There’s a quiet moment most investors don’t talk about, the one that comes after you’ve signed up, transferred your money, and placed your first trade based on someone else’s recommendation.

The charts are moving. The market feels alive.

But the real question shifts.

It’s no longer: “How much will I make?”

It becomes: “Did I make the right choice trusting this platform?”

That question doesn’t come from greed. It comes from responsibility toward your money, your time, and your peace of mind.

And when real capital is at stake, safety isn’t about bold claims or attractive returns. It’s about regulation, transparency, accountability, and what happens when something goes wrong.

Streetgains Review

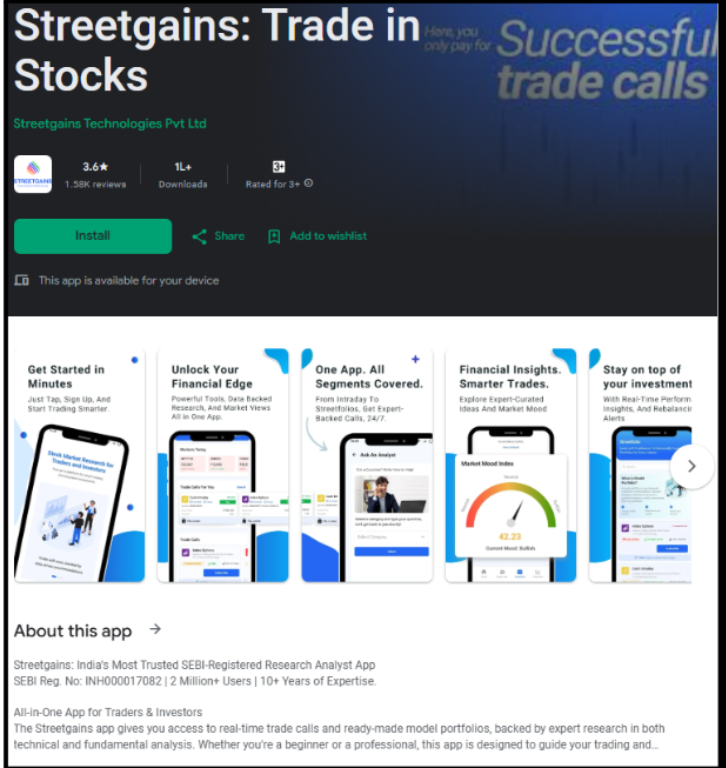

Streetgains is a SEBI-registered Indian financial research and stock advisory firm that gives investors and traders in India data-driven insights and trading tips.

It operates under the name Streetgains Technologies Pvt Ltd and works as a registered Research Analyst (INH000017082).

Its main goal is to help users make better decisions in the market by using a mix of technical analysis, fundamental research, and market data, mostly through its mobile app.

StreetGains has a credit-based subscription model.

Users only pay when a trade recommendation is marked as successful, not by paying a fixed fee for every call.

This setup connects the advisory fees with the outcomes, but the user still faces market risks.

The platform provides real-time trade calls for stocks, futures, and options, often based on technical breakouts, price and volume changes, and trend analysis, along with short-term trading tips.

Overall, Streetgains is made for both new and experienced market participants, whether they’re looking for intraday or swing trading opportunities or seeking long-term portfolio guidance, and it clearly positions itself as an advisory and research service, not a guarantee of profit.

Is Streetgains Safe for Retail Traders?

Many investors rely on different Streetgains reviews to understand real user experiences, but reviews should always be read alongside regulatory verification and risk disclosures.

On paper, it might seem like everything is set up properly with SEBI registration, organized research, clear procedures, and a noticeable online presence.

These things do offer some sense of security.

Safety of market advisory services isn’t just about what looks good from the outside. It also depends on how an investor uses the service, how well they understand the risks, and whether their expectations are realistic.

Trading can feel thrilling at first, with a way to make money quickly, meet small goals, or feel more in control of your money.

But the markets don’t always go the way we expect, and even well-researched advice can lead to losses. That difference between what we hope for and what actually happens is where stress usually starts.

This is why, even if Streetgains looks good, it’s still important to check things carefully.

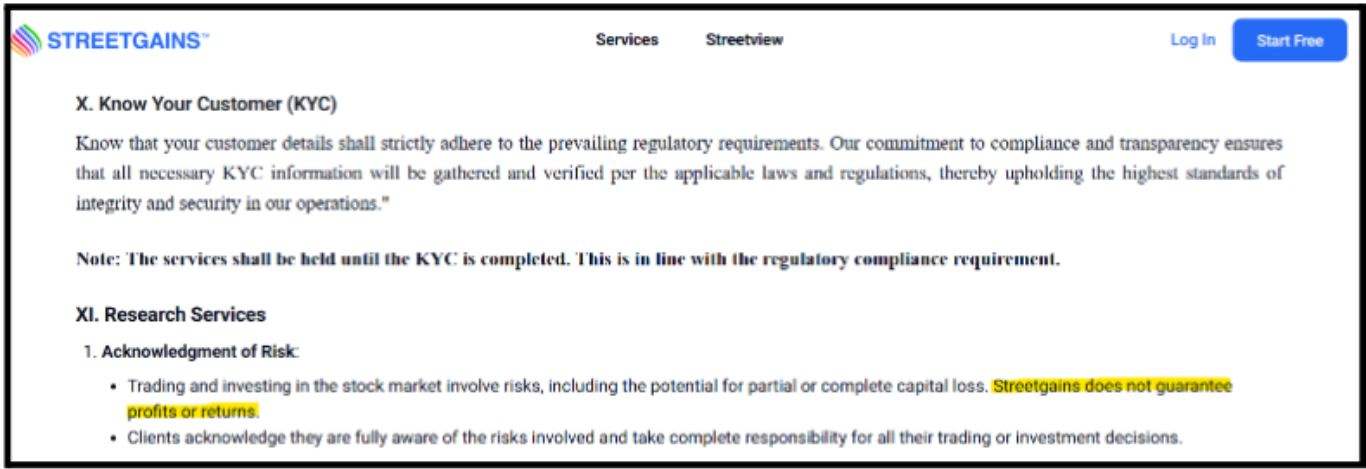

Investors should pay attention to disclaimers, explanations of risks, advice on managing money, and how losses are handled, and not just how wins are presented.

When decisions are made too quickly, when advice is taken without thinking, or when short-term gains influence emotions, safety starts to fade.

Money in trading affects more than just numbers on a screen; it affects how you feel.

What starts as a hopeful step toward growth can later feel overwhelming if risks weren’t fully understood from the beginning.

Being careful, asking questions, and staying mindful of the downsides isn’t being negative; it’s being responsible.

Streetgains Complaints

When it comes to safety, user complaints are important because they often show gaps in how things actually work, not just whether something is allowed by the rules.

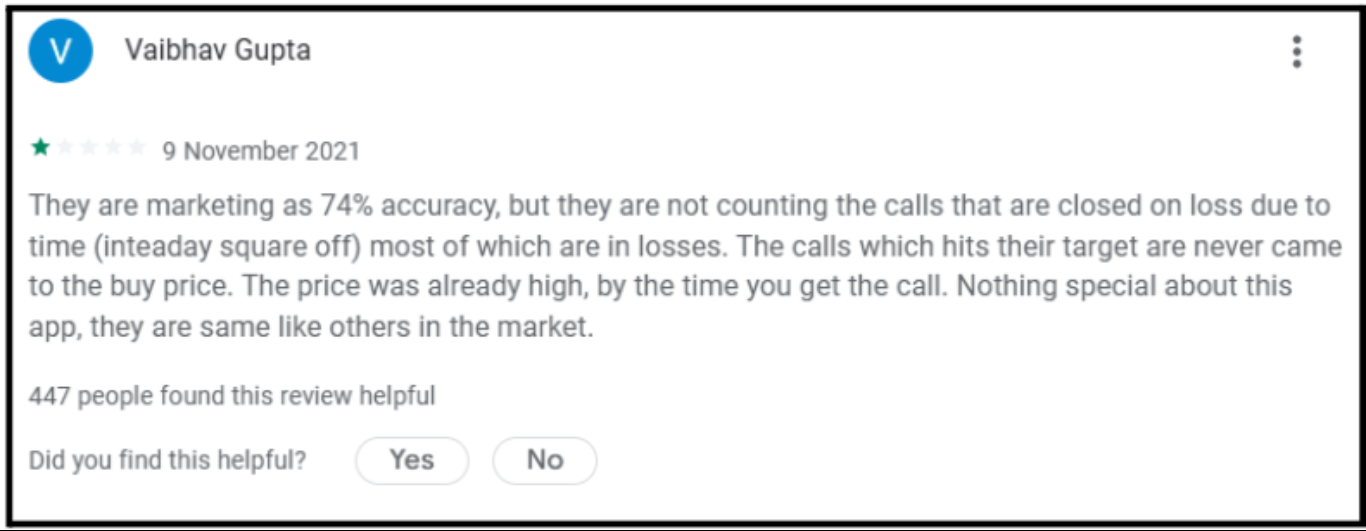

The pictures people shared show common issues that some Streetgains users have reported, especially about when trades happen, how prices change, and how the platform communicates.

These complaints don’t necessarily mean Streetgains Technologies Pvt Ltd is doing something wrong, but they do give important information for people who are thinking about whether to trust the firm.

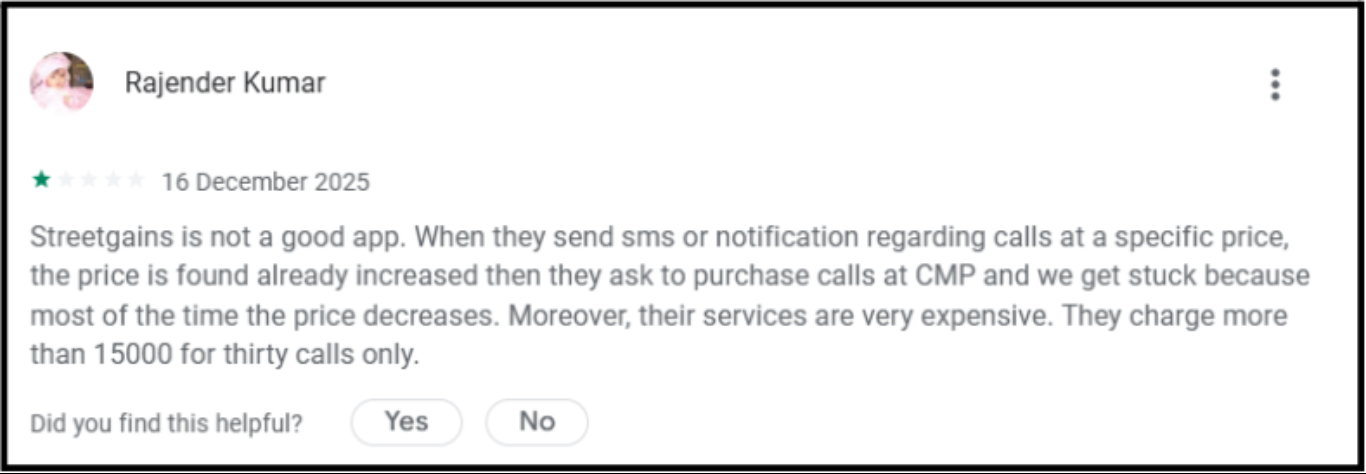

User 1: Worries about delayed trade calls and changing prices

The user says they get a text or app message at a certain price, but by the time they check, the price has gone up.

This is frustrating because buying at a higher price means more risk and less chance of making a profit.

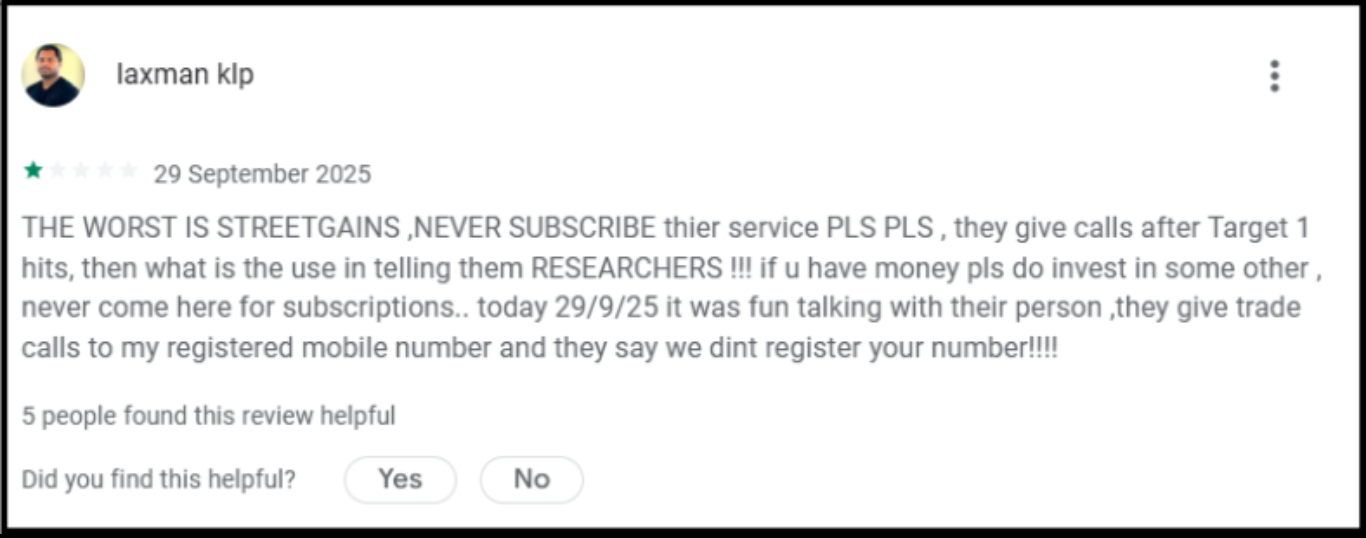

User 2: Issues with communication and alerts after a target is reached

This complaint is more about expectations than about whether something is legal.

Especially when people pay for a subscription, they want to feel like they’re getting value for their money.

If the cost feels too high and the results don’t match what was promised, users start to wonder if the whole thing is fair or safe.

User 3: Concerns about accuracy and whether the cost is worth it

These comments point to a key safety issue: transparency. When users aren’t clear on how trade calls are sent, tracked, or confirmed, trust starts to fade, even if the platform is officially approved.

User 4: Poor Customer Support

One user reported experiencing poor customer support from the advisory firm. While such complaints are often dismissed as minor, they are serious and deserve attention.

Imagine needing urgent clarification on advice you were given, only to find that calls go unanswered and responses, if any, are vague or dismissive.

In situations like this, the impact falls entirely on the investor. It is your money at stake, not theirs, and a lack of timely, clear support can turn uncertainty into real financial loss.

What Can You do in Such Cases?

If you experience any loss, confusion, or feel something wasn’t handled fairly while using Streetgains, it’s important to report the issue properly.

Staying calm and following the right steps will help you get clearer answers and better protection.

- Gather all your proof first: Start by collecting everything related to your experience.

This includes trade call messages, app notifications, emails, subscription invoices, payment receipts, chat conversations, and screenshots showing any price differences or delayed calls.

Having clear records makes it easier to explain your issue and ensures it’s taken seriously.

- Contact Streetgains directly: Before reaching out to any other authorities, speak with Streetgains’ official support channels.

Clearly explain what call you followed, what price you received, what went wrong, and what resolution you expect.

Always communicate in writing, either through your registered phone number, email, or in-app support, so there is a record of your conversation.

- Give the company time to respond: Allow the company time to reply and resolve the issue. Many problems are fixed at this stage through explanations, corrections, or clarifications.

Avoid using emotional language and stick to the facts and the timeline of what happened.

- Escalate the complaint through SEBI SCORES: If you don’t get a satisfactory response, you can file a complaint on SEBI’s SCORES platform. Upload all the proof you’ve collected and clearly state that your complaint is against a registered advisory service.

You can also monitor your SEBI complaint status online on the SCORES dashboard to track updates, responses, and resolution progress from the advisory firm and the regulator.

Need Help?

Register with us, if you’re feeling confused, stressed, or unsure about what to do next, you don’t have to face it alone.

We’re with you right from the start, helping you understand the situation clearly.

We will guide you on how to file a complaint, explain what’s important and what’s not, and support you every step of the way until the process is complete.

Whether it’s gathering the right information, knowing where to bring up your issue, or just getting things straight when things feel messy, we’re here the whole time.

Also, we help in the escalation of complaints related to SEBI-registered advisory and help by representing cases in arbitrations in share market.

You’re not alone. We are here to help, advise, and help you walk through this.

Conclusion

Questions like, is Streetgains safe? Don’t just come from being unsure; they come from being responsible.

When money is involved, especially money that’s been worked hard for, safety feels personal as much as it does practical.

Streetgains seems to follow the rules and stay within set guidelines from a legal standpoint.

But real safety goes beyond just being registered or having good features.

It starts with being aware of how financial advice works, knowing its limits, and understanding how quickly expectations can change in fast-moving markets.

What really helps an investor is not blindly trusting or constantly worrying, but making wise decisions based on knowledge.

Knowing when to stop, when to ask questions, and when to take a step back helps protect more than just money; it helps protect your mental peace.

Trading can help make small dreams come true, but if you ignore risks, hopeful thinking can slowly turn into worry.

You always have the right to ask for clear answers, to keep records of your experience, and to share worries if something feels wrong.

No platform should take away your ability to make your own choices.

In the end, the best protection isn’t any app or service; it’s an investor who stays sharp, steady, and confident enough to choose safety over sudden decisions.