Thinking about using Fizzy Cash to earn money?

Safety should be your first concern.

The app promises rewards through wheel spins. Over 10 lakh downloads suggest popularity.

But is your data secure? Can you trust this platform with personal information?

Let’s investigate the safety aspects thoroughly.

Is Fizzy Cash App Safe in India?

According to the Play Store information, the app is developed by “Thedustore108.” This developer’s name provides minimal transparency about who operates the platform.

Legitimate apps typically display registered company names. They provide official websites and customer support channels.

Clear contact information builds user trust.

With Fizzy Cash, none of these transparency markers exist.

The developer identity remains vague, and no official website appears in the listing. This immediately raises the question many users ask: Fizzy Cash app real or fake?

This lack of transparency creates immediate safety concerns.

When using any app that handles personal information, understanding data practices becomes essential.

Let’s examine what Fizzy Cash app reveals about protecting user data:

- Unknown Data Collection Practices

What information does Fizzy Cash collect from users? The app requires various permissions during installation.

Most earning apps request access to device data. Phone number, email address, and payment details become necessary for withdrawals.

However, Fizzy Cash’s privacy policy remains unclear. Users cannot verify how their personal information is handled.

- Payment Information Vulnerability

The app displays UPI payment options prominently. Users must provide payment details to purchase additional spins.

Where does this financial information go? How is it protected?

These questions lack clear answers.

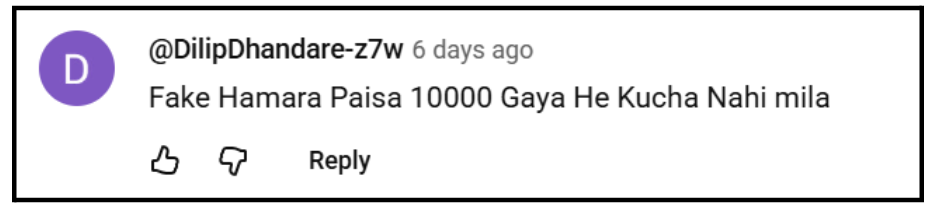

This indicates users have transferred real money. But protection mechanisms for these transactions remain questionable.

- Unverified Withdrawal System

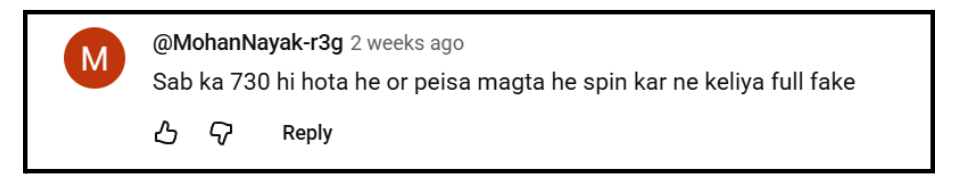

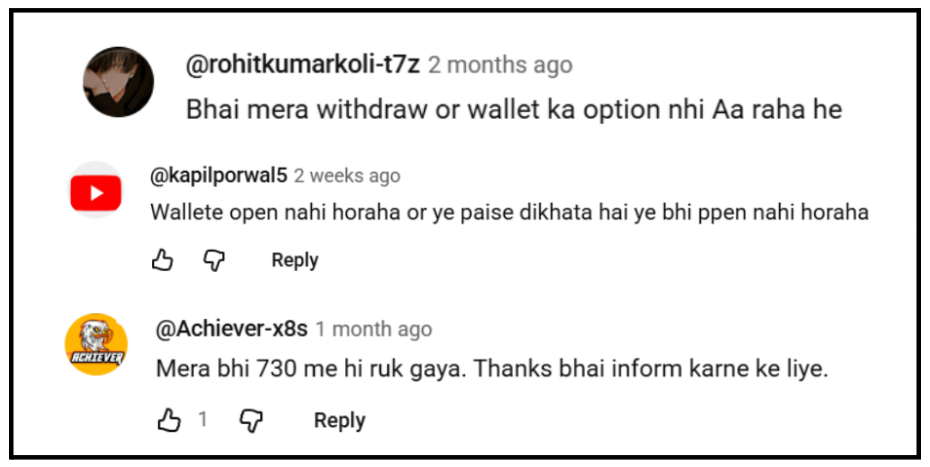

According to the app’s mechanics, everyone receives ₹730 in winnings. However, the withdrawal threshold sits at ₹1,000.

This mathematical gap forces users toward purchasing spins. But purchased spins don’t lead to successful withdrawals either.

- Wallet and Withdrawal Interface Issues

Multiple users report technical problems with the wallet functionality. These issues prevent access to supposed earnings.

According to these testimonies, the withdrawal feature itself becomes inaccessible for some users.

Even after collecting the ₹730 amount, the button to access funds simply doesn’t appear.

This reinforces that everyone receives identical amounts, and many face identical technical barriers preventing withdrawals.

- Entertainment Classification Concerns

According to Play Store categorization, Fizzy Cash lists itself under “Entertainment” rather than “Finance.”

This classification serves as legal protection. If users complain about financial losses, developers can claim it’s just entertainment.

However, this creates confusion about the platform’s actual purpose. Apps requesting real money payments should maintain financial category standards.

The mismatch between promised earnings and entertainment classification raises safety doubts.

- Absence of Regulatory Compliance

Legitimate financial platforms in India require regulatory compliance. RBI guidelines govern digital payment systems. Consumer protection laws apply to earning platforms.

Does Fizzy Cash comply with these regulations? No evidence suggests proper licensing or registration.

Apps operating outside regulatory frameworks cannot guarantee user protection. Safety mechanisms remain absent without oversight.

What To Do If You Are Being Scammed?

If you’ve experienced issues with this app, reporting helps protect others:

- Google Play Store – Use the “Flag as inappropriate” option, select “Deceptive behavior” or “Privacy concerns.”

- File a Cyber Crime complaint – File a complaint under “Online Financial Fraud” with evidence

- Consumer Forum – Approach the district consumer forum if losses exceed ₹10,000

- Banking Authorities – Report unauthorized transactions to your bank immediately

Documentation proves crucial. Screenshot all interactions, save payment receipts, and record communication attempts.

Need Help?

Lost money through Fizzy Cash?

You’re experiencing a common scam pattern.

Concerned about data privacy after installation?

Your worries are justified.

Unsure how to proceed with complaints?

The process seems complicated alone.

Register with us today. We provide comprehensive support for earning app scam victims across India.

Our services include:

- Security assessment of your affected accounts

- Step-by-step guidance through reporting processes

- Evidence organization for stronger complaints

- Coordination with consumer protection authorities

- Support group access for affected users

Contact us immediately. Your financial and data safety deserve protection.

Conclusion

Is the Fizzy Cash app safe? Evidence overwhelmingly says no.

Financial safety risks are severe. Users consistently lose money without receiving withdrawals. The platform operates without transparency or regulatory compliance.

Data privacy concerns remain unaddressed. Unknown data collection practices create vulnerability. Security measures appear absent from the platform.

Psychological safety suffers from manipulation tactics. False hope and impossible conditions target user desperation.

User testimonies uniformly report negative experiences. No successful withdrawal verifications exist anywhere.

From every safety perspective: financial, data privacy, emotional, and technical – Fizzy Cash presents significant risks.

Your safety matters more than promised earnings. Choose platforms with proven safety records and transparent operations instead.