Now and then, a new “get-rich-quick” app pops up, promising to turn your phone into a money-making machine. The latest name buzzing around is 91 Club.

You’ll find it everywhere: flashy ads that scream “easy profits,” 91 Club Telegram groups overflowing with so-called success stories, and friends bragging about how they doubled their money in just a few days.

But before you download it, know is 91 club is legal in India?

No wonder the offers, quick money promises, and even claims of a 91 Club hack attract many users.

But here’s the reality check: most of these platforms are not trading apps at all. They’re cleverly disguised gambling setups designed to make you lose more than you win.

In this blog, we’ll break down the big question: Is 91 Club Colour Trading even legal in India? And if you’ve already lost money, is there any way to recover it? Let’s dive in before your hard-earned cash gets trapped.

Is 91 Club Colour Trading Legal in India?

The short answer is NO.

91 Club and other colour trading apps are not recognised by any Indian regulator. Neither SEBI (which oversees stock markets) nor the RBI (which governs financial transactions) gives them approval.

That means, in the eyes of Indian law, they don’t fall under “trading” at all; they fall under gambling.

Some platforms try to look legitimate by showing offshore licences, often from places like Curaçao.

But here’s the truth: those licenses mean nothing in India. Indian law applies to Indian users, and the Public Gambling Act of 1867 makes it clear that games of chance are not permitted unless specifically allowed by a state government. Colour trading has no such exemption.

So while the app might operate freely online, participating in it is not legal for Indian users. And that legal gap also means you’re completely on your own if something goes wrong.

Is 91 Club App Safe?

Here are some risks of using colour trading apps like 91 Club:

- Withdrawal Issues – Users often face “system errors,” delays, or are asked to deposit more money before they can withdraw.

- Account Freezes – Some report sudden blocks or account closures without explanation.

- Addiction Factor – The app mimics a game, making users chase quick wins and fall into a gambling-like cycle.

- No Legal Protection – Color trading is not legal, and since it’s not recognised by SEBI or RBI, there’s no authority to approach if money is lost.

- High Scam Potential – Once funds are gone, recovering them is nearly impossible.

91 Club Complaint

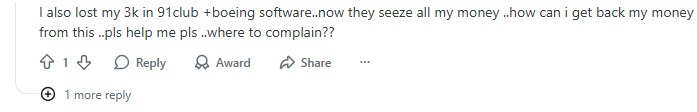

Several users have reported issues with the 91 Club app. Below are some real user complaints along with screenshots for reference.

- One user reported that they lost a large amount to 91Club and Boeing software, were pressured to invest more, and were warned that such scams often appear on social media and under big brand names.

- Another user reported losing ₹3,000 to 91Club and Boeing software, claiming that the platform has now seized all their funds. They expressed urgent concern about recovering their money and asked where to file a complaint for help.

These reports show how users have lost money and faced pressure or unresponsive support, serving as a strong warning to stay alert before investing in 91Club or similar platforms.

How to Report 91 Club App?

Now, if you have been unfortunate and ended up losing your money in the 91 Club app, then take quick action and file a complaint on:

- National Cyber Crime Portal – File a cyber crime complaint. This is the official platform for reporting online fraud in India.

- Local Police Station – Lodge a written complaint with all transaction details, screenshots, and communication records.

- Bank / Payment Gateway – Inform your bank or the app through which you made payments. Sometimes they can freeze or trace suspicious transactions.

Always keep proof, transaction IDs, chat screenshots, and app details. The stronger your evidence, the higher the chance of action being taken.

Need Help?

Register with us, and we will guide you through the process to file a complaint online and further with the escalation if required.

We have helped thousands of cyber crime victims to date and recovered more than ₹4 crores.

Conclusion

91 Club Colour Trading is not legal in India.

It isn’t recognised by SEBI or RBI and functions more like gambling than trading.

The risks are serious: blocked withdrawals, sudden account freezes, and no legal protection if you lose money.

The safest move is simple: avoid such apps and stick to regulated investments.