If you’ve been searching for instant loan apps to pull you out of an urgent money crunch, you may have stumbled upon something called the “Cash Cow App.”

The name itself sounds tempting. After all, who wouldn’t want an app that works like a personal cash cow, providing money whenever you need it?

But pause for a moment and think:

Why does an app with such a promising name have so little reliable information available about it?

And why do cyber experts repeatedly list it among risky or illegal loan platforms?

Here’s the reality check you might not have expected: while there are harmless “Cash Cow” reward apps that pay tiny amounts for games or tasks, any so-called loan app using this name is surrounded by serious red flags.

In fact, most searches for “Cash Cow Loan App” point straight to warnings, user complaints, and cybersecurity alerts.

It is often grouped with the hundreds of unregistered, unsafe, and illegal loan apps operating in India.

If this app crossed your screen, you’re right to be suspicious, and even more right to dig deeper before taking a step.

Is Cash Cow Loan App Safe in India?

One of the most important steps in ensuring your safety is to be able to identify the signs of a fake app.

Watch out for these signs, which are often referred to as red flags:

- Absence of RBI Registration: A trustworthy loan provider will always be registered with the RBI or a regulated Non-Banking Financial Company (NBFC).

- Prepaid Fees: Real lenders will only collect processing fees from your account after the loan has been approved and disbursed, definitely not before.

- Unusual App Permissions: If an app is demanding excessive and unnecessary access to your contacts or pictures, you should be very careful, since this is one of the main ways for abuse and blackmail.

- Bad Ratings: Many scam apps have promoted themselves through fake positive reviews; however, they also have a significant number of one-star reviews that point to fraud and harassment.

- Confusing and Threatening Behavior: If the app’s representatives, in an attempt to get their money back, use insulting or threatening language, this is a huge warning sign.

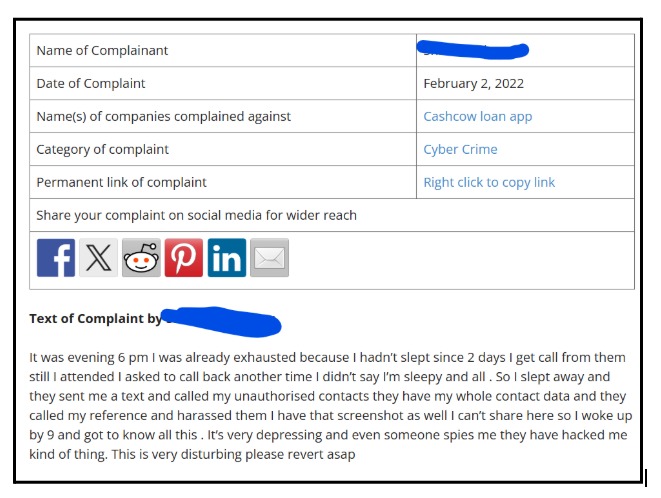

Cash Cow Loan App Complaints

Some of the victims’ and users’ reviews about the app:

- One victim stated,

“These people have no respect and no boundaries. They harass users with nasty and rude text messages, repeatedly threaten to contact family members and friends, and attempt to destroy their public image. This harassment happens several times a day, and their loan offers are often misleading.”

- In another case, the victim was getting threatening and abusive messages, and their relatives were also contacted and abused.

How to Report Loan Frauds in India?

If you have been a victim of such loan app scams, then take quick action.

Here are the steps to file a complaint against online loan app:

- Save the interactions by taking photos of the abusive messages, threat calls, the loan app interface, and any payment receipts.

- File a cyber crime complaint.

- File a complaint at the RBI Sachet Portal.

- Let Google Play Store or Apple App Store know that the app is a malware app.

- Tell your bank about the fraud and, if you want to be double sure, keep a close eye on your bank and credit reports for any illegal activities.

Need Help?

If an online scam has targeted you in any way, then register with us for help.

We will be with you through the whole process of complaint filing, evidence gathering, and taking the safety measures that follow.

We are proud to say that we have made it possible for thousands of victims to both recover and report their scams, and we are equally capable of doing it for you.

Conclusion

Don’t panic, fight back!

Never give in to the scammers’ demands for more money.

Your safety comes first. Use legitimate, RBI-approved sources for any financial needs.