Imagine this: 500x margin, zero brokerage fees, and instant withdrawals. It sounds like a dream come true for any trader in India, right?

A platform called TradeKaro, launched in 2024, is promising exactly that. But as the old saying goes, if something sounds too good to be true, it probably is.

Before you consider investing your hard-earned rupees, it’s vital to pull back the curtain on these “unbeatable” offers and question yourself: Is Trade karo App safe?

Are these incredible promises genuine opportunities, or regulatory red flags warning you about potential risks to your finances?

Well, let’s find out the answer to this.

Is Trade Karo Safe in India?

The evidence suggests that platforms like TradeKaro, which are not tied to official exchanges but let you “trade,” are likely operating a dabba trading scheme.

Before you get hooked by their flashy promises, let’s explore the reality of what this means for your money.

TradeKaro appears to operate as a dabba trading platform where:

- Your trades never hit NSE or BSE systems.

- The platform maintains its own private ledger.

- Fancy dashboards show potentially fake P&L statements.

- Withdrawals depend entirely on the operator’s discretion.

One of the biggest red flags is their 500X margin offer, which clearly violates SEBI regulations.

Since September 2021, the maximum leverage a legal broker can provide is 5X. Offering 500X is 100 times higher than the legal limit, definitely suspicious.

At this stage, you might naturally wonder, is Trade Karo legal in India?

Based on these practices, it’s certainly questionable.

Is Trade Karo App SEBI Registered?

Trade Karo lacks any SEBI, NSE, or BSE registration. This is the most critical red flag for any trading platform operating in India.

In India, if you’re trading equities or futures, registration with SEBI or the relevant exchange is mandatory.

In a legitimate trading environment, your orders go through the official stock exchanges (NSE/BSE) and are settled according to strict rules. In a dabba system, everything is private and opaque.

The absence of SEBI registration means:

- No regulatory oversight protecting your investments

- No legal recourse if the platform blocks withdrawals

- No accountability to Indian financial authorities

- Zero investor protection mechanisms

With dabba trading, investors lose legal protection, and if the broker decides to abscond with the money, there is no legal recourse available to recover the loss.

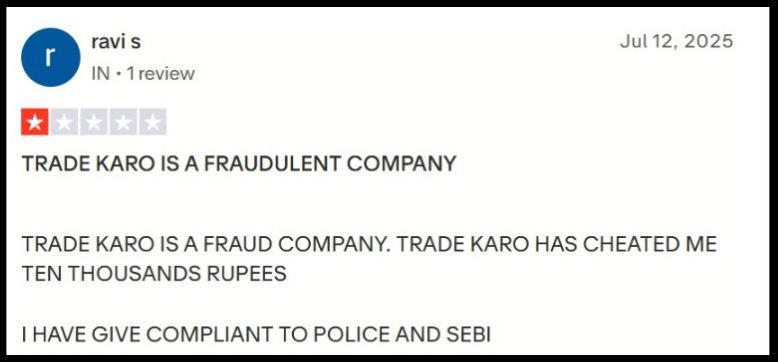

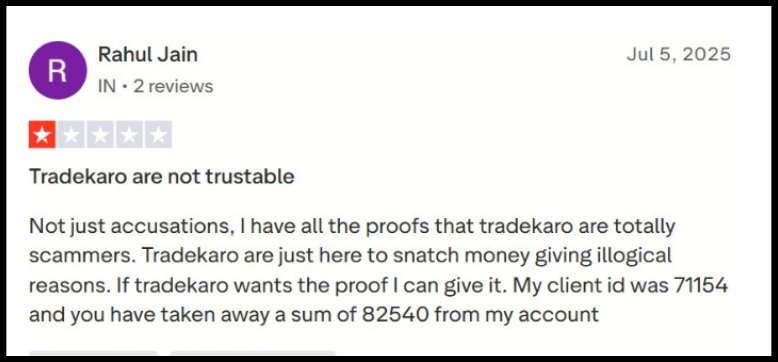

Trade Karo Complaints

While the TradeKaro app displays a 4.6-star rating on Trustpilot with 159+ reviews, real complaints are often buried among promotional reviews.

Here are the three most critical issues reported by users:

Issue 1: Trade Manipulation During Profits

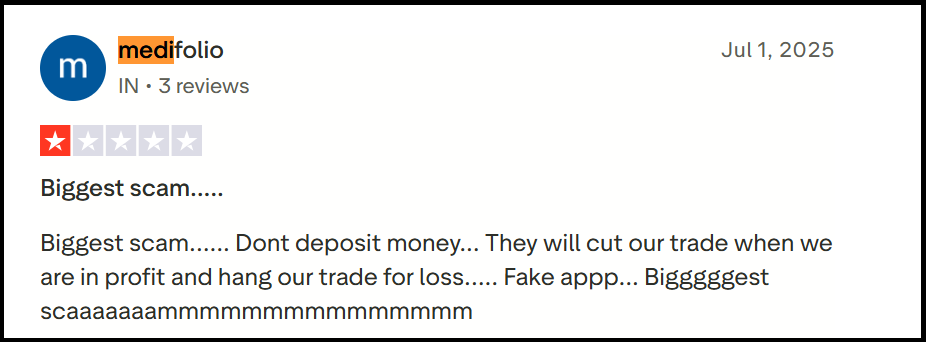

User Complaint: A Trustpilot reviewer named “medifolio” reported: “Biggest scam…… Don’t deposit money… They will cut our trade when we are in profit and hang our trade for loss….. Fake app”

What This Means: This is a classic dabba trading pattern where brokers manipulate trades to ensure users lose money.

Since TradeKaro trades never hit actual exchanges (NSE/BSE), the platform has complete control over showing fake P&L statements and closing profitable positions arbitrarily.

There are other similar complaints reported on Trustpilot as below:

Issue 2: Anonymous Ownership & Untraceable Operations

Trust Score Evidence: ScamAdviser rates tradekaro.com at only 64.5/100, significantly below trusted platforms. The site’s ownership is shielded (privacy-protected WHOIS), making it hard to verify who’s actually behind it.”

What This Means: TradeKaro’s hidden ownership, combined with zero SEBI registration, makes it impossible to hold anyone accountable if users lose money.

How to File Dabba Trading Complaints?

If you’ve faced issues with TradeKaro or suspect fraudulent activities, here’s how to file complaints:

- Draft your complaint

- Attach: Screenshots, chat records, bank statements, transaction proofs

- Send an email to SEBI

2. File a Cyber Crime Complaint

- Visit the cyber crime portal.

- Report online fraud and financial scams

- File an FIR with the local police cyber cell

Need Help?

Have you lost money to TradeKaro or similar platforms?

Register with us if you are facing this issue.

Don’t suffer in silence.

Our Fraudfree team specialises in helping victims of unregistered trading platforms navigate the complaint process and explore legal options for fund recovery.

Early reporting significantly increases the chances of successful intervention.

Conclusion

The evidence paints a concerning picture of Trade Karo’s operations.

The platform’s lack of SEBI registration, offering of illegal 500X margins, suspected dabba trading operations, and involvement in prohibited CFD trading are serious violations of Indian securities laws.

For Indian traders, the safest approach is to use SEBI-registered brokers that operate transparently within India’s regulatory framework.

While Trade Karo’s promises of high leverage and zero brokerage sound attractive, the potential risks to your capital far outweigh any perceived benefits.

Your financial security deserves the protection that only regulated, legitimate platforms can provide.