Wouldn’t it be great if instant loan apps could provide you with quick cash in just a few clicks?

However, before you download a “Bus Rupee” app (or any other similar app), think twice and verify the facts.

Is Bus Rupee Loan App Safe?

A brief answer would be that, according to the news about many such quick loan apps, you should really be very careful.

A great number of these apps are purposely left unregulated and are run under the radar of the regulatory authorities; thus, they pose high risks of losing money and leaking personal information.

However, there are two different apps: Bus Rupee and Rupee Bus.

In this blog, the Bus Rupee app has been considered for further discussion.

Bus Rupee and similar apps are what many people think of when they want quick loans via their phones.

Nevertheless, it is quite a different story when one sees the reviews and official advisories of the apps.

There are warnings about this app and its counterparts for exorbitant interest rates to as low as 7-day repayment periods, and no transparency regarding their promoters and even registration.

Furthermore, the app copies the names of RBI-registered applications, which confuses users and often leads them to apply for loans and later face serious consequences.

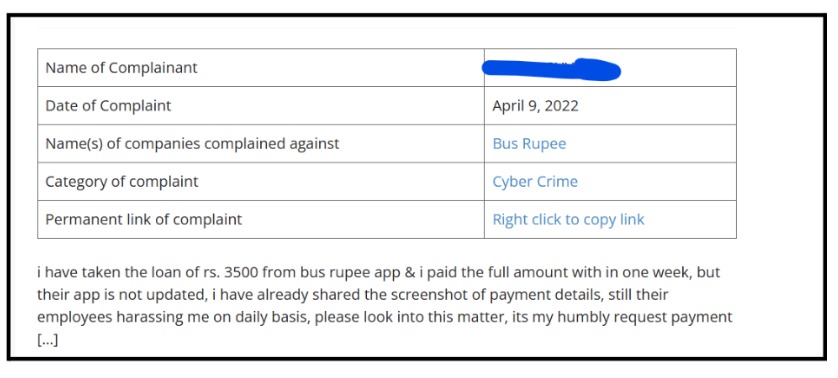

Bus Rupee Loan App Complaints

In multiple cases, it has been reported that victims died by suicide driven by harassment from loan app recovery agents.

In some cases, victims reported that, even after paying the full amount, they are harassed by the employees of the so-called loan app.

When borrowers couldn’t repay the exorbitant interest within the short time frame, the app operators would harass them, morph their photos, and threaten to send fake nude pictures to people on their contact list.

Do you ever see legitimate apps harass their users?

No, they will never do that.

How to Report Loan Frauds in India?

If you have been a victim of such loan app scams, then take quick action.

Here are the steps to file a complaint against online loan app:

- File a cyber crime complaint.

- You can also call the National Helpline number.

- Use the RBI Sachet portal to report the unauthorised entity, especially if they are falsely claiming an RBI affiliation.

- Flag the application on the Google Play Store or Apple App Store as ‘inappropriate’ or ‘spam/fraud’ to get it removed and protect others.

- File a formal written complaint with your local police station, providing all screenshots, transaction IDs, and contact numbers used for harassment.

Need Help?

Make a registration with us right away, and we will be the support that victims of online personal loan frauds in India need through the correct preparation of the files, writing of the complaint, and direction to the officials for filing the fraud report to the cyber police and the local police.

Conclusion

One cannot deny the charm of making easy money very quickly, but it has to be said that the risk caused by unverified digital loan apps, among which there is a device called “Bus Rupee,” is still very significant and dangerous.

Make sure you check the lender’s credentials as an absolute necessity: a non-RBI registration being easily verifiable is a huge red flag.

Act like a winner, keep your information safe, and always bear in mind that it is never worth sacrificing your tranquillity and personal security just for the sake of taking a loan.

Only lending platforms that are regulated and transparent should be used!