Imagine you get an opportunity to join a group pooling money monthly, promising quick cash for whoever bids the lowest.

Sounds like a smart savings hack, right?

What if your next “sure thing” is a scam in disguise?

If you’ve ever wondered, “is chit fund legal in India?”, you’re not alone. This question haunts millions eyeing easy group savings amid rising living costs.

In a country where mutual aid meets modern greed, chit funds blend tradition with risk. Stick around as we dive deep, separating legit opportunities from traps that could wipe out your savings.

Is Chit Fund Legal or Illegal in India?

A chit fund scheme brings together a fixed group of people who agree to contribute a set amount, like Rs 5,000, every month into a common pot.

Each month, the total pot goes to one member via an auction where bidders offer to take less than the full amount, and the savings get shared among others.

Picture friends in your colony chipping in for Diwali funds; the lowest bidder wins the prize money minus a small cut for the organizer, called the foreman.

This cycles until everyone gets a turn, fostering savings discipline.

But here’s the hook: Without rules, that pot can vanish. Ever ask yourself, “How does the foreman pick winners fairly?”

Good question, because legit ones use transparent auctions.

So, when it comes to legality, chit funds are legal in India, but only under strict oversight.

The Chit Funds Act, 1982, a central law enforced nationwide (except Jammu & Kashmir, earlier, now included), regulates them to protect subscribers. State governments handle approvals and RBI oversight for fairness.

This Act mandates registration with state authorities, ensuring transparency and preventing misuse. But there are many chit funds that operate without registration. These are illegal and designed just to run with your savings.

Wondering why scams persist despite this?

Loopholes let fraudsters mimic chit funds without registering, preying on trust.

So if you are worried about your chit fund being legal or illegal, read on to decode it yourself.

Chit Fund Rules and Regulations

Ever ask yourself, “What stops chit funds from turning rogue?”

Government rules are the guardrails, straight from the Chit Funds Act, 1982, enforced by state registrars.

Here’s the core checklist from official guidelines:

- A security deposit (typically 5-10% of the chit value) must be lodged with the registrar to protect subscribers if the foreman defaults.

- Auctions happen monthly, open to all members, with bids recorded transparently so no secret deals are allowed.

- Foreman commission can’t exceed 5% of the chit amount, and full accounts must be shared with members regularly.

- Detailed records of subscribers, bids, payouts, and defaults must be maintained and audited yearly.

- No chit can start without a minimum number of subscribers (usually 80% of the group size), and payouts prioritize needy members fairly.

- Defaulters face penalties like forfeiture, but subscribers get legal recourse through the registrar.

If your chit fund skips any of these, like no registration proof, opaque bids, or delayed payouts, it’s a massive red flag, and you must run!

Why risk it when legit ones thrive under these safeguards?

Chit Fund Scam

Scammers love chit funds’ trusted image, twisting it into Ponzi-like traps with fake high returns, vanishing after collections.

They rent flashy offices, lure via social media or agents with 10-20% promises, pay early to build false trust, then bolt.

How do they pull it off?

No registration, funds siphoned to personal accounts or abroad, leaving empty promises.

Readers often wonder: “Could this happen to me?” Absolutely, it can happen to anyone.

Have a look at these real fraud cases of chit fund:

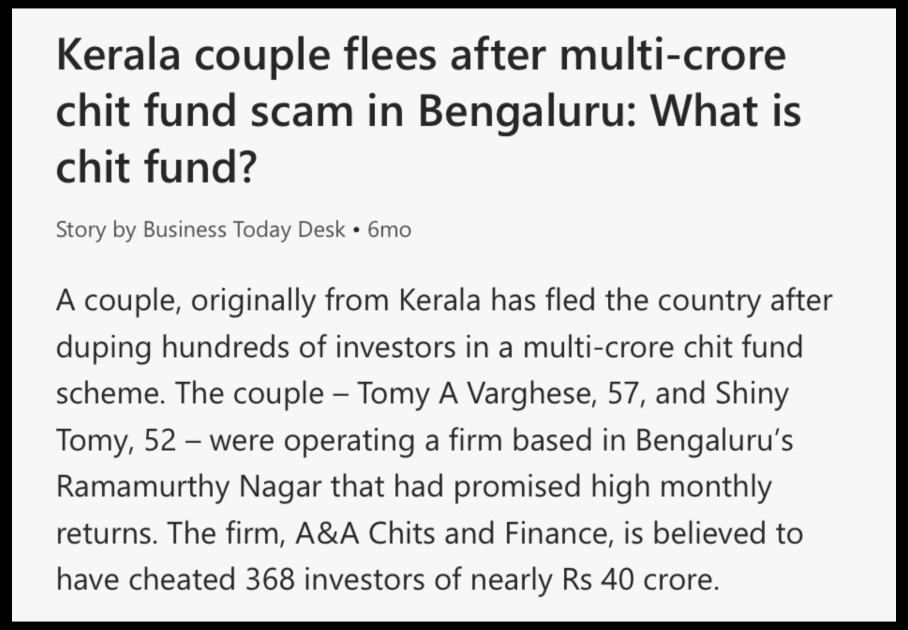

- The Bengaluru “A&A Chits” Betrayal

For 25 years, Kerala couple Tomy A. Varghese and Shiny Tomy cultivated unshakable trust in Bengaluru through their “A&A Chits and Finance” firm.

They drew in over 400 to 750 investors.

Then, in a heartless twist in July 2025, the couple abruptly halted all payments and vanished back to Kerala, leaving behind a staggering ₹40 crore in stolen funds and shattered dreams.

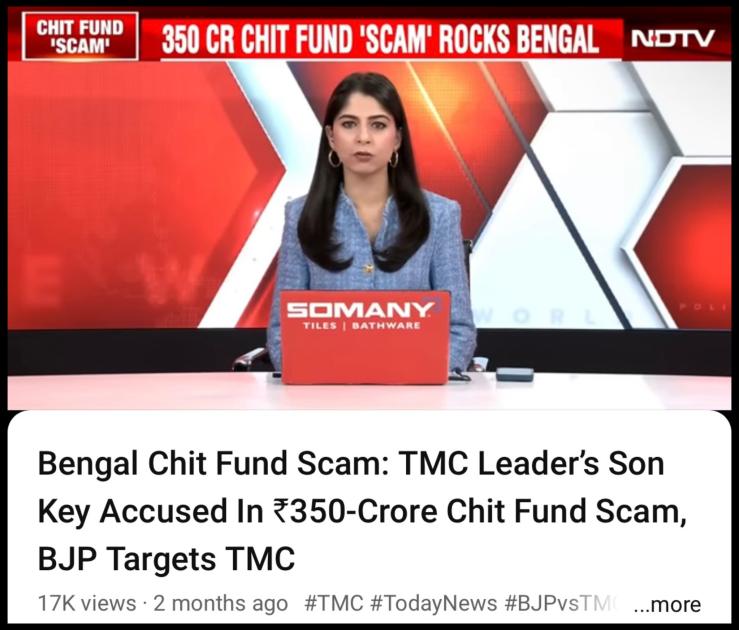

- The Asansol Ponzi Fury

In Asansol, West Bengal, Tahsin Ahmed, son of a prominent TMC leader, lured around 3,000 families into his unlicensed sham company with irresistible promises of 14% monthly returns.

The illusion crumbled in October 2025 when Ahmed disappeared overnight, sparking massive street protests as the true scale of the loot emerged: a whopping ₹350 crore vanished into thin air.

This explosive scandal exposed how political shadows can cloak financial predators, turning neighbors’ hopes into widespread despair.

- The Rightmax Technotrade Mirage

Rightmax Technotrade International dangled a too-good-to-be-true deal across Odisha and Tamil Nadu. It was, “deposit ₹10,000 and watch it double through ₹1,000 monthly payouts for 33 months.”

Director G. Sivakumar kept the scheme alive from 2018 until the CBI finally tracked him down and arrested him, unveiling the grim total: ₹18.25 crore.

The fallout lingers as a bitter lesson in the perils of unchecked “doubling” schemes.

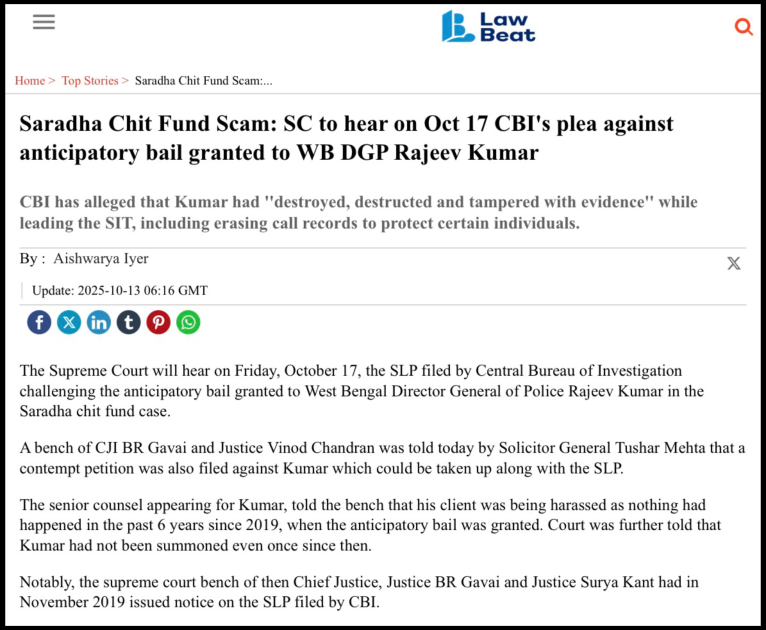

- The Saradha Group’s Lingering Shadow

Saradha Group dazzled millions across states with celebrity endorsements and glossy promises, funneling 1.8 million depositors into one of India’s largest Ponzi nightmares.

They gathered more than ₹2,500 crore before the house of cards collapsed.

The wounds remain fresh, with the Supreme Court still grappling with the fallout from this audacious fraud that preyed on trust in chit-like investments.

These tales underscore a vital truth: before handing over your hard-earned money, always verify if a chit fund is registered under the Chit Funds Act, 1982, because blind faith can cost everything.

What to do if Online Fraud Happens?

Caught in a chit trap?

Act fast; these steps reclaim your power. First, gather evidence: transaction receipts, chats, promises.

- Gather Evidence: Collect the necessary information, such as the following:

- receipts

- bank statements

- WhatsApp chats

- chit agreements

Screenshot everything and save dates, amounts, and promises.

- File an FIR: Visit your nearest police station or cyber crime department. Mention it’s a chit funds scam under IPC Sections 420 (cheating) and 120B (conspiracy).

- Lodge a complaint with Chit Fund Registrar: Contact your state’s Registrar of Chits (e.g., Tamil Nadu: 044-2859 3201). Submit docs online or in-person. They investigate unregistered entities.

- Alert RBI/SEBI Helplines: File a complaint with SEBI or RBI. Take all the evidence with you. They blacklist fraudulent entities.

- Join Victim Groups: You can share your story on social media for collective action and to make other people aware of the scam.

Need Help?

If you have been a victim of a Chit Fund Scam or any other scam, you can register with us.

We are a team of experts who will help you in every step of filing your complaint. By now, we have recovered 11 crore+ amount lost to scams.

Conclusion

Chit funds can build community wealth when legal, but scams shatter dreams daily.

We’ve uncovered the Act’s shield, red flags, and victim cries. Now it’s your move.

Ask: Is my scheme registered? Returns realistic?

Don’t let greed blind you; verify via state registrars.

India fights back with tools like cyber portals; use them ruthlessly.

Stay vigilant, invest wisely, and turn awareness into armor.