Received a message about DSJ Exchange? Someone promising you easy crypto profits daily? Showing impressive account balances growing every hour?

Before depositing your hard-earned money, you need the complete truth. What we discovered will save you from financial disaster.

What is DSJ Exchange?

Let’s start with what they claim to be. DSJ Exchange presents itself as a cryptocurrency trading platform based in London, advertising advanced security features and global compliance.

At first glance, it sounds professional, even reassuring.

But once you look closer, the cracks begin to show, and it doesn’t take long before a serious doubt creeps in: is DSJ Exchange a scam, or just another risky platform dressed up with polished marketing?

According to BehindMLM’s comprehensive investigation, DSJ Exchange connects directly with BG Wealth Sharing (BG-168). This operates as a click-based Ponzi scheme.

Here’s how their system actually functions. You receive supposed trading signals through messaging platforms.

These arrive as simple 6-character codes. You paste these codes into their application interface. Numbers climb on your dashboard.

But no actual cryptocurrency trading happens. Zero. Your “trades” exist only inside a manipulated database controlled by scammers.

Regulatory Warnings Against DSJ Exchange

Multiple international financial authorities investigated DSJ Exchange.

Their findings raise massive safety concerns.

1. UK Financial Conduct Authority Alert

According to the FCA’s official warning published May 7, 2025, DSJ Exchange operates completely unauthorized. The regulator explicitly warns people to avoid dealing with this operation.

Their listed contact methods? According to FCA documentation, just Telegram accounts @BG_Stephen and @Elena1992818, plus one email address.

Think about this carefully. Would legitimate crypto exchanges conduct business primarily through personal Telegram handles?

2. New Zealand FMA Blacklist

According to the Traders Union’s investigation, New Zealand’s Financial Markets Authority blacklisted dsjoo.com officially on April 25, 2025.

The charges listed? Market manipulation, including pump-and-dump schemes and wash trades. Fraud and various types of financial misconduct. Impersonation of licensed entities.

These aren’t minor compliance issues. These represent serious financial crimes.

3. India SEBI Status

For Indian investors specifically, this matters most. DSJ Exchange has zero registration with SEBI. None whatsoever.

What does this mean practically? Your deposits receive no legal protection. If money disappears, Indian financial laws provide no recourse.

Operating without SEBI approval while targeting Indian users violates Indian financial regulations directly.

DSJ Exchange User Complaints

Real users share remarkably similar experiences. Their testimonials reveal dangerous patterns.

Withdrawal Problems

According to multiple victim reports documented across review platforms, the pattern follows identical steps:

- Initial Success – Small deposits (₹3,000-₹5,000) process smoothly. First withdrawal succeeds (₹5,000-₹10,000 range). This builds false confidence deliberately.

- Encouragement Phase – Platform operators encourage larger deposits. Show projected returns using compound interest calculators. Promise guaranteed daily profits between 1.3% to 2.6%.

- The Trap – When attempting to withdraw larger amounts, sudden problems appear. The system demands “tax fees” before releasing funds. After paying these additional fees, accounts freeze permanently anyway.

- Complete Loss – Money never gets returned. Support becomes unresponsive. Telegram contacts disappear. Website domains change.

Real User Experiences

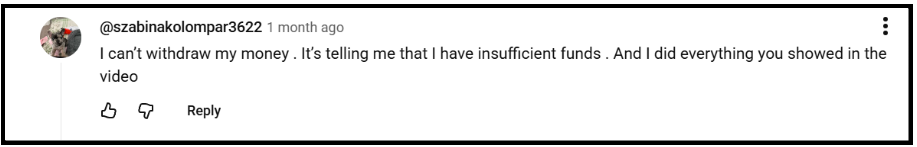

According to user comments on DSJ Exchange promotional videos:

This reveals the classic withdrawal trap. Users follow the official tutorial videos exactly. Yet withdrawals still fail with technical excuses.

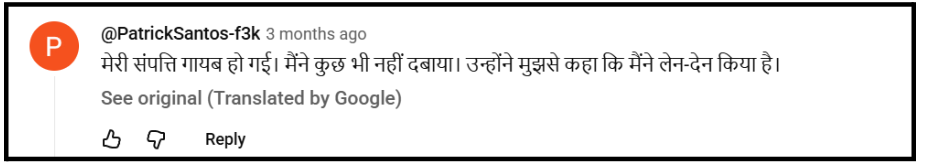

Translation: “My property disappeared. I didn’t press anything. They told me I made a transaction.”

This indicates unauthorized account manipulation. Funds are disappearing without user action. Platform blaming victims for non-existent transactions.

According to user reviews on ReliableForexBroker, one victim warns explicitly: “This company will rip you off. They don’t care about everything; they just want to rob you, and they don’t give you your money back, don’t do it, listen to me.”

How DSJ Exchange Actually Operates?

Understanding the mechanics reveals everything about safety.

According to BehindMLM’s detailed analysis, here’s the real operation structure:

Step 1: Initial Contact – Scammers reach out via WhatsApp, Telegram, or social media.

They display screenshots of growing profits. Build relationships over time before introducing investment opportunities.

Step 2: Deposit Phase – Victims deposit USDT (Tether cryptocurrency) into the platform. Receive access to the DSJ Exchange application.

Step 3: Fake Trading – Users receive “signals” through BonChat messaging or Telegram groups. These signals are just 6-character codes. Users paste codes into the app and click buttons.

Step 4: False Profits – Dashboard shows accumulating returns daily. Numbers climb steadily. Everything appears profitable on screen.

Step 5: The Reality – According to BehindMLM, zero actual cryptocurrency transactions occur on real markets. The buttons clicked don’t execute genuine trades. Profits displayed are fabricated database entries.

Step 6: Ponzi Structure – Your deposits fund earlier investors’ withdrawals. Classic Ponzi architecture. Recruitment bonuses get distributed. Platform expenses covered. When withdrawal requests exceed new deposits, the entire scheme collapses.

Step 7: Exit Scam – Accounts freeze suddenly. Domains change overnight. Telegram contacts disappear. Operators vanish with remaining funds.

And when you are scammed, you run to the customer support.

Messaging App-Based Operations

Real cryptocurrency exchanges operate through professional websites and registered mobile applications. They provide official customer support systems and verified communication channels.

DSJ Exchange? According to the FCA, their primary contacts are anonymous Telegram accounts. No official phone support. No verified email domain or physical office you can visit.

This setup allows operators to disappear instantly when withdrawals exceed new deposits.

How to File Cryptocurrency Complaints in India?

Already lost money?

Report trading scams immediately through these channels:

- File a Cyber Crime complaint– Select “Financial Fraud.” File your complaint under the “Online Investment Fraud” category. Include all evidence comprehensively.

- File a complaint with SEBI – Access SEBI’s complaint platform. Report the unauthorized trading platform. Mention zero SEBI registration explicitly.

- Economic Offences Wing – For losses exceeding ₹1 lakh, visit your state’s EOW office directly. Bring all printed evidence and documentation.

- Local Police Cybercrime Cell – File FIR at the nearest cyber cell. Document everything with screenshots, transaction records, and communication logs.

Include these details: All domain names used, Telegram contact handles, deposit transaction records, withdrawal attempt evidence, recruitment chain details, and all supporting screenshots.

Need Help?

Facing DSJ Exchange fraud already? Deposited money and now experiencing withdrawal problems? Confused because initial small withdrawals worked fine?

Register with us if you’re facing this issue. We understand your situation completely. The confusion. The frustration. The financial stress.

Our support includes:

- Evidence documentation guidance – Proper documentation significantly improves potential recovery outcomes

- Authority reporting assistance – Navigate SEBI, Cybercrime Portal, and EOW processes effectively

- Recovery strategy development – Each situation requires specific approaches based on your circumstances

- Legal expert connections – Access verified professionals specializing in crypto fraud cases

Don’t suffer alone. Don’t trust “guaranteed recovery” services demanding upfront payments.

Your trading scams recovery begins with proper steps. Register today.

Conclusion

Is DSJ Exchange safe? The evidence provides an unambiguous answer: Absolutely not.

Multiple international regulators issued formal warnings. The UK’s FCA blacklisted them. Australia’s ASIC confirmed fake licensing credentials.

New Zealand’s FMA cited fraud and market manipulation. India’s SEBI never authorized them.

According to victim testimonials, DSJ Exchange withdrawal requests systematically fail for larger amounts. According to independent assessments, no legitimate regulation exists anywhere.

The evidence overwhelms any doubt. DSJ Exchange operates as a Ponzi scheme using fake trading signals.

For Indian investors specifically, risks multiply dramatically. Zero SEBI protection means zero legal recourse. No complaint mechanisms apply. Fund recovery becomes virtually impossible.

Remember always: Legitimate crypto exchanges never operate primarily through Telegram. Never use completely fake identities. Never systematically freeze withdrawals.

DSJ Exchange does all these things. That answers everything about safety.