Before you pay ₹69,999 for stock market advice from Ruchir Gupta, you should check one critical thing.

Is the person legally allowed to give that advice?

Is Ruchir Gupta SEBI-registered?

Is Ruchir Gupta a Registered Advisor?

Ruchir Gupta operates as a stock market trainer. He runs Ruchir Gupta Training Academy. His presence on YouTube attracts thousands of followers.

At the same time, videos promise high returns and easy wealth.

He claims 17+ years of market experience. His marketing emphasizes expertise and success. Students trust these credentials.

They believe his qualifications are verified.

However, here’s what matters most. Does he have legal permission to sell investment advice?

The answer is NO. Ruchir Gupta does not appear in SEBI’s official databases.

According to our verification of SEBI registries, his name is absent from the Investment Adviser (IA) list.

He’s also missing from the Research Analyst (RA) registry. As of now, no registration exists.

Why SEBI Advisor Licenses Matter?

For advisory services in the stock market, one must either have an Investment Adviser or Research Analyst license or both licenses along with NISM certification.

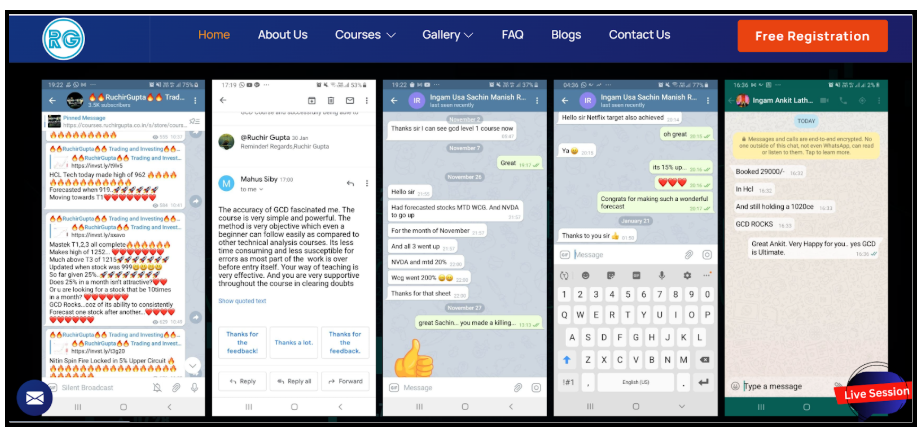

However, Ruchir Gupta held none and was still involved in providing stock recommendations and open call tips in his Telegram share buy-sell calls.

Other than this, without regulatory authorisation, he recommends entry and exit levels of stock.

During his live sessions, he used to mention price targets and suggest T1, T2, and T3 levels for entry and exit in stocks.

Ruchir Gupta SEBI Violations

Let’s document the specific violations stemming from a lack of registration.

Violation 1: Operating as an Unregistered Investment Adviser

According to available evidence, Ruchir Gupta courses recommend specific stocks.

Telegram groups share buy-sell calls. Scanners suggest entry points. All these services cost money from ₹9,999 to ₹1,09,999.

Why It’s a Violation: SEBI’s Investment Advisers Regulations 2013, Section 3 states clearly – no person shall act as investment adviser without registration.

Providing paid stock recommendations is an investment advisory service. The license is absent. Each paid recommendation violates this section.

Violation 2: Conducting Research Analyst Activities Without a License

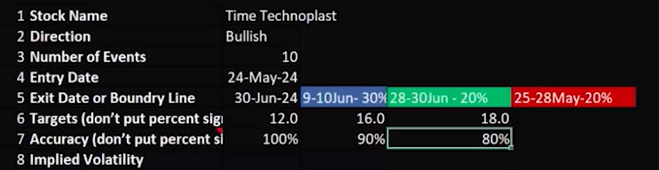

His courses provide stock names with precise codes. Future price targets appear as T1 (12-15%), T2 (18-22%), T3 (30%+).

Entry and exit timing are discussed. Expected returns are projected. Live classes pick specific stocks with complete trade setups.

Why It’s a Violation: SEBI’s Research Analyst Regulations 2014, Section 3 mandates registration for anyone preparing research reports on securities.

Providing stock-specific predictions with price targets is research analyst activity.

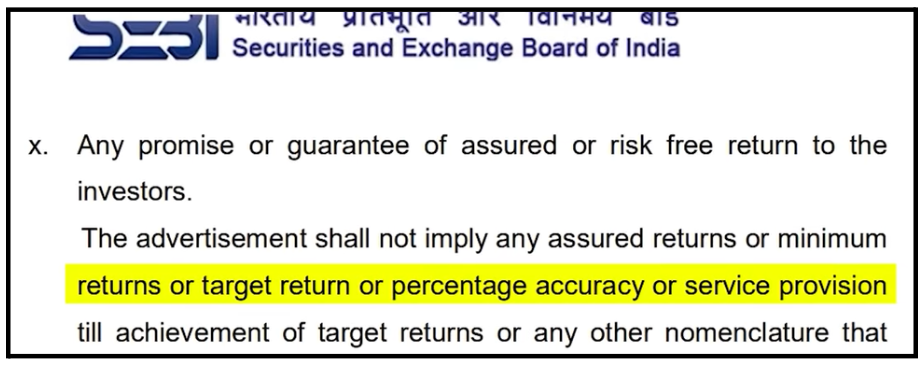

Violation 3: Accuracy Claims Prohibited by Section 8(C)(10)

As per the evidence, his marketing repeatedly claims accuracy.

“90% success rate” appears in live classes. “100% target achievement” gets mentioned in webinars.

Why It’s a Violation: SEBI’s Research Analyst Master Circular, Section 8(C)(10) explicitly states – Research Analysts shall not claim any specific success rate or track record percentage.

In practice, accuracy claims mislead investors. They create false confidence. Markets are uncertain.

Violation 4: Inducement Under PFUTP Regulations

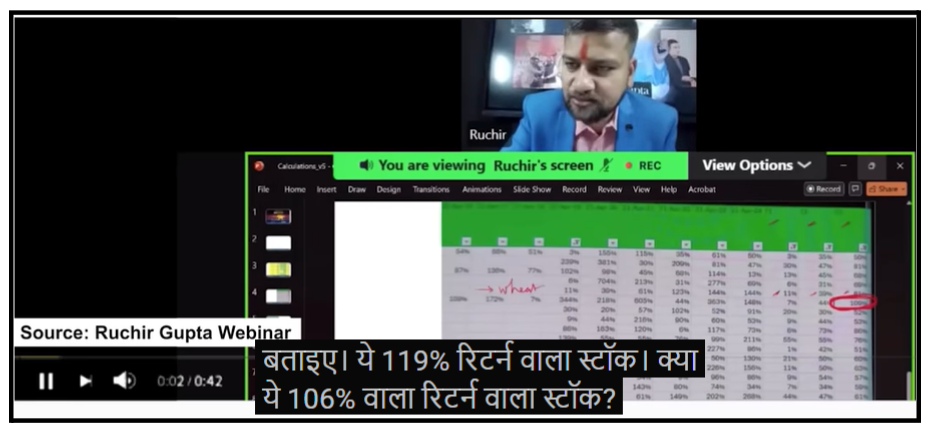

One of the webinar recordings shows that “thick-cream returns” are promised. “Easy money” is suggested. “Divine guidance” is claimed – statements like “God gives me market insights.”

Why It’s a Violation: SEBI’s Prohibition of Fraudulent and Unfair Trade Practices Regulations prohibit inducement.

Promising guaranteed returns, claiming easy profits, and making statements disconnected from market reality all constitute inducement.

Importantly, these statements are made knowing markets don’t work this way. This violates PFUTP regulations.

Violation 5: Misleading Advertisement Standards

YouTube thumbnails promise “150% returns.” Titles claim “best way to make crores.” Videos suggest easy wealth generation.

Marketing shows only winning examples – stocks that gave 317%, 119%, 106% returns. Losing trades disappear from narratives.

He selectively showcases only profitable trades of his students, while losses and unsuccessful outcomes are completely absent from public displays.

Why It’s a Violation: SEBI’s Advertisement Code requires truthfulness. Claims must be substantiated with data. Performance must be presented accurately, not cherry-picked.

What SEBI Says About Unregistered Advisers?

SEBI regularly publishes warnings against unregistered entities. The regulator advises investors to check registration before trusting anyone.

According to SEBI alerts, unregistered advisers pose serious risks: they operate without oversight, face no accountability, and can disappear after taking money.

SEBI specifically warns against social media influencers giving stock tips. YouTube videos with recommendations. Telegram groups with paid calls. All require proper licensing.

The regulator’s message is clear: verify registration first.

How to Report Ruchir Gupta?

Found someone operating without registration? Here’s how to report.

File a complaint under the “Unregistered Investment Adviser” or “Unregistered Research Analyst” category. Provide complete information:

Attach supporting documents: Screenshots of Telegram messages. Recordings of webinar claims. Course material showing stock tips.

Visit the website and file under the “Online Financial Fraud” category.

Describe misleading claims made online. How payments were collected digitally. How advice was distributed through digital platforms.

Need Help?

Discovered you’ve been taking advice from an unregistered adviser? Paid money to someone without an SEBI license? Facing losses from following unlicensed recommendations?

Register with us.

We provide comprehensive support:

- SEBI Complaint Filing: We help structure your complaint properly. We ensure all mandatory information is included. We review your evidence and suggest improvements.

- Verification Support: Not sure if someone is registered? We can help verify across all SEBI databases.

- Evidence Collection: We teach proper documentation. What screenshots to take. How to record conversations. What documents matter most?

- Legal Guidance: We explain your legal options. Consumer forums, cybercrime complaints, civil suits. We connect you with relevant experts if needed.

Don’t feel embarrassed about being deceived. These operators use sophisticated psychology. Take action.

Register with us. Let’s hold unregistered advisers accountable together.

Conclusion

Is Ruchir Gupta SEBI-registered? No.

He appears in neither the Investment Adviser registry nor the Research Analyst list.

This absence has serious implications. According to SEBI regulations, providing paid investment advice requires IA registration.

Offering stock-specific research with targets needs RA license. Making accuracy claims violates explicit rules. Operating without these licenses makes every activity illegal.

Importantly, awards and recognition don’t change this reality. Photos with politicians don’t grant SEBI licenses. YouTube popularity doesn’t replace legal registration. Government awards don’t validate securities market operations.

SEBI registration ensures qualifications are verified. It creates accountability through oversight. It mandates proper disclosures.

Without registration, none of these protections exist.