If you search for “Shark Exchange login,” the next question usually follows quickly; is Shark Exchange legal in India?

And after that comes an even more important concern: If it is operating here, does that automatically make it safe?

In India, crypto operates in a space that is neither fully banned nor fully regulated like the stock market. It is taxed. It is monitored for anti-money-laundering compliance.

But it is not supervised by a dedicated crypto regulator in the same way SEBI regulates stock brokers or exchanges.

That’s where confusion begins.

In this article, we’ll focus primarily on one question: Is Shark Exchange legally allowed to operate in India? Let’s break this down calmly and factually.

Is Shark Exchange Legal in India?

Before we answer that directly, let’s understand something important.

In India, crypto exchanges are not regulated the same way stock brokers are. There is no “crypto exchange license” issued by SEBI.

Instead, platforms that deal in virtual digital assets are expected to comply with anti-money laundering laws under the Prevention of Money Laundering Act (PMLA).

So when someone asks, “Is Shark Exchange legal?”– the real question becomes:

- Is it incorporated as an Indian company?

- Is it registered with the appropriate authority for AML compliance?

- Has any regulator banned or restricted it?

Let’s look at what Shark Exchange itself states on its website.

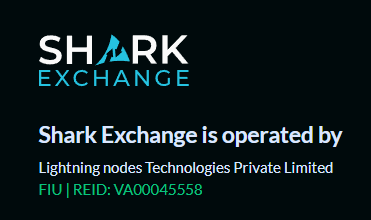

On its official platform, Shark Exchange displays the following information:

This data on their website states:

“Shark Exchange is operated by Lightning Nodes Technologies Private Limited

FIU | REID: VA00045558”

Now pause for a moment.

What does this actually mean?

What Does FIU Registration Mean?

FIU-IND (Financial Intelligence Unit – India) operates under the Ministry of Finance.

When a crypto exchange registers as a reporting entity:

- It agrees to follow KYC (Know Your Customer) norms

- It must monitor and report suspicious transactions

- It must comply with anti-money laundering obligations under PMLA

This is important.

It means the platform is acknowledging AML compliance requirements under Indian law.

But here’s the critical part many investors miss:

FIU registration is not the same as being regulated by SEBI.

It does not mean:

- Investor funds are insured

- Trading losses are protected

- The government guarantees the platform

- Disputes are handled under a SEBI grievance redressal system

It simply means the entity is registered as a reporting body for anti-money-laundering compliance.

That leads to a thoughtful question:

Does AML registration alone answer whether a platform is legally robust in all aspects?

Not necessarily.

What If an FIU-Registered Entity Violates Rules?

If a reporting entity fails to comply with AML obligations, such as not conducting proper KYC or failing to report suspicious activity, it may face:

- Monetary penalties

- Enforcement action

- Regulatory scrutiny

So registration brings obligations. It is not just a label, it comes with compliance responsibility.

So, Is Shark Exchange Legally Allowed to Operate?

Based on publicly available disclosures:

- It appears to operate through an incorporated Indian company (Lightning Nodes Technologies Pvt Ltd).

- It claims FIU registration under a specific REID number.

- As of the date of writing, no public regulatory ban order has been identified against it.

However, crypto exchanges in India function within an evolving regulatory framework. There is currently no dedicated crypto exchange regulator comparable to SEBI for stock markets.

Which brings us back to the bigger thought: Legal existence and operational safety are two different conversations.

Now that we understand the legal side, let’s look at what user experiences suggest about safety.

Is Shark Exchange Safe?

Now that we’ve looked at the legal side, let’s address the second question most investors really care about:

Is Shark Exchange safe to use?

And this is where things become more nuanced.

Because a platform can be legally incorporated and registered for AML compliance, but that does not automatically answer questions like:

- Are withdrawals processed smoothly?

- Is the app technically stable?

- Are charges clearly explained?

- Is customer support responsive?

To understand this aspect, it helps to look at user experiences, particularly app store reviews.

Shark Exchange is available on Google Play, and like any trading app, it has user feedback attached to it. App store reviews are not regulatory findings. They are personal experiences. But they can still highlight operational patterns worth noting.

Let’s look at some examples.

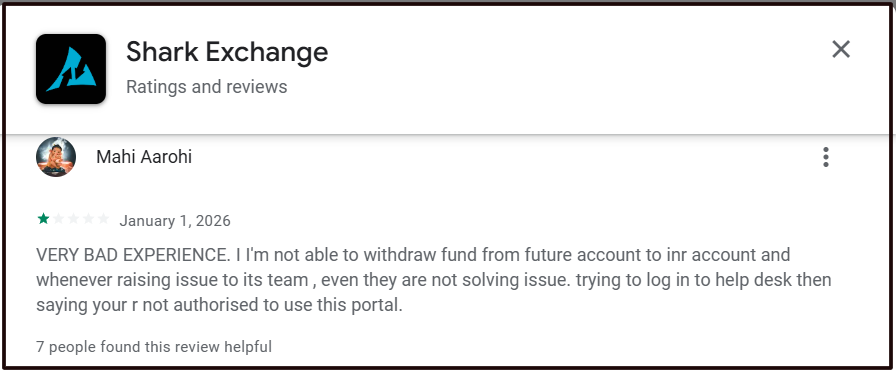

In this review, a user reports difficulty transferring funds from the futures account to the INR account and mentions issues accessing the help desk.

Withdrawal access is one of the most critical trust indicators for any trading platform. Even a legally operating platform must ensure that fund movement processes are transparent and reliable.

When users raise withdrawal-related concerns, it becomes an area that potential investors should independently verify before depositing large amounts.

2. Technical Issues During Order

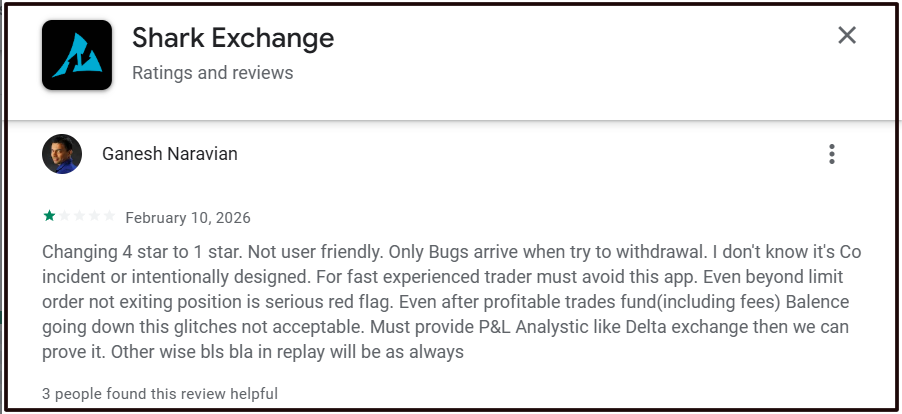

Another review highlights concerns about technical glitches during order execution and balance calculations.

In derivatives trading, especially where leverage is involved, platform stability is crucial.

Even small execution delays or display inconsistencies can significantly impact trading outcomes. While a single review does not establish systemic failure, repeated mentions of technical instability are worth noting.

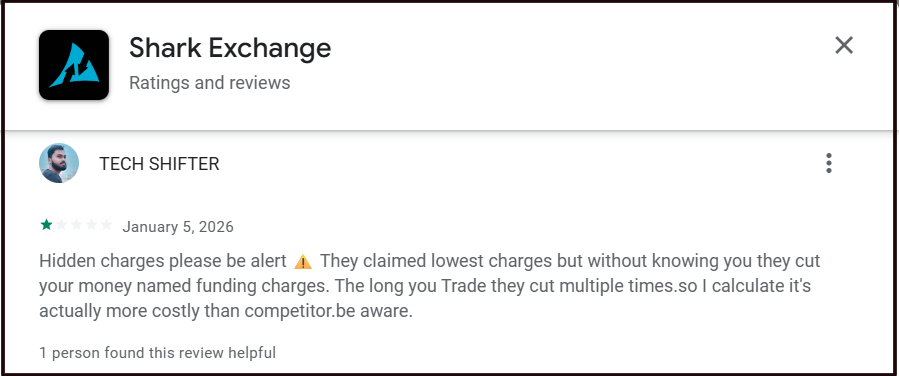

3. Hidden Charges

This review raises concerns about funding charges and fee transparency. Funding charges are common in futures trading platforms.

However, if users feel charges are unclear or higher than expected, it suggests the importance of carefully reviewing the platform’s fee structure before trading.

It’s important to approach reviews with balance.

- App store feedback reflects individual user experiences.

- It does not determine whether a platform is legally compliant.

- It does not automatically prove wrongdoing.

However, operational feedback, especially relating to withdrawals, order execution, or fee clarity, is something prudent investors should consider before committing funds.

This leads to the next practical question:

If someone does face issues on the platform, what can they actually do?

How to Report Shark Exchange?

If you ever face an issue with any crypto platform, whether it relates to withdrawals, account restrictions, technical glitches, or lack of response from support, the most important thing is to act calmly and systematically.

Panic rarely helps. Documentation does.

Here’s a practical approach you can follow.

1. Raise a Formal Complaint with the Platform

Before escalating externally:

- Submit a ticket through the official support channel.

- Send a detailed email describing the issue.

- Include transaction IDs, dates, screenshots, and amounts involved.

- Keep a record of every response received.

If the issue is technical or related to execution, clarity and timestamps matter.

2. Preserve Evidence

This step is critical.

Save:

- Deposit confirmation screenshots

- Withdrawal request details

- Order history

- Account balance records

- Email or chat communication

In financial disputes, evidence determines the outcome.

3. File a Complaint on the Cyber Crime Portal

If the matter involves suspected financial irregularity, non-processing of funds, or unresponsive support, you may file a complaint on the National Cyber Crime Reporting Portal.

Provide:

- Platform name

- Company details (if available)

- Transaction records

- Complete description of events

This ensures your complaint enters an official system.

4. Inform Your Bank (If INR Transfers Were Involved)

If you transferred funds via:

- UPI

- Net banking

- Bank transfer

Inform your bank immediately and ask about dispute mechanisms. Early reporting improves recovery chances in certain cases.

5. FIU-Related Concerns

If your concern relates to AML compliance or reporting irregularities, you may consider contacting FIU-IND with proper documentation.

However, remember: FIU primarily deals with anti-money laundering compliance, not individual trading disputes.

The key takeaway is this:

If something feels wrong, don’t ignore it, but don’t act emotionally either. Follow a documented, structured process.

Now, if you’re feeling overwhelmed about where to begin, here’s something important to know.

Need Help?

Dealing with crypto platform issues can be confusing. Many investors aren’t sure whether their problem is technical, regulatory, or something else entirely.

If you’re unsure about:

- How to document your case

- Which authority to approach

- How to draft a proper complaint

- What information is legally relevant

Register with us, and we will guide you from organising transaction records to drafting a clear and structured complaint.

Our goal is simple: It is to protect your interests and ensure your voice is properly documented.

You don’t have to navigate the process alone.

Conclusion

So, is Shark Exchange legal in India?

Based on publicly available information, the platform appears to operate through an incorporated Indian entity and claims registration with FIU-IND as a reporting entity under anti-money laundering laws.

As of the date of writing, no public regulatory ban order has been identified.

However, crypto exchanges in India operate within a developing regulatory framework.

FIU registration relates to AML compliance; it does not equate to SEBI-style investor protection or guarantee operational reliability.

Legal presence and user experience are separate considerations.

If you have been scammed, you should file a crypto fraud complaint through the proper legal channels as soon as possible.

As with any financial platform, independent verification, cautious capital allocation, and careful review of terms and charges remain essential before making trading decisions.

In crypto, clarity protects capital.