a localhost address (typically starting with “127.0.0.1” or “localhost”) indicates a website running on a personal computer, not an actual live trading platform.

This raises serious questions: Was the entire trading interface fabricated?

Were the profits shown even real trades, or were they generated on a mock website created specifically to deceive viewers?

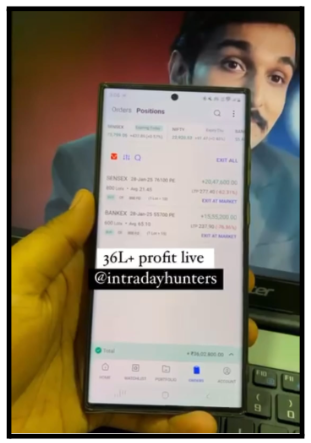

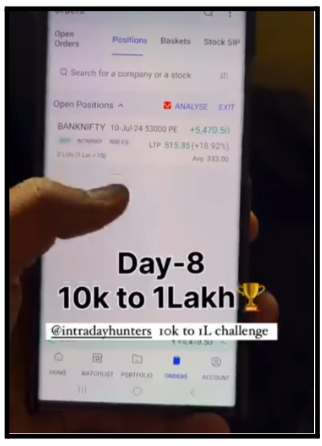

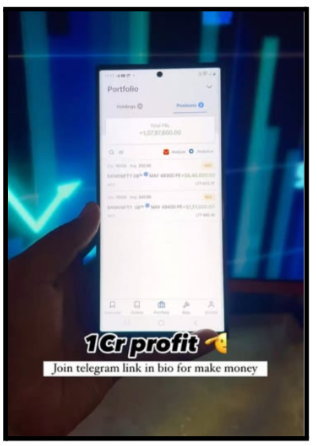

3. The ₹1 Crore Profit Claims and Inducement Shorts

Intraday Hunter regularly posts short videos on platforms like Instagram and YouTube showing massive profits:

- “36L+ profit live” – showing positions worth over ₹36 lakh

- “Day-8: 10k to 1Lakh” – claiming to grow ₹10,000 to ₹1 lakh in just 8 days

- “1Cr profit” – displaying portfolio values exceeding ₹1 crore

These inducement shorts are classic tactics used in what the CFTC describes as fraudulent schemes.

According to Business Standard’s report on YouTube influencer fines, such content is designed to create FOMO (Fear of Missing Out) and drive inexperienced traders to make impulsive decisions.

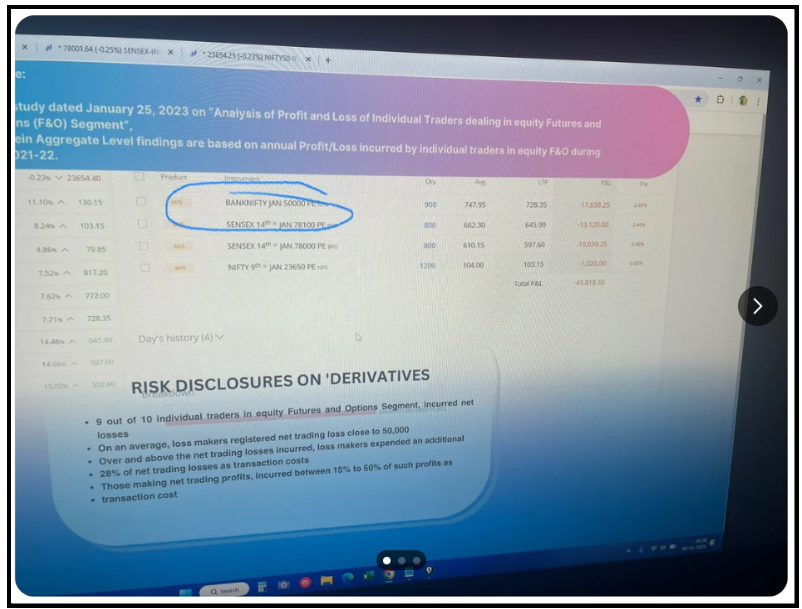

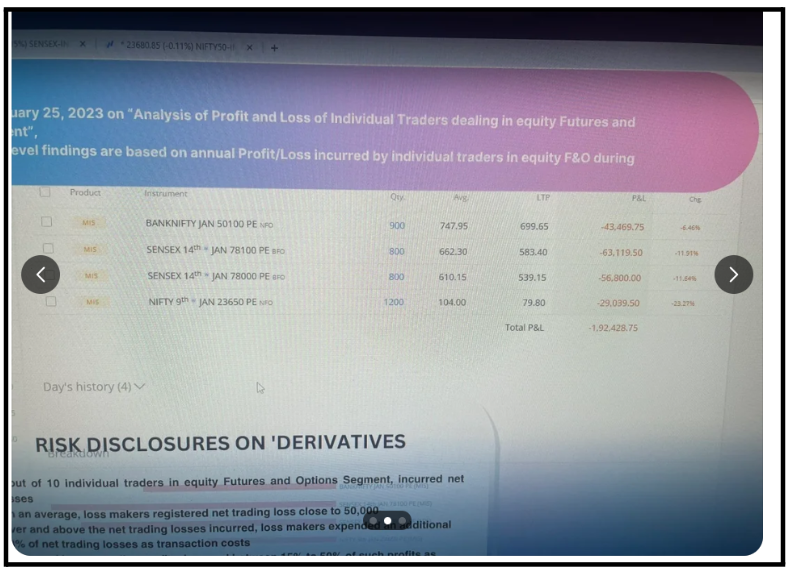

4. SEBI Data on Derivatives Trading Losses

Here’s the reality check that Intraday Hunter doesn’t want you to see clearly.

According to a SEBI study dated January 25, 2023, on “Analysis of Profit and Loss of Individual Traders dealing in equity Futures and Options (F&O) Segment,” the findings are stark:

Risk Disclosures on Derivatives:

- 9 out of 10 traders lose money – Yes, you read that right. 90% of people trading in F&O actually lose money

- Average loss is ₹50,000 – Those who lose money typically lose around fifty thousand rupees

- Transaction costs eat up profits – Even if you make some profit, 16% to 50% of it goes away in brokerage fees

The screenshots shared show specific data from this study:

- BANKNIFTY JAN 50100 PE NFO: Loss of -₹43,468.75

- SENSEX 14th + JAN 78100 PE BFO: Loss of -₹63,119.50

- SENSEX 14th + JAN 78000 PE BFO: Loss of -₹56,800.00

- NIFTY 9th + JAN 23650 PE NFO: Loss of -₹29,039.50

- Total P&L: -₹1,92,428.75

This official data contradicts the narrative that consistent profits in derivatives trading are easy or common.

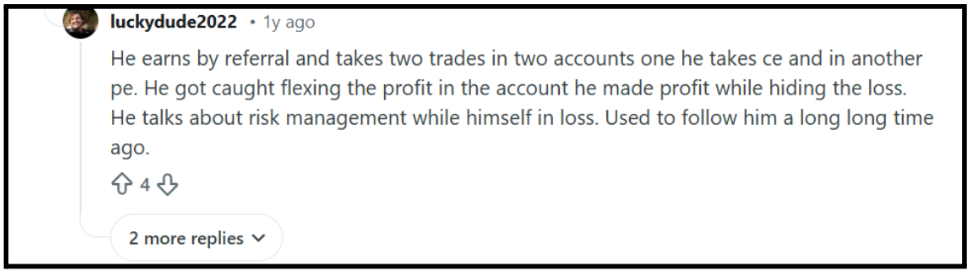

5. Hiding Losses

While specific organised complaints against Intraday Hunter are still emerging, the pattern follows similar cases that SEBI has prosecuted:

This exact pattern matches what followers have observed about Intraday Hunter’s selective profit showcasing.

Red Flags of Intraday Hunter YouTube Channel

Before you follow any trading guru’s advice, watch for these warning signs:

1. Unrealistic Profit Claims

- No legitimate trader makes consistent 100%+ returns

- Screenshots can be easily fabricated or manipulated

- Past performance (even if real) doesn’t guarantee future results

2. No SEBI Registration

- According to SEBI regulations, anyone providing investment advice or trading recommendations for a fee must be registered

- Operating without registration is illegal

3. High-Pressure Tactics

- “Limited time offer”

- “Join now before slots fill up.”

- “This strategy won’t be available tomorrow.”

4. Lack of Transparency

- No complete broker statements shown

- Only selective tradeare s displayed

- Losses are never discussed or shown

5. Focus on Recruitment Over Trading

- More emphasis on “joining the community.”

- Referral bonuses for bringing in new members

- Income primarily from courses/memberships, not trading

How to Report Trading Scams?

If you’ve been misled by Intraday Hunter or similar channels, take action immediately:

Here is how to file a complaint against such Trading frauds in India:

- File a complaint with SEBI: You can file your complaint by sending an email with your evidence.

- File a Cyber Crime complaint: The national cybercrime reporting portal is specifically designed for online fraud cases.

- Report on YouTube Platform: Report misleading videos directly on the platform by flagging them for scams and fraud.

- National Consumer Helpline: For cases involving mis-sold products or services like trading courses and premium memberships.

Need Help?

If you’ve been affected by misleading trading advice or have lost money following Intraday Hunter or similar channels, don’t suffer in silence. You’re not alone, and there are steps you can take.

We Can Help You:

If you’re facing issues with fraudulent trading advisors, fake profit claims, or have been mis-sold trading courses and services, register your complaint with us.

Our team can:

- Guide you through the legal complaint process with SEBI and other regulatory authorities

- Help you document evidence properly for filing complaints

- Connect you with legal experts specializing in financial fraud cases

- Assist in recovering your losses through proper legal channels

- Provide support in navigating consumer protection forums

Don’t let fraudsters get away with your hard-earned money.

Take action today and let us help you navigate the trading scam recovery process.

Remember: Your experience can help protect others from falling into the same trap. Report suspicious activities and share your story to warn fellow traders.

Conclusion

Here’s what Intraday Hunter won’t tell you: According to official SEBI data, 90% of retail traders in F&O lose money. The average loss is ₹50,000, not counting transaction costs.

The evidence against Intraday Hunter, from manipulated strike prices to localhost website usage to unrealistic profit claims, paints a concerning picture.

While we cannot definitively label it as fraudulent without legal proceedings, the red flags are impossible to ignore.

The bottom line: If someone’s primary business is selling the dream of trading success rather than actually trading successfully, question their motives.

Trading is hard. It requires years of learning, substantial capital, emotional discipline, and even then, most people lose money.

Anyone telling you otherwise is either lying or trying to sell you something.