When your investment dashboard shows profits but your bank account shows empty, is that platform truly safe?

Safety isn’t just about having an RBI license. It’s about whether you can access your money when you need it. Whether customer support answers when problems arise.

For thousands of LendBox investors, the answer to these questions has been devastating.

Let’s examine whether LendBox is genuinely safe for your hard-earned money.

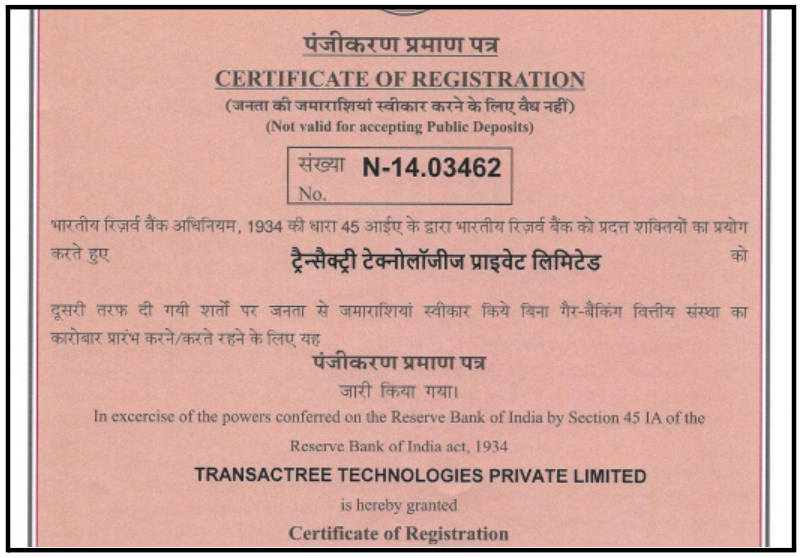

Is LendBox RBI-Registered?

LendBox holds NBFC-P2P certification from RBI. Registration number: N-13.03335. According to LendBox’s own claim, they received this in 2019.

Many investors assume RBI registration guarantees safety. It doesn’t.

Registration means permission to operate. Safety means actually operating responsibly. The difference matters enormously.

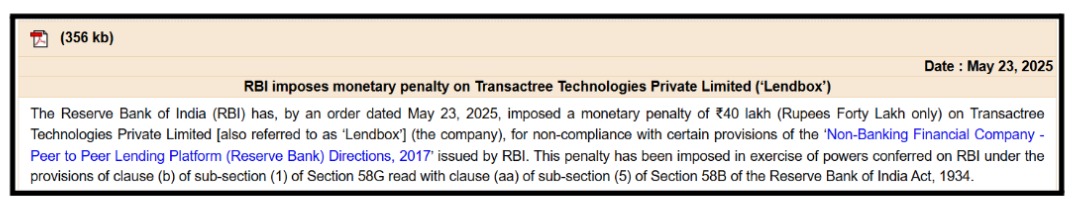

The ₹40 Lakh Penalty: When Regulators Lose Trust?

According to the RBI’s official press release dated May 23, 2025, LendBox was penalized for multiple serious violations:

Violation 1: Using unauthorized co-lending escrow accounts instead of proper P2P channels. Your money was routing through accounts it shouldn’t have.

Violation 2: Failing to disclose borrower credit assessments to lenders. You were investing blindly without risk information.

Violation 3: Disbursing loans without getting specific approvals from lenders. Your money was being lent without your permission.

These aren’t minor paperwork errors. These are fundamental operational failures affecting investor safety.

Safety verdict on regulations: Licensed but repeatedly violating norms. RBI registration provides legal cover, not investor protection.

Are Your Funds Safe With LendBox?

If you’re investing through LendBox, it’s important to understand the red flags before trusting your funds.

The Lock-In Crisis

When the RBI released new guidelines in August 2024, LendBox made a catastrophic decision.

They stopped “anytime withdrawal” features and re-invested approximately ₹7000 crore without explicit consent from investors.

Real Impact: What Happened to Investors?

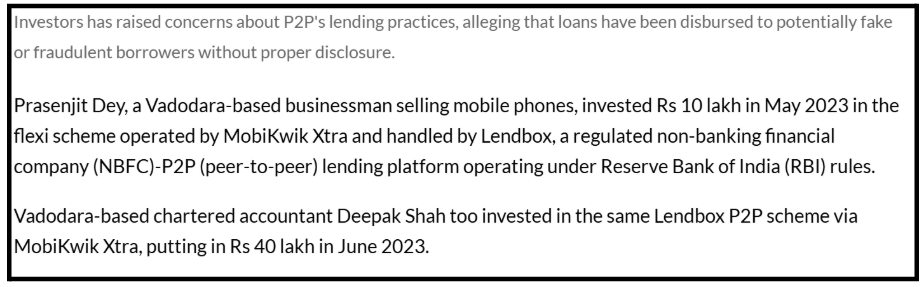

According to MoneyControl journalist Kayezad Adajania’s report, investors like Prasenjit Dey invested ₹10 lakh in May 2023, expecting flexibility.

His funds were locked until May 2026. CA Deepak Shah invested ₹40 lakh in June 2023. Locked until June 2026.

These weren’t new RBI guideline violations. These were contracts signed BEFORE the changes. Yet LendBox unilaterally changed terms.

The Business Model Collapse

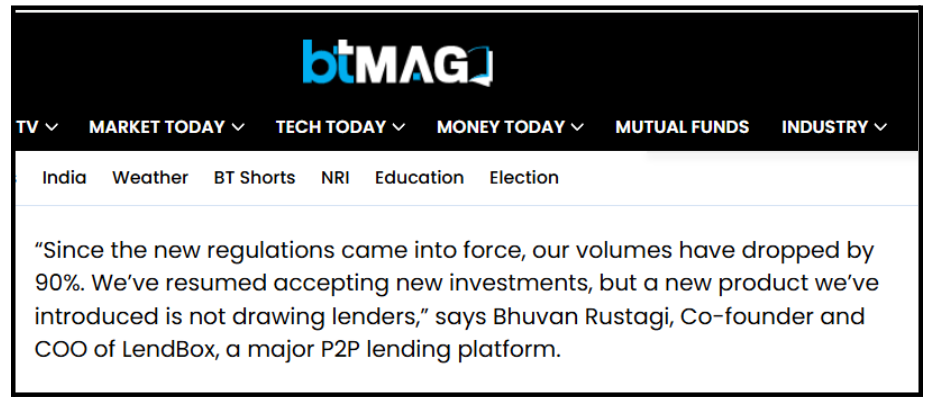

According to a report from October 2024, LendBox’s own COO Bhuvan Rustagi admitted their volumes dropped 90% after new regulations.

A 90% business collapse raises serious questions. When a platform loses that much volume, operational costs explode, staff reduces, and customer service crumbles.

Safety verdict on financial access: Funds locked without consent, withdrawals denied, massive business instability.

LendBox Privacy Concerns

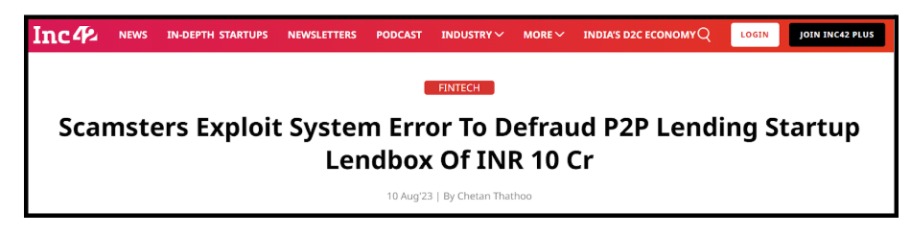

According to Inc42’s detailed report, between December 2022 and March 2023, scammers exploited system loopholes to steal ₹10 crore.

The fraud method was shockingly simple: Deposit money, withdraw through the app, file a chargeback claiming non-receipt, and get refunded. Double the money.

457 scammer accounts successfully executed this before LendBox noticed. More importantly, the FIR document itself acknowledged “system error at LendBox’s side.”

If basic security has such massive holes, what about your:

- Bank account details?

- PAN card information?

- Address proof documents?

- Transaction patterns?

Privacy Violations: The Disturbing Pattern

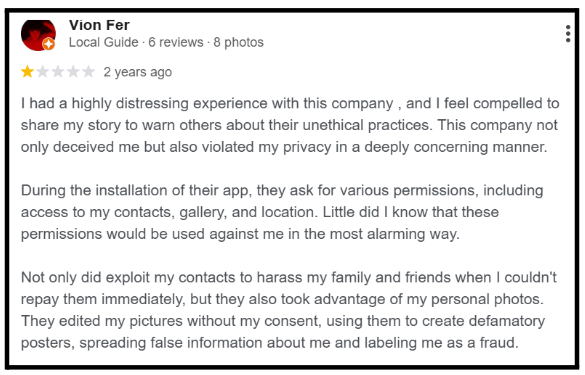

According to a Google Review by Vion Fer from 2 years ago, LendBox’s app asks for permissions to access contacts, gallery, and location.

When this user faced repayment delays, the platform:

- Contacted family and friends to harass them

- Took personal photos without consent

- Edited pictures to create defamatory posters

- Spread false information, labeling the user as a fraud

This isn’t a minor privacy breach. This is an aggressive misuse of personal data for harassment.

Safety verdict on data security: System vulnerabilities proven, privacy actively violated for harassment.

Fake Loans Destroying Lives

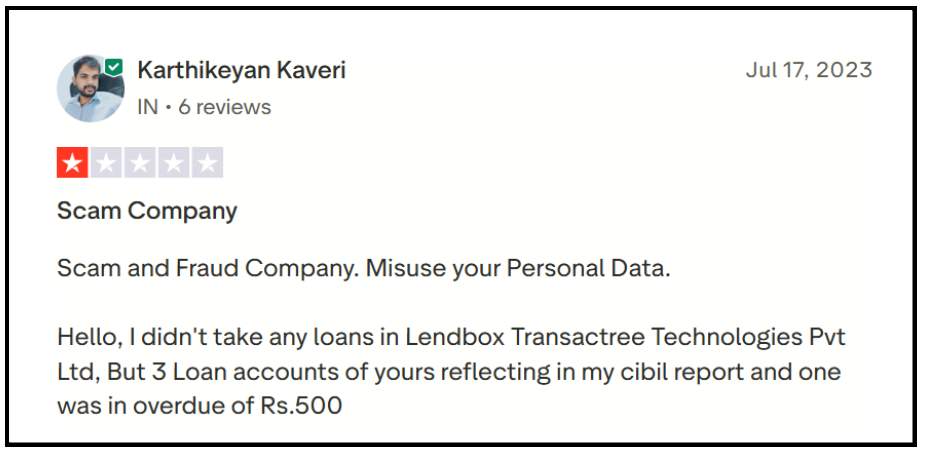

According to a Trustpilot review by Karthikeyan Kaveri dated July 17, 2023, three loan accounts appeared on his CIBIL report that he never took:

- Loan Account 778144: ₹2,000 (Closed)

- Loan Account 817656: ₹2,000 (Active)

- Loan Account 889848L: ₹1,000 (₹500 overdue)

He never borrowed from LendBox. Yet CIBIL showed him as a defaulter. His home loan application got rejected. Career opportunities requiring credit checks became unavailable.

The Pattern Continues

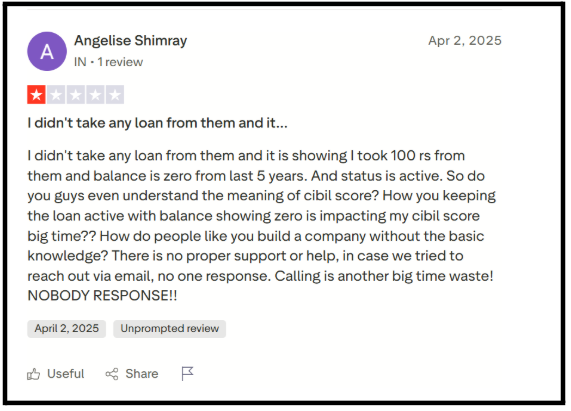

According to Angelise Shimray, she faced a fake ₹100 loan showing active status for 5 years with zero balance. Nobody from LendBox responded to fix it.

These aren’t isolated glitches. This is systematic CIBIL manipulation affecting hundreds, possibly thousands.

Safety verdict on credit protection: Fake loans appearing without permission, credit scores destroyed, and no resolution mechanism.

LendBox Complaints

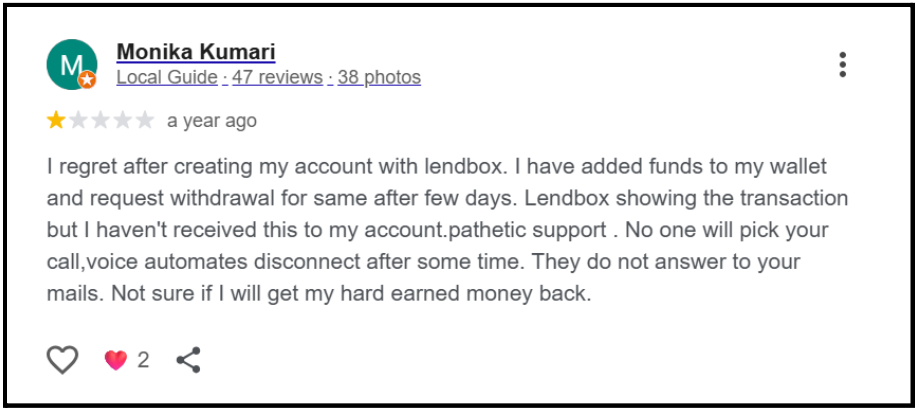

- According to Monika Kumari, she requested withdrawal. Dashboard showed transaction complete. The bank account remained empty. Calls went unanswered. Emails ignored.

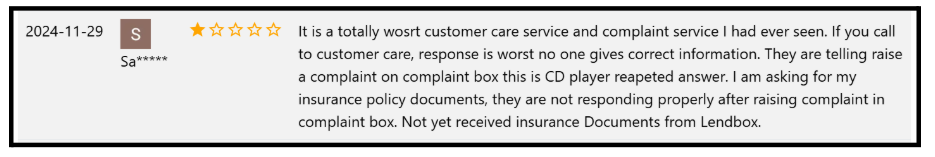

- According to another user, customer care gives the worst service.

Calls go nowhere, complaints get automated “CD player repeated answers,” and critical insurance documents remain undelivered despite multiple follow-ups.

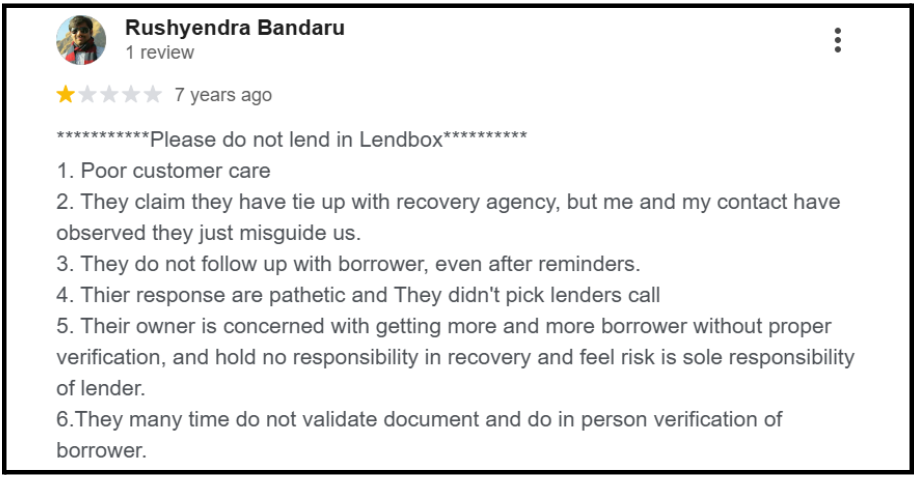

- According to a Google Review by Rushyendra Bandaru from 7 years ago, customer support problems existed back then: Poor customer care, misleading recovery agency claims, no borrower follow-up, pathetic responses, avoiding lenders’ calls.

Seven years later, according to recent 2024-2025 reviews, nothing changed. If anything, it worsened.

Safety verdict on customer protection: Support is non-existent when problems arise, Comparing LendBox’s Safety Claims vs Reality

According to their marketing and website:

- “RBI registered and regulated.”

- “Advanced borrower screening through 250+ data points”

- “Diversification reduces risk.”

- “Transparent borrower information”

- “Secure escrow mechanisms”

- “24-hour complaint investigation”

However, the reality shows a completely different picture:

- RBI penalized Lendbox with ₹40 lakh for serious violations

- Borrower Screening: According to Rushyendra Bandaru’s review, they don’t properly verify borrowers or do in-person verification

- Risk Diversification: When ₹7000 crore gets locked across all investments, diversification doesn’t help

- Transparency: Investors weren’t told about borrower risks or contract changes

- Secure Escrow: RBI penalty specifically mentioned unauthorized escrow account usage

- 24-hour Investigation: Multiple users report zero response for weeks and months

The gap between promises and performance is massive.

How to Report Investment Scams?

If you are facing fund blockage, delayed withdrawals, or suspect unfair practices, it’s important to report the issue through the correct channels and in the right order.

1. File your complaint with RBI:

- Go to its official website.

- Mention registration number: N-13.03335

2. File a complaint in cyber crime

- Go to the portal.

- Especially for privacy violations and CIBIL manipulation

3. CIBIL Disputes:

- Direct dispute at the CIBIL website

- Attach LendBox complaint proof

Need Help?

Dealing with safety issues at LendBox?

Whether it’s locked funds, fake CIBIL entries, privacy violations, or withdrawal denials, you don’t have to face this alone.

FraudFree team helps you in:

1. Risk Assessment: We evaluate your specific situation and determine the best protection strategy, whether RBI escalation, consumer court, or legal action.

2. Evidence Organization: We help structure your documentation to maximize impact in official complaints and legal proceedings.

3. Regulatory Complaint Filing: Our team has experience with RBI complaints against NBFC-P2P platforms. We ensure your safety concerns are officially recorded.

4. CIBIL Protection: If fake loans are damaging your credit, we guide you through dispute resolution and follow-up until removal.

5. Legal Support: Connect with lawyers specializing in financial consumer protection and platform negligence cases.

Your safety matters. Your financial security matters. Don’t let platform negligence destroy your financial future.

Act now. Protect yourself. Register with us today.

Conclusion

After examining regulatory penalties, user experiences, system vulnerabilities, business stability, and operational integrity, the answer is unequivocal. LendBox is not safe.

This isn’t about being overly cautious or risk-averse. Safety isn’t a luxury; it’s a fundamental requirement for any platform handling your money.

When a platform fails on all parameters simultaneously, it’s not just “risky”, it’s unsafe. There’s a difference.

Risk is calculated. Volatility is expected. But systematic operational failures affecting thousands of investors? That’s not a risk. That’s negligence.

Your money deserves better. Credit score deserves protection. Your financial future deserves security that actually exists, not just marketing claims.

Choose wisely. Choose safely. The platforms where “safe” isn’t just a word on the website, it’s proven through actions, transparency, and investor protection.