In the fast-moving world of crypto, where names like Binance and CoinDCX dominate the headlines, you might have stumbled upon a platform that seems to be everywhere lately: BingX.

It looks professional, the interface is slick, and the rewards for new users are hard to ignore.

But in an industry where even the biggest giants can stumble, you’re right to ask the million-dollar question: Is my money actually safe here?

Unlike the “too-good-to-be-true” scams that live on Telegram, BingX is a global heavyweight.

So, is BingX a secure vault for your digital assets in 2026, or is it just another “offshore” platform playing a risky game with your funds?

If you want an answer to this question, then you are at the right platform. This blog is for you.

Is BingX Safe in India?

Before jumping into the safety of BingX, let’s understand what BingX is.

BingX operates as an international cryptocurrency exchange. It provides users with multiple trading options, including spot trading, derivatives and an extensive copy-trading system.

BingX enables beginner users to access its platform, while some platforms restrict access to professional traders only.

The platform provides users with cryptocurrency trading options, along with a global guide and commodity trading opportunities through its derivative products.

Thereby offering a comprehensive trading solution for various speculators.

This is the most pressing concern for Indian traders. Currently, the safety of BingX in India is a game of “regulatory compliance”.

Think an international cryptocurrency platform can be safe?

Based on the available information, this app is currently available on the Apple App Store for Indian users.

However, the most important point is that the platform has no social media presence where users can verify how it operates.

Because nowadays people trust social media for everything.

How can we trust offshore platforms that lack the reliability of other apps or platforms?

Is BingX Legal in India?

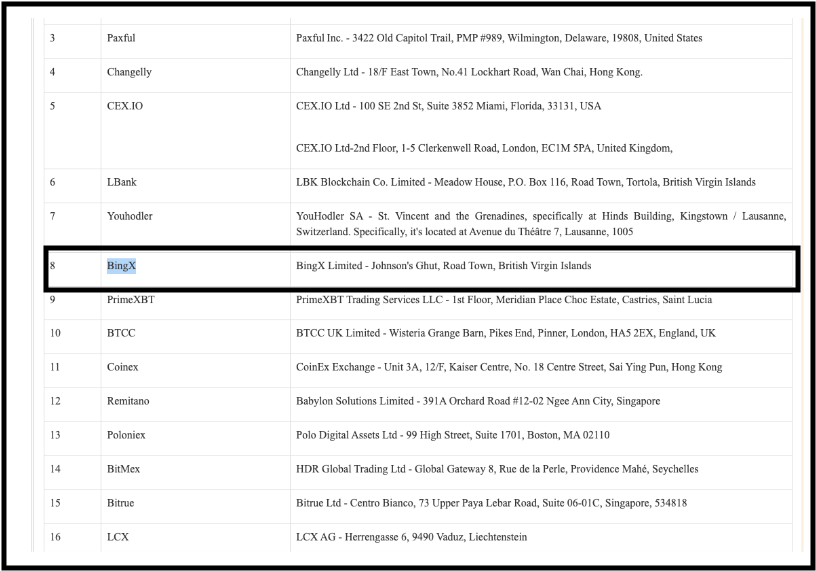

The question arises: if this platform is safe, why was it banned by the Financial Intelligence Unit in 2025?

This is a major thing to think about from a safety perspective, because our Indian government knows that this platform is not reliable and trustworthy for our Indian users.

Following the Financial Intelligence Unit crackdown in 2025, which led to the closure of several major offshore exchanges in India, the landscape has changed.

- PMLA Compliance: For an exchange to be “safe” and legal in India, it must register with the FIU and comply with the Prevention of Money Laundering Act (PMLA).

- The Risk: If you use BingX in India, you are responsible for calculating and paying your own 30% tax on gains and 1% TDS.

This clearly states that the app has been banned and is not safe for you to use, and that you should not blindly trust any other platforms either.

Check everything and the guidelines, and then avoid such fake platforms that are just here to steal your money.

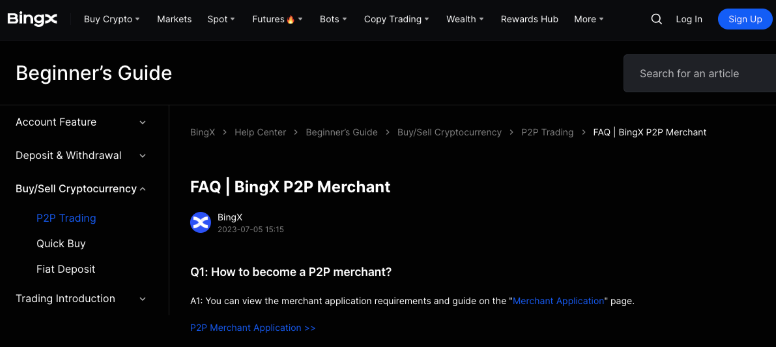

Is BingX P2P Safe?

Peer-to-peer (P2P) trading is the most common way Indians move INR into crypto, but it is also the most dangerous.

Now you must be wondering Is BingX P2P safe? The platform uses an escrow system to protect buyers and sellers, which is standard.

However, the risk in P2P isn’t usually from the exchange; it’s from the counterparty.

Many Indian users have reported bank account freezes after using P2P, as they unknowingly received funds from accounts linked to cybercrime.

While BingX tries to vet its P2P merchants, it cannot protect you from the Indian police (Cyber Cell) if your bank account is flagged.

On their website, they provide guidance on how to become a BingX P2P merchant. The new RBI policy states that platforms that market P2P lending are banned.

Then why is this platform guiding users on how to become P2P merchants? It clearly indicates that this platform is unsafe.

Key Aspects of the RBI P2P Policy

No Assured Returns: Platforms are banned from marketing P2P lending as an investment product with assured, guaranteed returns or liquidity options.

Risk Bearing: Lenders must bear the entire risk of principal and interest loss in case of borrower defaults; platforms cannot take on credit risk.

Lending Limits: An individual’s total exposure to all borrowers across all P2P platforms is capped at ₹50 lakh.

Net Worth Requirement: Lenders investing more than ₹10 lakh across platforms must submit a certificate from a chartered accountant confirming a minimum net worth of ₹50 lakh.

Escrow Account Mechanism: All transactions must pass through trustee-managed escrow accounts to ensure transparency.

Strict Operational Guidelines: Funds cannot remain in escrow for more than T+1 day, and platforms cannot cross-sell products, with the exception of insurance.

Transparency & Compliance: Platforms must disclose all risks to lenders and comply with India’s Digital Personal Data Protection Act, 2023.

These rules are designed to prevent excessive risk-taking by platforms and ensure that investors fully understand the risks involved in P2P lending.

BingX User Complaints

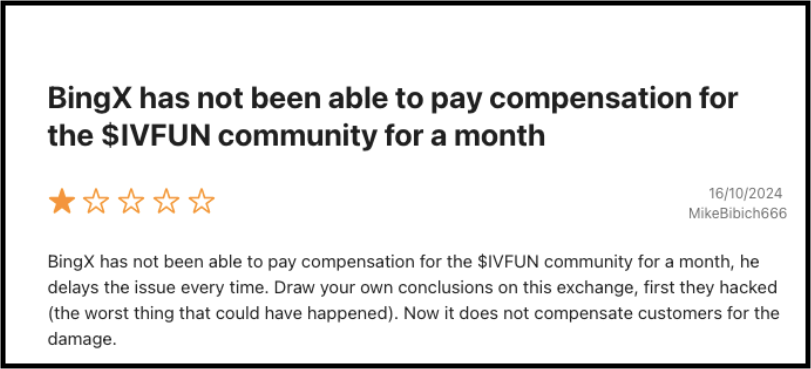

User feedback often highlights a few recurring BingX complaints

These are some complaints registered by international users who are facing issues with withdrawal and account blocking.

This frustrated user is complaining about BingX, which has not been able to pay compensation for about a month, and whenever this user asks about their money, they just delay it every time for about a month.

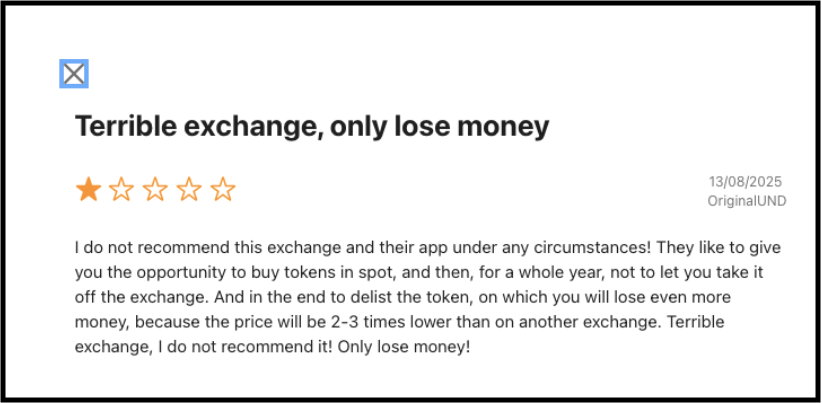

Here’s another victim of BingX; I’m not recommending this exchange to anyone else.

The platform operates in a way that first allows you to buy the tokens and then traps you, after which they do not withdraw your funds when it’s time.

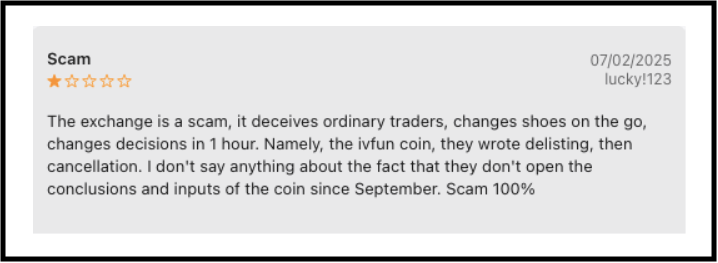

Here, another trapped user simply claims that this exchange is a scam.

I think it’s clear that users are complaining about this fake platform, whose sole purpose is to trap people and benefit itself at your expense.

How to File Cryptocurrency Complaints in India?

- Internal Reporting (Official BingX Channels)

Before going to the police, you must exhaust the platform’s own dispute resolution tools. This creates a paper trail for your case.

- 24/7 Live Chat: Access this via the BingX app or the website. This is the fastest way to get an initial response.

- Support Ticket: If your issue is complex (like a frozen account), submit a formal ticket through the “Submit a Request” section in the Help Centre.

- P2P Appeal: If you were scammed during a P2P trade or the seller hasn’t released funds, click the “Appeal” button on the order page. BingX will lock the assets in escrow until an agent reviews your payment proof.

If you have lost money to a P2P scam or if the exchange is refusing to release your funds without a valid reason, you should report it as a financial cybercrime.

- Visi cyber crime portal and file your complaint

- Helpline Number: Call immediately if your bank account has been compromised or frozen.

- Details to Include:

- Transaction IDs (TXIDs).

- Screenshots of the chat window and payment receipts.

- The Wallet Address where the funds were sent.

- The BingX UID of the counterparty (if it’s a P2P issue).

- Reporting to the Financial Intelligence Unit (FIU-IND)

Because BingX is an offshore entity, it is required under the PMLA to register with the FIU to operate legally in India.

- If you believe the exchange is operating in violation of Indian regulations, you can bring it to the notice of the Financial Intelligence Unit – India via their official portal.

- Note: This is usually for reporting the platform’s regulatory status rather than individual lost funds, but it adds pressure on non-compliant exchanges.

- Essential Evidence Checklist

When filing any report, ensure you have the following ready:

- Proof of Identity: Your KYC documents.

- Proof of Funds: Bank statements showing the INR deduction for P2P or the source of your crypto.

- Communication Logs: Exported chat history with the seller or BingX support.

- Error Screenshots: Clear images of withdrawal “Failed” or “Pending” statuses.

Need Help?

Facing withdrawal issues and account blocking from BingX?

Then you don’t have to worry anymore, just reach out to us and register whatever issues you are facing.

We will help you and guide you in resolving your issues and file complaints regarding trading scams recovery.

Conclusion

BingX is a feature-rich platform that has maintained a relatively clean track record since 2018, avoiding major hacks. However, for an Indian investor, “safety” is not just about hackers; it is about regulatory protection.

Because BingX is not an FIU-registered entity in India, you are trading at your own risk. There is no local mediator to help you if your funds are stuck, and the P2P system remains a “proceed with caution” zone for your bank account’s safety.

If you are a high-volume trader who understands the tax implications and uses cold storage for your assets, BingX offers great tools. But for a casual investor, the lack of local regulation makes it a high-stakes gamble.