Thinking about using Supreme Investrade for stock tips?

Hold on! Before investing your hard-earned money, you need to know if this company is really legitimate.

Let’s find out if Supreme Investrate SEBI is registered, and if yes, does it make it safe for advisory services?

Supreme Investrade SEBI Registration

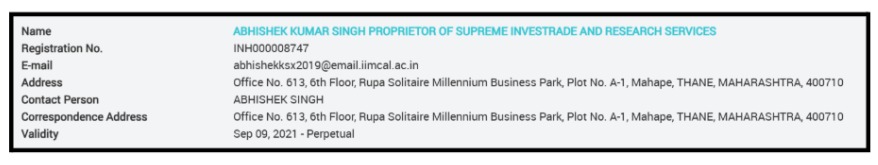

Supreme Investrade and Research Services operates from Navi Mumbai, Maharashtra, under the proprietorship of Abhishek Kumar Singh. The company provides research recommendations for the Options and Equity segments.

They claim to help traders with intraday tips, especially for Nifty and Bank Nifty.

According to SEBI records, Supreme Investrade is registered with SEBI. Their registration number is INH000008747.

The company got this registration on September 9, 2021. This means they are legally allowed to provide research recommendations in India.

However, being registered doesn’t mean everything is perfect.

Read on to understand the full picture.

Major SEBI Violations By Supreme Investrade

It is highly suspect for a registered entity to systematically engage in the very “fraudulent and unfair trade practices” (PFUTP Regulations) that SEBI exists to prevent.

It suggests the registration is being used as a cloak of legitimacy to carry out unscrupulous activities.

Here’s where things get seriously concerning.

According to SEBI’s official adjudication order dated December 2024 and a BSE arbitration, Supreme Investrade was found guilty of multiple violations. The company was fined ₹5,25,000 in total.

What did they do wrong? Let me break it down simply:

Violation 1: Promising Guaranteed Profits

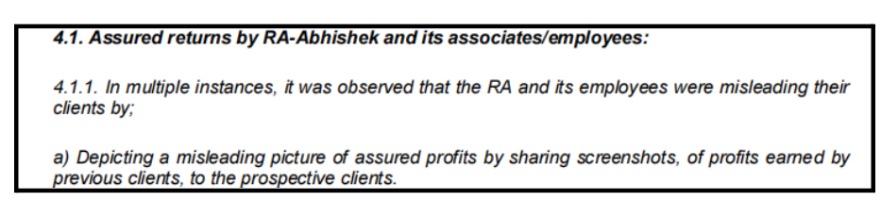

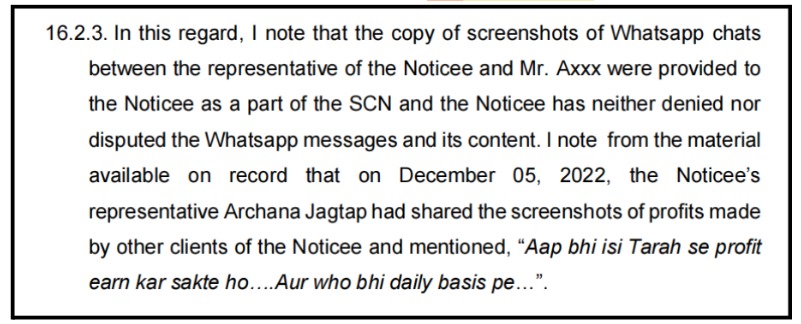

According to SEBI’s findings, Supreme Investrade shared profit screenshots of previous clients.

Their representatives told new clients: “Aap bhi isi tarah se profit earn kar sakte ho… Aur who bhi daily basis pe” (You can also earn profit like this… and that too on a daily basis).

This is illegal. No one can guarantee profits in stock markets. Such promises fool innocent investors.

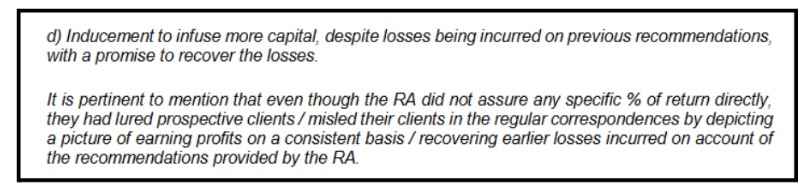

Violation 2: Asking Clients to Add More Money After Loss

According to the SEBI order, when clients lost money, Supreme Investrade asked them to put in more money. The firm promised to recover its losses with new tips.

In one case, the firm told the client to arrange more money for trading even after losing. This is called “inducement” and is completely banned by SEBI.

Violation 3: Sharing Past Performance of Other Clients

According to SEBI’s investigation, Supreme Investrade didn’t just give research tips. It indulged in inducement by sharing screenshots of the past performance of its clients.

Other than this, some messages revealed that they create urgency with proper risk disclosure.

One message said: “jaldi buy karo… maximum quantity buy karo” (buy quickly… buy maximum quantity).

This is wrong. Research analysts should only give research tips, not direct trading orders. This is called mis-selling.

Violation 4: Showing Fake Success Stories

According to the SEBI order, the firm used old profit screenshots to make new investors think they will also earn the same money.

They showed how much other clients earned to convince new people that success is guaranteed.

This is cheating because past success doesn’t mean future success.

Violation 5: Not Being Honest (Breaking Code of Conduct)

According to SEBI’s findings, Supreme Investrade broke the Research Analyst Code of Conduct by not being honest with clients.

Their documents said “no guarantees,” but their staff verbally promised profits.

Saying one thing in writing and another thing verbally is cheating.

Violation 6: Stopping Client from Exiting Losing Trade

According to the arbitration award, Mr. Mukul Singh wanted to exit when his loss was ₹15,000.

But Supreme Investrade’s representative said: “No sir! Wait. It will bounce back. Don’t panic. This is where most people go wrong. We’re expecting reversal in the next 5 mins.”

The loss then grew to ₹40,000. The judge said the firm was responsible for the extra ₹25,000 loss because they told him to wait.

Violation 7: Misuse of SEBI’s Complaint Resolution System (SCORES)

The Noticee is accused of orchestrating a false resolution to a SEBI SCORES complaint.

An employee of the Noticee drafted a message of satisfaction (“I am very happy…”) and instructed a complainant (Mr. Axxxxxxx Pxxxxx Sxxxx Jxxxxx) to send it via email to close his complaints.

This is a direct attempt to defraud the regulatory grievance redressal system.

Key Red Flags You Should Watch For

Based on Supreme Investrade’s case, watch for these warning signs with ANY advisory:

- Profit Screenshots – If they show you how much others earned, be very careful. According to SEBI, this is misleading.

- Recovery Promises – If you lose money and they say, “add more capital, we’ll recover it,” run away. This is against the rules.

- Exact Trading Instructions – If they tell you “buy now, sell at this time,” they’re crossing limits. Research analysts should only give research, not execution advice.

- Pressure Tactics – If they stop you from exiting losing trades, that’s manipulation. Your exit decision is YOUR right.

- Non-Refundable Policies – While legal, this means once you pay, money won’t come back regardless of service quality.

How to Report Issues with Supreme Investrade?

Facing problems?

Here’s exactly where to complain:

1. Lodge a complaint in SCORES

- SEBI’s official online complaint system

- You can track the complaint status

- Resolution is usually within 30 days

- Useful when seeking refunds or compensation

- File through BSE’s Investor Grievance Cell

- May involve arbitration fees

3. Company’s Grievance Officer

You can formally raise the issue with Supreme Investrade’s Grievance Officer.

- Send a written complaint via email or the official website

- Clearly mention your client ID, issue details, and supporting proof

- Allow reasonable time for a response (usually 7–10 working days)

Need Help?

Are you facing issues with Supreme Investrade?

Have they made false promises? Did you lose money following their advice? Are they refusing refunds?

We specialize in helping investors like you navigate the complaint process.

Our team has experience with:

- SEBI SCORES complaint filing

- BSE arbitration procedures

- Compiling evidence properly

- Drafting effective complaint letters

- Following up until resolution

- Understanding your investor rights

Contact us today. We’ll guide you through every step to recover your hard-earned money.

Stay safe. Invest wisely. Stay informed!

Conclusion

So, is Supreme Investrade SEBI registered?

Yes, they are. Registration number INH000008747 is valid and active.

But is registration enough? Absolutely not.

According to SEBI’s official findings, they violated multiple regulations, caused additional losses to clients. According to user reviews, satisfaction is very low.

SEBI registration is like having a driving license.

It means you’re allowed to drive, but it doesn’t mean you drive well or follow traffic rules. Supreme Investrade has the license but has broken several traffic rules.

Make informed decisions. Understand that NO ONE can guarantee stock market profits. According to SEBI regulations, promising assured returns is actually illegal, yet firms still do it.