No one worries about safety when the market is moving in their favour. You worry when you try to withdraw. You worry when the app lags during a volatile candle or the support stops responding.

That’s when the real question hits:

Is Shark Exchange actually safe?

In crypto trading, losses from market volatility are one thing. But losing access to your own funds, facing unexplained deductions, or dealing with technical glitches, that’s a completely different level of risk.

Shark Exchange is actively operating. It has an app. It mentions registration details and markets itself as a crypto futures platform. But safety is not decided by marketing claims.

In this article, we’ll examine Shark Exchange from a safety perspective, based on user experiences, operational signals, and investor protection considerations.

Is Shark Exchange Safe in India?

When investors navigate a Shark Exchange login screen, they are often thinking about potential gains, but the real priority should be the security of their capital.

In the high-stakes world of crypto, safety isn’t about sleek branding or aggressive promotional claims; it’s about what happens after you’ve moved your funds into the ecosystem.

The true test of an exchange occurs when markets are in chaos.

Can you withdraw your money without friction during a crash?

Will your orders execute correctly when volatility spikes? Are the funding charges transparent, or do they eat into your balance unexpectedly?

In crypto trading, confidence is built or broken during these moments of stress, not when the charts are moving sideways.

A platform may look professional. It may offer competitive fees. It may advertise advanced trading features.

But safety is not defined by features; it is defined by reliability.

Is Shark Exchange Legal in India?

Before focusing entirely on safety, it’s important to clarify the legal position.

Crypto trading is not banned in India. Individuals are allowed to trade, but crypto is not legal tender and there is no dedicated regulator like SEBI overseeing crypto exchanges the way it oversees stock brokers.

Shark Exchange states on its website that it is operated by Lightning Nodes Technologies Private Limited and mentions an FIU registration reference number.

The reference to FIU (Financial Intelligence Unit – India) indicates that the platform claims registration as a reporting entity under India’s anti-money laundering framework.

This generally means the entity is required to follow KYC norms and report suspicious transactions under PMLA guidelines.

However, FIU registration relates to AML compliance; it does not mean:

- SEBI regulation

- Investor protection coverage

- Government guarantee of funds

As of the date of writing, no public regulatory ban against Shark Exchange has been identified. Based on publicly available information, it appears to be operating through an incorporated Indian entity and claims AML registration.

But legality and operational safety remain two separate considerations for investors.

Shark Exchange Complaints

No trading platform is completely free from complaints. Especially in leveraged crypto trading, frustration is common.

But when similar concerns appear repeatedly, withdrawals, glitches, funding charges, and support issues, they deserve careful attention.

Let’s examine the themes visible in user reviews.

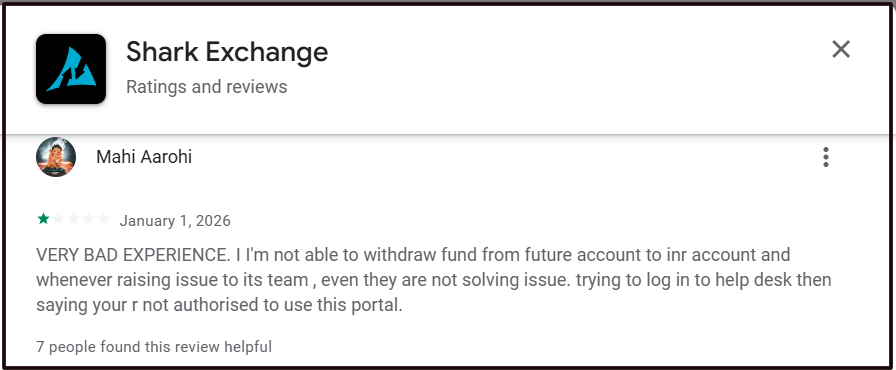

1. Withdrawal & Fund Access Concerns

One of the most sensitive areas for any exchange is withdrawal reliability. Safety is often tested the moment you try to move money out.

This review mentions difficulty transferring funds from the futures account to the INR wallet and challenges accessing the help desk portal.

For any investor, withdrawal friction immediately raises risk perception. Even if technical or temporary, delays in fund movement create uncertainty.

In financial platforms, smooth deposits are expected. Smooth withdrawals are what build trust.

If multiple users report fund access issues, cautious investors should test withdrawals with small amounts before committing larger capital.

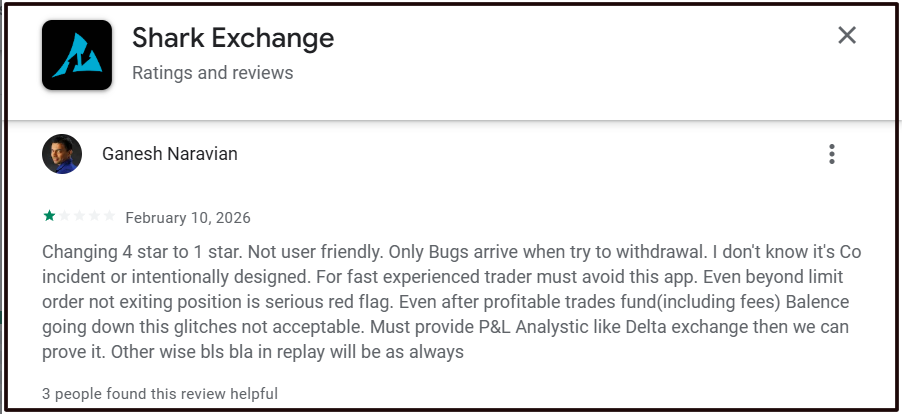

2. Technical Glitches & Order Execution Errors

In leveraged trading, execution precision matters. Even small errors can lead to liquidation.

This review raises concerns about:

- Bugs appearing during withdrawal attempts

- Positions not exiting properly

- Balance discrepancies after profitable trades

If balance calculations appear inconsistent, even temporarily, it creates anxiety. In high-leverage environments, technical instability can translate directly into financial loss.

While one review does not prove systemic failure, repeated mentions of glitches are operational signals investors should not ignore.

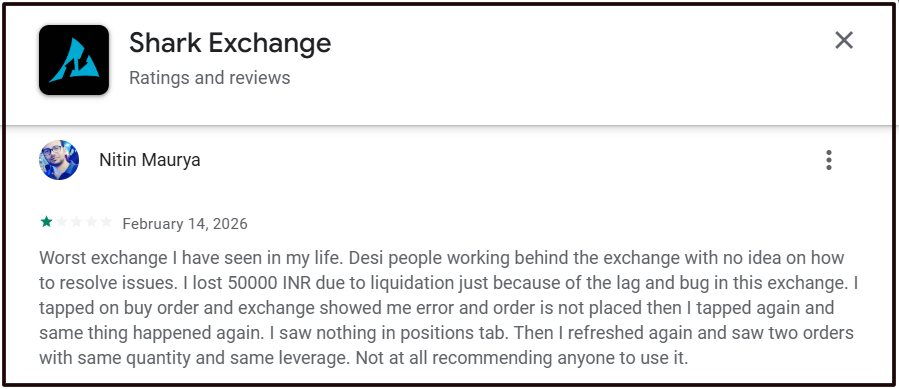

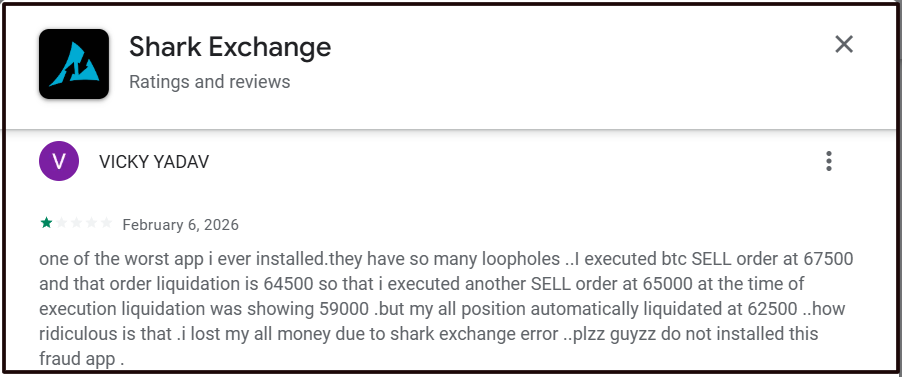

3. Liquidation & Order Duplication Concerns

Another review describes execution errors during order placement.

The user claims the app showed an error while placing an order, but later two orders appeared after refresh, leading to liquidation.

In volatile markets, even seconds matter. If execution systems are not stable, traders may face unintended exposure.

It’s important to note that liquidation can occur due to leverage and volatility.

However, when users attribute losses to technical lag rather than market movement, that perception affects trust significantly.

Before trading with high leverage, platform stability must be tested carefully.

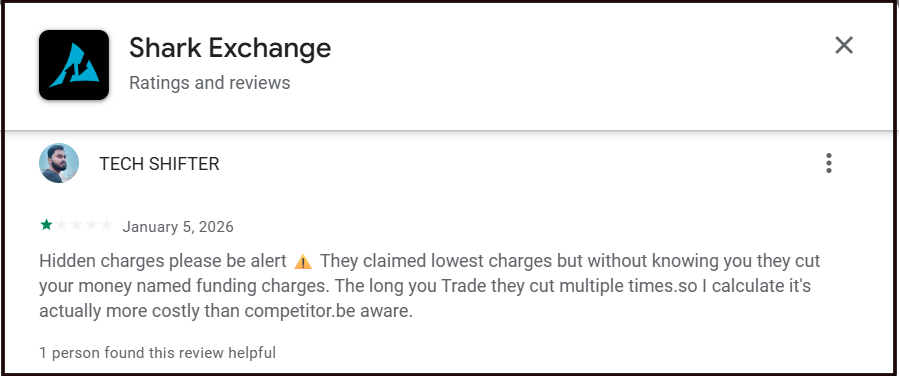

4. Funding Charges & Fee Transparency

Funding fees are common in perpetual futures contracts. However, confusion about charges often leads to dissatisfaction.

This review suggests that users felt funding charges were deducted more frequently than expected.

Funding mechanisms are part of derivatives trading. The key issue is clarity. If users do not fully understand how funding works, or if calculations feel unclear, trust can weaken.

Investors should carefully review:

- Funding intervals

- Fee structure

- Maker/taker fees

- Any additional charges

Transparency is critical for safety perception.

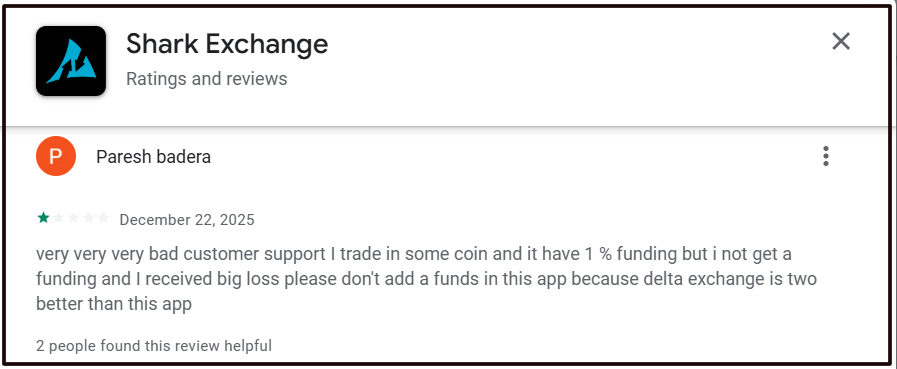

5. Funding Payment & Customer Support Complaints

Support responsiveness often determines whether an issue feels manageable or escalated.

This review mentions dissatisfaction with funding credit and customer support experience.

Even when technical disputes arise, responsive support can restore confidence. When support feels inaccessible or unhelpful, risk perception increases.

In financial platforms, safety is not just about systems; it is about resolution.

6. Severe Liquidation Experience Allegation

This review alleges liquidation occurring at levels inconsistent with the displayed liquidation price.

It’s important to approach such claims carefully. Liquidation mechanics depend on leverage, margin type, and funding adjustments.

However, when users feel liquidation levels were inaccurate, it signals either a misunderstanding or a system inconsistency.

High-leverage trading always carries inherent risk. But clarity in liquidation logic is essential for perceived fairness.

Online reviews represent individual experiences. They are not regulatory judgments. They do not automatically prove systemic failure or misconduct.

However, patterns matter.

When multiple reviews reference:

- Withdrawal friction

- Technical glitches

- Balance discrepancies

- Funding charge confusion

- Support dissatisfaction

It suggests areas where cautious investors should conduct independent verification.

How to Report Shark Exchange?

It is crucial to file a crypto fraud complaint in India through the proper legal channels as soon as possible if you have been the victim of a scam.

If you face issues such as withdrawal delays, balance discrepancies, or a lack of support response, follow a structured approach:

1. Raise a formal complaint with the platform

Submit a detailed support ticket and send an email explaining the issue clearly. Include transaction IDs, dates, order numbers, and screenshots.

2. Preserve all evidence

Save deposit confirmations, withdrawal requests, order history, account balances, and all communication records.

3. File a complaint on the Cyber Crime Portal

If the issue remains unresolved and involves funds, submit a complaint with complete documentation and a clear timeline.

4. Inform your bank (if INR transfers were involved)

Report the transaction promptly and ask about dispute or chargeback procedures.

5. Escalate with documentation

Ensure every claim is supported by records and written communication.

A calm, evidence-based approach is always stronger than a rushed reaction.

Need Help?

Many investors hesitate to escalate because they’re unsure where to start. Some are not certain whether their issue is technical, regulatory, or operational.

If you’re facing unresolved concerns with a crypto platform and need clarity on:

- How to organise your documents

- How to draft a structured complaint

- Which authority to approach

- What information is legally relevant

Register with us, and we can guide you step by step.

Conclusion

So, is Shark Exchange safe?

Safety in crypto trading cannot be determined by marketing claims, app presence, or even registration details alone.

It depends on operational reliability, how consistently withdrawals are processed, how accurately trades are executed, how clearly charges are explained, and how effectively support responds to disputes.

Publicly visible user feedback highlights certain operational concerns.

While individual reviews do not establish wrongdoing, recurring themes related to withdrawals, technical stability, and fee clarity deserve careful consideration.

Crypto trading already involves significant market risk. Platform-related uncertainty adds another layer that investors must evaluate independently.

Before engaging with any crypto exchange, it is important to conduct thorough due diligence, verify information from multiple sources, and understand the risks involved.